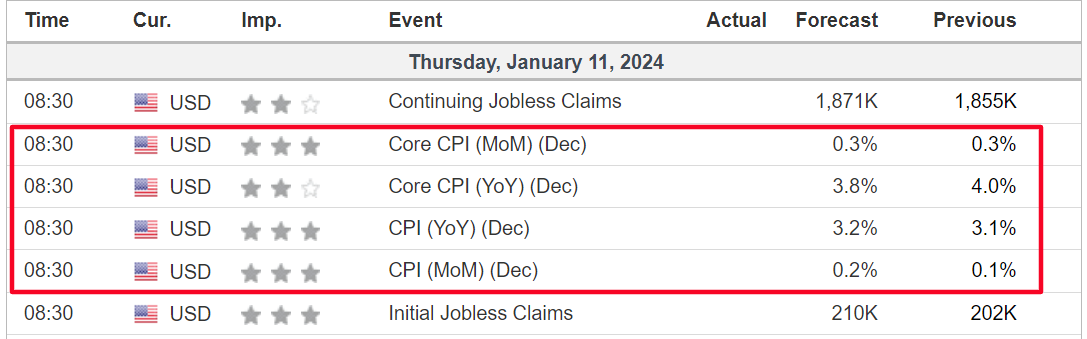

- The December CPI report is due on Thursday at 8:30AM ET.

- Headline annual inflation is seen rising 3.2% and core CPI is forecast to climb 3.8%.

- While the rate of inflation is declining, it’s not yet clear whether it will drop to the Federal Reserve’s 2% target anytime soon.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

With investors now firmly expecting the Federal Reserve to start cutting interest rates at some point this spring, Thursday’s CPI inflation report will likely be key in determining the U.S. central bank’s policy moves in the first half of 2024.

As per Investing.com, the monthly consumer price index is forecast to rise 0.2% in December after inching up 0.1% in November.

Meanwhile, the headline annual inflation rate is seen rising 3.2%, accelerating from a 3.1% annual pace in the previous month.

Source: Investing.com

Source: Investing.com

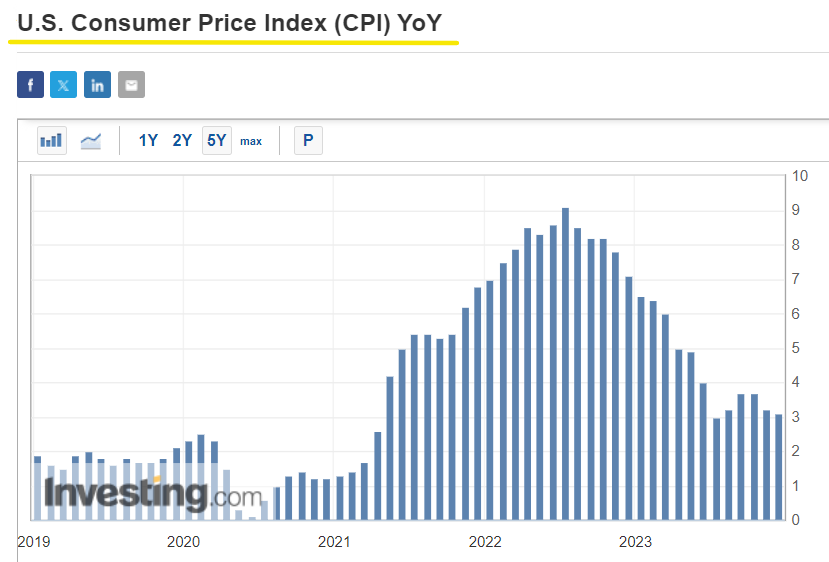

A cooler than expected print, which sees the headline figure fall to 3% or below, would likely add to the rate-cut buzz, while a surprisingly strong reading could keep pressure on the Fed to maintain its fight against inflation.

As seen in the chart below, U.S. inflation has come down noticeably since the summer of 2022, when it peaked at a 40-year high of 9.1%, amid the Fed’s aggressive rate-hiking cycle.

Nonetheless, while the rate of inflation is declining, prices are still rising far more quickly than what the Fed would consider consistent with its 2% target range.

Meanwhile, the December core CPI index - which does not include food and energy prices - is expected to rise 0.3% on the month, matching the same increase in November.

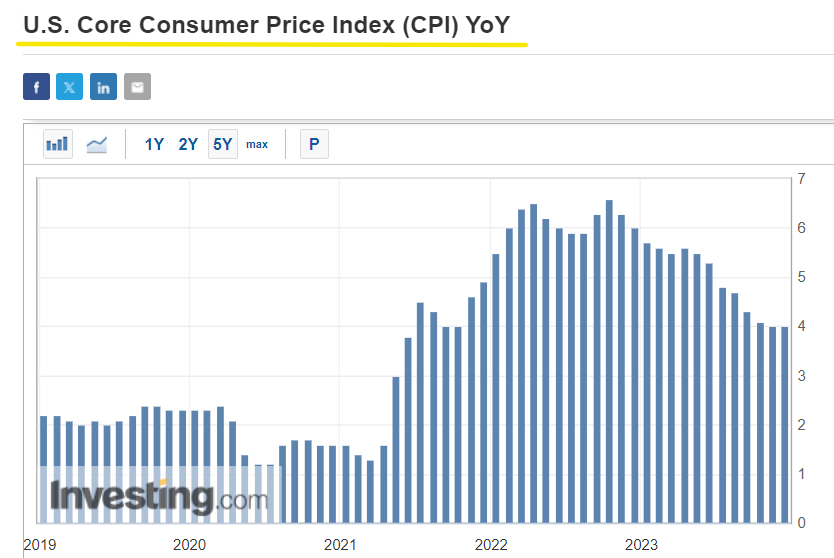

Estimates for the year-on-year figure call for a 3.8% gain, slowing from the previous month’s 4.0% reading. If confirmed, that would mark the lowest annual core CPI reading since May 2021.

The core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Fed chair Jerome Powell acknowledged last month that further rate hikes are unlikely as inflation falls faster than expected, and the time for rate cuts is drawing closer.

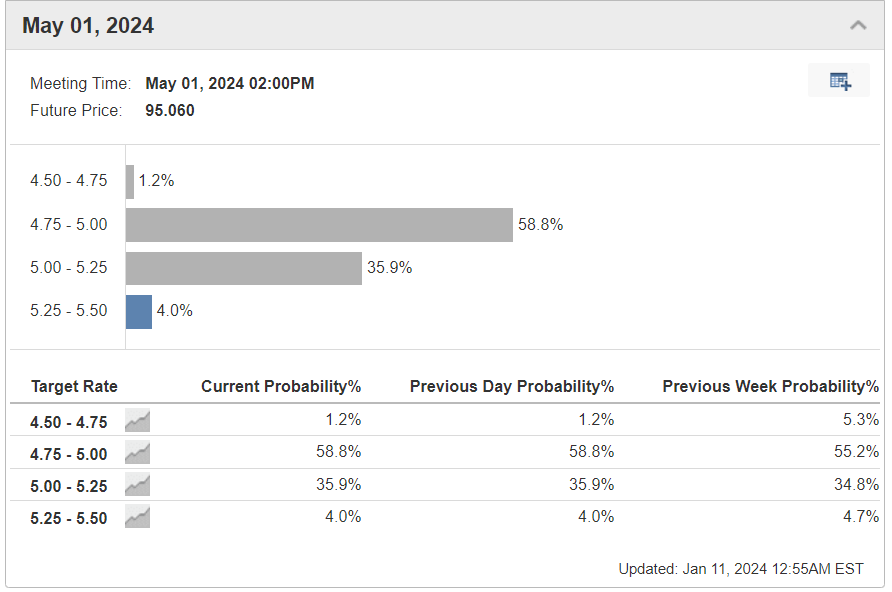

Underlining the Fed’s dovish pivot, policymakers have penciled in rate cuts amounting to 75 basis points in 2024 according to the most recent FOMC dot-plot forecasts.

Markets are even more dovish. They're now betting on six rate cuts in the year ahead, with the first one expected to come this spring. As of Thursday morning, financial markets see a 69% chance of a rate cut in March, and a 96% likelihood by May, according to the Investing.com Fed Monitor Tool.

Source: Investing.com

What to Expect

Contrary to the market’s view, I believe a rate cut would likely only come in September as inflation takes longer to return to the Fed's 2% target than many had hoped.

Indeed, fresh concerns have emerged surrounding a potential regional war in the Middle East, which could rattle global energy markets if the conflict escalates to destabilize the oil-rich area. A lasting spike in energy costs would unravel progress on the inflation front.

As such, inflation levels could remain elevated for a more extended duration than is presently anticipated by financial markets, potentially forcing the Fed to leave rates at higher levels for longer than markets currently anticipate.

Taking that into consideration, the Fed’s inflation battle is far from over.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

***

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice