- After more than 6% loss for May, gas’ ability to resume upside is in question

- Bears cite ever-rising output, throttled LNG exports, and weak demand for cooling

- Bulls say potential global supply squeeze still holds U.S. gas in good stead

Elevated production, subdued LNG, and cooling demand: The all-too-familiar language of the bears is back to haunt the bulls who had already seen the eight-week-long rebound in natural gas snapped twice.

A new thing is now being added to the mix: Gas storage by the end of this month, which could potentially be at a surplus of 400 billion cubic feet, or bcf, to the five-year average.

At the time of writing, gas futures on the New York Mercantile Exchange’s Henry Hub were still in the green for the week, showing a near 4% gain since last Friday.

But the price rebound in America’s favorite fuel for indoor temperature control — which many seemed to take for granted just six weeks ago — appears to have lost its steam with a 6.4% loss for all of May.

That raises the question: Could gas resume its rebound after its own version of Wall Street’s “Sell in May and Go Away?”

Gas futures on the New York Mercantile Exchange’s Henry Hub initially went from strength to strength between the end of March and early May — climbing from sub-$2 per mmBtu to near $2.70 for the first time in two months.

But in recent days, they have hit formidable resistance again at mid-$2.

Technical charts for Henry Hub’s front-month suggest a return to mid-May highs but not too far beyond in the interim, Sunil Kumar Dixit, chief strategist at SKCharting.com, said, adding:

“Sustainability above $2.19 would be supportive for upside move towards $2.42 and $2.52 followed by $2.68.”

“But weakness below $2.19 would favor further drop to $2.04.”

The phenomenon comes as weather across most of the United States remained mild to a fault, for the bulls at least.

Refinitiv, the Reuters-associated market data provider, said there were 48 total degree days, or TDDs, last week compared with a 30-year normal of 63.

TDDs measure the number of degrees a day's average temperature is above or below 65 degrees Fahrenheit (18 degrees Celsius) to estimate demand to cool or heat homes and businesses.

Said analysts at EBW Analytics in a note issued Wednesday:

“While our long-term storage trajectory is sharply lower and the medium-to-long term fundamental outlook points to upside price potential, natural gas may have to muddle through a near-term soft patch in coming weeks first.”

Near-term technicals remained bearish and fundamentals lackluster, the EBW team said, adding:

“Elevated production, subdued LNG, and cooling demand reverting lower may enable the storage surplus to approach 400 bcf above five-year norms into late June.”

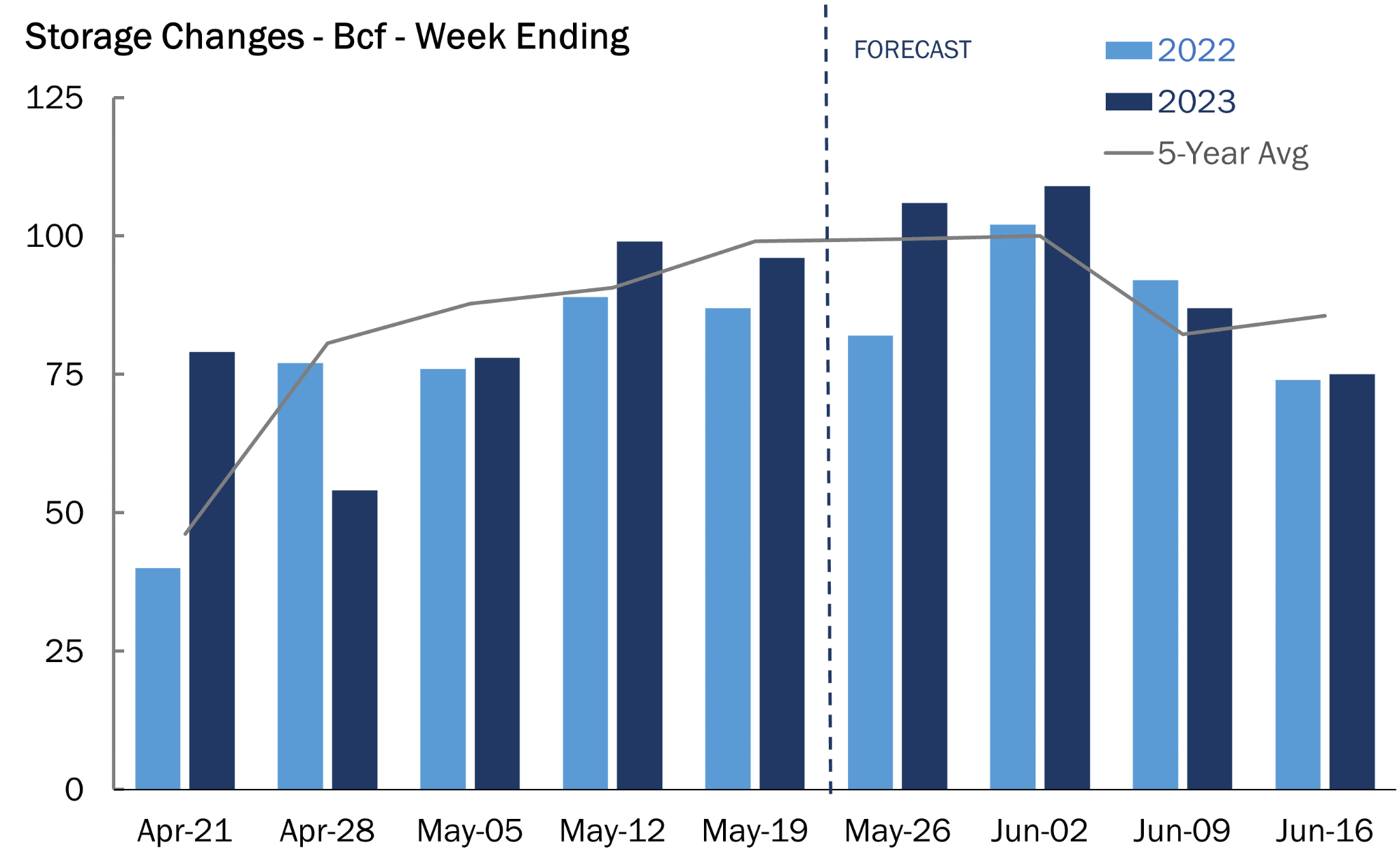

Source: Gelber & Associates

As of the week ended May 19, total gas in underground caverns in the United States stood at 2.336 trillion cubic feet, or tcf — up 29.3% from the year-ago level of 1.807 tcf and 17% higher than the five-year average of 1.996 tcf.

The Energy Information Administration, or EIA, broke the data down further by saying stockpiles were 529 bcf higher than this time last year and 340 bcf above the five-year average.

Thus, hitting a 400-bcf surplus to the five-year average might be nothing, given the pace of storage builds anticipated in the coming weeks.

Industry analysts project that last week itself could have seen a storage increase of 106 bcf. That would compare with the 82-bcf injection seen during the same week a year ago and the five-year (2018-2022) average build of 101 bcf.

While the odds of reaching a 400-bcf surplus to the five-year might be a given, such a headline could have a wrecking ball effect on the trade, given that gas production is going only one way — higher and higher.

In a market read reproduced from Reuters, data provider Refinitiv says average U.S. gas output in the Lower 48 states rose to 101.7 bcf per day so far in May, topping April's monthly record of 101.4 bcf/d.

The amount of gas flowing from Canada to the U.S. was on track to jump to a 10-week high of 8.54 bcf per day on Wednesday from 7.81 bcf per day on Tuesday, according to Refinitiv.

So far this month, Canadian exports have dropped from 8.52 bcf per day on May 4 to a 25-month low of 6.41 bcf per day on May 17 as wildfires in Alberta caused energy firms to cut oil and gas production.

Canadian exports rose to 8.12 bcf per day on May 23 after firefighters made significant progress controlling the blazes.

That compares with average Canada-to-U.S. exports of 8.3 bcf per day since the start of the year and 9.0 bcf per day in 2022.

About 8% of the gas consumed in, or exported from, the United States comes from Canada. Meteorologists projected the weather in the Lower 48 states would remain mostly near normal from May 31-June 10 before turning warmer than normal from June 11-15.

Refinitiv forecast U.S. gas demand, including exports, would rise from 89.5 bcf per day this week to 92.7 bcf per day next week as the weather turns seasonally warmer.

Those forecasts were similar to Refinitiv's forecast on Tuesday. Gas flows to the seven big U.S. LNG export plants fell from a record 14 bcf per day in April to an average of 13 bcf daily so far in May due to maintenance work at several plants.

Last month's record flows were higher than the 13.8 bcf per day of gas the seven big plants can turn into LNG since the facilities also use some of the fuel to power equipment used to produce LNG.

Some have, meanwhile, questioned whether this year's gas price collapse in Europe and Asia could force U.S. exporters to cancel LNG cargoes this summer after mostly mild weather over the winter left massive amounts of gas in storage.

In 2020, at least 175 LNG shipments were canceled due to weak demand.

For now, the notion is that energy security concerns in the aftermath of Moscow’s Ukraine invasion — and sanctions and other curbs placed on Russian gas — should keep global prices of the fuel high enough to sustain record U.S. LNG exports in 2023.

European gas was hovering near a 25-month low of around $8 per mmBtu on the Dutch Title Transfer Facility, TTF, benchmark at the time of writing and near a 24-month low of $9 at the Japan Korea Marker, or JKM, in Asia.

That put TTF down about 65% and JKM down about 68% so far this year. In contrast, U.S. gas futures are down almost 50% on the year, lagging global peers as the top producer of the fuel faces constraints in shipping out more LNG that could boost domestic prices.

**

Disclaimer: The content of this article is purely to educate and inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.