Street Calls of the Week

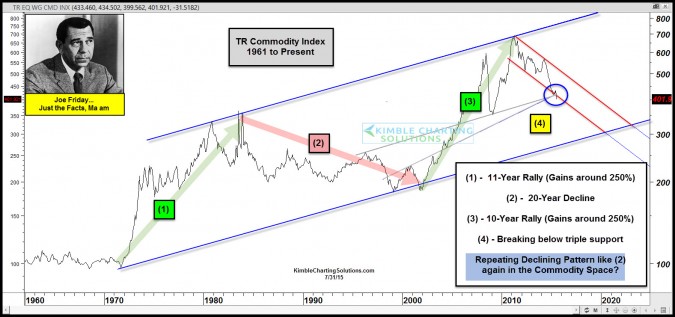

This chart looks at the Reuters/Jefferies Commodity Index (CRB) on a monthly basis for the past 50 years

The index took off in the early 1970s and rallied over 200% in a little over a decade at (1). Then it created a potential double top.

So what followed at (2)? An unwinding of the rally that lasted nearly 20 years, taking it to the bottom of its rising channel.

In the early 2000s, the index took off again, gaining over 250% in a decade's time at (3). That rally looks to have ended in 2011, as it was hitting the top of this long-term rising channel.

Since hitting the top of the channel the index has been pretty soft, losing nearly 40% of its value in the past few years.

Could commodities be pulling a repeating pattern again and remain soft for a long period of time?

If you are like me, it's hard to believe that commodities could be in a 20-year bear market again. What is happening to the index at this time looks like the trend will continue, as the index could be breaking triple support at (4) right now. If it does break down through triple support, it would suggest the down trend in this space continues.