-

Coinbase surge: The stock hit a new 52-week high in pre-market trading, driven by Bitcoin crossing the $59,000 mark, thanks to capital flowing into spot ETFs.

-

ETF concerns: Analysts worry that low-cost ETFs may impact Coinbase's fee revenues and trading volumes.

-

Overvaluation signals: The stock's 172% rise since November 2023 raises questions about its overvaluation.

This morning, Coinbase Global's (NASDAQ:COIN) stock price surpassed its 52-week high in pre-market trading, propelled by a significant rise in Bitcoin prices, which earlier today breached the $59,000 mark, also setting a new 52-week high.

This surge is primarily attributed to the burgeoning interest in cryptocurrencies following the U.S. approval of ETFs, which were launched earlier this year.

Since the beginning of February, Coinbase shares have escalated by 63%, further lifted by its impressive Q4 earnings results, which exceeded expectations. The company reported Q4 EPS of $1.04, surpassing analysts' predictions by $1.00, with a revenue of $953.8 million against an anticipated $826.69M.

These strong quarterly results have led to a series of analyst upgrades.

Additionally, transaction revenue saw a 64% increase year-over-year to $529.3M (NYSE:MMM) in Q4, while subscription and services revenue rose by 33% to $375.4M.

But as the stock begins to looks more expensive, the questions that pop into investors' minds are:

- Is too late to buy it?

- And, when is the right time to start taking profits?

In this piece we'll use our flagship InvestingPro tool - exclusive only to subscribers - to dig deep into these questions and find the answers.

You can do the same analysis for every stock in the market for less than $9 a month using this link.

And if that's not enough, included in the same subscription, you will also gain access to our state-of-the-art predictive AI tool, ProPicks - which gives you 70+ market winners every month!

Subscribe now and never miss another bull market again.

Fundamentals: A closer look at valuation concerns

Analysts at JPMorgan have cautioned about the potential for a decline in trading volume for Coinbase. Reacting to management's comments on these concerns, JPMorgan (NYSE:JPM) noted:

Considering Coinbase's direct participation and monetization efforts, we were hoping management would have provided more robust insight into the economics of the arrangements with issuers.

Moreover, concerns regarding the possibility of ETFs cannibalizing Coinbase's fee revenues, with the speculation that investors may prefer the lower-cost ETFs to holding the assets directly, are also a likely headwind for the stock.

A deeper review of the fundamentals with InvestingPro suggests that Coinbase's stock price might have risen excessively, marking a 172% climb since November 2023, fueled by the rally in Bitcoin prices.

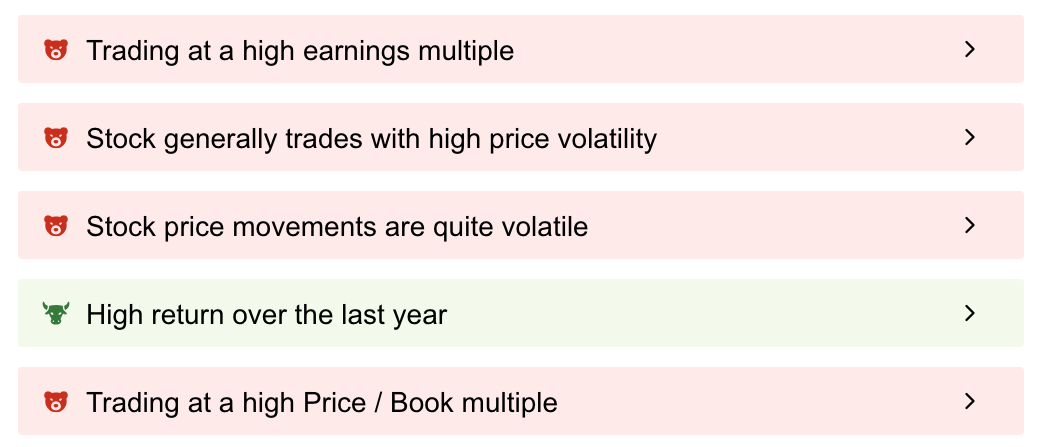

Our ProTips underscore Coinbase’s weaknesses, such as the company's high earnings multiple and Price/Book ratio, suggesting that the stock might be overvalued.

Source: Investing.com

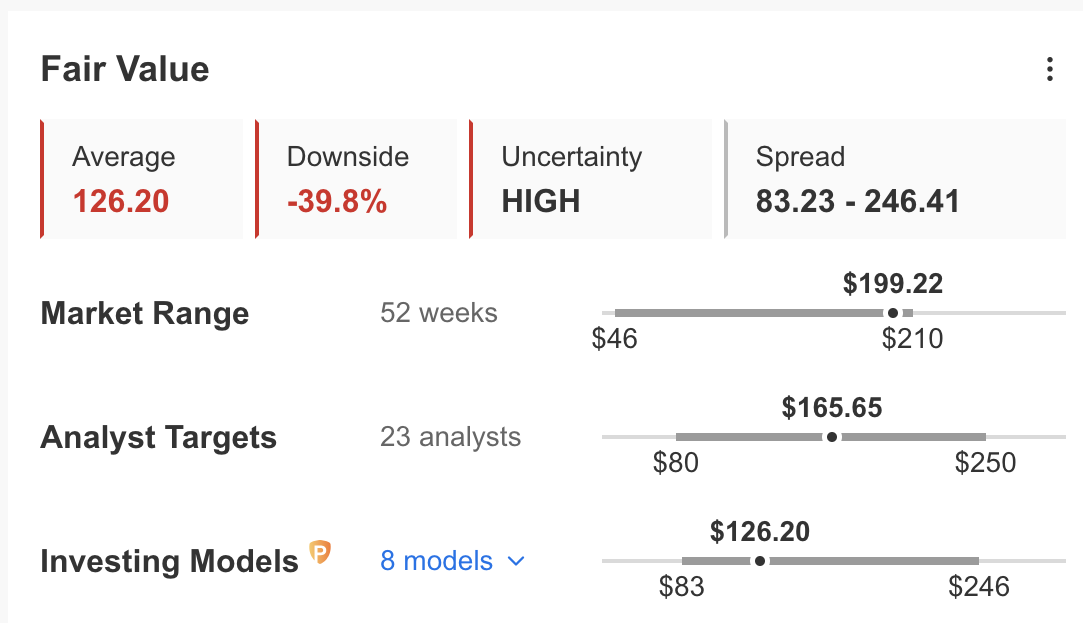

InvestingPro's Fair Value analysis predicts a nearly 40% decline in the stock price, while Wall Street analysts anticipate an approximate 17% downside.

Source: Investing.com

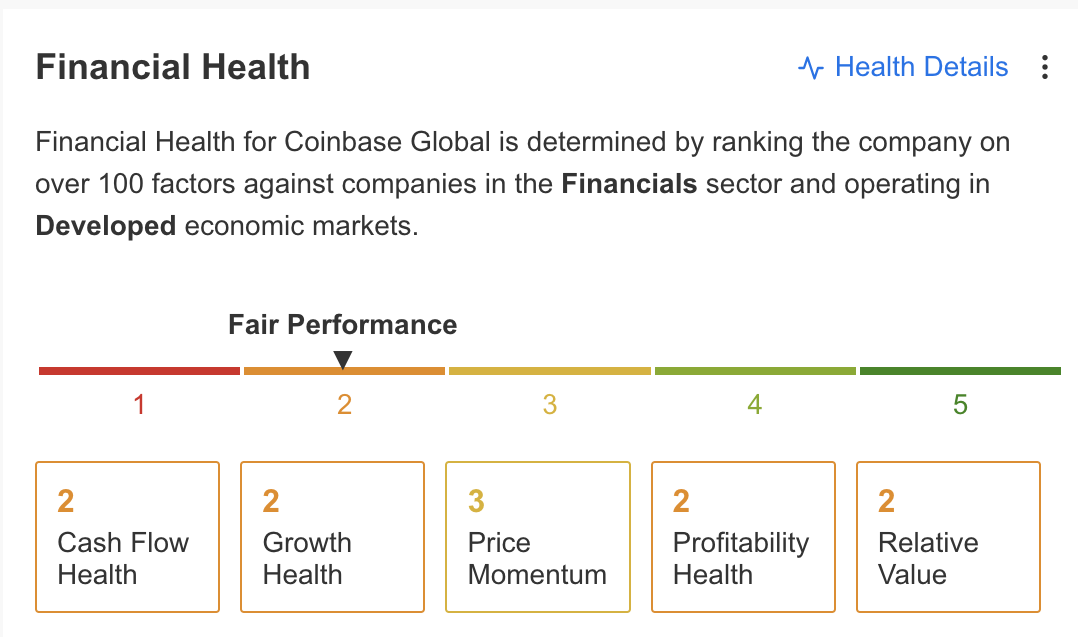

Moreover, InvestingPro rates Coinbase's financial health as merely "Fair" when compared to over 100 factors across companies in the Financials sector and those operating within Developed economic markets.

Source: Investing.com

Bottom Line

While the current surge in Bitcoin prices may still have room to grow, pushing Coinbase's bull run even further, our fundamental models indicate that the stock is already nearing highly overbought levels and, therefore, caution is advised.

Given the high risks presented, investors that have ridden this year's uptrend are advised to start taking some profits soon. Conversely, investors looking to buy the stock, should wait for a pullback for a better entry point.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

*Readers of this article get an extra 10% off our annual and 2-year Pro plans with codes OAPRO1 and OAPRO2.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.