BoJ Happy:

Welcome back to your desks for the start of another important week in the trading world which features central bank action from Australia, Canada and the Eurozone.

But first of all, we turn the clocks back to Friday afternoon where Japan’s finance minister Tarō Asō, cited a surplus of money in the economy combined with weak domestic demand in his comments to public broadcaster NHK, re-assuring markets that the BoJ is unlikely to expand it’s QE program in the near term.

“At this point, the government is not thinking about anything like that, and probably the Bank of Japan will not undertake additional monetary easing right now.”

With the BoJ unchanged at their most recent meeting a week before last, these comments are a healthy reminder and are intended to have the effect of keeping markets stable and on their current course. An outcome that benefits the technical traders nicely.

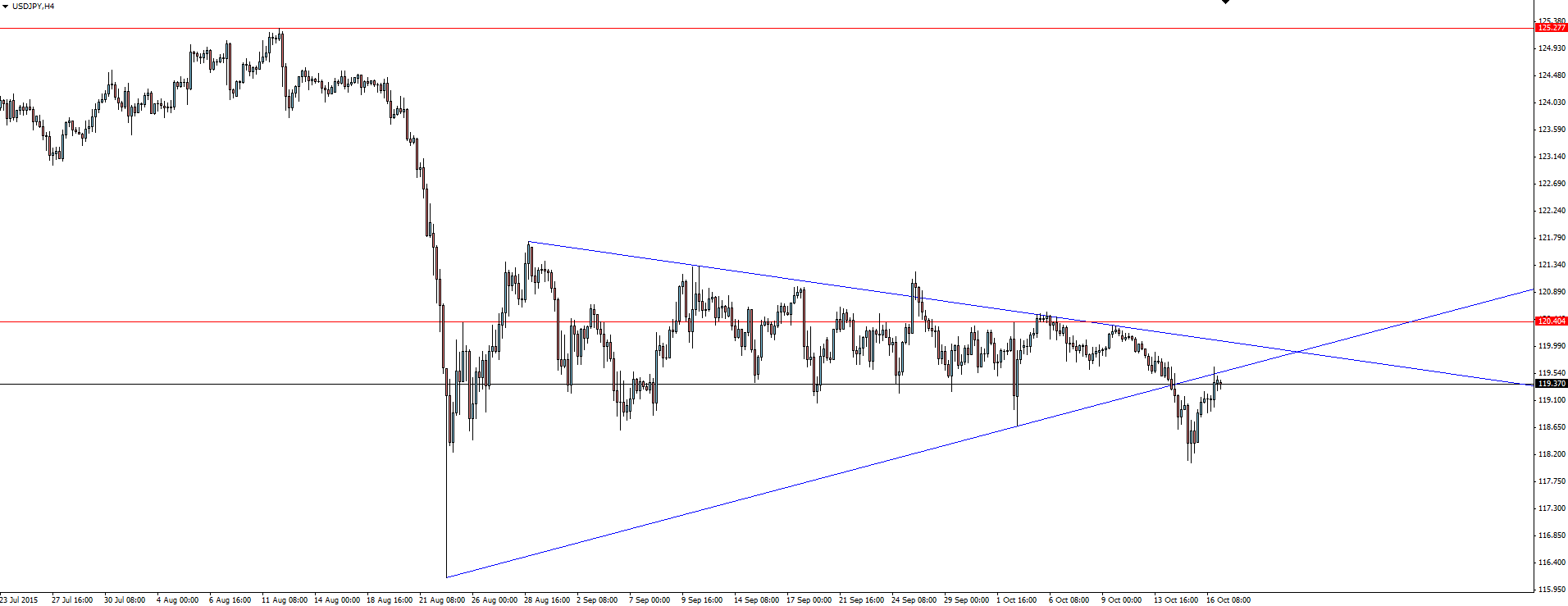

USD/JPY 4 Hourly:

Click on chart to see a larger view.

This ‘triangle’ has been in play for what feels like forever now, with the constant sideways drift causing the bottom line to shift each time the chart is posted.

As I’ve said before, because we’ve drifted so far like this, the pair is prone to fake-outs and I see the safer option being to fade the edges rather than play for the immediate breakout. Either way, it’s a line that will help the day traders manage their risk around on the possible re-test.

Data Deluge:

Elsewhere across Asia, we have quite the deluge of Chinese data to kick off our Monday morning. With Chinese woes the in vogue topic when it comes to central banks around the world putting monetary policy normalisation on hold, today’s Industrial Production and Fixed Asset Investment will gain added attention.

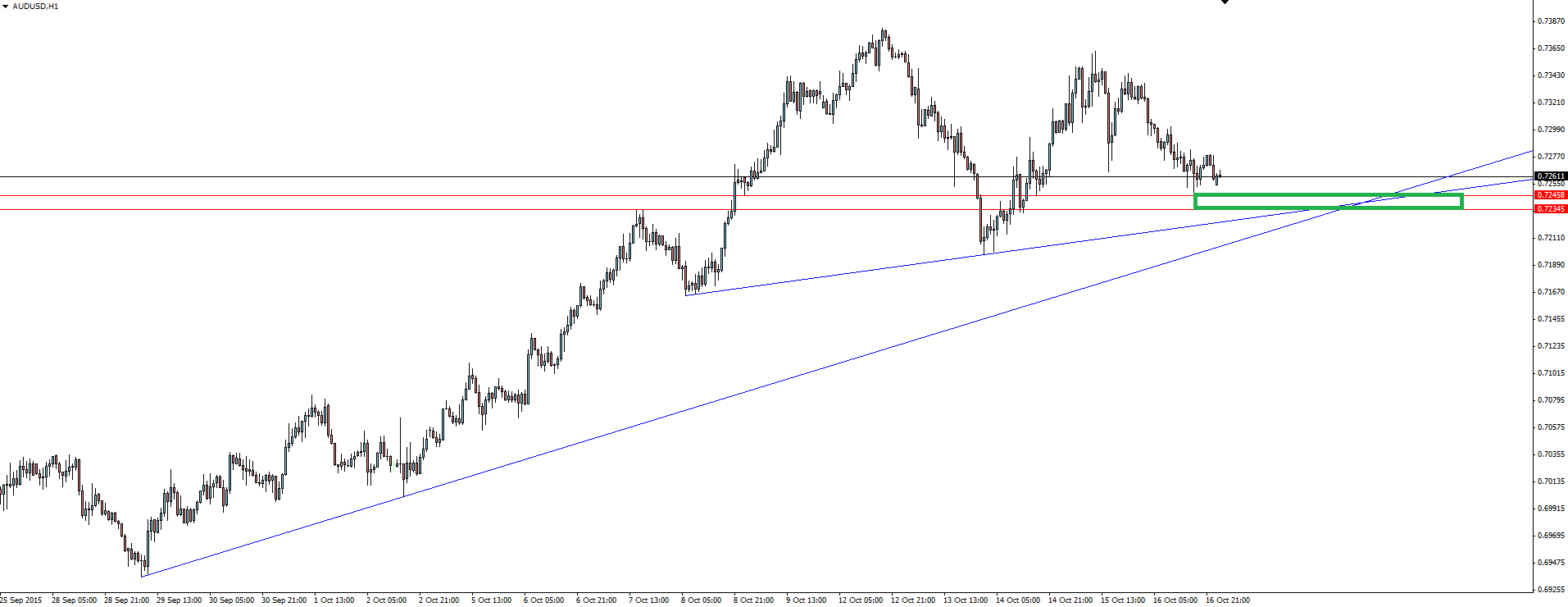

The data will also see the Aussie come into play today with the hourly chart catching my eye for the following level.

AUD/USD Hourly:

As long as AUD/USD stays tucked back above the weekly trend line then I favour playing from the long side. This hourly zone looks a nice little confluence of support where buyers will surely be lurking.

On the Calendar Monday:

Quite the deluge of Chinese data to kick off our Monday morning.

CNY GDP q/y

CNY Industrial Production y/y

CNY Fixed Asset Investment ytd/y

CNY Retail Sales y/y

CNY NBS Press Conference

USD FOMC Member Brainard Speaks

Chart of the Day:

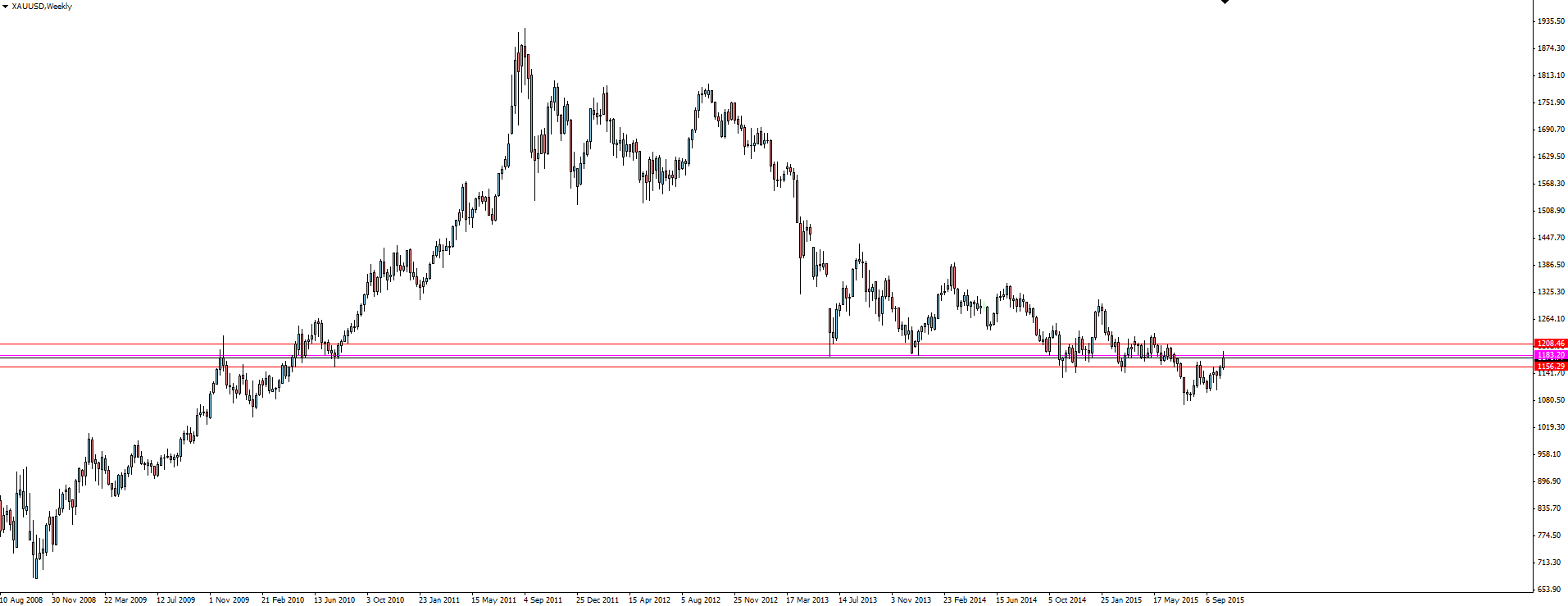

With all the Forex action lately, Gold Trading hasn’t been given the attention it deserves. Today’s chart of the day takes a look at XAU/USD.

Gold Weekly:

The gold weekly chart sees price still buzzing around the major support/resistance zone between 1156 and 1208. With the Fed pushing back interest rate hikes, the break below this major level couldn’t be sustained and we’ve rallied back up to re-test the zone this time as possible resistance.

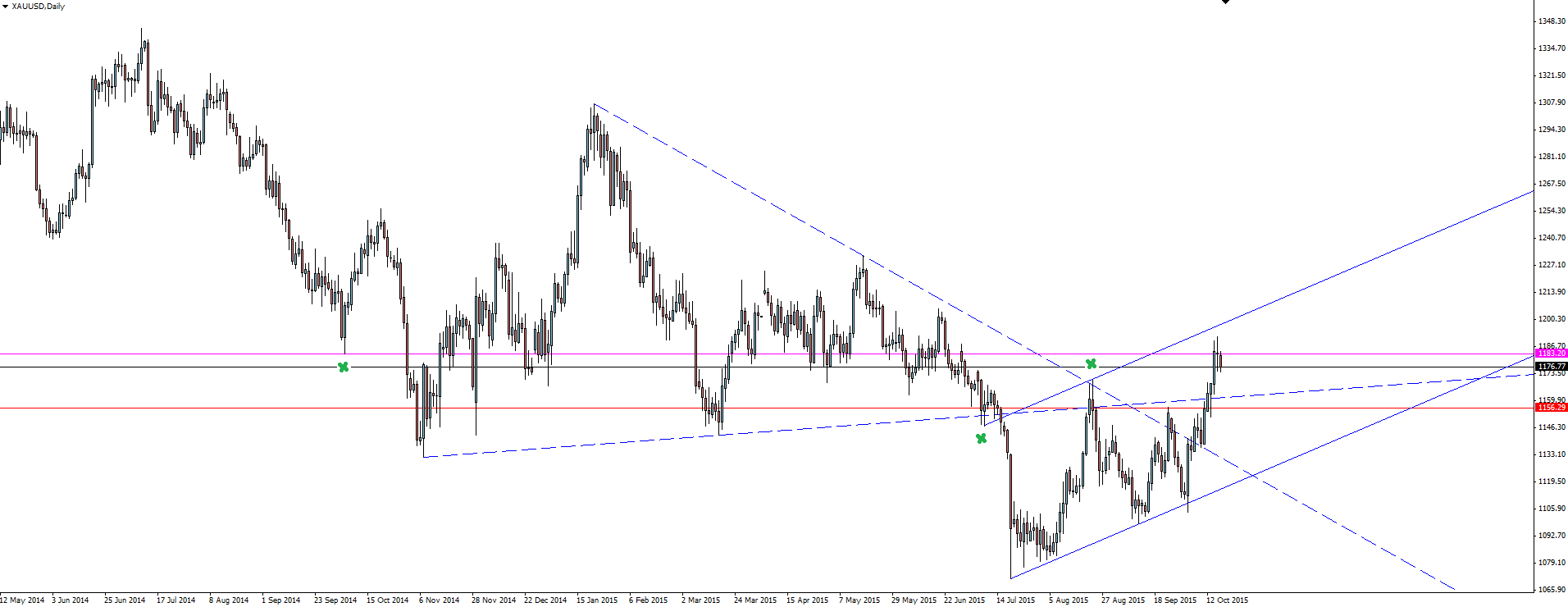

Gold Daily:

Zooming into the daily chart, we see a few short term channels and triangles being broken and respected. The short term bullish channel is still in play, with price pushing towards the upper line and coinciding with the marked horizontal level where price reacted before.

I don’t want to fight this new found bullish momentum and am looking to play from the long side on pullbacks while price is above 1156. Just keep in mind the possible re-test of the weekly support/resistance zone.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade the Forex Market. All opinions, news, research, Forex analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a Forex trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and FX Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.