China Q2 data on target

This week, just 15 days after the period end, China reported its GDP result for the second quarter of 2015, hitting market forecasts between the eyes to come in at 7.0 percent.

The report was always going to hit the target, of course. It always does!

Whether or not you actually believe that the Chinese economy is still growing at 7 per cent per annum is another matter entirely, a point I pondered in a healthily sceptical manner in a little more detail last year.

Just as has been the case in the US, Europe and Australia, folks in China are facing a challenge in terms of the rate of return on their investments, as monetary policy has been eased and interest rates lowered.

With an economy notionally growing at 7 per cent per annum, yet bank deposits paying somewhere closer to just 3 per cent, the conundrum has been: where to for capital flows?

Stock bubble "stabilises"

Investors in China initially targeted real estate, but following overbuilding of apartments, property prices across many Chinese cities are in a funk, and have been so for quite some time. In turn, attention has turned with a vengeance towards stock markets indices, particularly the Shanghai Composite, with markets being fuelled by a hitherto unprecedented use of margin loan debt by record numbers of inexperienced participants.

After the sparking of an outrageous bubble - quickly followed by indices losing close to a third of their value - China's stock market indices have "stabilised" somewhat over recent trades, for want of a better word.

Even the word "market" is used here somewhat advisedly. After all, it's hard for prices to fall when trading is halted and market participants are banned from short selling, and even banned from selling in some instances.

Where to next is anyone's guess.

Stock prices are still trading way above the levels seen only one year ago, but the market collapsing by a third in a matter of weeks will have shattered a few illusions about stock markets being a one way bet. Market participants must surely have been spooked by the panicked crash, despite desperate intervention in order to halt the slide into oblivion.

Stock market or stock casino?

China's stock markets have been likened to giant casinos. It would be fair to observe that "investors", choosing to acquire stocks which are trading at high P/E ratios, are not buying because they see value in any traditional sense of the word.

Rather because they are speculating that the "P" could be higher in a month's time. In many cases, the quality and sustainability of the "E" is arguably somewhat opaque too.

Indeed it has been suggested recently that the popularity of stock markets in China may have been inversely proportional to the level of activity in casinos. Certainly when I went to Macau a few years ago I didn't even get near to the tables. Partly that was because as someone who hasn't smoked for years I didn't want to suffer a collapsed lung from all the vapour, but mainly it was because the tables were full to bursting with gamblers. And that was midweek!

But following a crackdown on corruption, gambling activity has reportedly begun to decline.

After meandering along for a long period of time, ignited by margin debt and the promise of ever faster gains, stock markets exploded into a US$6.5 trillion rally over the space of just one year, a stock market bubble of epic proportions.

Capital flight into overseas assets

While the theorists were theorising about whether Chinese interests were acquiring Australian real estate, the investors were busily mopping up Australian assets.

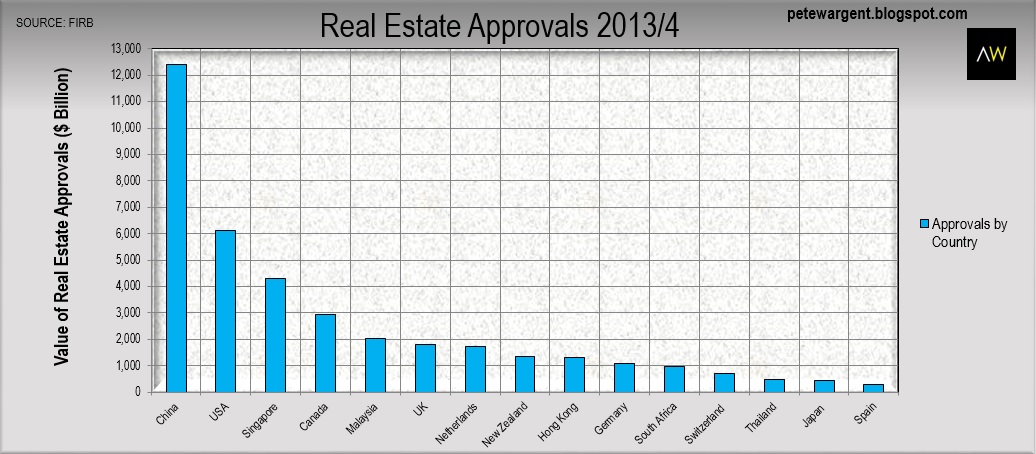

Lingering doubts about the potential scale of interest in Australian assets was blown away when the most recent Annual Report from the Foreign Investment Review Board (FIRB) confirmed that China had become, by far and away, the most material country of origin for real estate approvals in Australia.

And there's much more to come over the decade ahead.

Moreover, the FIRB data records only approved real estate purchases, and let's be blunt, there have been a great many instances of Chinese capital finding its way into established residential property too.

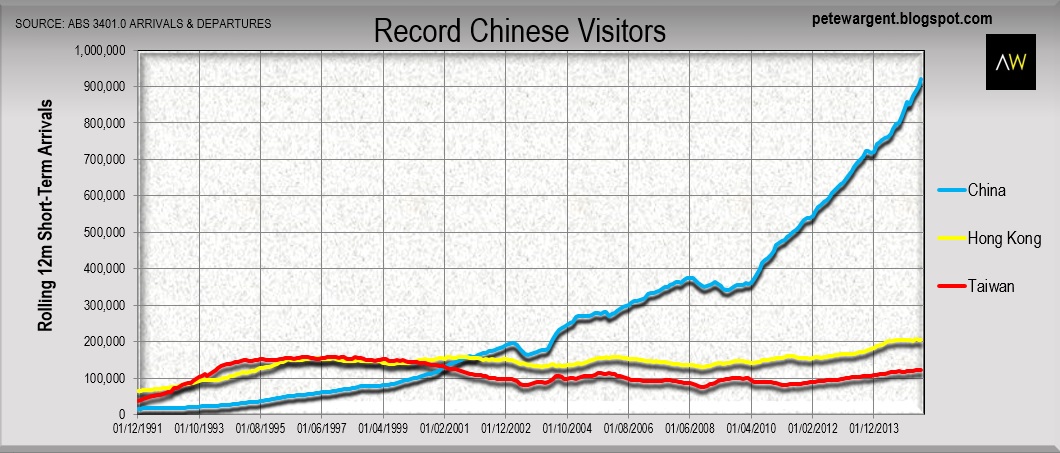

While Chinese settlers in Australia are tracking at close to record levels, the most dramatic trend has been in the number of short term Chinese visitors to Australia.

In the month of February 2015 alone - the month which comprised the Chinese New Year - there were an unprecedented 198,700 visitors from China, Hong Kong and Taiwan - nearly quadrupling the equivalent figure from a decade ago.

A Chinese currency play

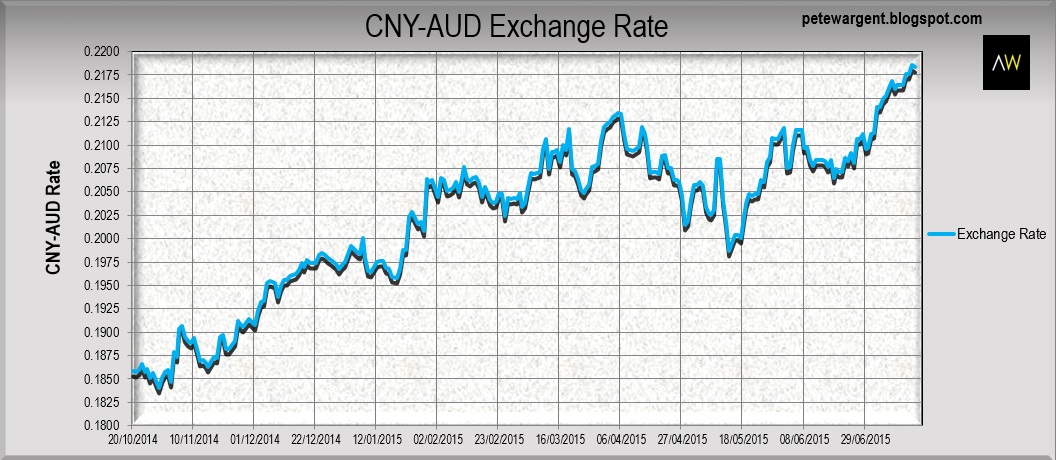

Are Australian assets considered expensive by foreign investors? Not particularly. As Chief Market Strategist of IG, Chris Weston, pointed out to me the other day, there is no asset price bubble in Australia when considered from offshore.

In fact, asset prices are loitering down at multi-year lows. Below, recent movement in the CNY/AUD FX rate:

Materiality

Perhaps the key underlying point is the relative size of potential Chinese investment as compared to the size of Australia's markets. Ultimately, Australia is a huge island with a comparatively tiny population of fewer than 24 million persons.

Setting aside for a moment the role of margin debt, China's share market rally added an enormous US$6.5 trillion to the market capitalisation of stocks in just one year. If for some reason you were to decide to buy every house in Australia - from Federation homes to fibros, from Queenslanders to maisonettes, from studios to shoebox apartments - at today's market prices this would set you back around A$5.5 trillion.

In other words the "value" poured into Chinese stocks since the beginning of the rally could swallow Australia's property market whole, leaving more than A$3 trillion of walking around money.

For that matter the market capitalisation of the Australian Securities Exchange (ASX) is only around A$1.5 trillion, so that could comfortably be gobbled up too. More pertinently from a property market perspective, real estate prices are necessarily set at the margin, and only around 7 per cent of the housing stock of 9.5 million dwellings is likely to be traded in any given year.

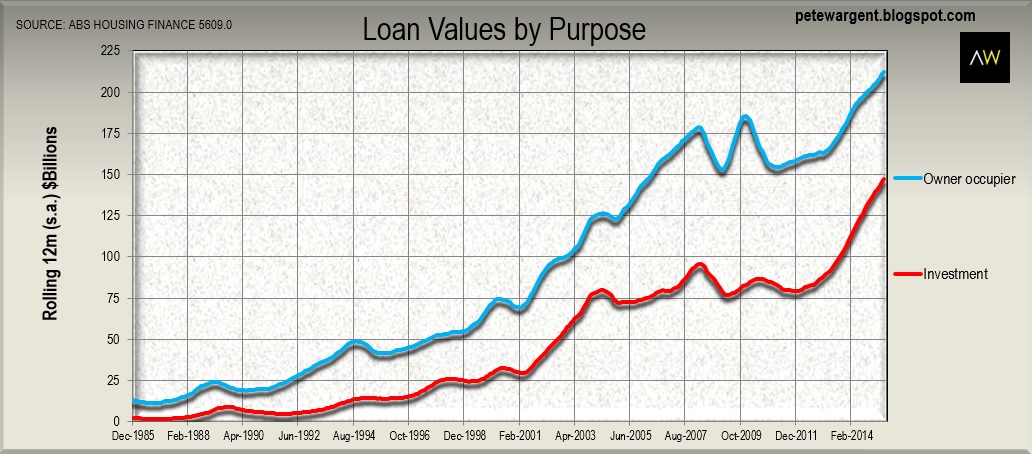

The total value of housing finance written over the past 12 months was a comparatively trifling A$360 billion.

As for whether there is evidence of Chinese capital finding its way into Australia's established property markets? Go to a few public auctions and judge for yourself.

My experiences have told me that the answer is "yes, very much so" - either that, or I'm the unluckiest bidder in the history of Australian real estate auctions. I must confess, I'm leaning towards the former.

Spend a few moments contemplating some of the assets and businesses acquired by Chinese interests across the calendar year 2014.

Should China ever unleash in full the awesome potential of its capital account on Australian assets...well, look out.