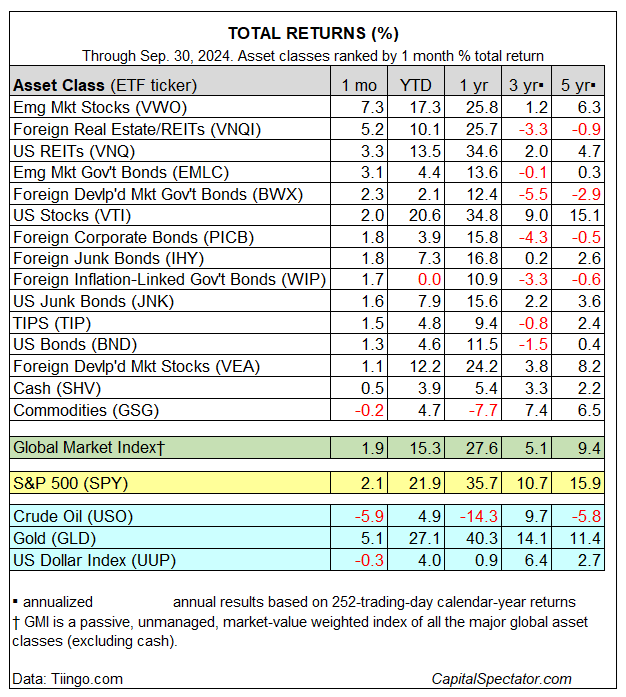

Emerging-market stocks surged in September, delivering the lead performance for the major asset classes, based on a set of ETFs.

Real estate shares were also strong performers last month, extending recent strength for these stocks. Commodities, once again, were the downside outlier.

Vanguard Emerging Markets (VWO) rose a sizzling 7.3% in September, beating the rest of the field by a wide margin.

The gain marks the eighth straight monthly increase for the ETF and the strongest rally in nearly two years.

A key driver of last month’s red-hot rise for these shares: A dramatic rebound in China stocks following news of a more aggressive stance on stimulus programs to support the country’s slowing economy.

Foreign property (VNQI) and US real estate investment trusts (VNQ) continued to post strong gains last month.

September marks the third straight month that property shares posted leading (or in September’s case near-leading) returns relative to the rest of the field.

Commodities Lag, Bonds Rise

US stocks (VTI) and bonds (BND) continued rising last month. The only loser in September was commodities (GSG).

The 0.2% dip for raw materials marks the third straight monthly decline. Gold (GLD), however, is bucking the trend for commodities writ large with another strong monthly rise of 5.1%.

For year-to-date results, rallies dominate the field, led by US shares (VTI) with a 20.6% gain for 2024. The weakest performer this year: foreign inflation-linked government bonds (WIP), which is flat so far in 2024.

The Global Market Index (GMI) posted its fifth straight monthly gain, advancing 1.9% in August.

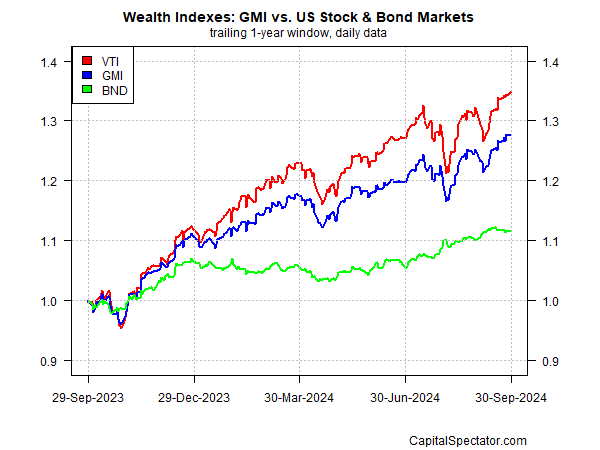

GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

Year to date, GMI is up a strong 15.3%

For the one-year window, GMI continues to reflect a middling performance relative to US stocks (VTI) and US bonds (BND).