When gold (or any other asset for that matter) nears an intermediate degree cycle low, without fail we start to hear all kinds of negative predictions. 'Gold is going to collapse;' Gold is going to $800, $600...' I even saw someone predict $200 gold the other day.

Those are the kind of negative emotions needed to form a cycle bottom. When you start to see traders become irrationally negative, that's when you're getting close to the point where you just run out of sellers. Sentiment in gold is again at 17% bulls.That's a level of pessimism only seen a few times in the last 40 years.

I noted yesterday, a lot of blogs and traders recommending shorting gold. Imagine that, shorting gold after it has already dropped 18 out of the last 21 days. A drop so severe it's never occurred in history. Text book emotional behavior.

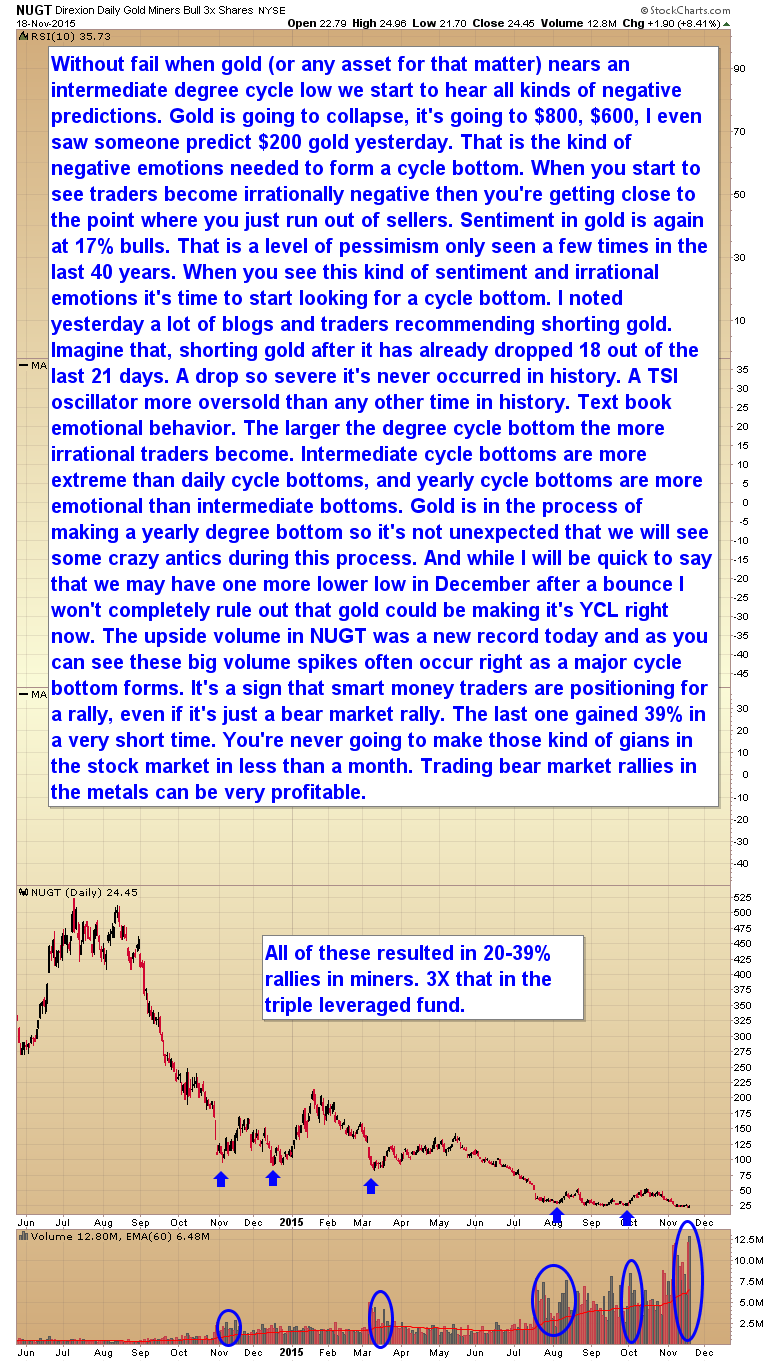

We may have one more lower low in December after a bounce, I won't completely rule out that gold could be making its yearly cycle low right now. The upside volume in Direxion Daily Gold Miners Bull 3X Shares (N:NUGT) was a new record yesterday and as you can see, these volume spikes often occur right as a major cycle bottom forms.

It's a sign that smart money traders are positioning for a rally, even if it's just a bear market rally.