Attention shifts to the UK tonight, with the Bank of England’s interest rate decision the stand-out event of the day. Well we actually get the bank rate decision, a monetary policy summary and the votes showing how the MPC members voted!

Members are expected to vote unanimously to keep interest rates on hold at the current level of 0.5%, exactly the same as last month. Last month was the first vote in a while where the decision among voting members was unanimous, with the previously sole dissenter Ian McCafferty changing his vote to hike and instead siding with the crowd.

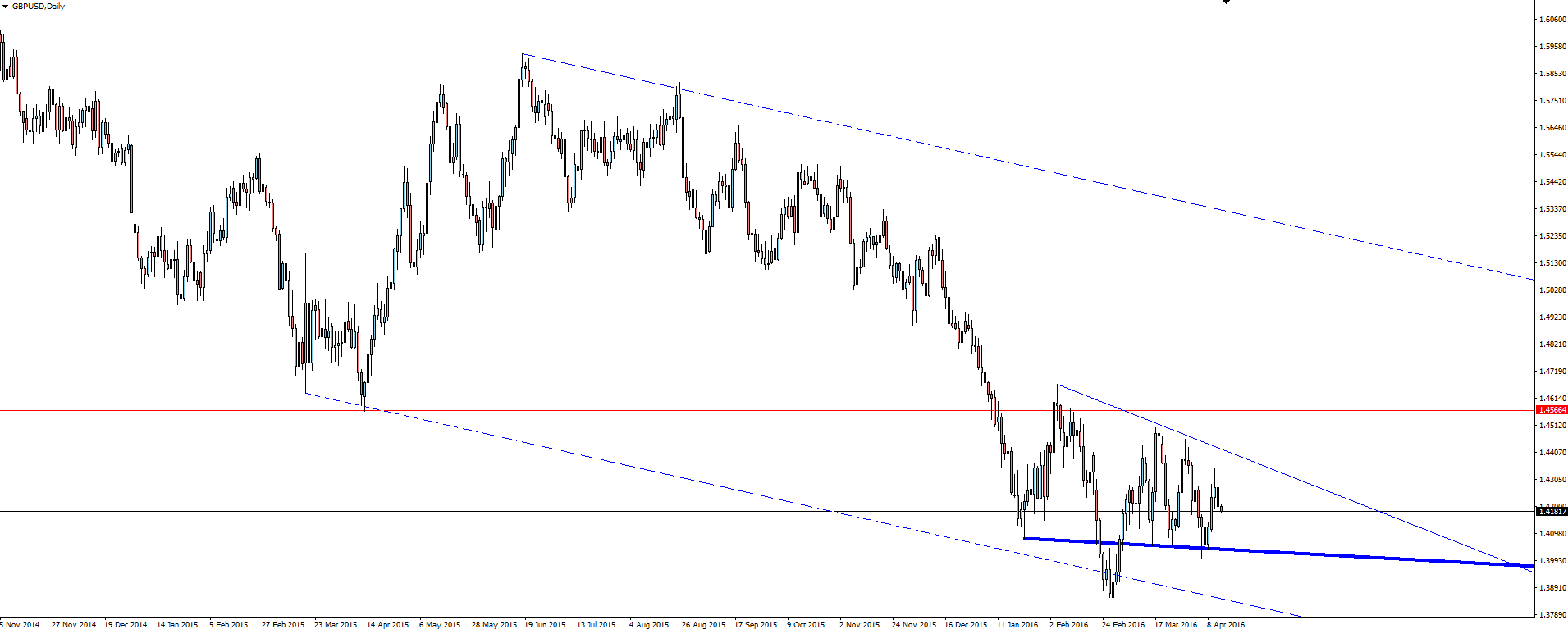

With inflation stubbornly low and the risk of Brexit clouding economic certainty, the BoE is in no rush to move any time soon and a bearish looking GBP/USD daily chart reflects this fact.

GBP/USD Daily:

We took a quick look at Cable during Monday’s Weekly Risk Watch post and the short term level we were watching has stayed intact.

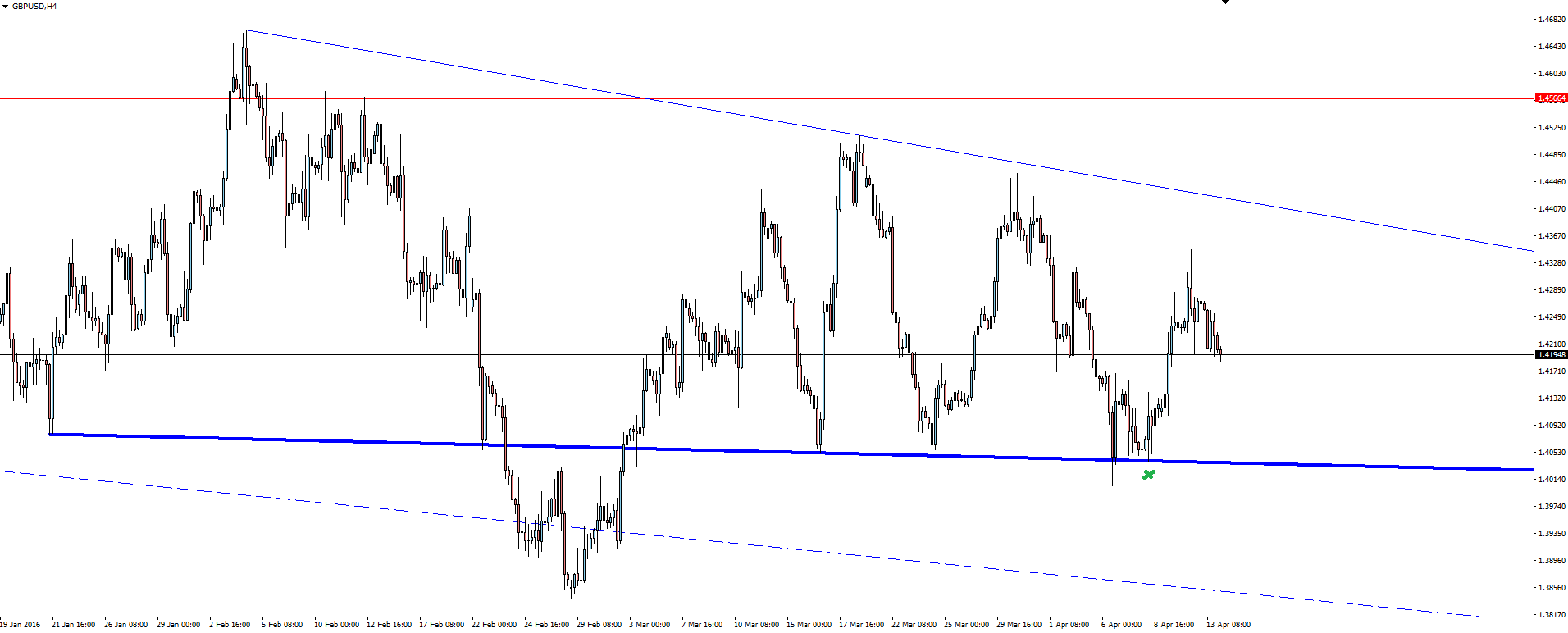

GBP/USD 4 Hourly:

I still think that level is just asking to be broken after the amount of touches we’ve seen, but as we say as traders, we have to say “it’s support until it’s not”. With price now sitting in a little bit of no man’s land heading in to BoE tonight. A clear sign of market uncertainty.

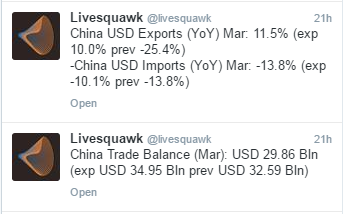

Moving forward and after the trade balance was released, we saw stocks enjoy the confidence that a good Chinese data print gives. An injection of central bank infused credit is seemingly doing its job with both imports and exports beating their expected numbers by a wide margin.

Whether the doom and gloom outlook for the Chinese economy was misplaced isn’t something any economist can answer with certainty, but on the surface that print will go a long way to allowing the bulls to exhale the deep breath they have been holding.

We’re obviously all watching the Aussie dollar, but…

Chart of the Day:

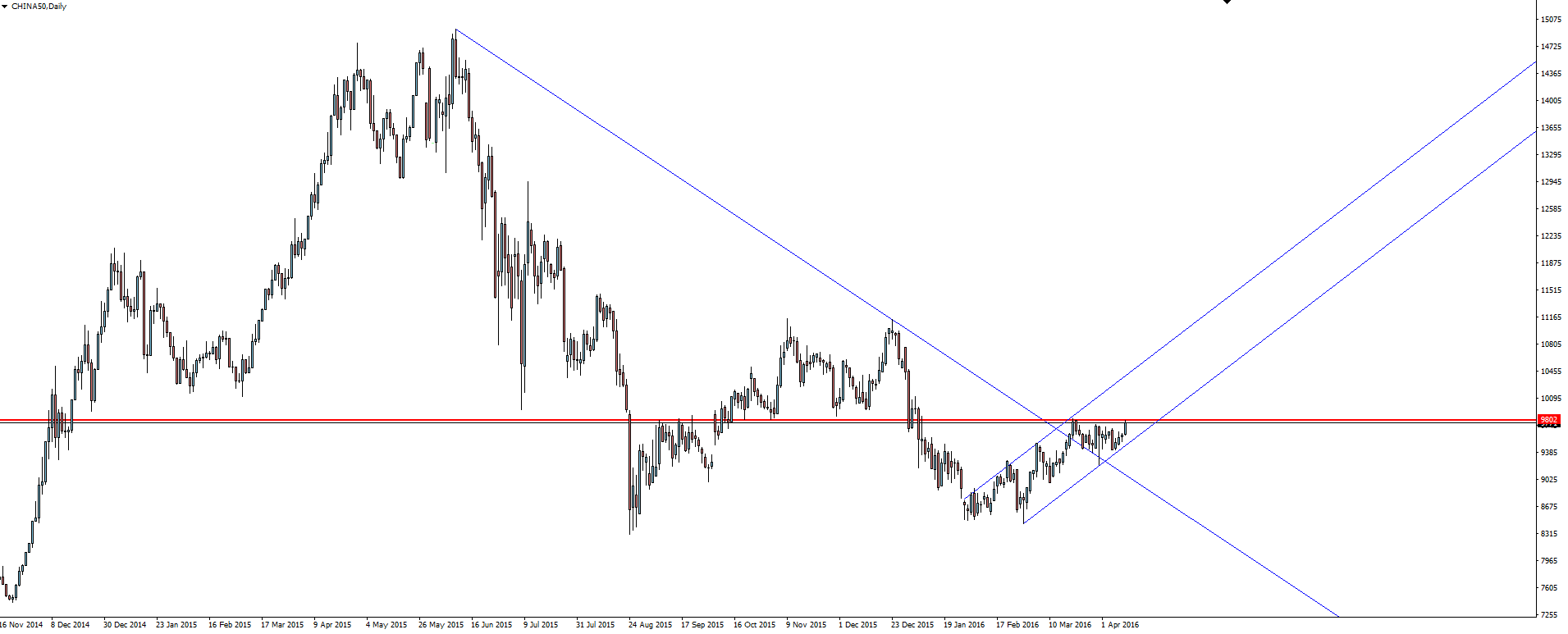

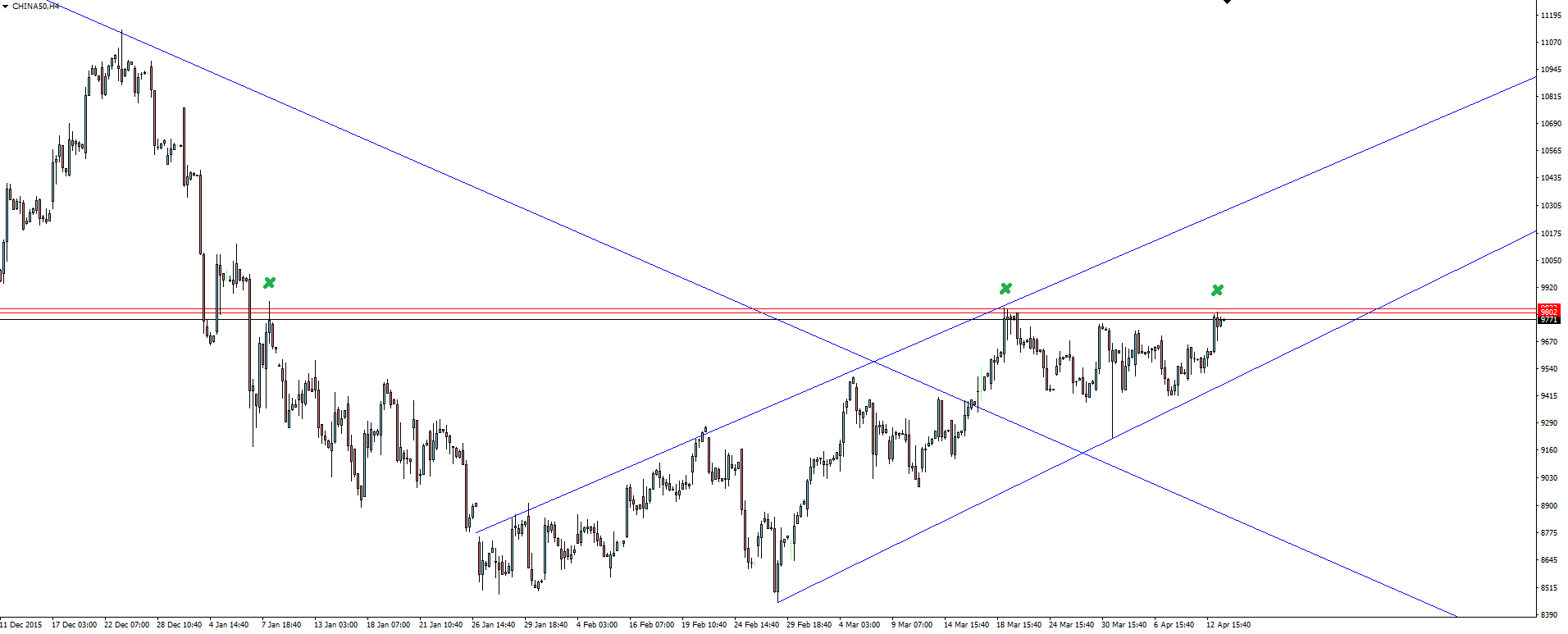

Another market in which you can try to take advantage of strength or weakness in the Chinese economy is the China 50. Already one of the more popular markets amongst Indices traders on the Vantage FX book, we take a look at what the above news could mean for the charts.

CHINA50 Daily:

It’s really hard to grab a clear trend off this chart, but as most of technical analysis is a self fulfilling prophecy, I’ve gone with the most obvious. To me that’s a bearish trend, simply because the lower highs are steeper than the higher lows. It doesn’t have to be scientific, it just has to be obvious.

Within that bearish trend, you can see that while price rallied to test the trend line, it formed what looks something like a short term flag pattern. Yes it’s broken out of the trend line, but it’s still an obvious bearish trend. Getting carried away with breakouts within long term trends is always fraught with danger.

CHINA50 4 Hourly:

Zooming into the 4-hour chart and we have some horizontal resistance in play. Remembering that we’re still in the midst of a longer term bearish trend, this level will be hugely significant in seeing just how strong the market is.

This is your level to manage your risk around.

On the Calendar Thursday:

AUD: Employment Change

AUD: Unemployment Rate

GBP: MPC Official Bank Rate Votes

GBP: Monetary Policy Summary

GBP: Official Bank Rate

USD: CPI m/m

USD: Core CPI m/m

USD: Unemployment Claims

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex Broker Vantage FX on the MT4 charts, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.