- Contrary gloomy predictions, investors that bought the 2022 dip are now sitting on juicy returns as the S&P 500 hits a new high

- Likewise, investors that resisted the selling pressure of the last bear market have regained their positions in full

- While we do not the length of the new bull market, markets keep teaching us that long-term investing remains the easiest path to success

- Looking to build a market-betting portfolio for 2024? Join InvestingPro now and access the AI-powered strategy that outperformed the market by 670% over the last decade.

It's easy to reflect and think we could have approached things differently, but now it's clear that the initial fear of stumbling into another major bear market was a bit exaggerated.

Looking back, we tend to view past declines as opportunities once they've been overcome. On the other hand, anticipating potential "future" declines often feels too risky. The focus on avoiding downturns can lead us to miss out on the upsides and significant buying opportunities that come with them.

At the same time, whenever there's an unanimous consensus on something, it's important to start questioning it.

We saw this recently with the widespread certainty of an impending recession that never happened. In early 2023, predictions of a stock market "crash" dominated the consensus.

However, today, the sentiment has completely shifted. Currently, 91% of fund managers expect a short-term (next 12 months) decrease in interest rates, signaling a projected "soft" landing and fostering high confidence in the market.

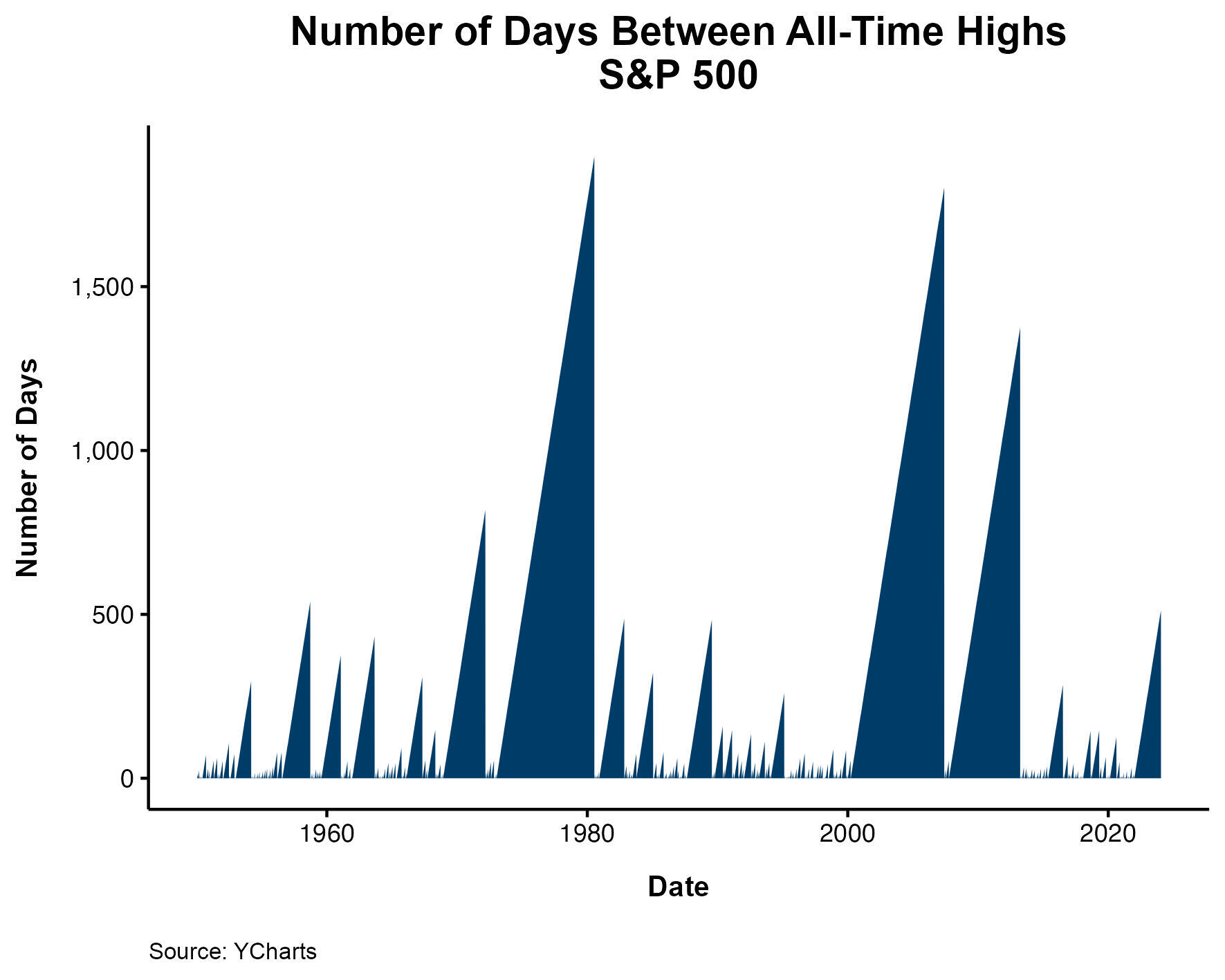

The S&P 500 has reached a fresh all-time high, surpassing the previous peak of January 3, 2022, in the 4818 range after a gap of 511 trading days (or 747 total calendar days).

Notably, this marks the sixth-longest duration it has taken to attain a new all-time high.

Nasdaq and Dow Jones also reached new all-time highs this week.

Over the past five years, the S&P 500 has posted an 80% performance. This goes to show that patience, once again, has rewarded the long-term investor.

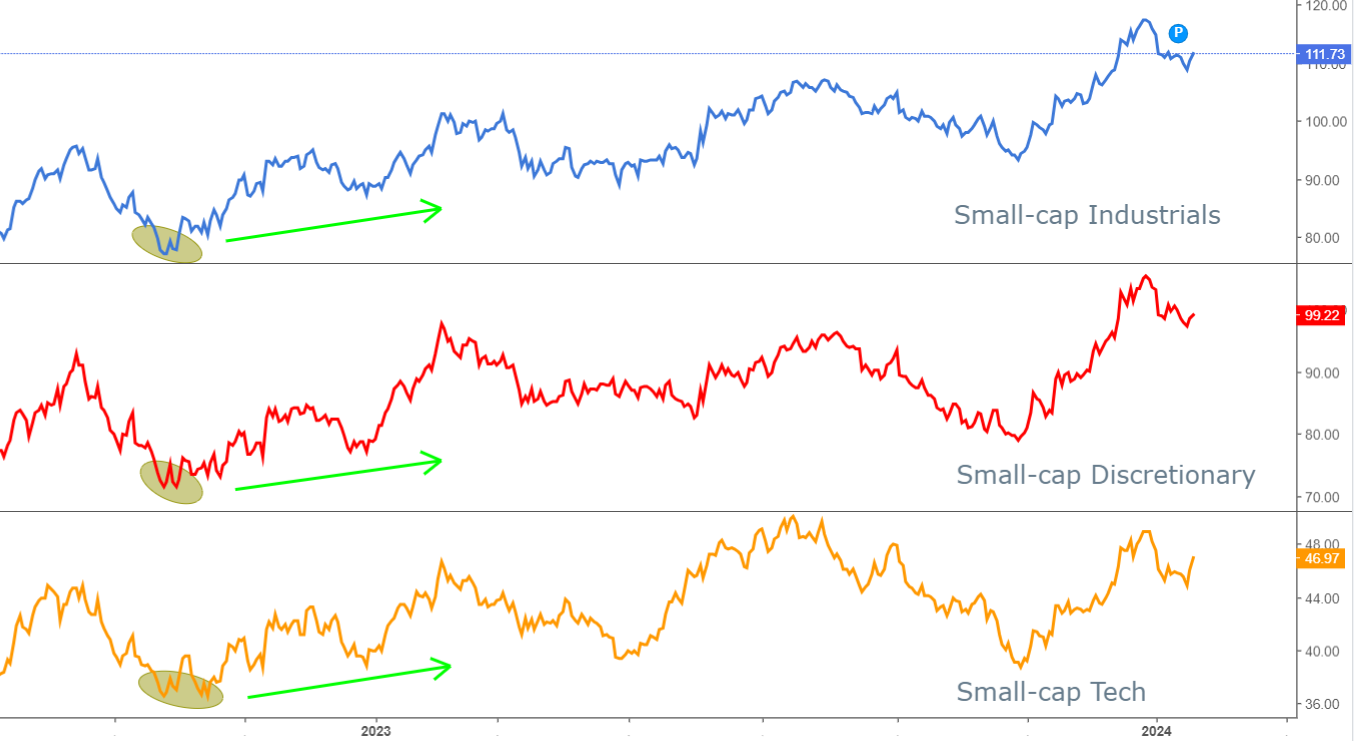

Many individuals made decisions, like staying on the sidelines, influenced by the underperformance of "small caps" and the perception that the Russell 2000 couldn't "keep up." However, in reality, most sectors, especially the major ones, are performing well.

Examining the chart above, since the lows of September 2022, a bullish trend is evident for Small-cap Industrials, boasting a noteworthy gain of +44%. Additionally, Small-cap Discretionary has demonstrated a robust performance, recording a +39%, while Small-cap Tech has shown a respectable +27% increase.

Since its lows in October 2022, the S&P 500 has surged by +35%, while the Russell 2000, since its lows in October 2023, has seen an increase of about +20%. It's a well-established trend that small caps often lag behind large caps during bullish markets, like the one we're currently in. Therefore, witnessing more convincing performance than the S&P 500 from small caps is quite typical.

However, on a positive note, small caps are presently achieving new highs in comparison to previous attempts, as indicated by the chart. This serves as another signal of a bullish market trend.

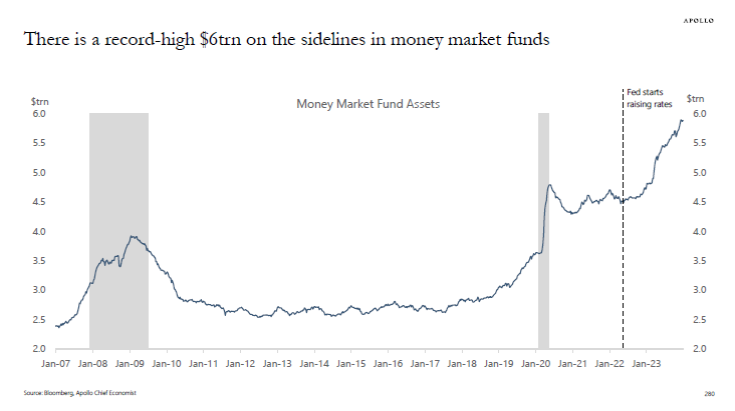

Lastly, a potentially record level of $6 trillion in money market accounts could benefit equities and the overall economy.

Let's embrace the bull market (acknowledging the uncertainty of its duration) while recognizing that bearish markets are an inherent risks of the financial landscape.

***

Beating the market has now become a lot easier with our Flagship AI-Powered ProPicks

Oftentimes, investors will miss incredible market opportunities simply by not knowing which companies to bet on.

Luckily, those times are long gone for InvestingPro users. With our six cutting-edge AI-powered strategies, including the flagship "Beat the S&P 500," which outperformed the market by 829% over the last decade, investors now have the best selection of stocks in the market at the tip of their fingers every month.

Strategies are rebalanced monthly, guaranteeing that our users stay ahead of the curve amid shifting market dynamics and an ever-changing macroeconomic environment.

Subscribe here for up to 50% off as part of our year-end sale and never miss a bull market again!

Disclosure: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.