- Buffett keeps outperforming the S&P 500 at the age of 92

- The Oracle of Omaha has kept on buying stocks amid this year's bear market

- Here's a look at his current portfolio with InvestingPro

- Technology hardware, storage, and peripherals (41.9%).

- Banks (13.2%)

- Oil, gas, and fuels (10.9%)

- Beverages (8.4%)

- Consumer finance (7.3%)

- Food products (4.2%)

- Capital markets (3.3%)

- Media (2.0%)

- Computer services (2.0%)

- Entertainment (1.9%)

- Healthcare providers and services (1.3%)

- Food and basic necessities (0.8%)

- Insurance (0.8%)

- Automotive (0.6%)

- Internet and direct retail marketing (0.4%)

- Chemicals (0.4%)

- Specialty retail (0.3%)

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

When we talk about value investing, the one person who will always come to mind is Warren Buffett, arguably the greatest investor of all time. Born on August 30, 1930, in Omaha, Nebraska, United States, he is one of the wealthiest men in the world and is the chairman of Berkshire Hathaway (NYSE:BRKa) (NYSE:BRKb).

When he was 24 years old, he was hired to work in the company of another great investor, Benjamin Graham. In 1956, he left that company and, with his savings, opened the Buffett Partnership, an investment partnership.

Eventually, he began to buy Berkshire Hathaway shares aggressively, and after taking full control of the company, he changed the company's business from textiles to insurance. On August 14, 2014, Berkshire Hathaway's stock price reached $200,000 per share.

Warren Buffett is one of the greatest exponents of value investing, an investment philosophy that consists of buying undervalued companies to sell them in the future or even hold them for the very long term. However, what not many people know, is that the concept of value investing, in fact, comes from Buffett's mentor, Benjamin Graham, who coined the term in 1928.

Let's dive into Buffett's current portfolio using the InvestingPro tool:

Portfolio Evolution And Composition

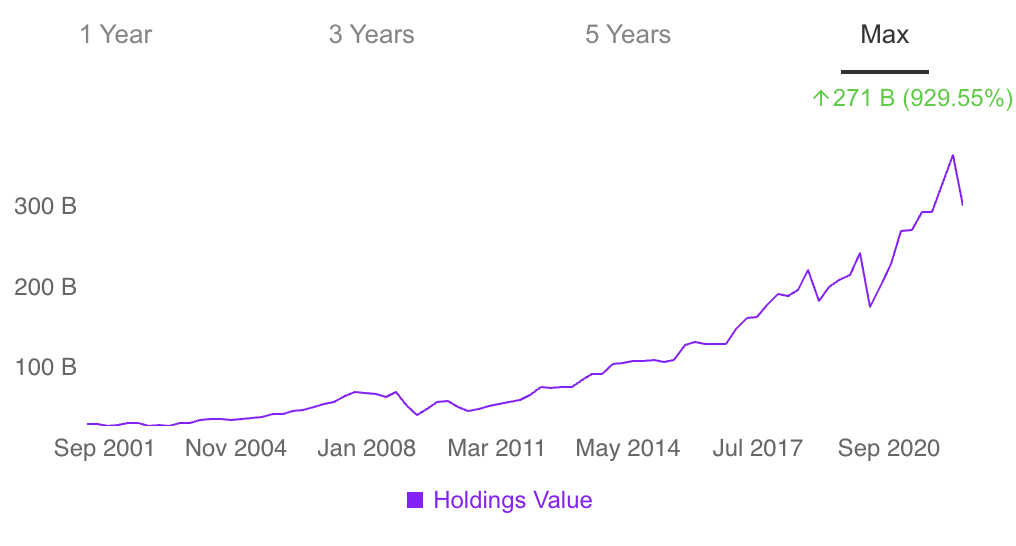

In the following chart, we can see the long-term evolution and accumulated profitability of Buffett's portfolio. Undoubtedly, an investment success.

Source: InvestingPro

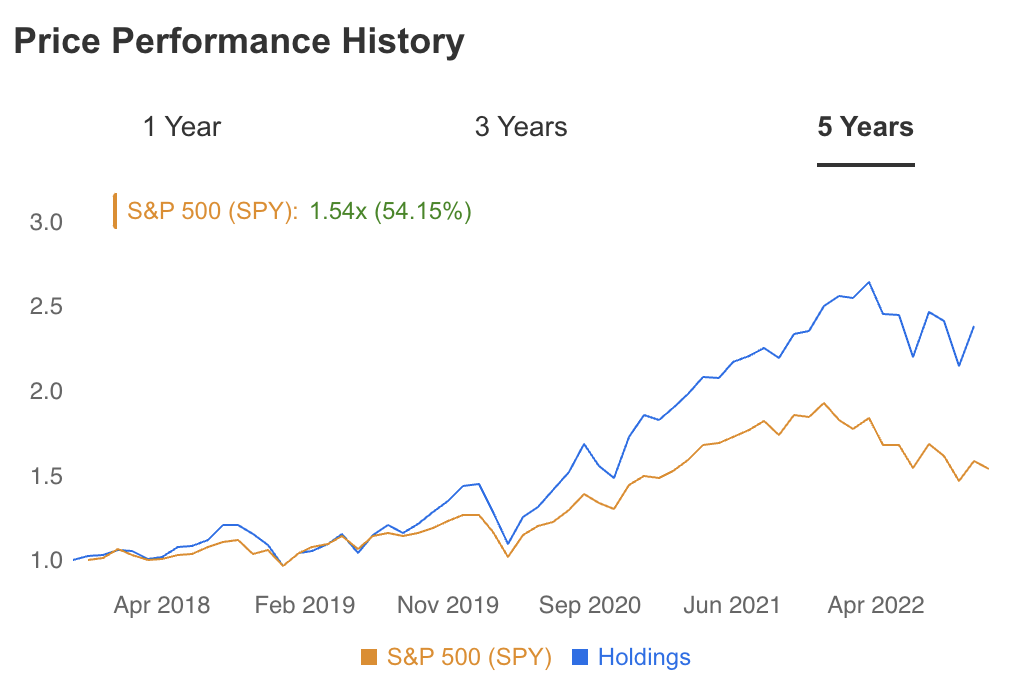

In the second chart, we can see a comparison of the profitability of his portfolio versus the SPDR S&P 500 (NYSE:SPY) in the last five years.

Source: InvestingPro

Now, a breakdown of the current portfolio composition, by sector:

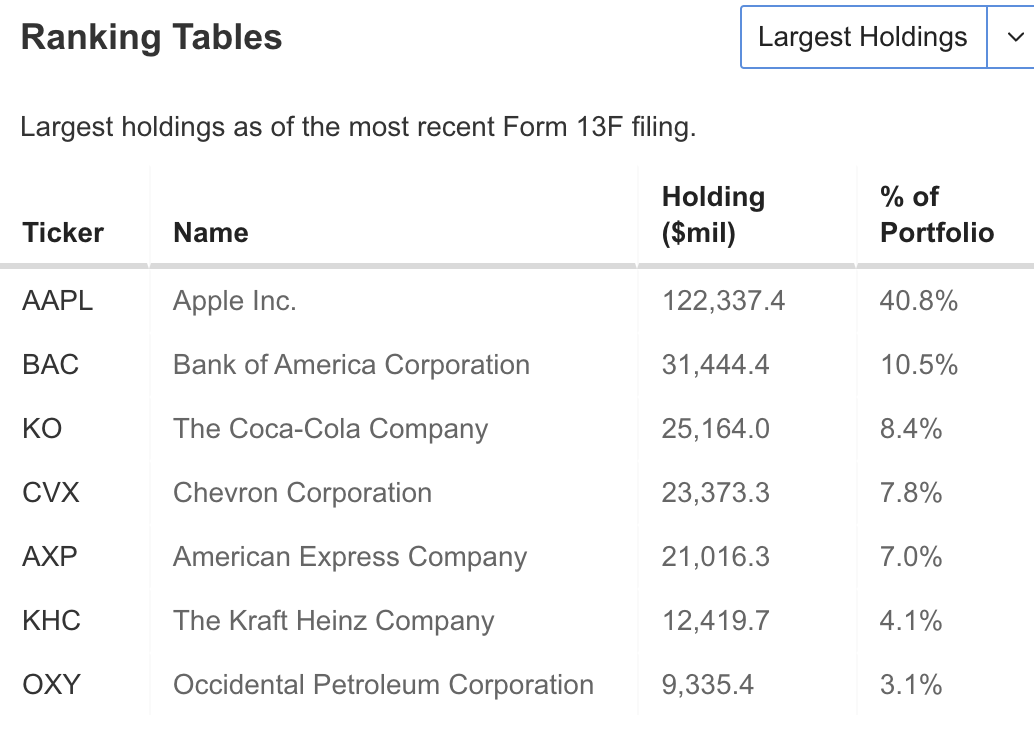

Let's have a closer look at his top five holdings, i.e., those five stocks that dominate the portfolio and have the highest weight, all based on the latest official report issued.

Source: InvestingPro

1. Apple

Cupertino, California-based Apple (NASDAQ:AAPL) is the world's largest company and, accordingly, occupies the first position in Buffett's portfolio with a very high weight of 40.8%.

The company develops, manufactures, and sells devices of all kinds, the best-known being cell phones, laptops, smartwatches, and headphones.

Apple has recently presented outstanding financial results for its fourth fiscal quarter of 2022, corresponding to the months of July, August, and September. It had its best fiscal year in revenue, up 8% from 2021. Sales in all categories of its products and services, minus the iPad, have grown in the last year, despite the general industry-wide sales decline.

2. Bank of America

Bank of America (NYSE:BAC) ranks second in the portfolio with a weight of 10.5%.

Like Apple, the behemoth bank also posted positive earnings recently. With results with a net income of $7.1 billion, equivalent to earnings per share (EPS) of 81 cents, above the 78 cents anticipated by the consensus. Revenues of $24.5 billion exceeded the $23.5 billion estimated.

Moreover, net interest income rose 24% to $13.8 billion, driven by the benefits of interest rate hikes by the U.S. Federal Reserve, including lower premium amortization expense and solid loan growth.

3. Coca-Cola

Atlanta-based Coca-Cola (NYSE:KO) also posted both revenue and earnings growth in the quarter, beating market expectations, and raised its full-year 2022 earnings outlook on the back of demand.

Net revenues increased by 10% to $11.1 billion. Earnings per share came in at 69 cents, up 7%. Year-over-year sales volume was up 4%.

It expects organic revenue growth for the year, between 14% and 15%, from a previous estimate of 12 to 13%.

4. Chevron

The company earned $29.112 billion (up 175% from last year) in nine months and $11.261 billion in the quarter, the second-highest figure in its history.

It also paid dividends of $2.7 billion (up 6% per share from the same period a year ago), increased investments by more than 50% over last year, paid down debt for the sixth consecutive quarter and repurchased $3.75 billion in stock (more than 1% of shares outstanding).

5. American Express

Surprise: like all of Buffett's top 5 holdings, American Express (NYSE:AXP) also beat earnings estimates last quarter.

The company earned $2.47 per share, beating market estimates of $2.41 per share, on revenue of $13.56 billion. It also raised its full-year outlook amid increased customer spending and expects revenue growth to be 23% to 25% higher than 2021.

The credit card company increased its reserves for potential defaults. The provision for credit losses of $778 million in the quarter represents an increase of almost 90% from the previous quarter.

Disclosure: The author currently does not own any of the securities mentioned in this article.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »