The US aircraft manufacturer Boeing (NYSE:BA) has experienced numerous scandals in recent years, which have put the company under a lot of pressure. Despite a new order from the US Air Force worth 2.56 billion US dollars for the development of surveillance aircraft, confidence in Boeing remains severely shaken.

Between crashes, production errors and ethical misconduct

Boeing has made negative headlines several times in recent years. The crashes of two Boeing 737 Max aircraft five years ago, which killed 384 people, were particularly serious. In this context, the company may have provided the courts with false documents in order to avoid criminal prosecution. Despite a settlement and the introduction of a compliance programme, Boeing was accused in May 2024 of violating the terms of the settlement.

The technical problems are not stopping: from problems with oxygen masks in 2600 Boeing 737 aircraft to an incident in which a section of the fuselage of a Boeing 737-9 Max broke off shortly after take-off, confidence in the quality of Boeing aircraft has been severely damaged. Further incidents, such as an emergency landing in Istanbul and a tyre bursting during a landing in Alanya, are adding to the concerns.

Tragic deaths and further scandals: whistleblowers in danger

The problems at Boeing became particularly explosive when two whistleblowers who had drawn attention to abuses in the company died. A former quality manager was found dead, and another quality inspector died after a sudden infection. Both deaths raise questions and reinforce the impression that there are more than just fundamental problems at Boeing. All the ingredients for a serious criminal case are present.

The future of Boeing: a long road to restore trust

Although Boeing continues to win major contracts, as the recent deal with the US Air Force shows, the company faces a long and difficult road to regain lost trust. The numerous scandals and technical problems have raised public awareness, and it will take some time before Boeing's efforts to improve quality and safety bear fruit. Nevertheless, it seems clear that Boeing, as a major player in the US economy, is considered to be "too big to fail" and that everything will be done to support the company. At the same time, international aviation authorities will have to keep a close eye on developments at Boeing.

It is no surprise that after this series of scandals, the days of the last CEO, David Calhoun, were counted earlier than initially planned. He was actually supposed to remain in the top job until the end of this year. Obviously, Calhoun has become untenable and is now being replaced by Kelly Ortberg. Kelly Ortberg is no stranger to the industry.

Kelly Ortberg was already retired. The 64-year-old had previously spent many years running aerospace and defence supplier Rockwell Collins (NYSE:COL) and worked for Rockwell parent company RTX (formerly Raytheon (NYSE:RTN)) until his retirement three years ago. He is likely to take on one of the most difficult and thankless board positions at Boeing. It will be a very long road out of the crisis.

Is this course of action enough?

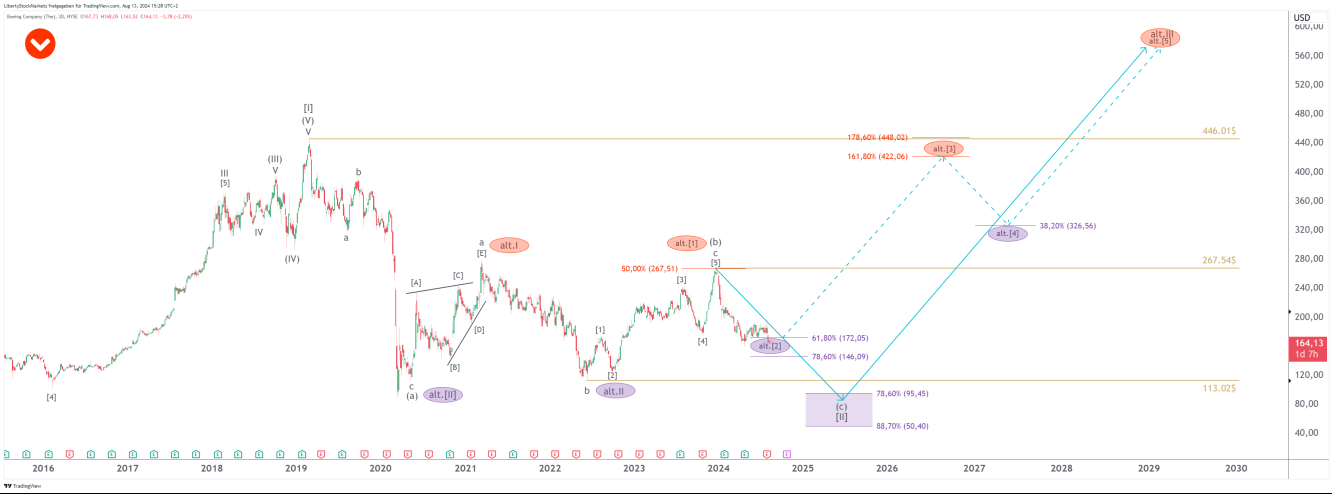

We remain extremely sceptical. If we look at the Boeing chart, it is fully in line with our forecast.

And even now, we see no reason to deviate from our forecast. We therefore maintain our assessment that the Boeing share will fall to the purple box between $95.45 and $50.40. We see the best chance for a sustainable turnaround there. This would also fit in very well with the fact that the new CEO must first deliver. If the share price were to rise sustainably now, that would, in our view, be a completely wrong signal. There are simply too many things amiss.

Even though everything points to a final sell-off for the reasons given, a direct breakout to the upside is possible as an alternative. The stock is now in exactly the ideal range for a sustainable upward trend reversal. However, we consider this to be significantly less likely than our forecast.

Until confidence is fully restored, we can understand anyone who does not want to fly on a Boeing plane to go on holiday – including us.

If you want to see more accurate analysis and benefit from our trading signals, then become part of our rapidly growing community. To do so, simply click on the link next to my picture above this text. By the way, you can test our service for a full 14 days free of charge.

Disclaimer/Risk warning:

The information provided here is for informational purposes only and does not constitute a recommendation to buy or sell. It should not be understood as an explicit or implicit assurance of a particular price development of the financial instruments mentioned or as a call to action. The purchase of securities involves risks that may lead to the total loss of the capital invested. The information provided does not replace expert investment advice tailored to individual needs. No liability or guarantee is assumed, either explicitly or implicitly, for the timeliness, accuracy, appropriateness or completeness of the information provided, nor for any financial losses. These are expressly not financial analyses, but journalistic texts. Readers who make investment decisions or carry out transactions based on the information provided here do so entirely at their own risk. The authors may hold securities of the companies/securities/shares discussed at the time of publication and therefore a conflict of interest may exist.