A bright start for bulls on the back of positive NVIDIA Corporation (NASDAQ:NVDA) earnings wasn't enough to generate a day of meaningful gains. However, it did help stall the losses of the last couple of days.

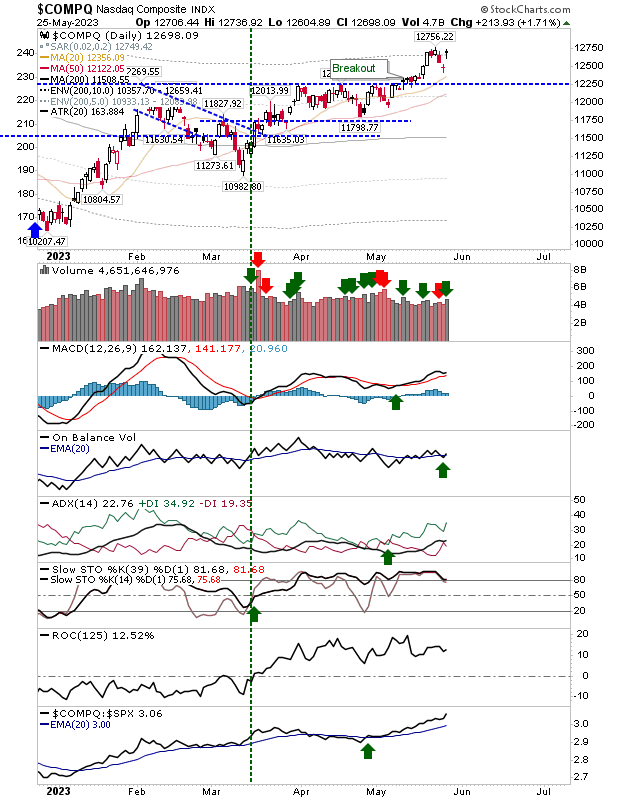

The Nasdaq was the biggest beneficiary of today's action, but not enough to see an end-of-day finish that cleared last week's swing high, nor delivery of a large white candlestick, despite the morning breakout gap.

Technicals are net bullish, and relative performance against the S&P 500 has become consistently stronger since the start of May. While today's candlestick I would view as typically 'bearish,' today's volume ranked as confirmed accumulation (bullish). Overall, I would be looking for higher prices from here.

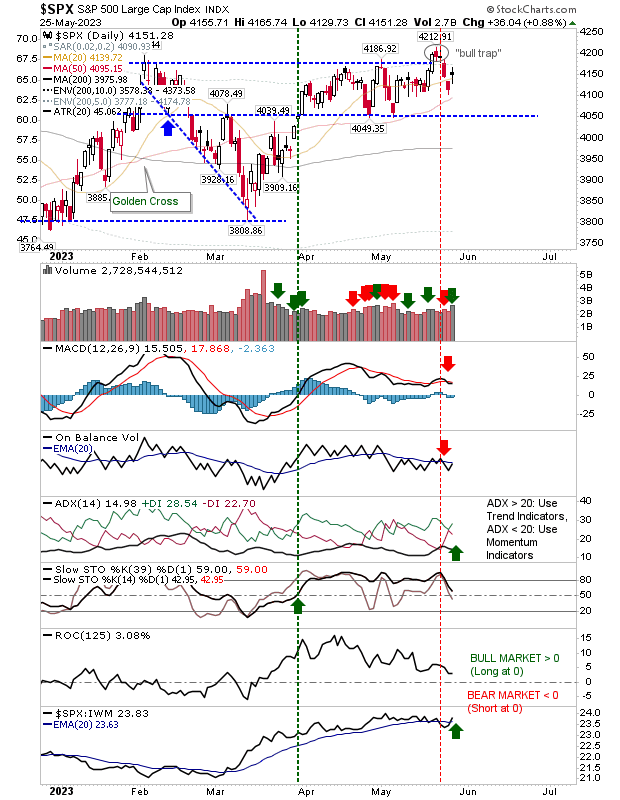

The S&P remains caught in a bit of a no-mans land after the 'bull trap.' The index is once again inside the April-May trading range but above 4,050 support defined by February-March trading. Today's gain registered as accumulation, but not enough to reverse previous 'sell' triggers in the MACD and On-Balance-Volume. The index is outperforming the Russell 2000 and is likely to continue to do so over the coming days.

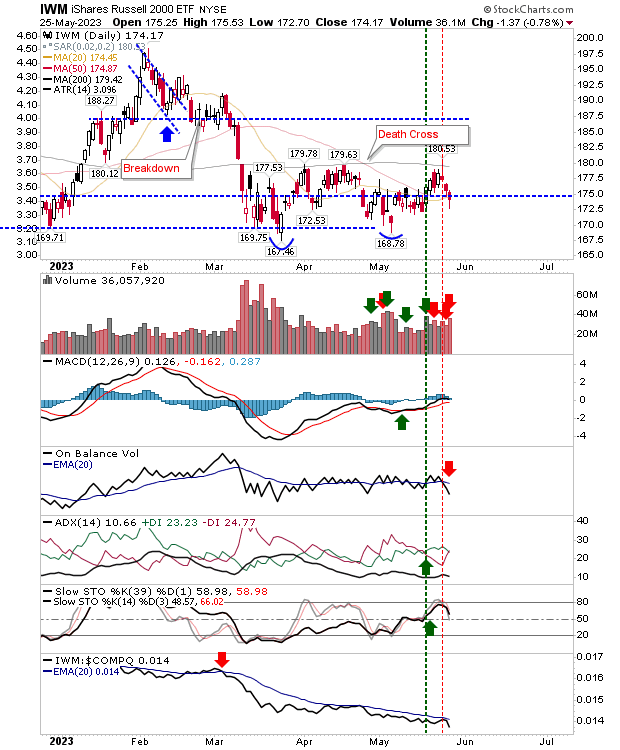

The Russell 2000 (IWM) was a little clearer in its intentions, with a loss that dropped the index just below its 50-day MA. This added to the trouble in On-Balance-Volume, which has been switching back and forth for the last few months. The damage isn't terminal, but a higher close is needed before we hit the long weekend.

For Friday, ideally, we want to see a positive finish to the end-of-week, one which neutralizes the bearish aspect of today's "black candlesticks" and the selling in the Russell 2000. The S&P remains the leadership index, and there is a good chance we could have new all-time highs by the close of business tomorrow.