This article was written exclusively for Investing.com

- Bitcoin and Ethereum tanked from all-time highs

- Ethereum outperformed Bitcoin in Q2

- Ethereum explosive over H1 2021, moving ten times higher than Bitcoin on percentage basis

- Market seems to favor the Ethereum protocol

- Bitcoin’s threat to governments recedes, Ethereum’s is rising

Over the past weeks and months, Bitcoin appears to have handed the bullish baton to Ethereum. That wasn't the case when each cryptocurrency was introduced to markets. Both provided early investors with extraordinary financial rewards.

In 2010, a Bitcoin token was only five cents. On Apr. 14, at over $65,500, a $10 investment at its inauguration would have been worth over $13.1 million. By August 2015, Bitcoin had risen to $261; that $10 investment was worth $52,200 in mid-April.

In August 2017, an Ethereum token was at 75.33 cents. Switching to Ethereum in mid-2017 bought nearly 69,300 Ether tokens. At the May high of over $4,400, the $10 purchase in 2010 and swap in 2017 was worth over $300 million. Of course, hindsight is always twenty-twenty.

Meanwhile, Ethereum may be the cryptocurrency with the second-leading market cap, but its price momentum in 2021 has made it the leader in capital appreciation.

Bitcoin and Ethereum tanked from all-time highs

Like shooting stars, Bitcoin and Ethereum came tumbling down in the second quarter as the parabolic rallies imploded. While a text from Elon Musk about the carbon footprint of cryptocurrencies left by Bitcoin mining and Tesla's (NASDAQ:TSLA) decision to abandon accepting the crypto as payment for its EVs stated the selling, China’s ban accelerated the declines.

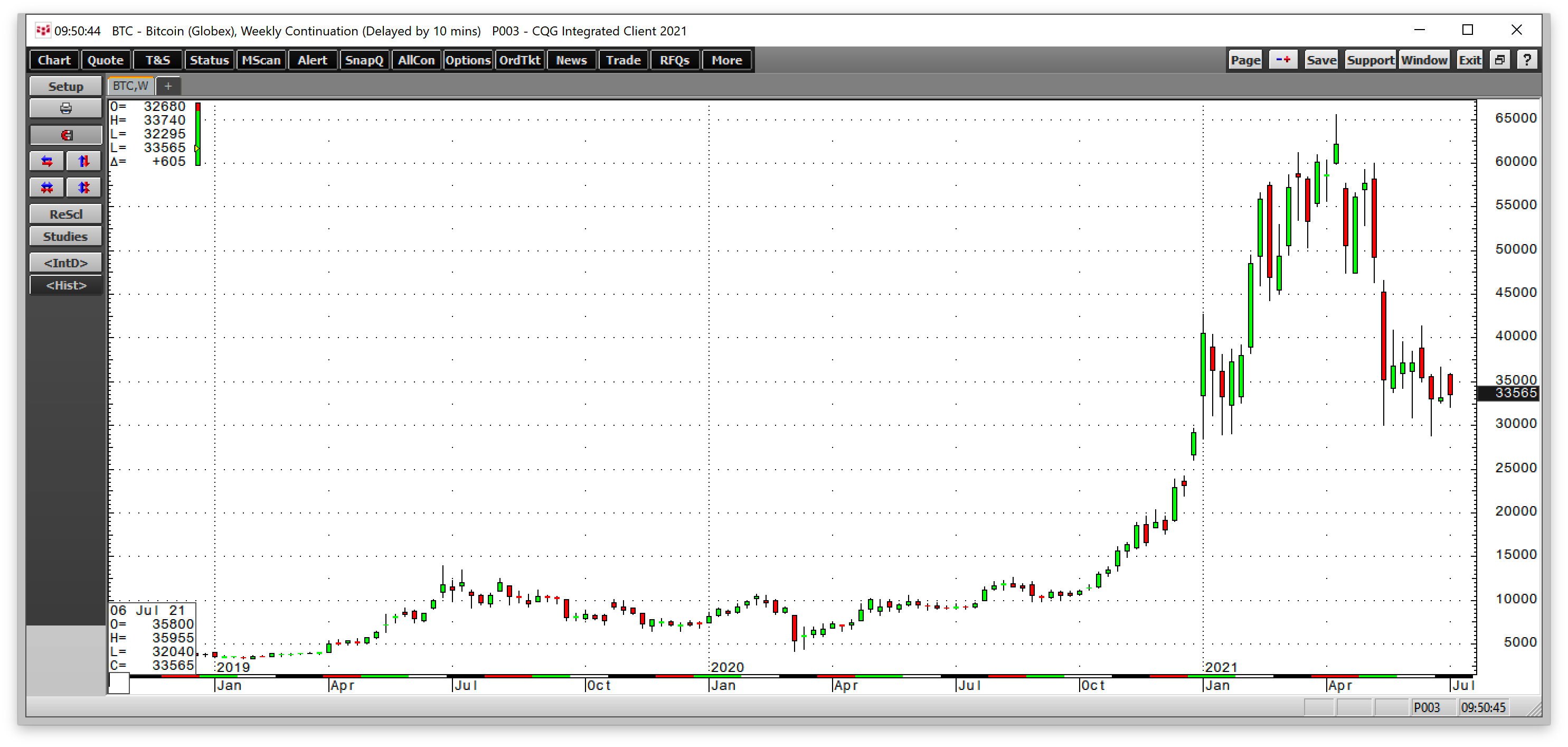

Source, all charts: CQG

The chart of Bitcoin futures highlights the decline from a record $65,520 high on Apr. 14 to a low of $28,800 in late June. Bitcoin was around the $33,500 level at the end of last week, a lot closer to the low than the mid-April peak.

Ethereum reached $4,406.50 per token in mid-May before the price dropped like a stone to $1,697.75 in late June. At the $2,136 level on July 9, Ethereum was also closer to the low than the high.

Ethereum outperformed Bitcoin in Q2

In Q2, Bitcoin fell 42.11% from its closing level at the end of March 2021. Ethereum moved 16.60% higher over the same period.

Over the first six months of 2021, Bitcoin was still 20.09% higher than its closing price at the end of 2020. Ethereum was up 205.19% over the same timeframe. Ethereum has been the star of the top two cryptocurrencies in 2021 as the market has chosen to support the crypto with the second-leading market cap.

Ethereum explosive over H1 2021, moving ten times higher than Bitcoin on percentage basis

As Ethereum moved over ten times higher than Bitcoin on a percentage basis over the first six months of 2021, the market has sent a powerful message.

In markets across all asset classes, analysts and pundits try to explain why one market outperforms or underperforms another. However, the most significant factor is, that it does.

Sentiment or herd behavior is the most critical factor when explaining an asset’s performance. Nonetheless, at the end of the day, the explanations are meaningless. All that matters is price action.

The asset's chart is the single compelling factor; the analysis is secondary. The research becomes stale while price action is a living, breathing, real-time snapshot of sentiment.

Prices move higher when buyers are more aggressive than sellers and vice versa. The price action in Bitcoin and Ethereum over the first half of 2021 validates the market’s pivot towards the latter.

Market seems to favor the Ethereum protocol

Ethereum was born as a complement to Bitcoin, but it developed into a competing protocol. Blockchain technology is the heart and soul of fintech. The philosophical question—which came first, the chicken or the egg—applies to Bitcoin and blockchain.

However, Bitcoin has developed into a store of value and medium of exchange or a currency with a libertarian twist. Meanwhile, Ethereum embodies the most attractive attributes of blockchain as transactions are far faster and efficient on the Ethereum network than on Bitcoin’s.

As fintech continues to revolutionize the financial world, reducing settlement times on transactions from days to seconds or even shorter, the Ethereum protocol’s value has grown. The ascent of the Ethereum token and its outperformance compared to Bitcoin over the first half of 2021 reflects the value the market is placing on the cryptocurrency with the second-highest market cap.

While Ethereum’s efficiency explains the recent performance, the price action is enough to validate its value.

Bitcoin’s threat to governments recedes, Ethereum’s is rising

All cryptocurrencies are a threat to the government’s control of the money supply. Controlling the purse strings is a critical component of power over the masses. Cryptocurrencies are a libertarian means of exchange. A libertarian philosophy seeks to maximize autonomy, political and economic freedom, remove power from governments, and return it to individuals. The central bank and government control of the money supply run counter to libertarian theory.

Therefore, Bitcoin and Ethereum pose a threat to governments. Cryptocurrency prices are a function of the bids and offers for the tokens, nothing else. They have limited supplies, while governments can print fiat currencies to their heart’s content.

Though governments shroud their policy decisions to expand or contract the money supply with explanations of “stability” or “stimulus,” it all comes down to control. The cryptos reflect a free-market approach to money without government interference.

We are likely to hear negative comments from governments rise with the market cap of the cryptocurrency asset class as growth comes at the expense of fiat currency’s role in the global financial system. The recent hacks and ransom payments from Colonial Pipeline and JBS, the energy and meat packing companies, will serve as fodder for the government to challenge cryptocurrencies for their nefarious uses.

Governments will strive to increase regulations and control over the cryptocurrency market. They will eventually issue digital currencies they can control using fintech innovations within a framework that achieves their goal of controlling the money supply.

Meanwhile, Bitcoin has been in the crosshairs of governments, but that focus could shift to Ethereum. It is a more robust protocol, achieving market acceptance because of its speed and efficiency, making it a potential target for government regulators and legislators looking to maintain the status quo.