- This week, significant events in the crypto space garnered a surprisingly calm market response

- Initial panic subsided within 24 hours as the market digested a potential power shift in the cryptocurrency industry

- Bitcoin bulls are currently aiming for a rally toward $40,000 and the likelihood increases if it closes the week above $38,000

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

This week marked significant developments in the cryptocurrency industry, with the DOJ imposing a historic fine on Binance and the exchange's admission to serious accusations leading to the forced resignation of Changpeng Zhao. Despite the gravity of these events, Bitcoin's eventual response was quite subdued.

Surprisingly, the initial panic that ensued following these revelations dissipated within a short 24-hour period, and the market swiftly resumed its course. Notably, the market actively embraced recent developments indicating a potential shift in the balance of power within the cryptocurrency industry, with institutional investors lending their support.

Industry experts, commenting on Binance's reconciliation with US authorities, have asserted that it is in the best interest of the market. Moreover, the increased rhetoric around transparency in the sector is believed to strengthen the likelihood of approval for the spot Bitcoin ETF, a development that has significantly influenced the market in recent months.

Bitcoin's price chart this week also shows that the Binance incident was quickly priced in. Bitcoin, which fell 5% on Tuesday amid panic selling on the news of the settlement, recovered its losses the next day and continued to maintain its positive outlook.

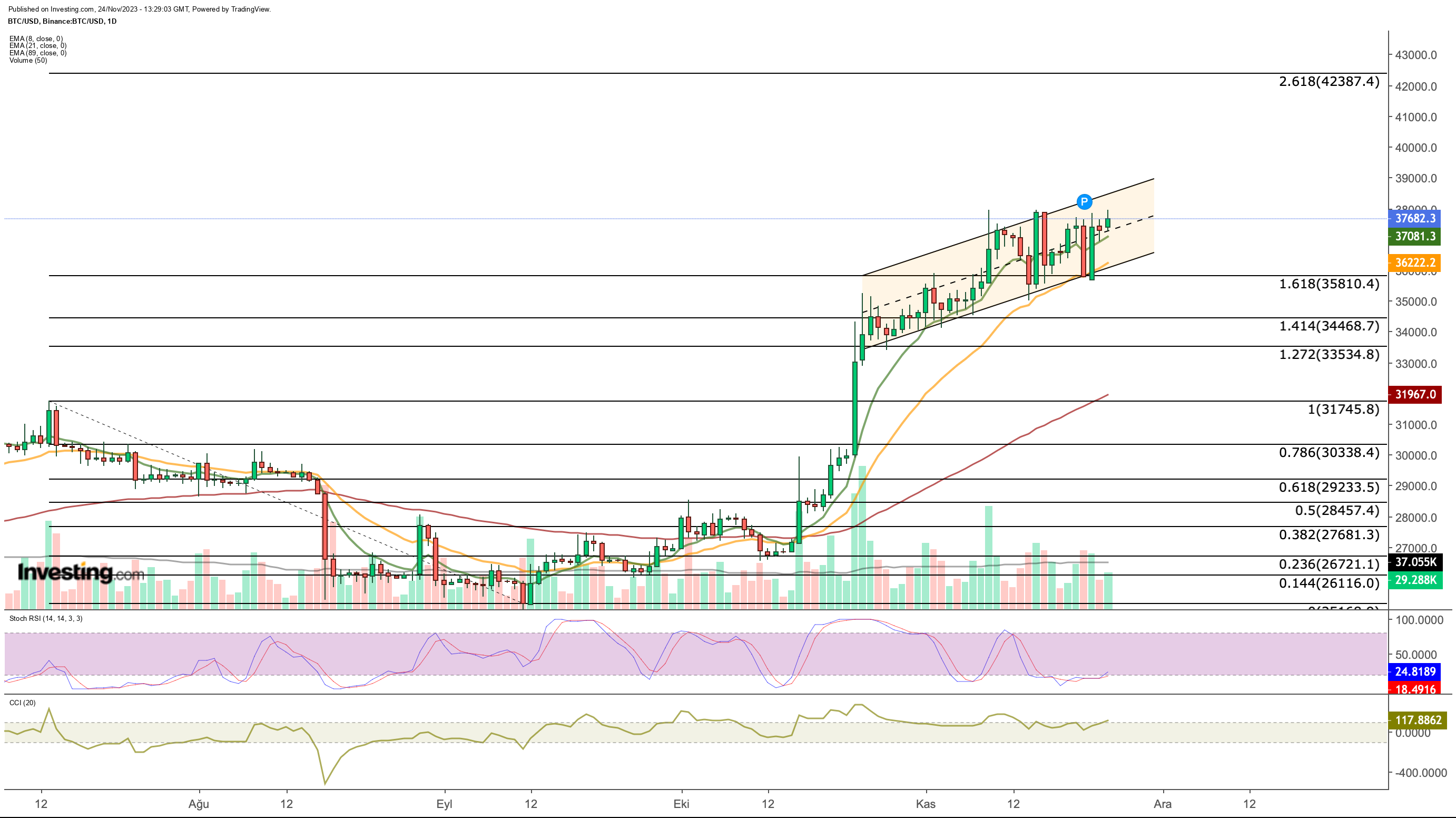

Bitcoin has remained in a sideways pattern in the $35,500 - 37,500 range within the ascending channel in November. At this point, the cryptocurrency, which has exceeded the Fibonacci expansion area according to the last bearish momentum, has turned the Fib 1,618 value into support. In November, an intermediate resistance was formed in the narrow band of $37,500 - 38,000. Just above this resistance, a second resistance line at $38,500 - 38,600 may form in the short term.

Is $40,000 Likely for Bitcoin?

According to the short-term price action, Bitcoin, which witnesses increased demand again in the second half of the week, could see its next stop in the $40,000 region if it can realize a weekly close above the resistance line in the $38,000 band. This possible trend is supported by the Stochastic RSI, which tends to break out of oversold territory on the daily chart, and the BTC price remains above the short-term EMA values.

On the other hand, if buyers fail to generate enough volume to step into the $38,000 band, we could see that the cryptocurrency may retreat towards around $35,800, which is short-term support within the band movement, with sellers lurking.

While maintaining this value, which corresponds to the lower band of the ascending channel, can keep bullish expectations alive, a clear daily close below it can be considered as the beginning of a correction. Accordingly, in a possible correction, the possibility of Bitcoin retreating to $ 33,500 will increase.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.