Bitcoin becomes the 7th largest asset worldwide, meanwhile investors prefer US over EU equities. Each week, the Syz investment team takes you through the last seven days in seven charts.

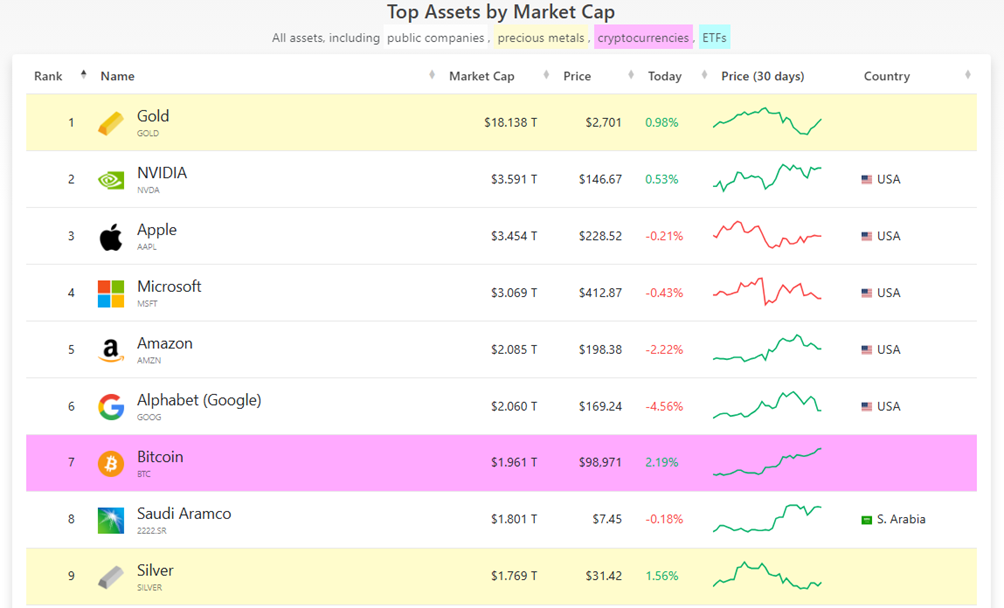

1. Bitcoin Is Now the World's 7th Largest Asset in Terms of Market Capitalisation

As it flirts with the USD $100,000 threshold, bitcoin is now the world's 7th largest asset in terms of market capitalisation and could very soon move up to 5th place. Meanwhile, most individuals, pension funds, and other institutional investors have no exposure to this asset. How high will the price go if they start paying attention?

Source : www.companiesmarketcap.com

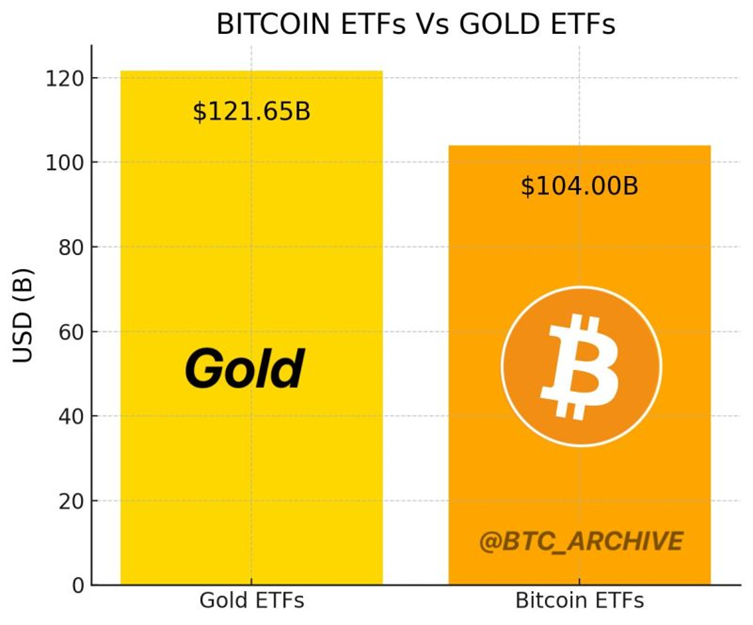

2. Bitcoin ETFs on the Verge of Overtaking Gold ETFs

Bitcoin ETFs are catching up with gold ETFs in terms of total assets held: $104 billion for bitcoin versus $121 billion for gold ETFs. This comes only 11 months after the launch of the 1st bitcoin spot ETF.

Source: Bitcoin Magazine

3. Most US Retail Investors Missed the Stock Market Rally

According to JP Morgan, the average individual investor has gained just 3.7% year-to-date, despite the market's historic rebound. By comparison, the S&P 500 is up 25% and on course for its best election year in 88 years. This is the worst annual performance for retail investors versus the index, which has recorded double-digit performance since 2015.

Retail investors lost most of their potential gains due to poor timing during market downturns. This year, retail investors stand to experience their fourth consecutive year of underperformance relative to the S&P 500 index.

Source: JP Morgan, The Kobeissi Letter

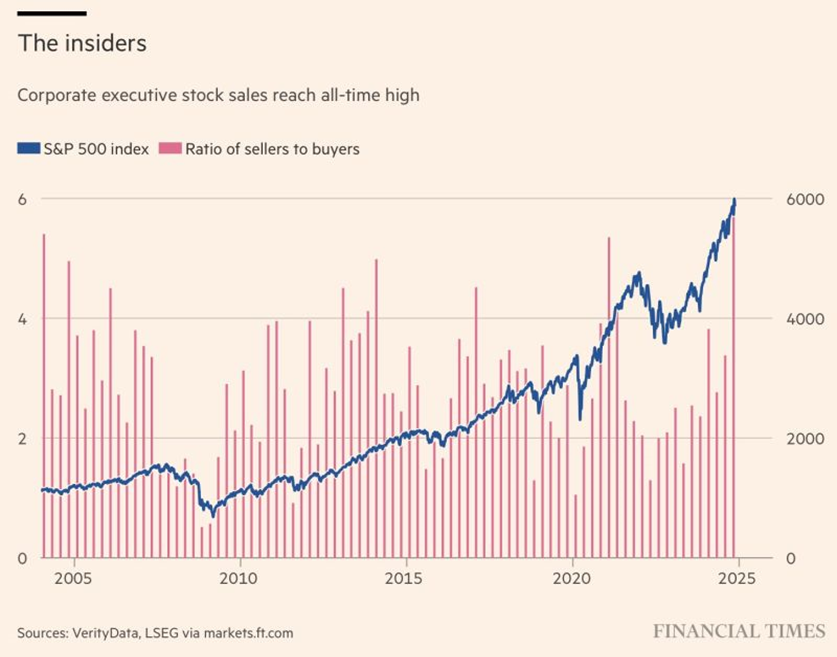

4. Company Executives Are Selling Their Company Stock

A record number of US executives are selling shares in their companies, with insiders from Goldman Sachs (NYSE:GS) to Tesla (NASDAQ:TSLA) and even Donald Trump's own media group taking advantage of the stock market surge that followed his election victory. According to VerityData, the rate of insider sales reached a twenty-year high for a single quarter.

These sales, carried out by executives of companies belonging to the Wilshire 5000 index, include punctual profit-taking operations as well as regular sales triggered by the executives' automatic trading plans. The Wilshire 5000 index is one of the largest indices of US companies. While insider selling is commonplace - especially as the stock market was already breaking records before Trump's victory - the surge that followed on 5 November shows that US executives are already personally profiting from his return even before he re-enters the White House.

Source: Financial Times

5. Germany's Decline

Germany's decline is evident on the stock markets: the total market capitalisation of German companies as a percentage of global market capitalisation has once again fallen by less than 2%. Only two German companies - SAP and Siemens - feature in the global Top 100.

Source: Bloomberg, HolgerZ

6. A Record Underperformance of European Equity Markets Versus the US

The Stoxx Europe 600 index has underperformed the S&P 500 by 21% this year, the most on record. European equities have returned just 3% since the start of the year, significantly less than the 24% gain in US equities. The Stoxx Europe 600 index is now on course for its eighth year of underperformance in the last ten years.

Over the past decade, European equities have risen by just 50%, far less than the S&P 500 (187%). As a result, the US stock market is now 4 times larger than the European market. Investors favour the US over Europe.

Source: Financial Times

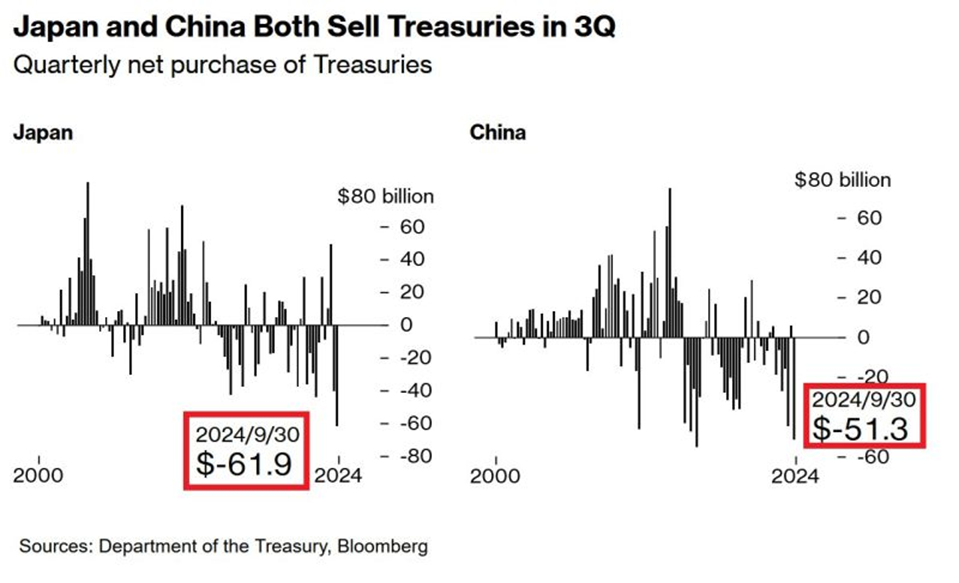

7. China and Japan Continue to Dump US Treasuries

Japanese investors sold $61.9 billion worth of Treasuries in Q3 2024, the highest amount on record. Chinese funds sold $51.3 billion, the second-highest amount on record. Japan and China are the two largest foreign holders of US government debt.

Source: Bloomberg