By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

The U.S. dollar traded higher against all of the major currencies Tuesday as the 10-year Treasury yield rose above 2.4%. Stronger-than-expected manufacturing data, the prospect of US tax reform and the imminent announcement of a Fed Chair pick has investors excited about the outlook for the dollar. Tax reform would be extremely positive for the greenback as it provides a legitimate source of growth for the U.S. economy in the coming years. According to House GOP members, a tax bill could be released as early as November 1. The race for the next Fed chair seems to boil down to Powell and Taylor – we know Powell is less beneficial to the greenback than Taylor but if we get a chair/vice chair mix, the outcome could still be dollar-positive as investors view the selection as a reduction of uncertainty. However now that USD/JPY has touched 114, further gains will hinge on actual developments rather than hope and speculation. With no major U.S. economic reports scheduled for release Wednesday and Thursday, until those announcements are made, investors will shift their focus to the Bank of Canada and European Central Bank monetary policy announcements.

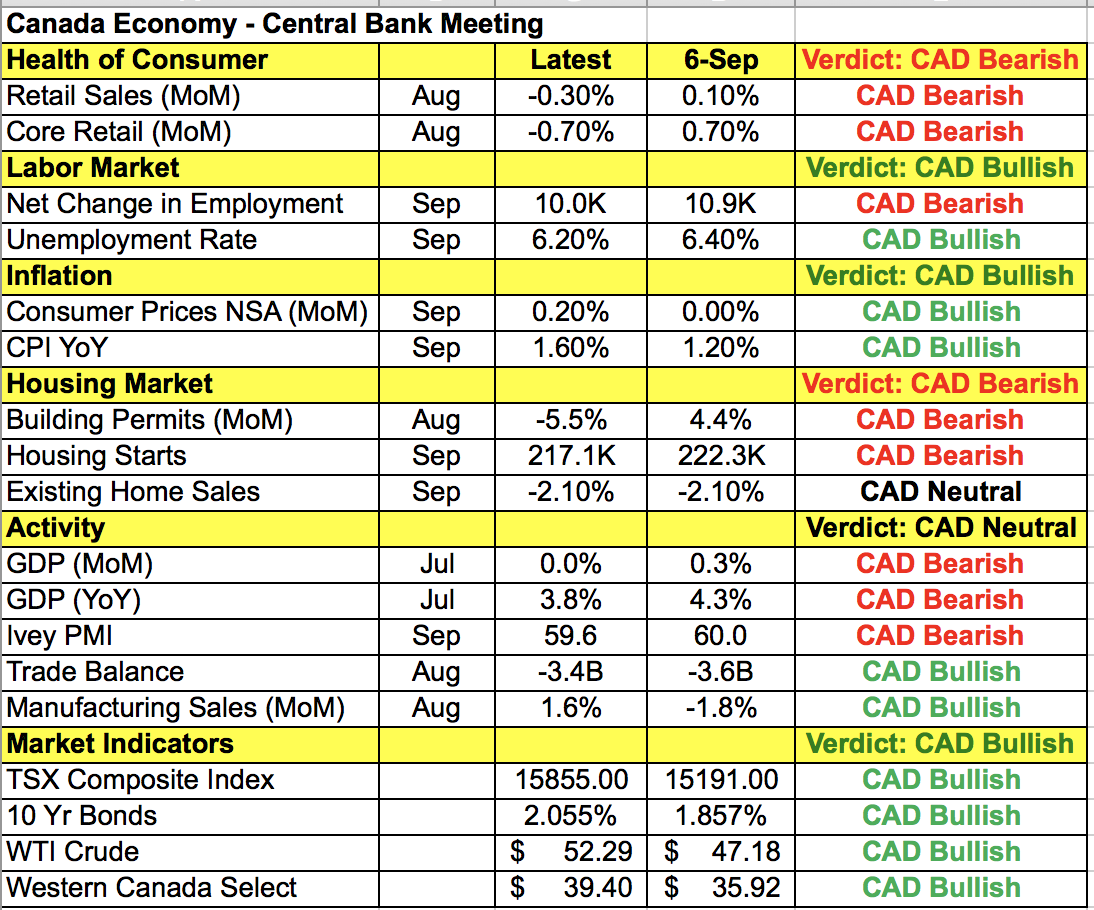

Wednesday will be a busy day in the FX market and the most important event risk will be the Bank of Canada’s monetary policy announcement. The loonie is trading softly ahead of the rate decision. Last week’s surprise decline in retail sales and slower-than-expected consumer price growth reinforced the central bank’s cautious outlook. After raising interest rates two meetings in a row and providing very little detail after the last hike, investors were looking for a third round of tightening. However at the end of September, BoC Governor Poloz killed expectations for another hike before year end by saying there is “no predetermined” path for Canadian rates and they won’t be mechanical and will proceed cautiously going forward. Taking a look at the table below, there’s certainly been more deterioration than improvement in Canada’s economy since early September, but the labor market remains firm with the unemployment rate holding steady. As recently as October 14, Poloz said he still sees improvements in the global economy and while housing speculation has dissipated, housing demand is still outpacing supply. This tells us that the BoC is not overly pessimistic, but based on the performance of the economy over the past month or so, there’s very little reason for the central bank to adjust its view that growth will moderate in the second half. With that in mind, it may be difficult for Poloz and Wilkins to avoid dropping hints about future policy when they speak after the rate decisions. If the BoC maintains a firmly neutral tone – confirming rates won’t increase before the end of the year and providing little insight into future policy actions – USD/CAD will soar above 1.27. However if BoC utters a comment about having no predetermined path for rates with a positive outlook for the economy, we could see USD/CAD sink back to the 20-day SMA near 1.2520. Taking everything into consideration, we think a tinge of optimism is likely.

The Australian dollar is also in play with a third-quarter consumer price report scheduled for release this evening. AUD spent the entire day under pressure although part of that may be due to NZD weakness. Although consumer inflation expectations increased between July and September, Tuesday's CPI forecast was high. If prices did not rise as much as economists anticipate, we may actually see a decline in AUD. Tuesday's worst-performing currency was the New Zealand dollar, which dropped another 1% on the back of the election results. NZD/USD traders are clearly not happy with a minimum-wage hike and the employment mandate for the Reserve Bank that adds another barrier to tightening. Technically, NZD/USD has fallen sharply but we don’t see any major support until the 2017 low near .6820.

Euro and sterling moved in completely opposite directions. The single currency spent the entire North American trading session in a narrow range with a mildly positive bias while sterling ended the day at its lowest level in 2 weeks. This divergence drove EUR/GBP sharply higher, putting the cross pair on a path to test 90 cents. No economic reports were released from the UK but investors were not happy with European Council President Tusk’s comment that Brexit can still be stopped and that it's up to London on how Brexit talks end. As they see no-Brexit as an option, investors fear that the EU won’t be particularly conciliatory during its negotiations with the U.K. Third-quarter GDP numbers are scheduled for release on Wednesday and the pace of growth is expected to remain steady at 0.3%. If it accelerates, reinforcing the Bank of England’s hawkish bias, we could see GBP/USD back at 1.32. But if it slows, the next stop could be 1.3050.

Euro, on the other hand, caught a bid ahead of the European Central Bank’s monetary policy announcement despite mixed Eurozone PMIs. Strong manufacturing activity in Germany and France was offset by weaker service-sector activity. This led to a drop in the composite PMI index to 56.9 from 57.7. Looking ahead, the German IFO report is due for release. Given the uptick in manufacturing activity, stronger industrial production and factory orders, we believe that the risk is to the upside for this report.