by Shane Obata

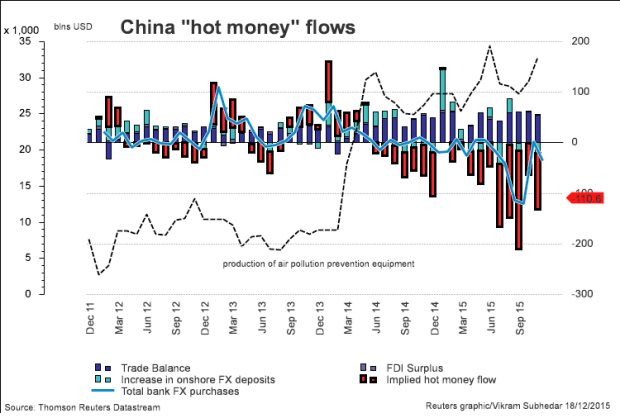

It seems like every day we are inundated with news out of China. Investors are already concerned. The offshore renminbi (CNH) is more international than the onshore one (CNY), which is tightly managed by the government. As such, the rising spread (CNH-CNY) between the two may be indicative of mounting skepticism about China’s economy and its markets. Likewise, capital is fleeing the country as hot money flows have accelerated:

|

| Source: @vikramreuters |

In the following sections we will attempt to analyze China’s markets and determine the biggest risks facing its economy. Lastly, we will try to answer the following question: does it matter to us?

Financial Markets

As the first week of trading in 2016 came to an end, the Chinese markets had already been halted twice. Newly minted circuit breakers, which have since been suspended, were triggered when China’s main equity index, the CSI 300, fell 7% on two separate occasions. The first selloff was triggered by a rumor that the China Securities Regulatory Commission (CSRC) was planning to suspend a short sale ban that has kept a reported ~$185 billion off the market. Subsequently, the CSRC decided to extend the ban in order to calm the markets. The second drop followed a significant devaluation of yuan by the People’s Bank of China (PBOC). China has also backtracked on that move. Basically, the Chinese markets are confusing…

That said, the volatility is not surprising considering how unsophisticated China’s market is. One university study found that 2/3 of the new investors at the end of 2014 did not have a high school diploma:

|

| Source: Bloomberg Brief |

Along the same lines, individuals account for at least 80% of trading on the mainland exchanges. In other words, there are many speculators and few investors. China’s markets are undeveloped and relatively unimportant. Nonetheless, they may offer some clues into consumer sentiment and the government’s ability (or inability) to control the economy.

Economy

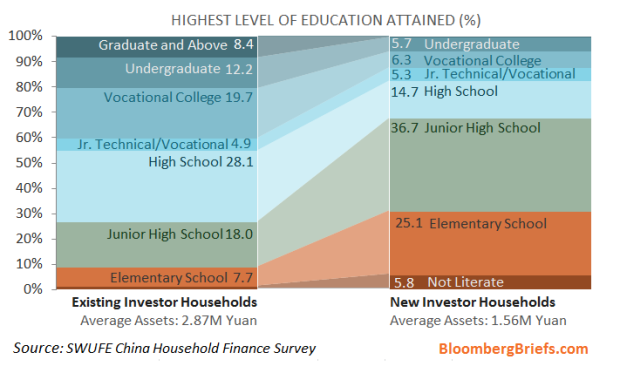

China remains an indispensable part of the global economy. In nominal terms, China is the world’s second biggest economy with a GDP of ~$10.3 trillion. However, in terms of Purchasing Power Parity-adjusted GDP (PPP), it has surpassed the US. Moreover, it accounts for ~40% of global PPP-adjusted GDP growth:

|

| Source: The Economist |

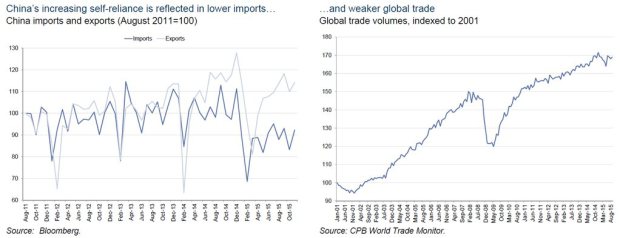

With regard to trade, China is the world’s biggest player. In 2013, it led the world in exports ($2,209 billion) and was the number two country for imports ($1,950). The combined value of its trading amounted to $4,159 billion, marginally higher than the US’ $3,909 billion.

Debt

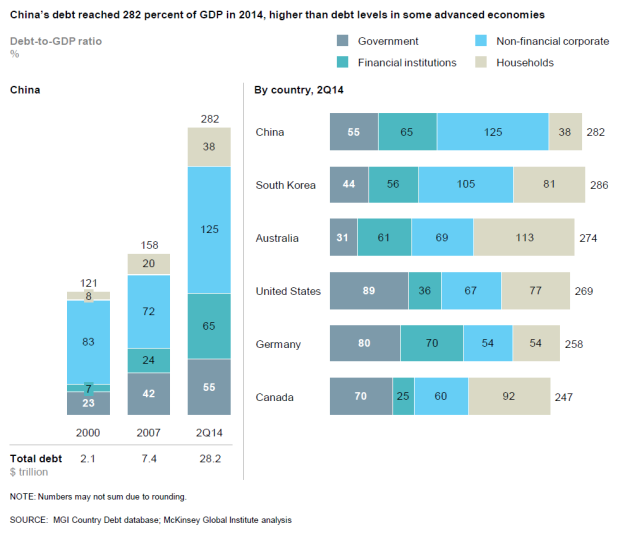

China’s aggregate debt level is one of the highest in the world, although it may not seem to be at first glance. China’s government debt-to-GDP ratio is 55%. To put that in perspective, the US and Japan are at 89% and 234%, respectively. Even so, it is always prudent to consider a country’s debt composition. China’s mounting debt comes into focus when we account for non-financial corporate debt (125% of GDP), financial institution debt (65%) and household debt (38%). The grand total is an astounding 282% of GDP, or $28.2 trillion:

|

| Source: McKinsey |

The rate of debt growth is also a concern. Non-financial corporate debt, increased from 72% to 125% of GDP from 2007 to 2Q14, a 73.6% increase.

China’s debt load is a global risk because of how tightly managed its economy is. The government has allowed unprofitable companies to stay in business. Though defaults have been very limited, China must allow these companies to fail eventually. Otherwise, it will continue to suffer from high debt servicing costs (~30% of GDP).

Overcapacity

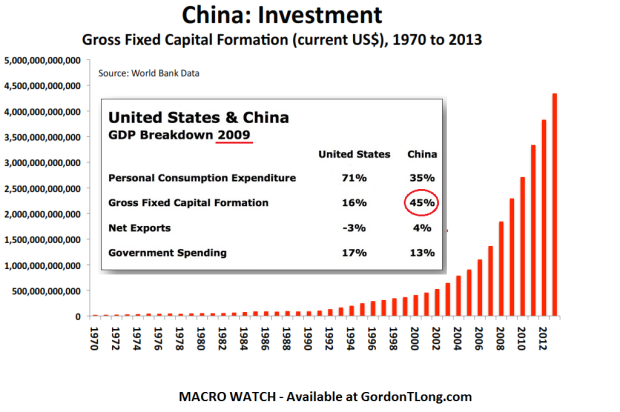

Government investment has been a big part of China’s economy. Massive amounts of stimulus went into factories, leading to overcapacity in sectors such as coal and steel. This is making it very difficult for companies that operate within those sectors to make profits – both domestically and abroad. Fiscal stimulus also went into housing and infrastructure, which are both clearly overbuilt. Despite the overcapacity, gross capital formation still represents ~45% of GDP:

|

| Source: Gordon T. Long |

That is more than twice as high as it is in both the US and the European Union.

Monetary Policy And FX

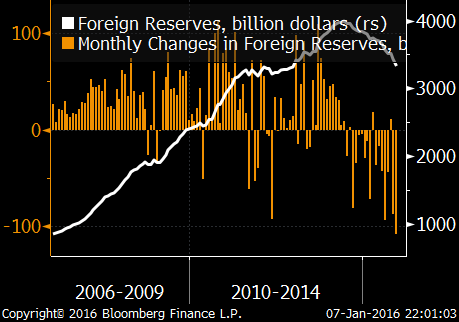

The PBOC has been very active trying to support the economy. It has cut rates 6 times since November of 2014. Likewise, it has been lowering its Reserve Requirement Ratio and selling its foreign reserves in an attempt to prevent excessive devaluation of the yuan (CNY). They are down more than $400 billion (from a peak of ~$4 trillion) since mid-2014:

|

| Source: @TomOrlik |

FX is also a risk because China has a great deal of USD-denominated debt. In mid-2015, non-bank borrowers held ~$1.2 trillion worth of it. This debt becomes more expensive as USDCNY rises, which is exactly what the markets expect to happen.

Corruption Crackdown

China’s anti-corruption campaign is a step in the right direction. That said, it is a big political risk for foreign investors. High profile businessmen and officials have been disappearing while others are being investigated. Moreover, securities regulators have been cracking down on market manipulators, “ensnaring some of the nation’s most high-profile money managers and announcing more than 2 billion yuan of fines and confiscated gains” (source: BBG Brief). Critics of the campaign suggest that it may deter business while failing to address the corruption that exists within the ruling party.

Implications

As investors, we should be concerned because China is one of the biggest economies and the world’s leading trader. Therefore, if it slows down, so will global growth:

|

| Source: Goldman Sachs |

China is also important because it is a massive source of demand for many commodities. Thus, its weakness is spreading to undiversified economies such as Russia, Brazil, and South Africa. Recessions in those countries might not spill over to the rest of the world. Nevertheless, it is important to consider the amount of debt they have accumulated since the financial crisis.

In the US, credit is already tightening. If borrowing costs rise for the emerging markets, especially China, then we may see a wave of defaults with untold consequences.