- Berkshire Hathaway is set to report earnings over the weekend

- Expectations remain high from Buffett's company

- As the market eagerly awaits the results, let's take a deep dive into the company's major holdings

Warren Buffett and Charlie Munger's legendary investment behemoth Berkshire Hathaway (NYSE: BRKa) BRKb) is poised to reveal its second-quarter 2023 earnings performance during the upcoming weekend, potentially shaping the overall market performance next Monday.

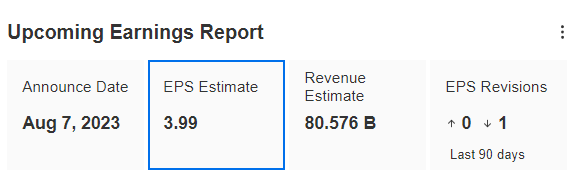

Anticipation runs high as analysts project a solid year-on-year performance, forecasting Berkshire Hathaway to announce earnings per share of $3.99 for the quarter. This expected growth reflects a favorable contrast to the previous quarter's EPS of $3.69.

Yet, despite the positive overall market expectation, top-line numbers remain a big question mark for the company. Analysts believe there might be a slight dip in revenue, projected to be $80.576 billion compared to the previous month's $85.393 billion.

Source: InvestingPro, results screen

Berkshire Hathaway is not just your typical company; it's a diverse holding company with active subsidiaries in insurance, rail freight, power generation and distribution, services, manufacturing, retail, and more.

But what truly influences its financial performance is its substantial portfolio of equities and derivatives.

In this article, we'll focus on Berkshire's investment portfolio, specifically its major holdings like Apple (NASDAQ:AAPL), Bank of America Corp (NYSE:BAC), American Express Company (NYSE:AXP), and Coca-Cola Co (NYSE:KO).

Our close review of how these stocks performed in the market during the second quarter will help us understand their contribution to Berkshire's results.

We'll also take a look at the recent quarterly results of these companies and analyze the insights provided by analysts and the InvestingPro Fair Value for each of them.

Apple

- AAPL stock performance in the second quarter: +17.6%

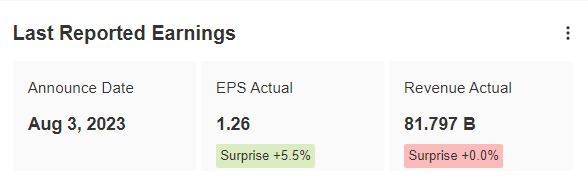

On Thursday, the iPhone maker Apple unveiled its quarterly results. The company reported consensus sales of $81.797 billion and earnings per share of $1.26. Notably, the earnings per share exceeded analysts' expectations by 5.5%.

Source: InvestingPro, results screen

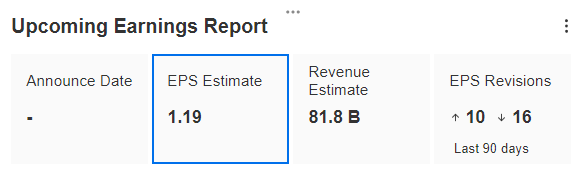

Looking ahead to the next quarter, Apple did not provide clear guidance during the earnings call. Luca Maestri, the company's CFO, mentioned that investors should anticipate revenues for the September quarter to align with those of the June quarter.

The consensus among analysts is that the earnings per share (EPS) for the next quarter will be approximately $1.19, with sales projected to reach around $81.8 billion. The publication date for the next quarter's results has not yet been disclosed.

Source: InvestingPro, results screen

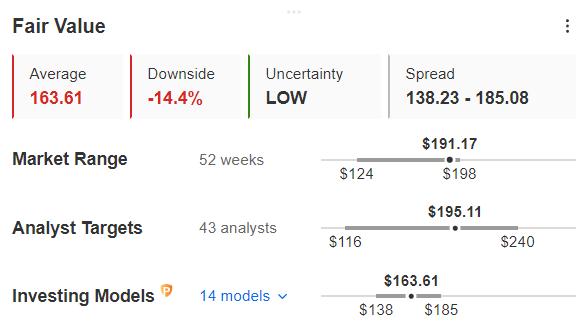

According to the 43 analysts tracking Apple shares, the average 12-month target price for the stock is $195.11. This means there is virtually no upside potential compared to Thursday evening's closing price.

Source: InvestingPro, preview screen

Furthermore, Apple's InvestingPro Fair Value, based on 14 financial models, currently stands at $163.61. This value is more than 14% below the stock's current price.

American Express

- AXP stock performance in the second quarter: +5.6%

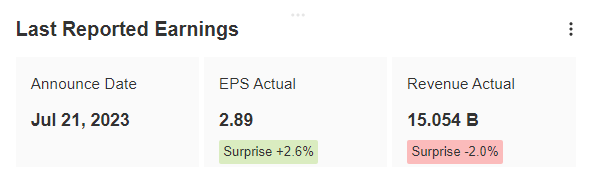

Credit card company American Express reported mixed quarterly results on July 21.

Source: InvestingPro, results screen

Earnings per share of $2.89 exceeded consensus by 2.6%, while revenues came in 2% below consensus at $15.054 billion.

Source: InvestingPro, results screen

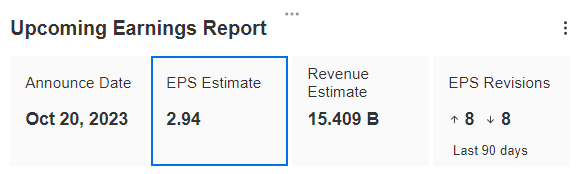

For the upcoming quarter, scheduled for release on October 20, analysts anticipate American Express to report earnings per share (EPS) of $2.94. This would represent a 1.7% increase compared to the previous quarter's earnings.

Additionally, they expect the company's revenues to reach $15.409 billion, indicating a growth of 2.35% compared to the second quarter.

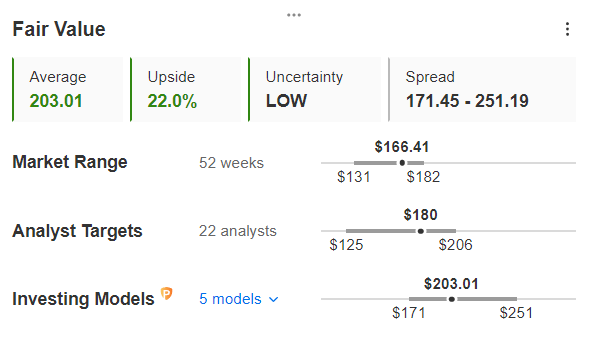

As for analysts' expectations for AXP shares, the average target price from the 22 analysts who closely monitor the stock is $180. This target price represents an 8.1% increase compared to Thursday's closing price.

Source: InvestingPro, preview screen

Furthermore, considering the InvestingPro Fair Value, which averages based on five recognized models, the value stands at $206.99. This suggests a potential upside of over 24% from the stock's current price.

Bank of America

- BAC stock performance in the second quarter: 0.3%

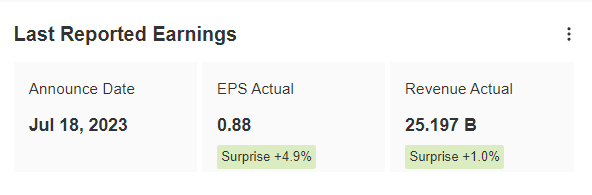

Bank of America, one of the largest banks in the United States, announced financial results on July 18, which exceeded expectations.

Source: InvestingPro, results screen

EPS came in at $0.88, 4.9% ahead of consensus, while sales of $25.197 billion exceeded expectations by 1%.

Source: InvestingPro, results screen

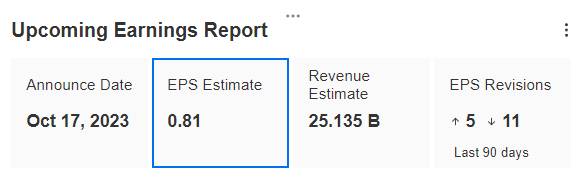

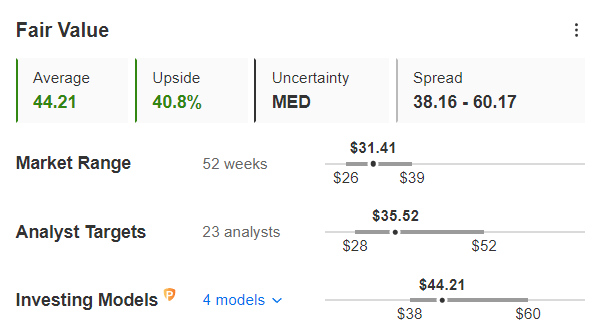

For the quarter that began in July, the results of which will be unveiled on October 17, analysts are predicting EPS of $0.81 on revenues of $25.135 billion.

Analysts' opinions are optimistic, and valuation models consider the stock to be undervalued.

Source: InvestingPro, preview screen

The 23 analysts who follow the stock have set an average target of $35.52, 13% higher than last night's closing price. In contrast, BAC's InvestingPro Fair Value, based on the average of 4 financial models, stands at $44.21, implying a potential upside of almost 41%.

Coca-Cola

- KO stock performance in the second quarter: -2.9%

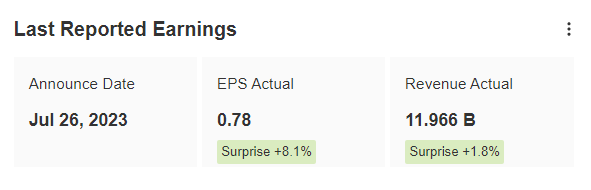

The Coca-Cola Company also posted satisfactory earnings for the second quarter of 2023.

Source: InvestingPro, results screen

The company's earnings per share for the quarter came in at $0.78, surpassing analysts' forecasts by 8.1%. Additionally, sales for the quarter exceeded expectations, reaching $11.966 billion, which is 1.8% higher than analysts had predicted.

Source: InvestingPro, results screen

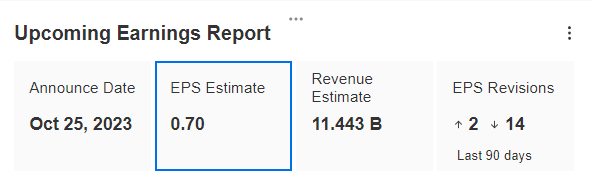

For the quarter ending in September, analysts are predicting a decrease in earnings per share (EPS) to $0.70, indicating a decline compared to the previous quarter. Additionally, sales for the quarter are expected to be slightly lower than in Q2, with a projected figure of $11.443 billion.

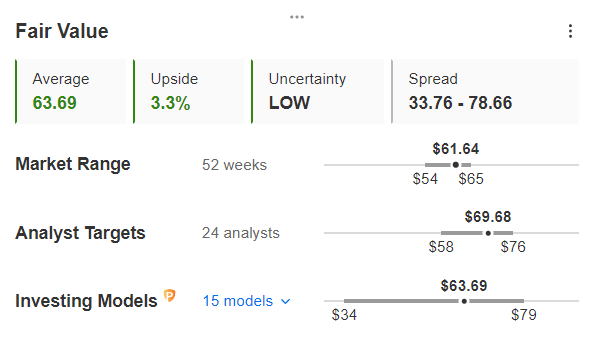

Furthermore, it's worth noting that both analysts and valuation models suggest limited upside potential for Coca-Cola shares.

Source: InvestingPro, preview screen

Indeed, based on the observations of 24 analysts who closely track the stock, the average target price stands at $69.68. This implies a potential upside of 13% from the current share price.

However, the InvestingPro Fair Value for KO is of particular significance. Based on 15 reliable financial models, the Fair Value currently rests at $63.69, representing only a 3.3% increase above the current share price.

Bottom Line

The performance of Warren Buffett's major holdings suggests a positive outlook for Berkshire Hathaway's upcoming earnings report. Particularly, noteworthy investments like Apple, Bank of America, American Express, and Coca-Cola have exceeded analyst predictions, indicating a potential favorable outcome in the forthcoming report.

Investors, however, should watch out for the company's top-line as a the greatest risk for this period. Yet, despite the impending risks, Berkshire appears poised to keep outperforming in the long term. This shows the company's impressive strategic strength and portfolio resilience at both good and bad times.

***

Disclaimer: This article is for information purposes only; it is not intended to encourage the purchase of assets in any way and does not constitute a solicitation, offer, recommendation, opinion, advice, or investment recommendation. We remind you that all assets are considered from different angles and are extremely risky, so the investment decision and the associated risk are the investor's responsibility.