Global Markets

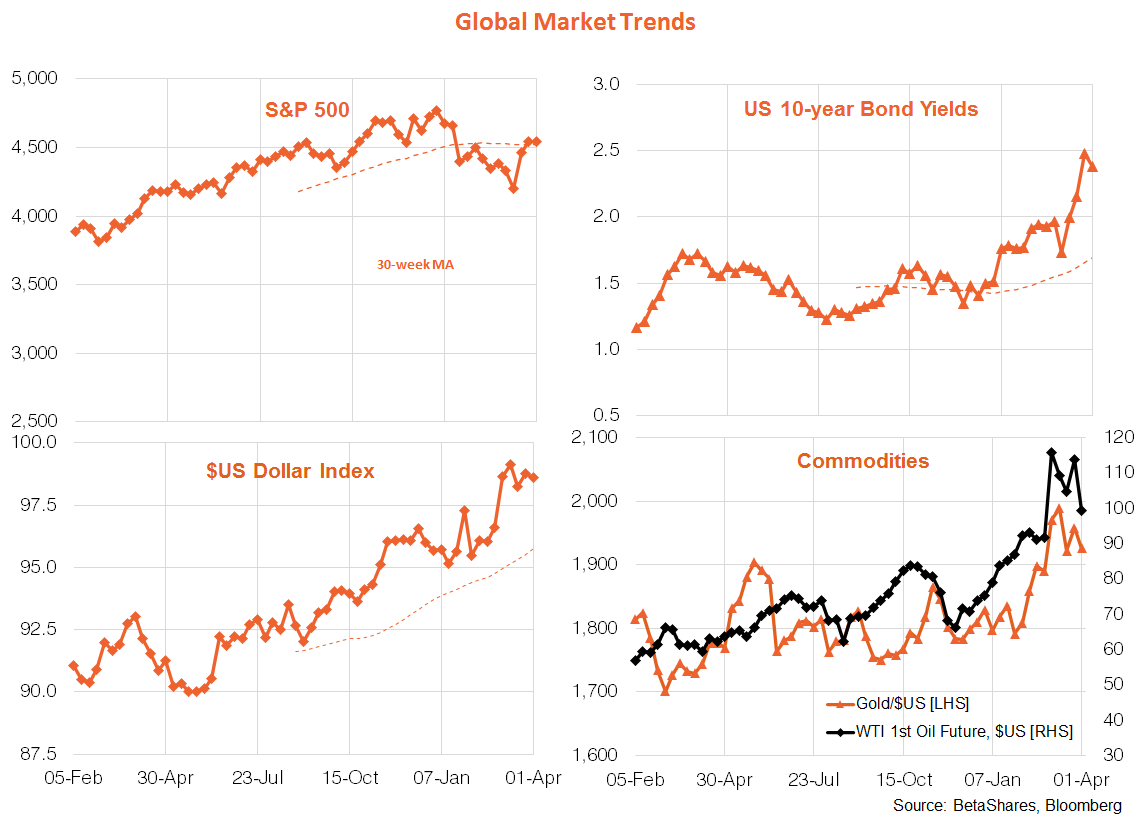

Global equities consolidated last week after solid gains over the previous two weeks, with the most notable market movement being a sharp drop in oil prices as the U.S. announced the biggest ever withdrawal from its strategic reserves. Equities continue to hope for a peace deal between Russia and Ukraine, and are also continuing to see solid U.S. economic growth as “good news”, even if it bolsters the case for aggressive Fed tightening. Indeed, the market has now almost fully priced a 0.5% hike at the May Fed meeting, and it would not surprise if the market started to toy with the idea of an even larger 0.75% move.

In fact, I’d argue 0.5% in May is no longer sufficient to jolt current high U.S. inflation expectations – I think the Fed should (though, of course, likely will not) hike rates by a full percentage point next month. Consider last Friday’s payrolls report: although the 431k in employment gain in March was a bit less than the 490k market expectation, February employment was revised up 72k. The unemployment rate, moreover, fell a bit more than expected to a near-historic low of 3.6% while annual growth in average hourly earnings was a touch more than expected at 5.6%.

The U.S. labour force participation rate – which I have been hoping would rebound strongly to ease labour market shortages – continues to improve only glacially. As a result, there are major labour constraints despite the fact U.S. employment still remains 1.6 million below pre-COVID levels. Also released last week, annual growth in the U.S. core consumption deflator hit 5.4% in February, which is up from the January level of 5.2% but a touch less than the market expectation of 5.5%.

Also attracting increased attention last week was the near inversion of the U.S. 10-Year versus 2-Year bond yield spread – especially as this has tended to be a reliable indicator of recession in the past, albeit with long and variable lags of up to a year or more. To my mind, it seems inevitable that this spread will invert in coming months, if not weeks, as the Fed’s tightening schedule progresses. I’d note, moreover, that an equally impressive indicator of likely recession is the unemployment rate. Simply put, the U.S. unemployment rate has rarely been as low as it is at present, meaning the next major move seems likely up than down – a move higher of around 0.5% has usually signalled recession in the past. We’re not there yet, of course, but the next one to two years will be tricky!

Key highlights this week include minutes to the Fed meeting on Wednesday – with markets focused on how close it was to hiking by 0.5% last month and how close it is to selling bonds back into the market (quantitative tightening). The on-again off-again Russia/Ukraine peace talks will also be keenly watched – to my mind no-one wants to aggressively short equities due to the dire Fed outlook ahead – a possible “pop” higher in prices if a truce is finally called in the ugly war.

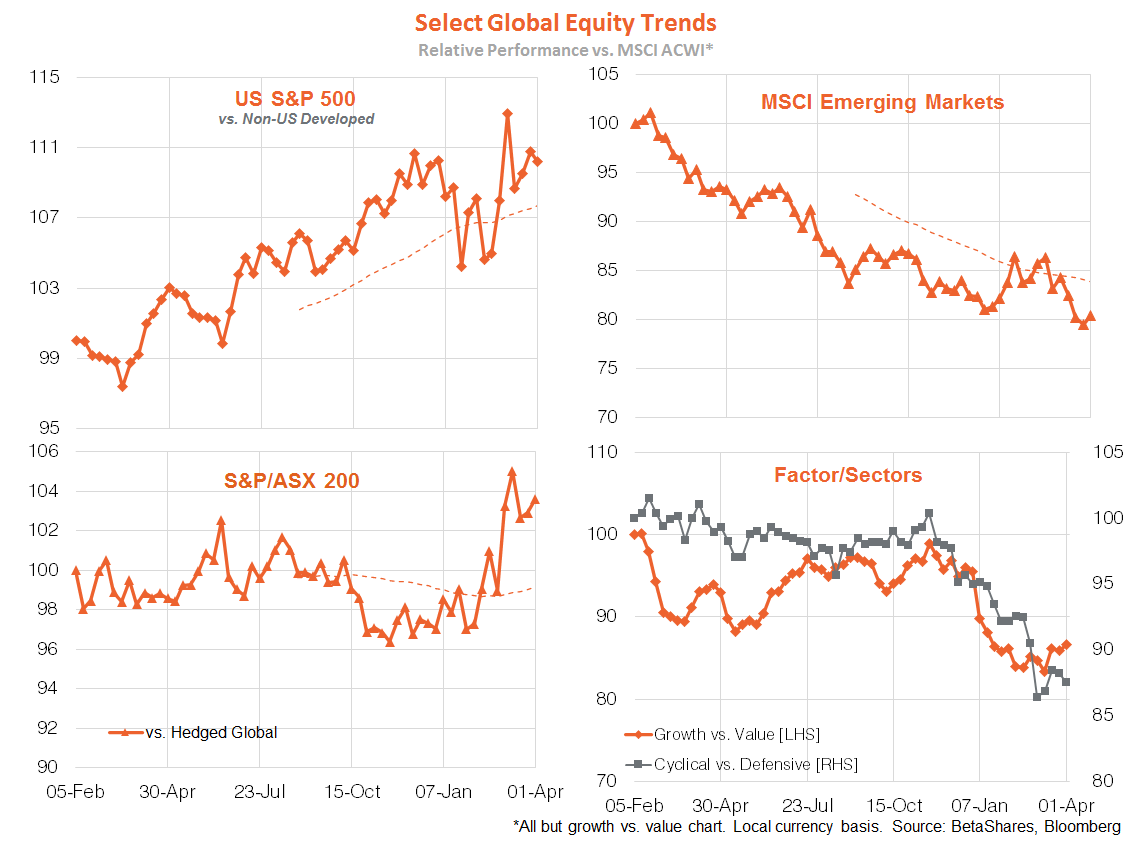

Among global equity trends, Australia continues its recent period of outperformance while growth has been holding it own relative to value in recent weeks – in line with the impressive global equity rebound.

Australian Market

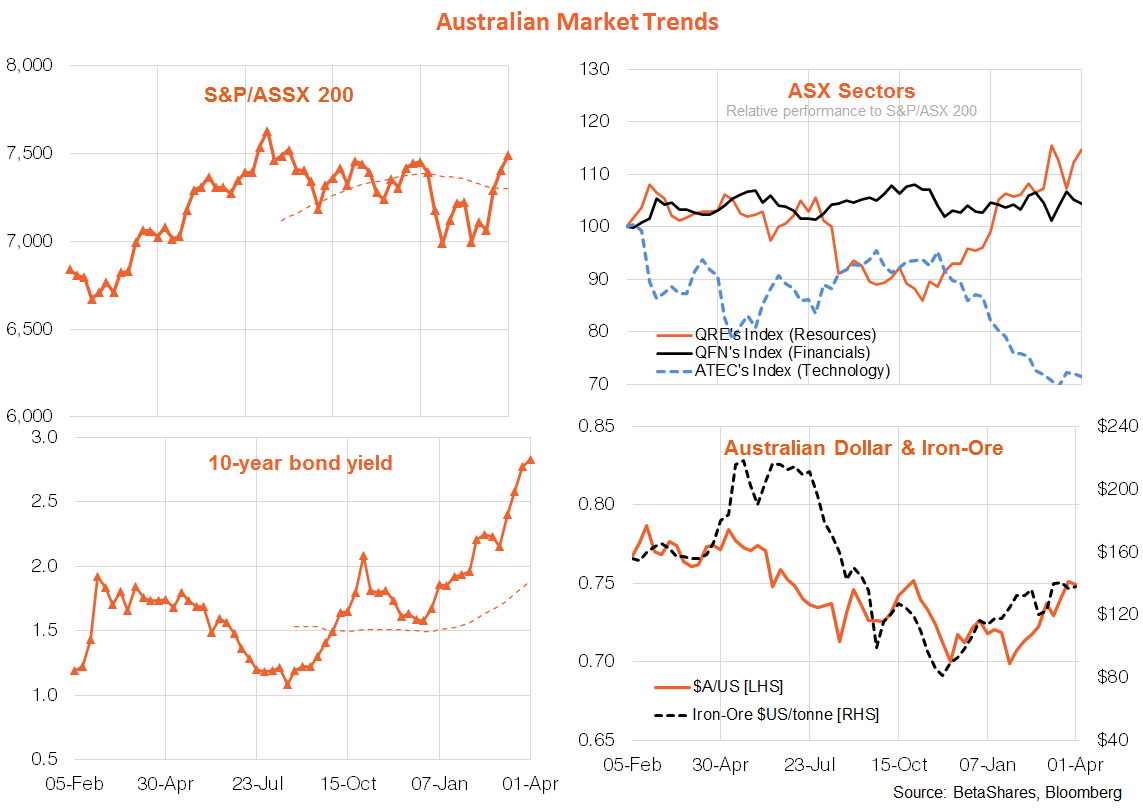

Due to both good (COVID) management and good (iron-ore) luck, the Federal Government has been blessed with a further chunky improvement in the budget bottom line over recent months, only part of which it saw fit to spend in last week’s budget. It’s fair to say that given already high household saving and red hot consumer spending, there was not a compelling economic case for the billions spent to ease “cost of living pressures”. Of course, it made sense politically, and the least we can say as economists is that it’s heartening the Morrison Government was not tempted to spend even more. On balance, the support package will further support consumer spending in coming months and adds to the case that the RBA will likely raise interest rates by year-end.

Indeed, economic data last week revealed retail spending continues to charge ahead as COVID restrictions ease, while house prices are cresting across the nation. Despite a return to lockdowns in parts of China, iron-ore prices remain remarkably firm which is supporting both the $A and relative performance by the resource sector. Also surprising is the still very aggressive rate increases the market still expects from the RBA over the next two years – with a cash rate at 3.25% at end-2023 compared with my expectation of a rise to only 1.75% at most.

In this regard, interest this week will be in whether the RBA retains its “prepared to be patient” language its in post-meeting policy Statement tomorrow. I think it will. Indeed, my base case remains that the RBA will begrudgingly raise rates twice this year, in September and November.