As we had expected, the BoJ raised its policy rate to 0.25% and announced the JGB purchases would be halved by 1Q26.

The growth outlook was trimmed modestly for FY24 while the inflation outlook remained above 2% until FY25. As we expect real wage growth to turn positive and growth conditions to improve, we maintain our call for a 25bp hike as early as 4Q24

0.25% Target (NYSE:TGT) rate - Higher than expected

BoJ Accelerates Policy Normalisation

We believe that recent data has been good enough to give the Bank of Japan confidence that the economy is in a virtuous cycle of wage growth, consumption, and inflation, despite growing concerns about weak growth.

Earlier today, industrial production contracted by 3.6% month-on-month (seasonally adjusted) in June mainly due to weak car production, adding to the concern over weak growth. However, the BoJ has likely decided to focus on the recovery in inflation and consumption.

The weakness in the yen could be another major factor for the hike. Although the yen has changed direction recently, the BoJ seems to be increasingly concerned that excessive JPY weakness could have a negative impact on the economy.

These concerns were well noted in the BoJ decision statement. It said that the economy and prices are developing generally in line with the BoJ’s outlook and that import prices have turned positive recently with upside risks.

Some might argue that the BoJ is rushing to raise rates. Looking back at the March rate hike, it was hard to find evidence in the data to support the BoJ's claim that rising wages would stimulate consumption and thus keep inflation in the 2% range.

However, wage negotiations came in much higher than expected, making the March hike possible. Three to four months later, Japan's indicators are improving in line with the BoJ's expectations.

Furthermore, despite the rate hike, real interest rates remain negative, so the BoJ couldn't risk further weakening the yen, which would dampen consumption.

Quarterly Outlook Report Hints at Additional Rate Hike by Year-End

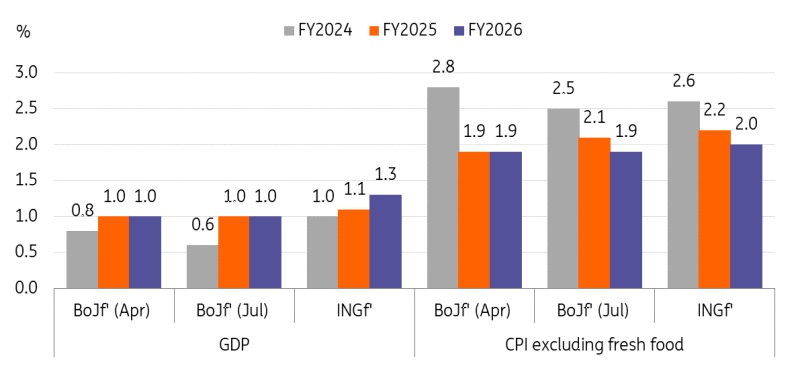

In the outlook report, the BoJ lowered its FY24 GDP forecast from 0.8% year-on-year to 0.6%, while keeping the FY25 and FY26 outlook at 1.0%.

The weaker-than-expected industrial production, triggered by another safety sandal issue, is likely the main reason for the downward revision of FY24, but the BoJ left its FY25/26 forecast unchanged as it believes the slowdown is temporary and the underlying recovery trend should continue.

On the inflation front, it is interesting to note that core inflation for FY24 was revised down to 2.5% YoY from 2.8% previously, while the outlook for FY25 was revised up to 2.1% from 1.9%.

The BoJ pointed out that import prices have recently turned positive and upside risks are significant, but the BoJ still revised down the inflation outlook for FY24. In our view, the slowdown in growth and policy normalization are playing a role in limiting upside pressures.

However, inflation is expected to remain above 2% through to FY25, which we interpret as the Bank of Japan's view on sustainable inflation being more certain than before.

Macro Outlook: BoJ vs ING

Source: Bank of Japan, ING estimates

BoJ Watch

The latest outlook report supports our view that the normalization of the Bank of Japan's policy will accelerate in the coming months. In addition, Governor Ueda's comments were relatively hawkish: he was quite open to further rate hikes, stating that the Bank of Japan will raise rates again if growth and inflation move in line with the Bank's forecasts.

According to our forecasts, GDP and inflation should rise slightly faster than the BoJ expects. The decision on whether to raise rates further this year will likely be determined by the data, the most notable of which is real wage growth.

While nominal wage growth began to accelerate in April, real wage growth has declined. However, we expect real wages to turn positive sooner rather than later as inflation falls back into the low 2% range and the spring wage deal is fully reflected in pay cheques.

However, if the yen trades in a more stable manner as other major central banks cut rates, the urgency of a rate hike by the BoJ may decline. Also, Governor Ueda mentioned that the BoJ will take time to monitor the impact of rate hikes on the economy, so the timing of the next rate hike is uncertain.

We believe that October is most likely but depending on data development, it could be delayed to December. Even if the BoJ hikes by another 25bp, real interest rates will remain negative, which would support further BoJ normalization.

FX: JPY Is on More Solid Ground

USD/JPY is trading on the soft side and testing 152.0 following Governor Ueda’s hawkish press conference. The pair had previously rebounded to the 153.0 area following an initial knee-jerk short-lived drop below 152.0 as the rate hike was announced.

The shift in policy is consistent with USD/JPY trading below 152.0, and we believe that the FOMC announcement today and the US jobs figures on Friday can keep pressure on the pair.

The reaction in the yen still appears relatively muted considering that the consensus and markets were not positioned for a hike. That might be due to some disappointment about the size of the bond purchase reduction - which ultimately determines the upward flexibility for JGB yields - and concerns about soft growth, which are making investors reluctant to price in more than 14bp of hikes by year-end.

However, we think that technical factors continue to be crucial in JPY price action. Markets have trimmed their JPY shorts in the past couple of weeks, meaning that net positioning may no longer look too stretched for speculators seeking structural carry-advantageous JPY shorts. In our view, this is the main factor that has prevented a major JPY rally this morning.

The yen is, anyway, on more solid ground after today’s hike. Carry-trade profitability has been cut and we can read this BoJ move as a potentially coordinated effort to help the yen recover/stabilise.

Data on FX intervention will be released shortly, and the yen won't like a high number. But if the BoJ is ready to hike rates, as it seems, questions on the sustainability of MoF intervention may not be all that relevant after all.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more