Perverse Incentives

We haven’t written about Australia’s residential real estate bubble for some time (readers may want to check out last year’s post “Australia’s Bubble Trouble”, which contains numerous relevant charts and data).

Property auction in Sidney

Our friend Jonathan Tepper of Variant Perception has recently visited Australia for a fact-finding tour (more on this further below), so we felt we might as well take the opportunity to write an update on the topic.

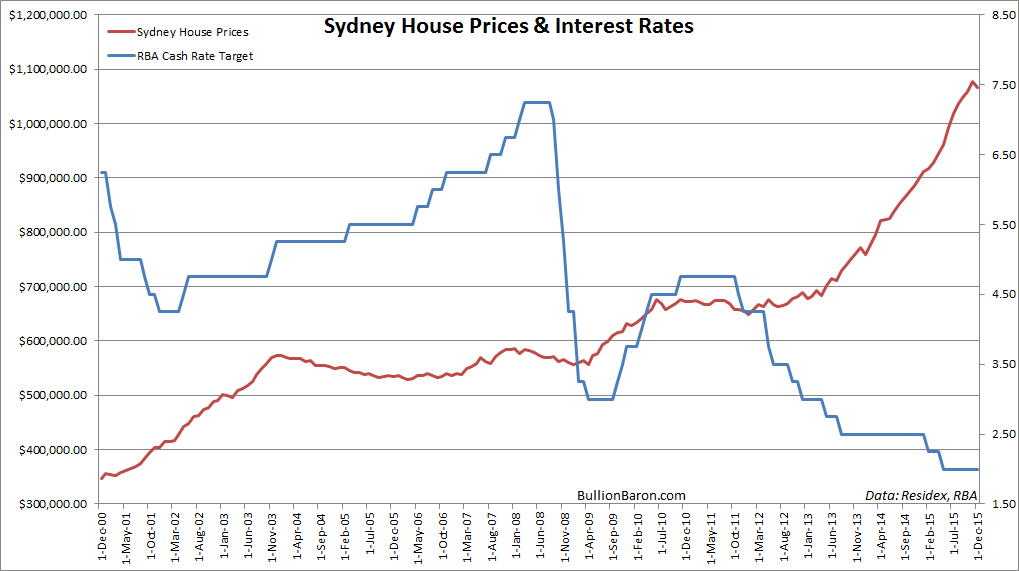

House prices in Sidney vs. the administered interest rate of the Reserve Bank of Australia, above. As you will see below, interest rates aren’t the only driver of the bubble:

Our reader D.S., who moved to Australia five years ago, had provided us with a number of very interesting observations on the Australian housing market late last year, which we are sharing below. As D.S. notes, there are a number of interesting wrinkles specific to Australia’s real estate market, which outsiders are generally not likely to be aware of. We have highlighted a few passages in his report below which we think are especially important:

“The housing bubble in Australia has been talked about so extensively and has lasted so long without any harm coming to it that people here have pretty much dismissed the very possibility of a crash – including, it has to be said, the chances of a recession. The reason I was motivated to write this note is because there are some (I believe) unique dynamics at play in this housing market, which aren’t necessarily apparent to the outsider – at least, I was never aware of them until I moved here.

Australia has one of the highest levels of home ownership in the developed world and, in common with other Anglophone countries, the home is commonly viewed as people’s ‘primary asset’ i.e. the financial windfall they will one day be leaving to their children. When the property market is hot — as it has been in the past couple of years — people love nothing more than to talk about property values and how well they’re doing. Property developers, meanwhile, are presently building furiously in order to sell into current demand. Perhaps this is all that is propping up GDP growth right now (making the latest weak print all the more relevant).

To begin: Australia has a fairly unique approach to ensuring its citizens are provided for in retirement i.e. they have a system of mandatory saving for all workers – superannuation – which is supposed to provide the majority of contributors a healthy lump sum on which to retire. Funds are essentially deducted from each salary check and the proceeds typically invested in stocks by their friendly investment firm (think mutual fund, long-only, index-hugging types). There are a number of major issues with this system, not least declining forecast returns (in recent years), which means that future employee contributions will need to rise sharply, but that’s a discussion for another time.

Leaving aside the ideological objections to ‘forced saving’, this arrangement appears quite sensible as the State certainly doesn’t want to end up providing for those who would rather ignore retirement planning altogether. But the Superannuation system also means that Australians have one of the highest per capita equity exposures in the world (not that investment in equities is mandatory either but, culturally, equities is pretty much the only show in this town).

Again, this may not appear to be a bad thing, but here’s the problem: Australia’s banking oligopoly makes up fully 30+% of the entire main index (where the majority of Superannuation is invested) and the actual exposure to banks may be greater given that the ‘Big 4’ banking stocks have the most attractive dividend yields in the index. A quick glance at the ‘Big 4’ balance sheets reveals that the biggest single exposure they have is to is residential real estate (60+% in each case). This leaves the average Australian home-owner much more exposed to the real-estate market than most would appreciate.

But it doesn’t end there. Australia has a perverse tax subsidy called ‘negative gearing’, the origins of which I am not certain, but it effectively allows owners of investment properties to offset any losses they incur on that investment against personal income for tax purposes. This has made owning investment property de rigeur among many middle class Australians and, again, Australians have one of the highest levels of investment property ownership in the developed world (no doubt aided by this incentive). The incentive, of course, means that such property is very often acquired at what would be deemed, absent the subsidy, economically unattractive levels.

The ‘negative gearing’ subsidy is widely held by the public to be too politically sensitive to be considered for ‘review’, but talk of winding it back has started to crop up in the media for the first time in many years. In common with just about every other DM country the fiscal situation here is deteriorating and the government is under increasing pressure to address it. Negative gearing, depending on the source, costs the treasury some $8bn to $16bn per annum and the left-leaning opposition party, the ALP, is contemplating whether to make negative gearing one of the central policy planks at the next election (investment properties are largely deemed the domain of the better-off LNP supporter, after all).

And it gets worse: the government, in recent years, made Self Managed Superannuation Funds (SMSFs) more broadly accessible to its citizens so that they weren’t held hostage by the inherent limitations of mutual fund managers. In a subsequent development, SMSFs were then allowed (indeed, encouraged) to include residential property, which has led to a stampede by retirement savers into the investment property market — aided by a tsunami of positive media coverage. This change is undoubtedly partially responsible for the latest big leg up in the already substantial bubble. Apartment blocks have been going up like mushrooms all over metropolitan Australia to meet demand from investment buyers, Superannuation funds and the ubiquitous Chinese (collectively a whopping 40% of all buyers). Meanwhile, first-time buyers are reportedly, at their lowest levels (as a proportion of buyers) in history.

Glenn Stevens (the Reserve Bank of Australia governor) has been fairly open in admitting that this next leg up in the property boom is designed to build a bridge to a resource-sector recovery (whenever that may be) but that strikes me as a hell of a risk given the state of the global economy and its current trajectory. The property bubble is everything to this economy and the country’s citizens, whether they know it or not, are ‘all in’.

Well, good grief.

Australia’s ASX All Ordinaries Index has made no net progress in the past decade. It first moved sharply higher on the back of the commodities bull market, while it is now primarily held up by the “big four” bank stocks, which in turn are probably regarded as the main beneficiaries of the housing bubble – as long as it continues, that is.

In short, Australia’s citizens have far greater exposure to the bubble than is immediately obvious. On the one hand, property investment has become a kind of national pastime which people have taken to with gay abandon, seemingly oblivious to the risks. On the other hand, given that retirement savings are largely invested in the stock market, in which banks represent a 30% weight, they are exposed to the bubble indirectly through their pension plans as well.

Mortgage lending has grown at an enormous pace in Australia and as always happens in major credit bubbles, it has taken on ever more irresponsible forms (interest only loans have become ubiquitous – nearly half of all new mortgages are interest only loans these days). A serious downturn in house prices would undoubtedly lead to a major crisis in the banking system. People have gotten so used to the bubble’s seeming imperviousness, that neither insane practices nor insane prices seem to be fazing those involved any longer.

Those who so-to-speak “live inside the bubble” are no longer aware of its dangers. The mentality of Australians is generally well aligned with the country’s great weather – their outlook usually tends to be “happy-go-lucky” and optimistic. Given this fact and their experience to date, why would they heed the warnings of curmudgeons like us?

Consider for instance that eleven months have passed since we have last written about the situation. We suspected at the time that the demise of the commodities boom might finally trip Australia’s housing bubble up – and yet, here we are, with home prices in most regions of the country continuing to rise as if nothing had happened. However, this doesn’t mean that such warnings have become less relevant – on the contrary, they have become more so.

Australian household debt as a percentage of disposable income is at an all time high and has by now reached levels well beyond good and evil.

Evidence of a Bubble in its Late Stages

How much longer can the boom continue? D.S. has provided us with a personal anecdote that adds some color on this point:

“My neighbor is a valuer [ed note: appraiser] – he does property valuation work for banks and various other clients. I expressed concerns to him about the mind-boggling number of apartment blocks that have sprung up in our area (suburban, residential) in the past 12 months and he admitted that, privately, there are huge concerns in the industry over the glut that has developed, not just in our local area – the picture is the same all over the city (we are in Brisbane, Australia’s 3rd city). And many developments still haven’t even ‘broken dirt’ yet. He mentioned that during – and long after – the 2008 financial crisis, banks demanded developers pre-sell nearly 100% of apartments before they would commit to financing them. Recently, standards have plummeted and banks are falling over themselves to make loans. Pre-sales requirements are now as low a 15%. Incentives like guaranteed minimum rental returns for the first 12 months are commonplace and, often these run to three years guaranteed.

There is also something quite curious about this latest building boom: in many instances blocks of apartments don’t appear to go on sale — having been built, there remains a complete absence of ‘For Sale’ signs at the properties and few or no adverts at all in the local media – as though they’ve been built and just abandoned. My neighbor confirmed that, in many cases, the apartments are not being marketed locally at all but to investors in other States and through dedicated Chinese agents. Then again, if they are selling, there would surely be ‘For Lease’ or ‘For Rent’ signs going up (there are few, if any) but more than 80% of local apartments (my observation) remain unoccupied.”

(emphasis added)

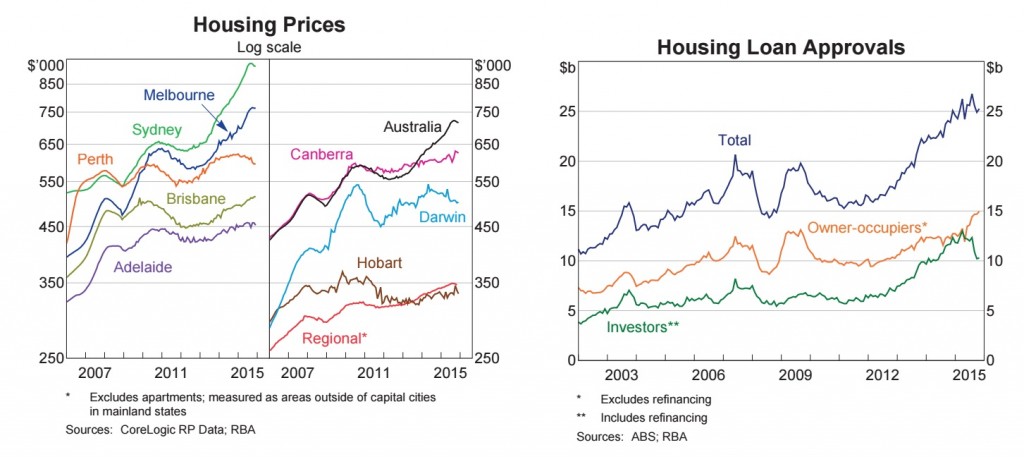

Indeed, tentative evidence is beginning to emerge that indicates that the bubble is probably entering its final stretch. Some of it is anecdotal, such as the observations related by D.S. above, but there are also a few warning signs detectable in the data. For instance, prices in some regions have begun to look a bit wobbly of late. More importantly, loan approvals for investors have noticeably decreased, something that has last happened during the 2008 financial crisis:

Australian house prices by region and mortgage loan approvals – in some regions, prices are coming under pressure, while lending to investors has begun to decrease. Loan growth has mostly shifted to owner-occupiers instead.

There is reason to believe that these recent developments are connected with the commodities bust. While the housing bubble has for a while taken on a life of its own, not least due to sharply declining interest rates and the effects of the government incentives outlined above, real estate prices in regions that are highly dependent on the mining business have been hit hard. This is apparently not felt in the large cities as of yet, but we suspect that the losses are beginning to add up – and that will inevitably begin to impact other regions as well (for some anecdotal color on this specific point, see also the video further below).

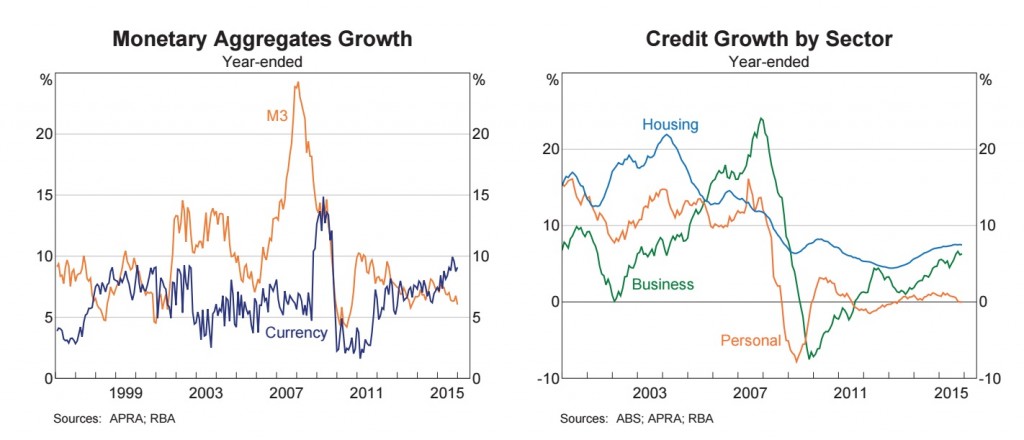

Data on broad money supply and credit growth likewise suggest that a major pillar supporting the boom is threatening to crumble – credit growth is lately only accelerating in the mortgage market, while it is flattening, resp. declining in other sectors. This has led to a slowdown in money supply growth in spite of the RBA’s loose monetary policy.

Australian money supply growth and credit growth by sector: consumer lending has come to halt, while growth in business lending is beginning to stall out. Only mortgage lending growth has still accelerated recently – but for how long can this continue?

“Home Groans”

This brings us to Jonathan Tepper’s fact-finding tour. Australia’s 60 Minutes has interviewed him and accompanied him to a home auction for a report aptly entitled “Home Groans”. Jonathan has experienced Spain’s housing bubble first hand (and predicted its demise in timely fashion), so it is probably fair to say that he should be inured to bubble behavior. However, even he is seemingly stunned by what he is seeing.

The video segment begins with a report on Kate Maloney, the better half of a couple once crowned “Australia’s property investors of the year” (in 2012) – who now find themselves bankrupt, after borrowing over $A6 million which they invested in homes in a coal mining town in Queensland. In the meantime, house prices have crashed there: homes that used to sell for A$ 900,000 can be sold for A$ 180,000 nowadays – “if you’re lucky”, as Kate Maloney wistfully admits.

As Jonathan points out, the entire country seems to be in the grip of “collective madness”, as “everyone is borrowing more than they should”. What happened in the small coal mining town in Queensland will eventually happen everywhere. Given the astonishing extent of household indebtedness we have little doubt that this will lead to a major crisis – and quite likely it will be the worst economic and financial crisis to hit Australia in the entire post WW2 era.

To this it should be remembered that Australia’s banks are presumably still quite dependent on wholesale funding originated in London. This turned out to be a major Achilles heel of the banking system during the 2008 crisis, so perhaps they have in the meantime diversified their funding sources a bit. We still think that this is going to become a factor again once the crisis begins.

Readers should definitely invest the 15 minutes it will take to watch the 60 Minutes video below – it is really quite an eyeopener. A quite interesting detail is that banks are apparently prepared to approve loans even if they recognize the related dangers. They don’t really check whether people will be able to repay their mortgages in stress situations. This is typical late stage bubble behavior.

We have to agree with Jonathan that there is really only one word to properly describe Australia’s housing bubble: Insane. As he says, all that remains to be determined is when exactly the bust will begin. Considering the data points presented above, we believe it will be sooner rather than later.

Conclusion

As the Australian property boom has once again shown, bubbles driven by loose monetary policy have a tendency to last much longer than seems possible to reasonable observers. In this particular case, the boom has already progressed to a rare extreme: with home prices at 10 to 12 times disposable income (far higher than the peaks attained in the housing bubbles in the US, Ireland and Spain), the end is clearly getting close.

Australian home-owners, property investors and banks will be in for quite a rude awakening. Readers should perhaps take a minute to commiserate with them and then give some thought to how money might be made from the situation. People based in Australia should definitely ponder how to best hedge themselves against the inevitable denouement.

We cannot give any concrete recommendations at this juncture, but there are obviously many possibilities (such as buying CDS on bank stocks or shorting financial sector and construction stocks, to name a few examples). This is something everyone will have to find out and decide for himself. We merely want to make the point that every crisis is at the same time an opportunity – and the best opportunities tend to present themselves while most people are still blissfully unaware of the impending disaster.

Addendum: Additional Footage

Jonathan’s Twitter (N:TWTR) feed has some additional video material on the property auction in Sidney that didn’t make it into the final cut of the 60 Minutes show (“Extra Minutes”).