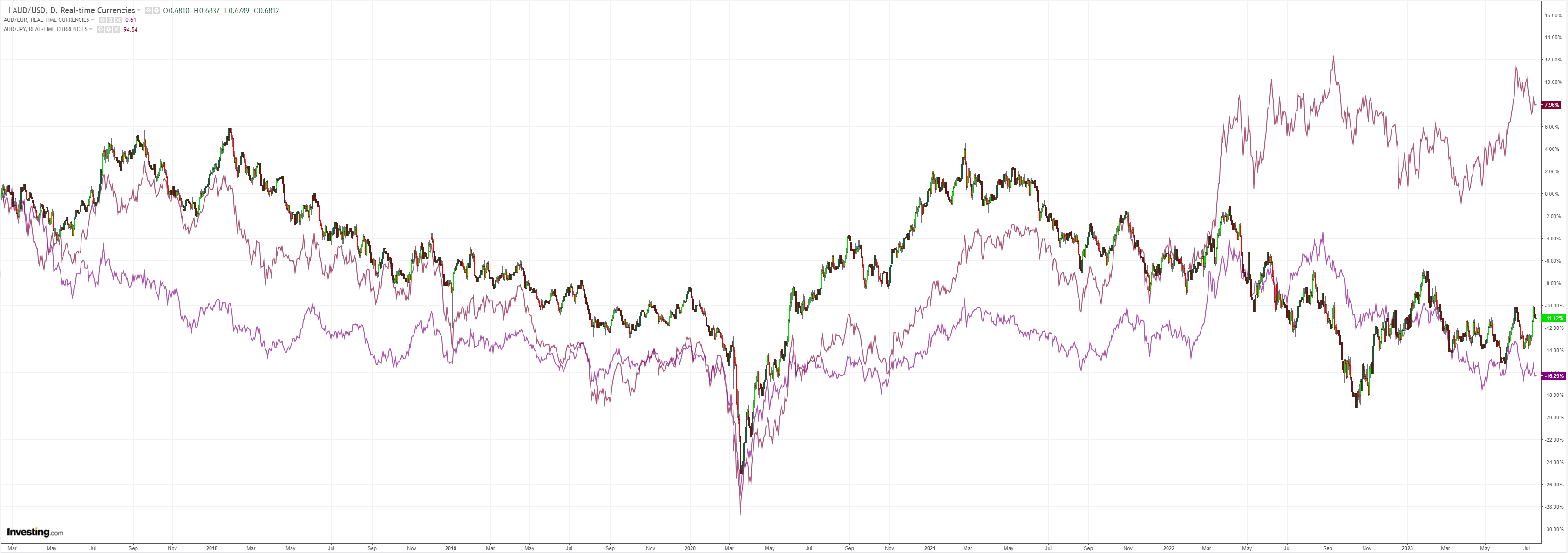

Risk is raging but the AUD is not.

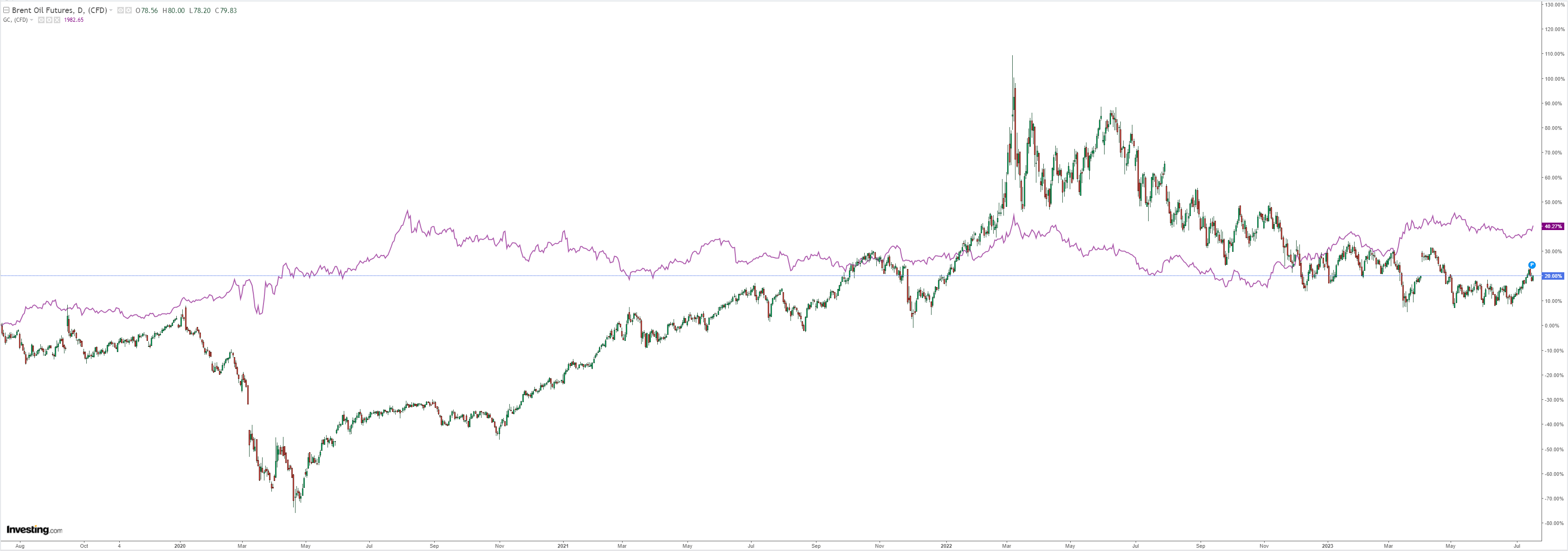

Gold and oil are food and running:

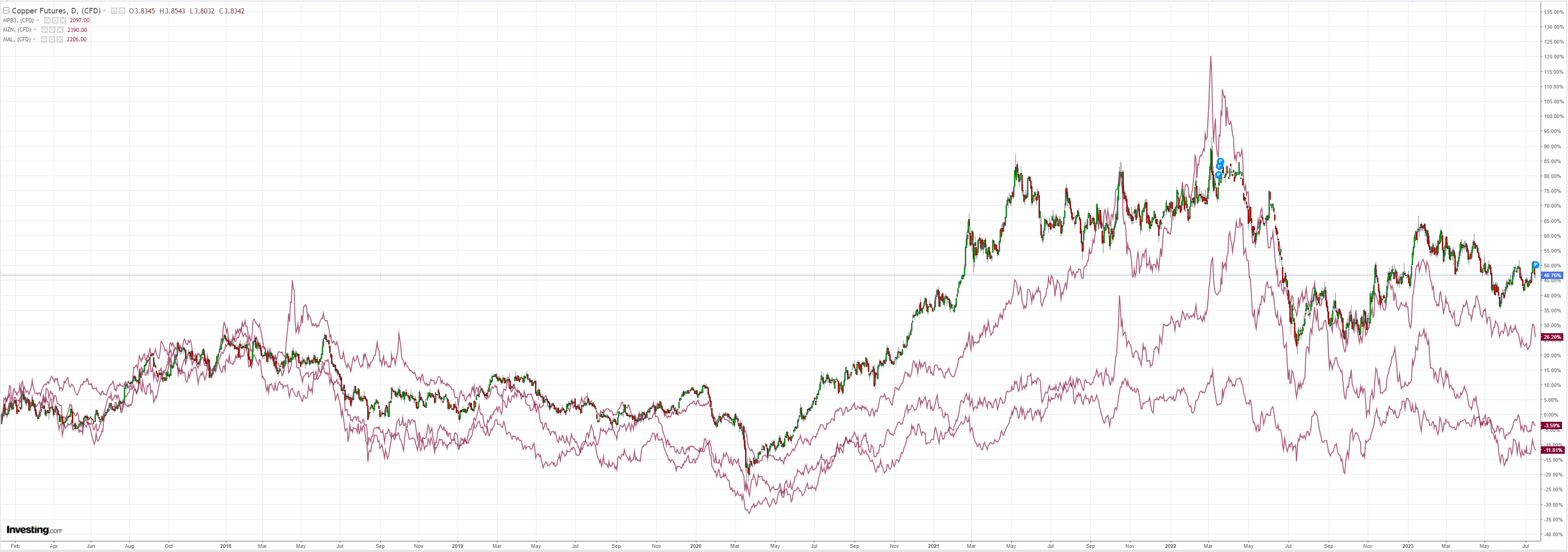

Dirt yawn:

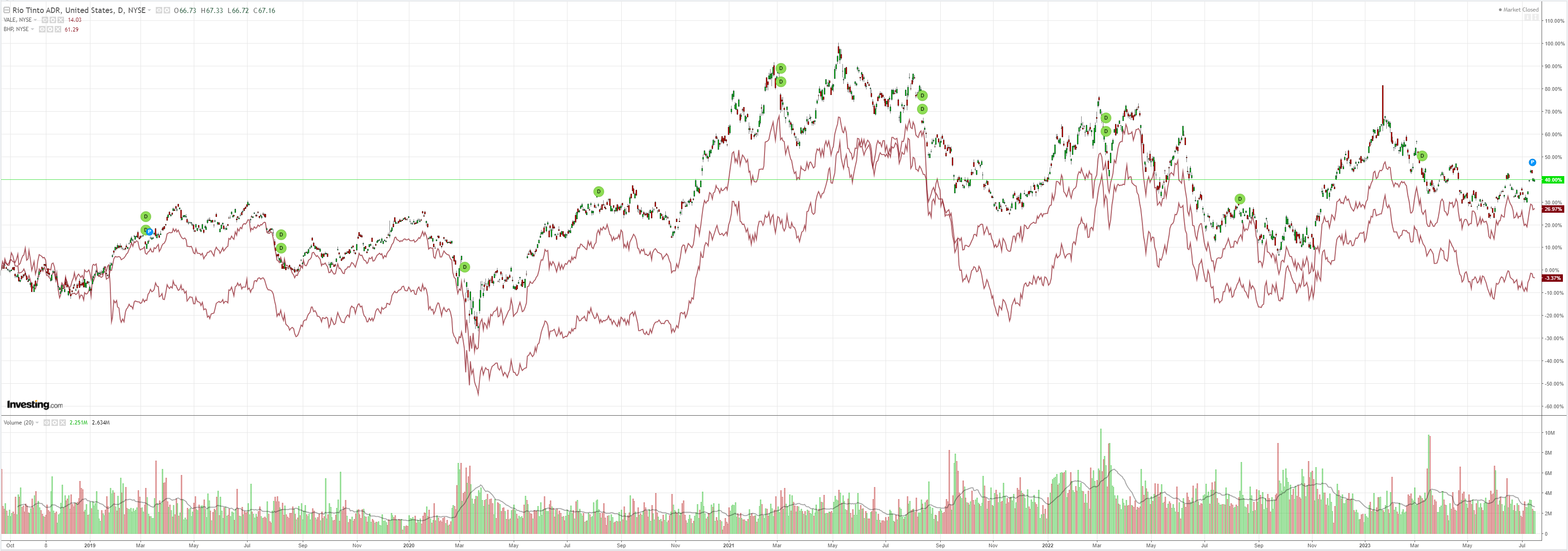

Mining (NYSE:RIO) yawn:

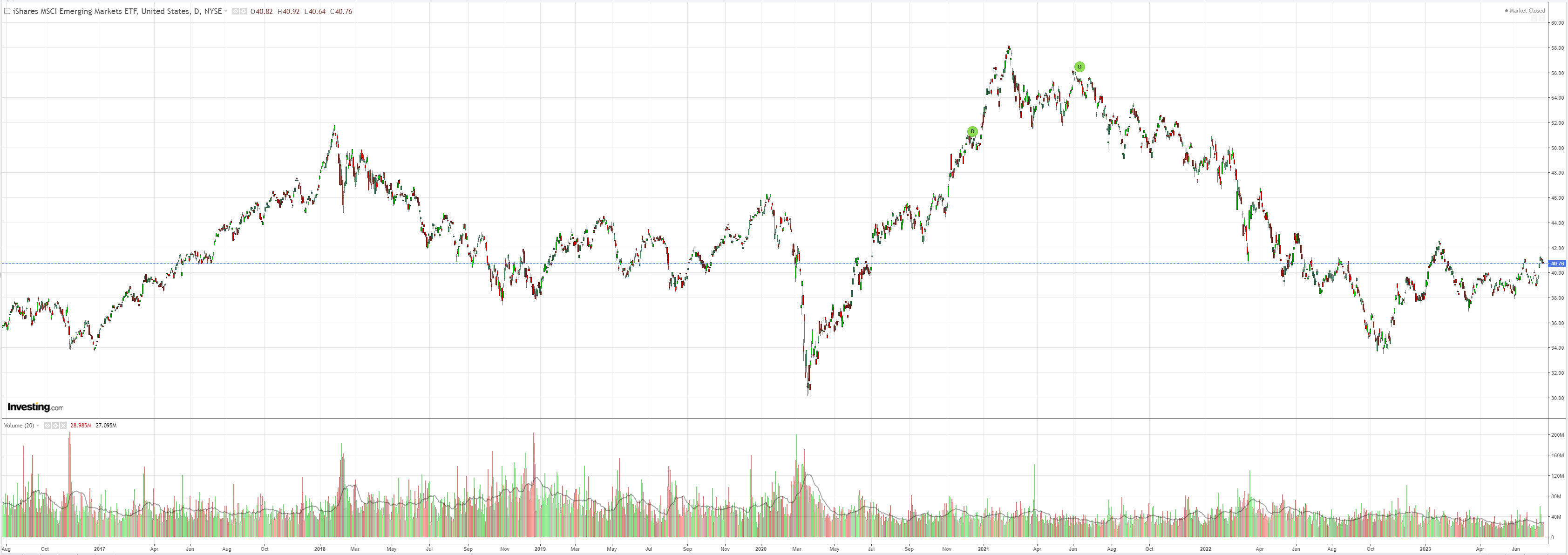

EM (NYSE:EEM) may be dead thanks to China going ex-growth:

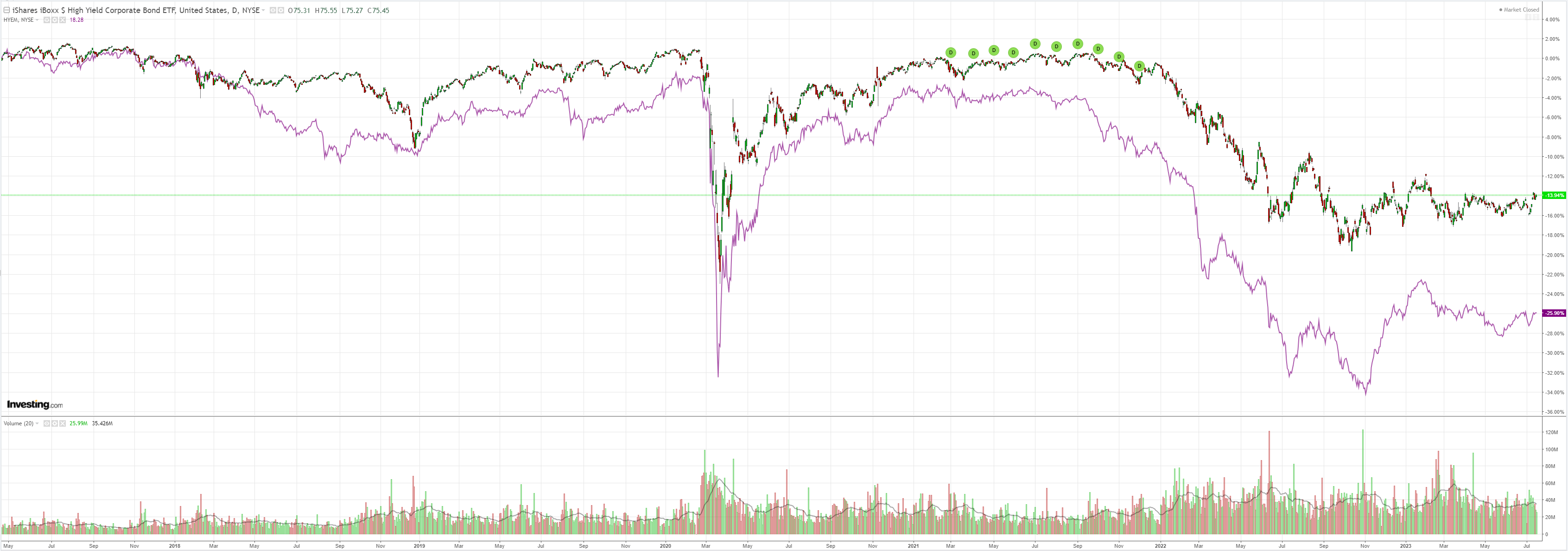

Junk (NYSE:HYG) is not supportive:

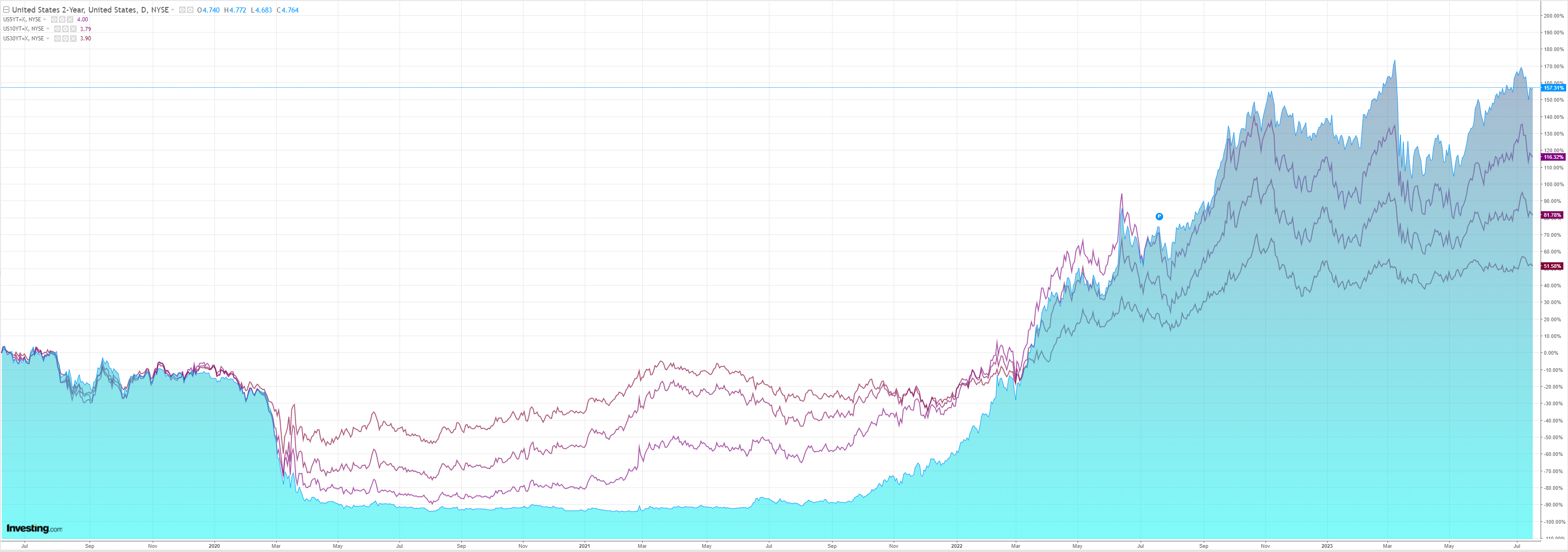

Yields eased:

Stocks only go up:

Especially insolvent banks (NYSE:KRE) as the dash for trash accelerates. Did credit-crunched small US banks? Buy ’em!

Everything US is partying but global risk is not.

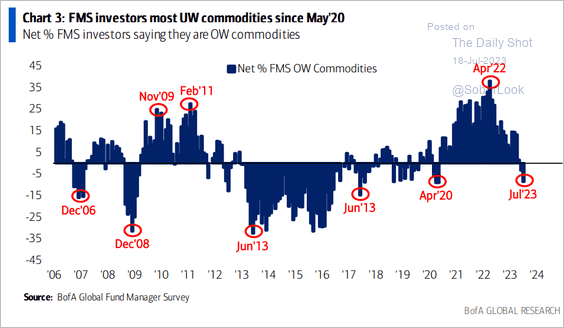

A big, fat and exhausted Chinese elephant has sat on everything else. Goldman’s and Zoltan’s commodity super cycle is getting hosed:

While the falling DXY persists, there will be upwards pressure on AUD but it is fighting massive wind shear in ex-growth China.

The latter will win easily in the long run as we redo the post-2012 period for dirt.

A super bust cycle for commodities and the AUD.