DXY is back and charging as EUR falls:

The AUD was hit:

Oil is one way rocket ship:

Dirt is trying but largely failing to follow:

Big miners (LON:GLEN) were stable amid falls:

EM stocks (NYSE:EEM) are breaking down again:

Led by EM junk (NYSE:HYG) which is a screaming meteor of doom for risk assets:

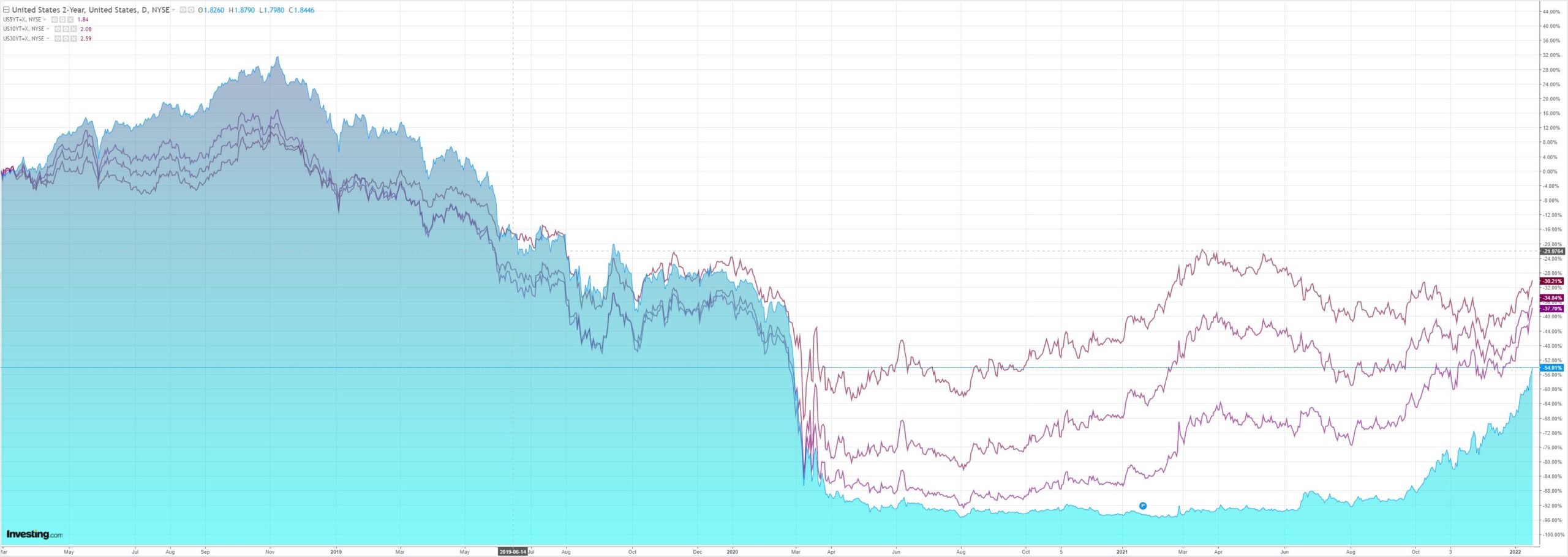

As yields spiked. The curve flattened marginally:

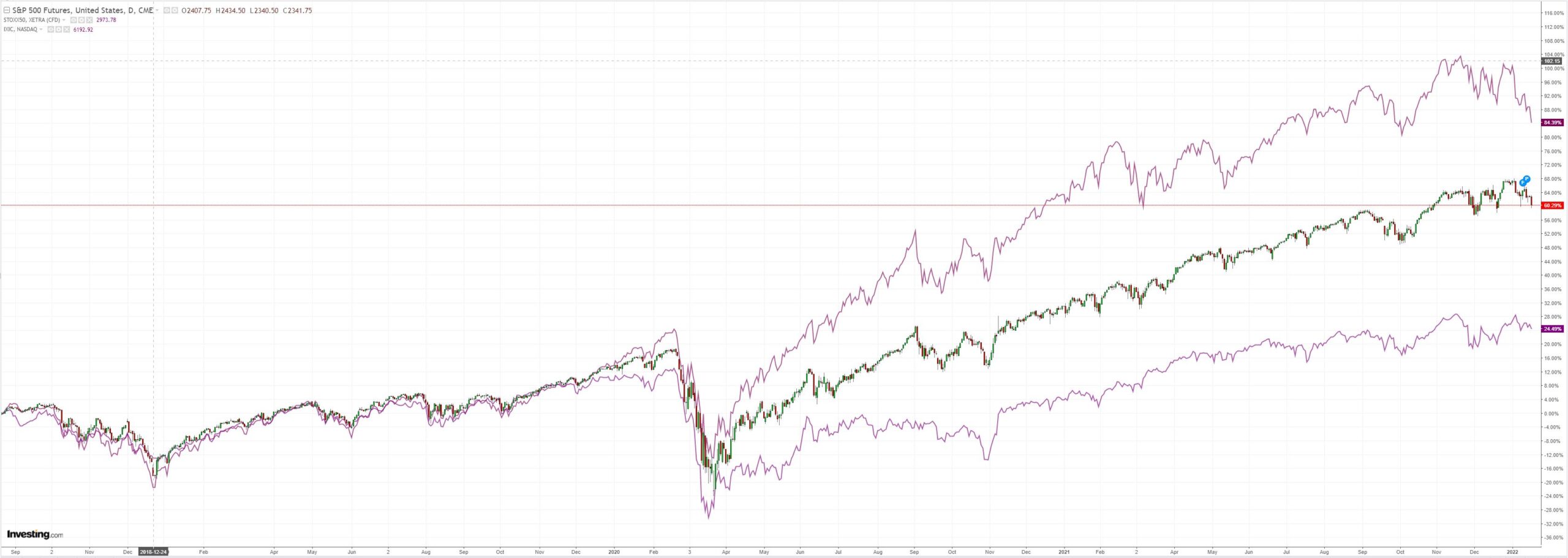

Stocks copped it, led by Growth:

Westpac has the wrap:

Event Wrap

US NAHB homebuilder sentiment survey held firm at 83 (est. unch at 84), citing high material costs, lack of available supply delaying construction, and faltering confidence among builders in the North East. The NY Fed’s (Empire State) manufacturing survey fell 32.6 points to -0.7 (est. +25.0) – the lowest since May 2020, and probably reflecting Omicron and supply chain disruptions (though the impact from the latter seemed to be easing). W

Eurozone ZEW economic sentiment survey showed a rise in expectations, although current conditions fell (probably affected by Omicron restrictions). German expectations rose to +51.7 (from +29.9) and Eurozone expectations rose to +49.4 (from +26.8). Current conditions fell to -10.2 (from -7.4) in Germany and to -6.2 (from 2.3) in the Eurozone. Inflation expectations for the next six months fell to -38.7 (prior -33.3), with 58% of respondents expecting inflation to decline over the next six months.

UK unemployment rate in December continued to decline, reaching 4.1% (est. unch.). Average weekly earnings met expectations of 4.2% (from prior 4.9%).

Event Outlook

Aust: The Westpac-MI Consumer Sentiment survey for January will provide insight into the impact of omicron on confidence.

NZ: Volatility in December’s card spending is anticipated given the ongoing effects from lockdowns.

Ger/UK: December’s CPI for Germany and the UK should remain near 30-year highs (market f/c: 0.5% and 0.3% respectively).

US: The strength of underlying demand for housing should continue to buoy housing starts and building permits, although rising costs and labour market tightness are a slight dampener (market f/c: -1.7% and -1.0% respectively).

This market is now warming into a full stagflation hysteria versus the Fed. The commodities complex is the chosen battleground. It is being bought by stagflationists (which is creating the stagflation) supported by fading pandemic stimulus demand in the US, OMICRON and stimulus in China, and notions of ESG constraints which are largely drivel.

On the other hand, the Fed is going to do what it must to stomp on commodity crazy town to rein inflation. If it has to kill demand to achieve this, it will do it.

This is now a fight to the death for the future of the business cycle.

The first casualties are already bloodied. EM assets are under intensifying pressure across the board. It can’t be long before Chinese easing adds a falling CNY to their pain.

Now, DM stocks are being drawn in though junk dent is still OK which tells us that the stress needs to increase a lot more yet.

Commodities are fighting hard for now, especially oil, but the Fed must break them too before it eases up.

The Australian dollar is caught between these titanic forces with stagflation pushing up and the Fed down.

For me, there can be only one winner in this battle.

It may take a bit of time but don’t fight the Fed.