DXY faded last night as the war began:

AUD lifted like a Levantine rocket:

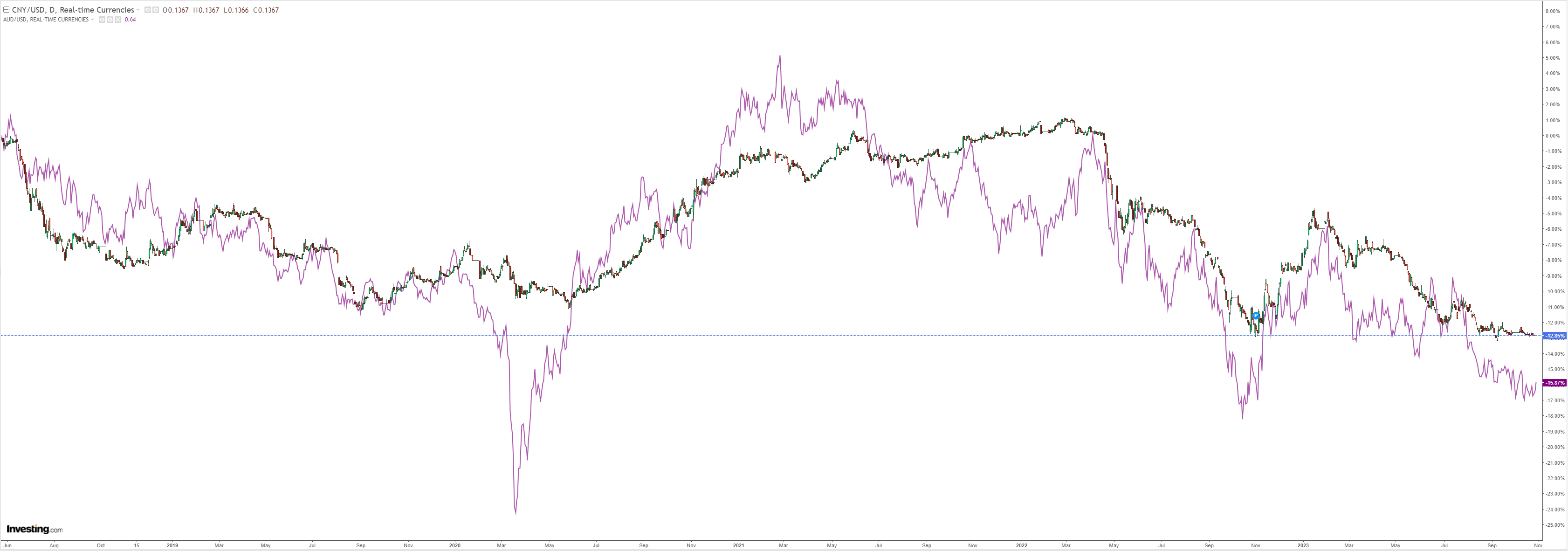

Check out that shiny new CNY peg!

Oil slumped:

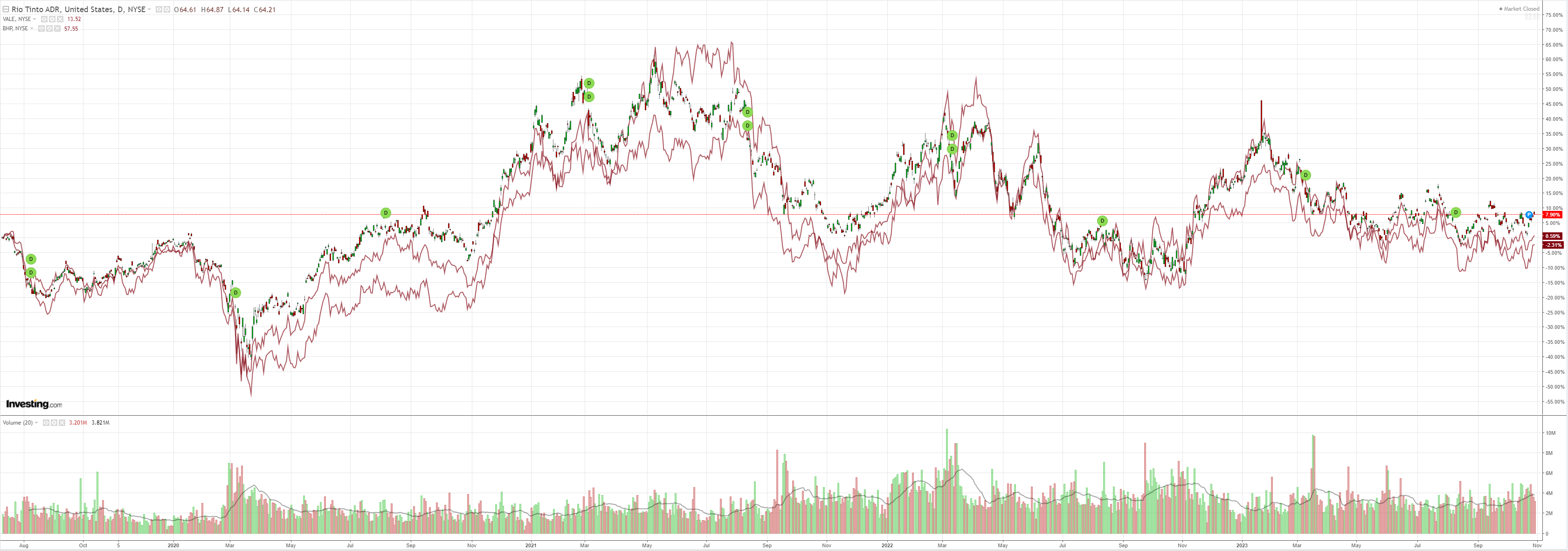

Dirt relief rallied:

Mining a little:

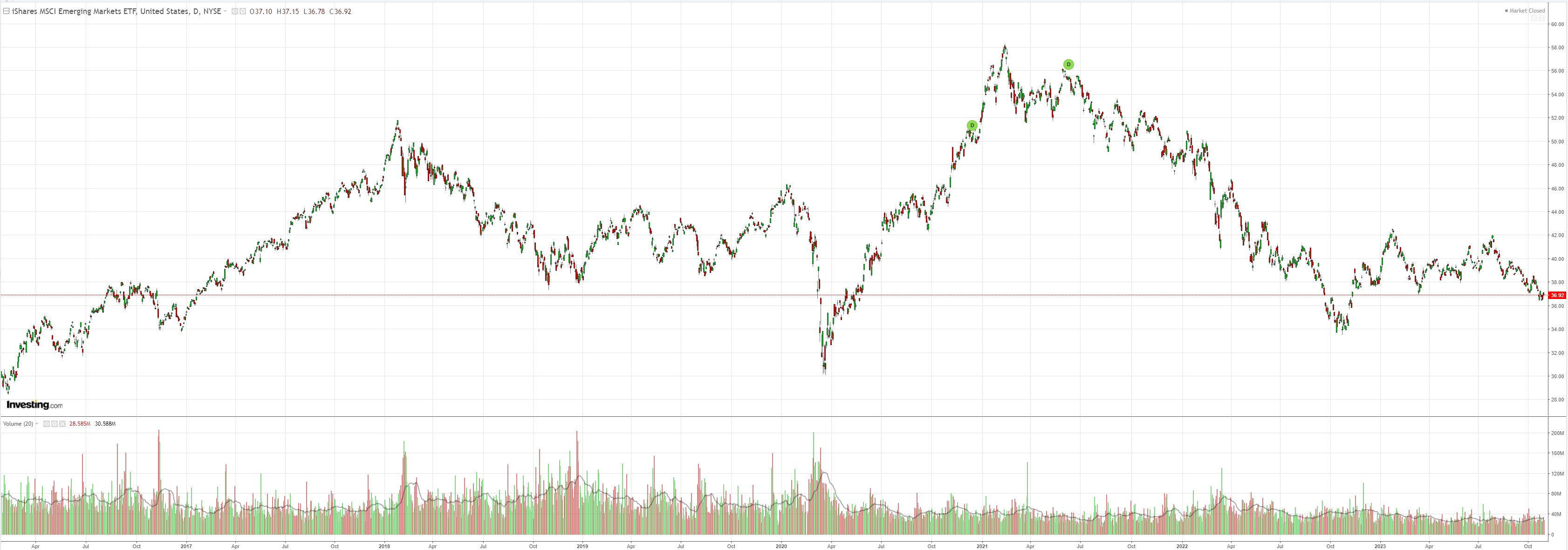

EM less:

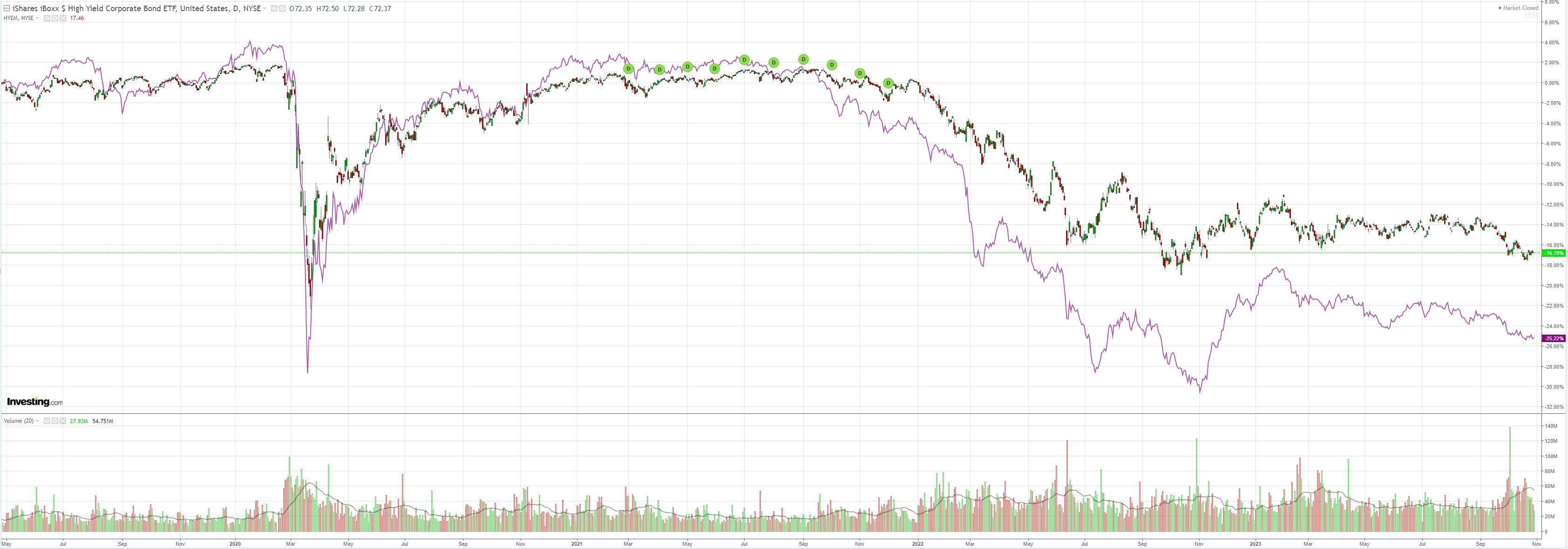

Junk not at all:

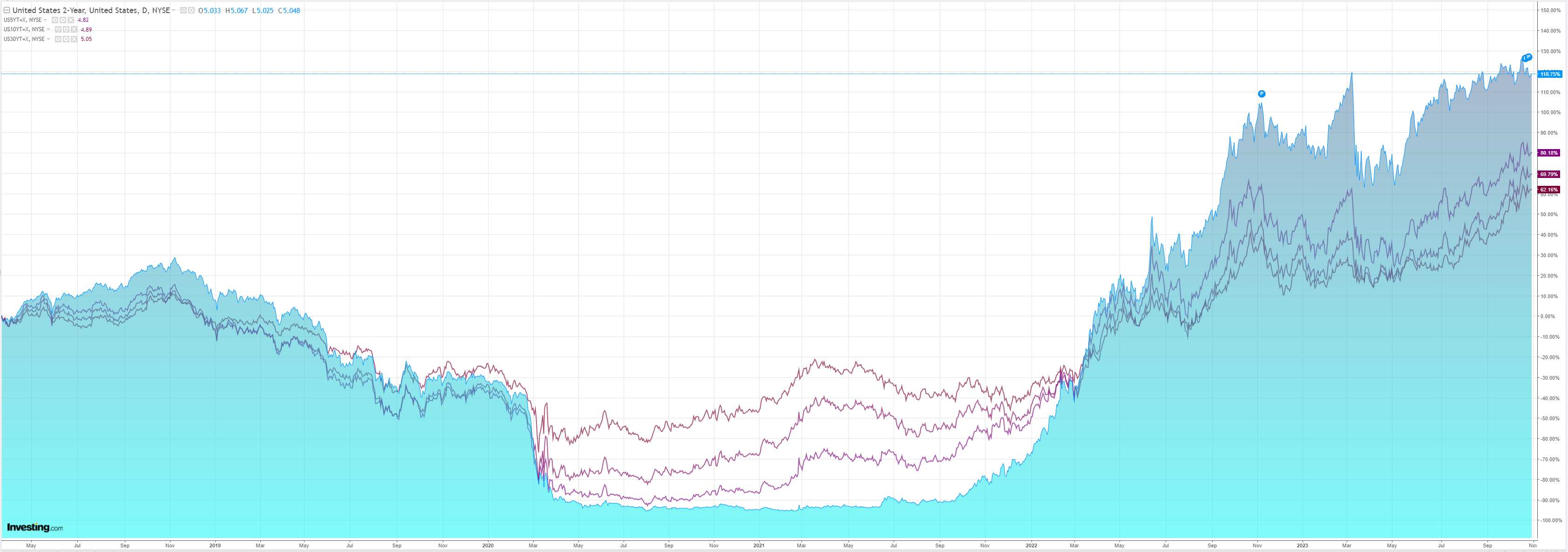

As yields firmed anyway:

And stocks rebounded moderately:

Markets usually rally when wars begin. Whether it can continue will hang on yields.

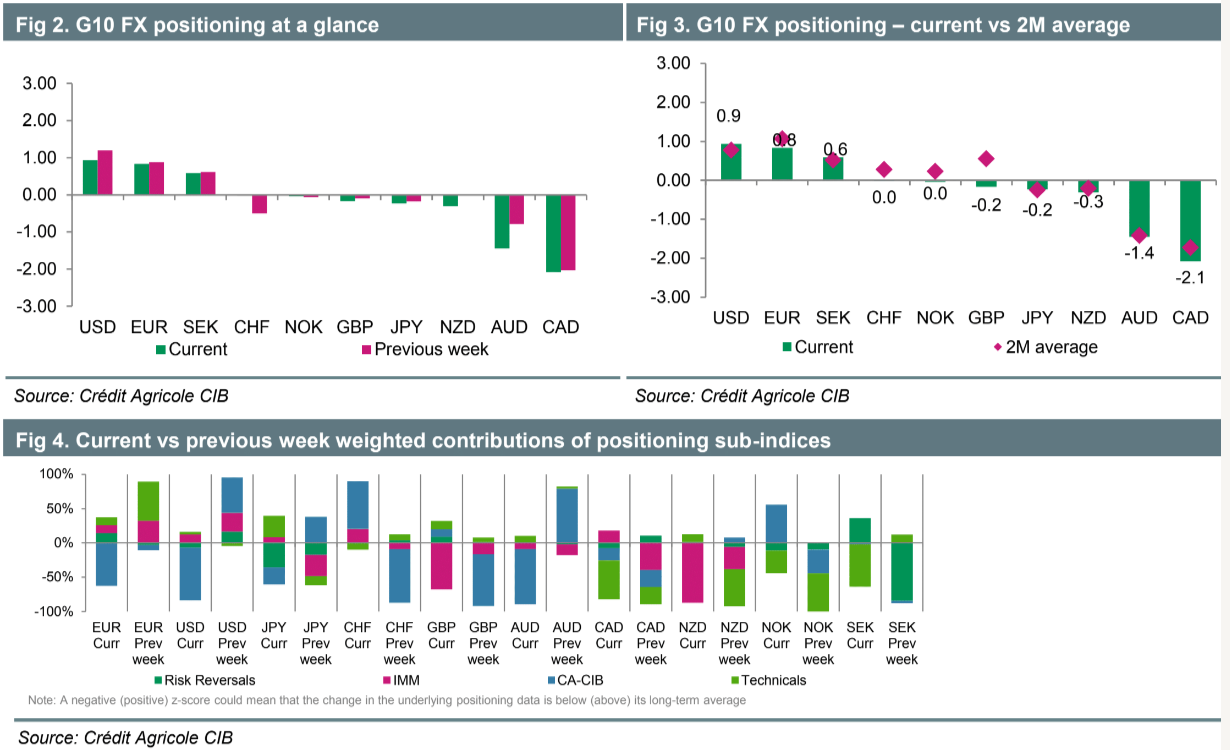

Credit Agricole (EPA:CAGR) says positioning has evened out:

At present, the G10 FX PIX 2.0 signals that positioning is close to the medium-term average for all currencies in the G10 space.

The EUR experienced fresh selling interest last week, predominantly driven by Crédit Agricole CIB flows. Our FX flow data points at banks and corporates inflows, as well as hedge funds and real money investors outflows.

The USD remains the biggest long in the G10 FX despite fresh selling interest last week, predominantly driven by Crédit Agricole CIB flows. Our FX flow data points at banks and hedge funds inflows, as well as corporates and real money investors outflows.

The JPY experienced mild selling interest last week, predominantly driven by Risk Reversals flows. Our FX flow data points at banks and hedge funds inflows, as well as corporates and real money investors outflows.

The CHF enjoyed new buying interest last week, predominantly driven by Crédit Agricole CIB flows. Our FX flow data points at hedge funds inflows, as well as banks, corporates and real money investors outflows.

The GBP experienced some selling interest last week, predominantly driven by IMM flows. Our FX flow data points at banks and hedge funds inflows, as well as corporates and real money investors outflows. All in all, the GBPis no longer in oversold territory.

The AUD experienced new selling interest last week, predominantly driven by Crédit Agricole CIB flows. Our FX flow data points at banks, hedge funds and real money investors inflows, as well as corporates outflows. All in all, the AUD is no longer in overbought territory.

My view is that we are somewhere near the lows, but it will take time to consolidate a bottom.