DXY is up and away. This bull market is going to stampede everything in the months ahead. I see twenty-year highs coming for the King as the safe haven roars while the Fed gallops over everything:

AUD fell sharply. Once JPY also turns safe haven you’ll know we’re getting to the pointy end:

Oil is in trouble as global recession comes into view

Dr Copper sniffed at it as well:

Miners (LON:GLEN) were OK:

Not EM stocks (NYSE:EEM):

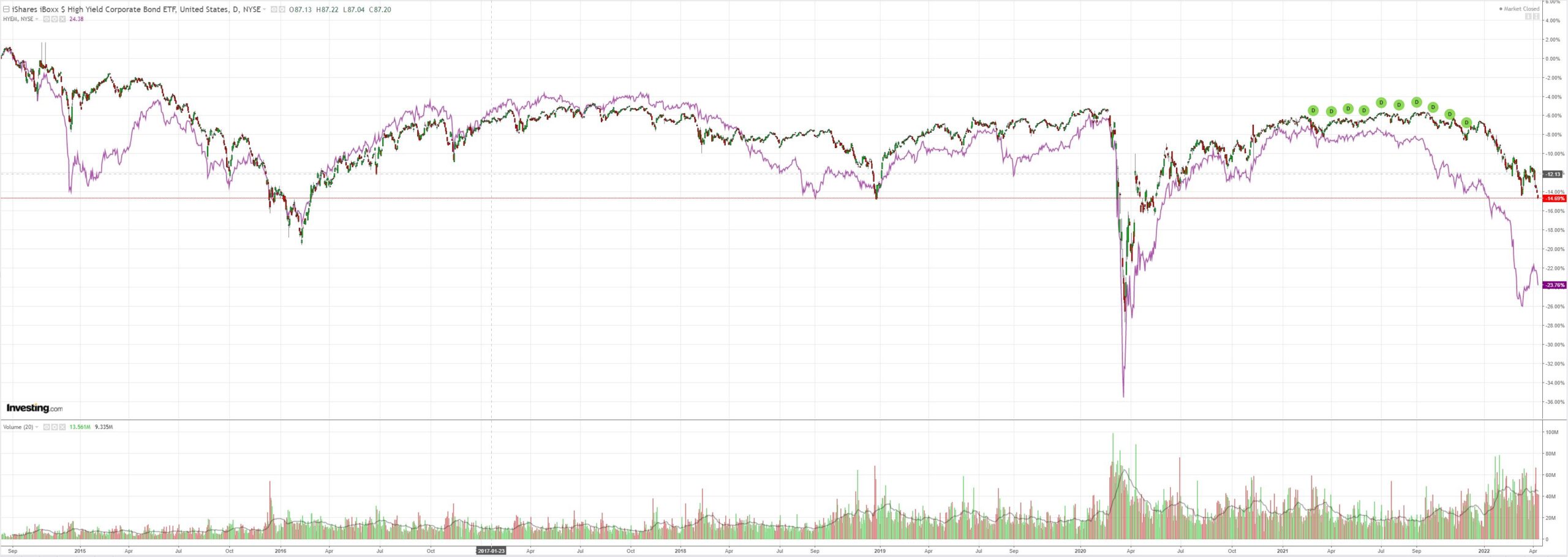

And junk (NYSE:HYG) retreated. Heed this for all risk assets:

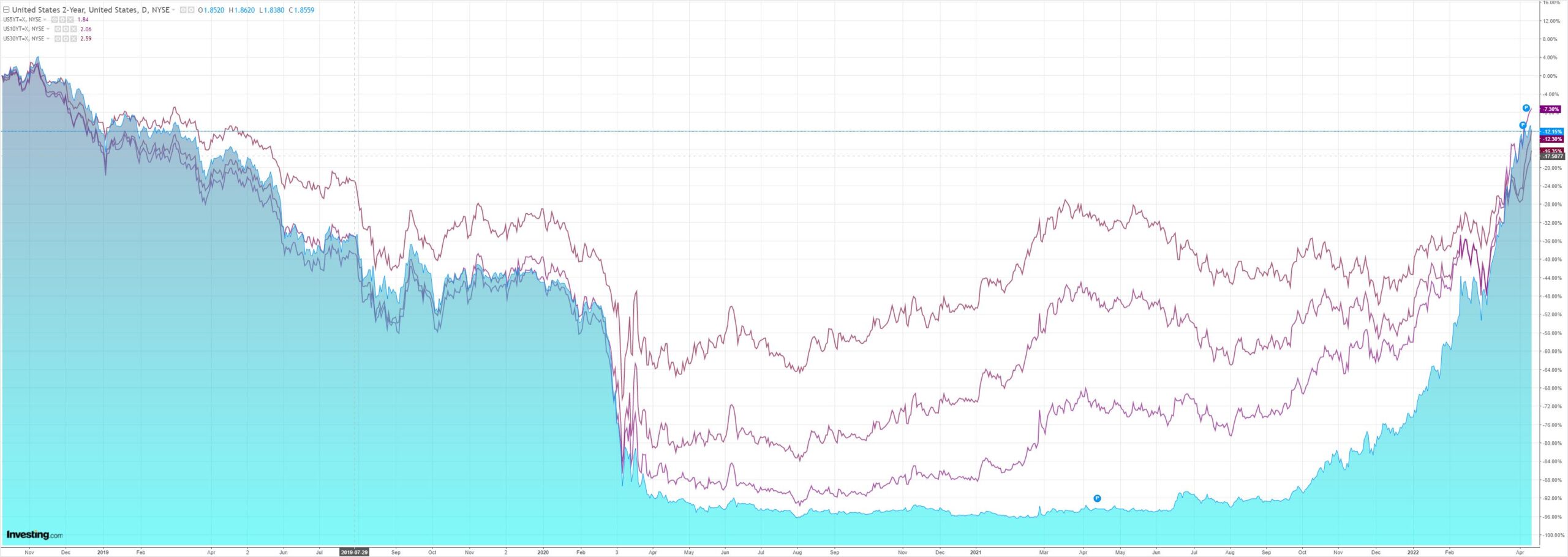

The curve steepened on QT. It’s premature:

Stocks were thumped:

Watch DXY and (NYSE:HYEM). While the former rises and the latter falls all risk assets including AUD will get hit. But not before. When the two reverse together then you’ll know the global recession scare (and/or reality) is over.

Westpac has the wrap.

—

Event Wrap

UK activity data for February were softer than expected. GDP rose 0.1%m/m (est. +0.2%m/m), +1.0%y/y (est. +0.9%y/y). Industrial production fell 0.6%m/m (est. +0.3%m/m) and manufacturing fell 0.4%m/m (est. +0.3%m/m).

Chinese Premier Li said that downside pressures on the economy were rising and that there was need for better macroeconomic policy.

FOMC member Waller said it will be difficult for the economy to avoid collateral damage from the “blunt-force” rise in interest rates. Evans said a 50bp hike is “worthy of consideration” and is “perhaps highly likely.” He believes the economy will be fine with a neutral policy stance.

Event Outlook

Aust: Mixed conditions will be present in the March NAB business survey given the improvement in hospitality post-omicron alongside the severe flooding in NSW and Qld. Meanwhile, the preliminary estimate for March’s overseas arrivals and departures will provide a gauge of the rebound in travel since the international border reopening.

NZ: A further deterioration of confidence and a lift in inflation gauges are anticipated in the Q1 QSBO business opinion survey. Net migration should also remain weak in February given the border closure.

Eur/UK: The April ZEW survey of expectations will continue to reflect an uncertain outlook with the Russia-Ukraine conflict. Meanwhile, the UK’s economic recovery has pushed the ILO unemployment rate back to pre-COVID levels (market f/c: 3.8%).

US: Rising cost pressures are the key concern, as evidenced by consumer inflation which is expected to rise further in March (market f/c: 1.2%). NFIB small business optimism will likely remain at weak levels in March (market f/c: 95.0). The FOMC’s Brainard is due to speak.