DXY was weak last night and EUR strong:

But nothing could stop AUD falling. It appears poised to break DXY and EUR support:

Commods went nowhere:

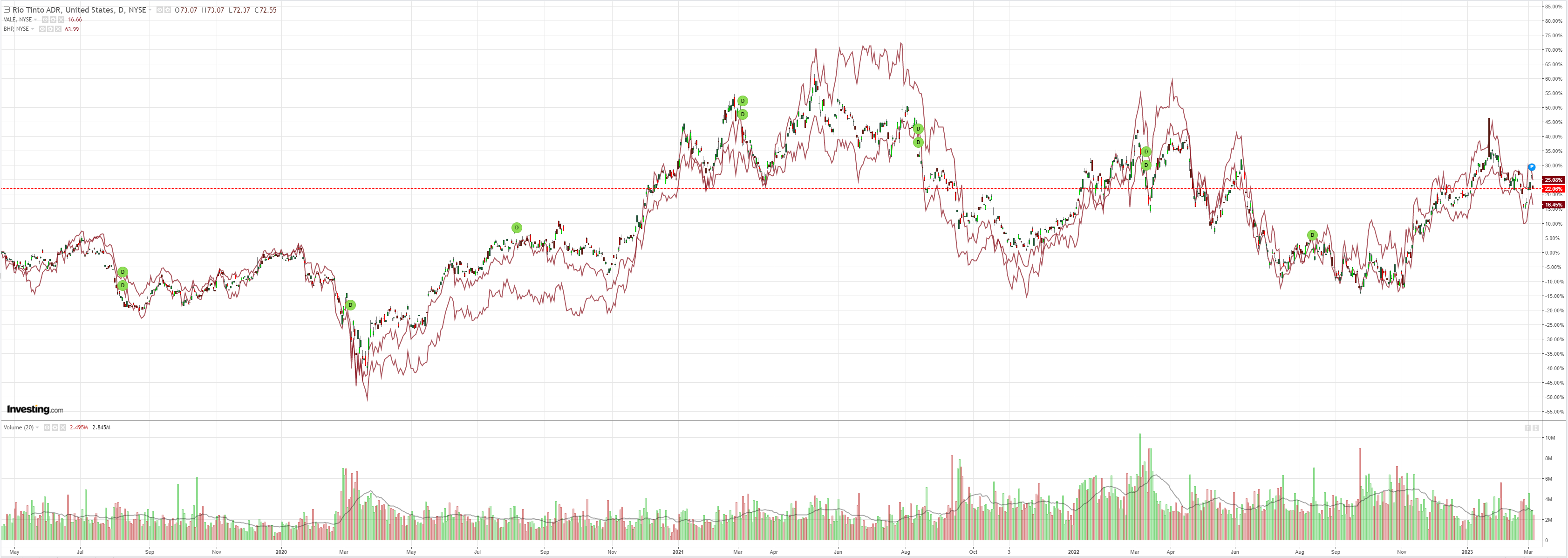

Big miners (NYSE:RIO) were thumped:

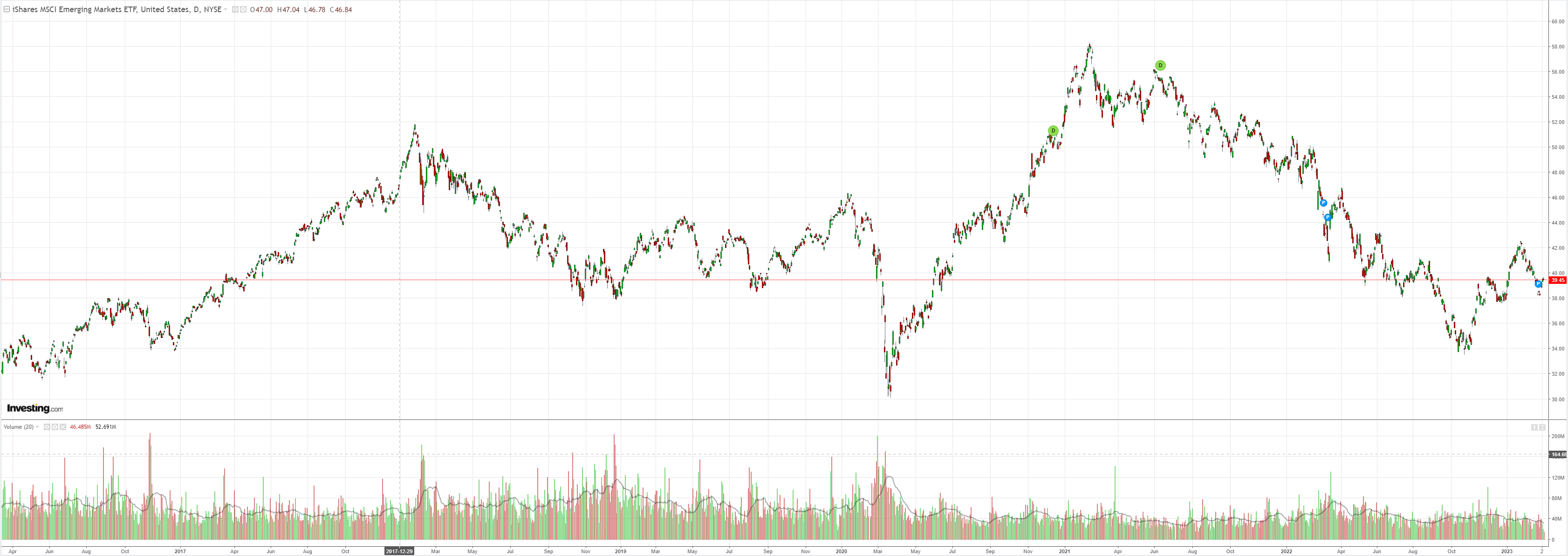

EM stocks (NYSE:EEM) firmed:

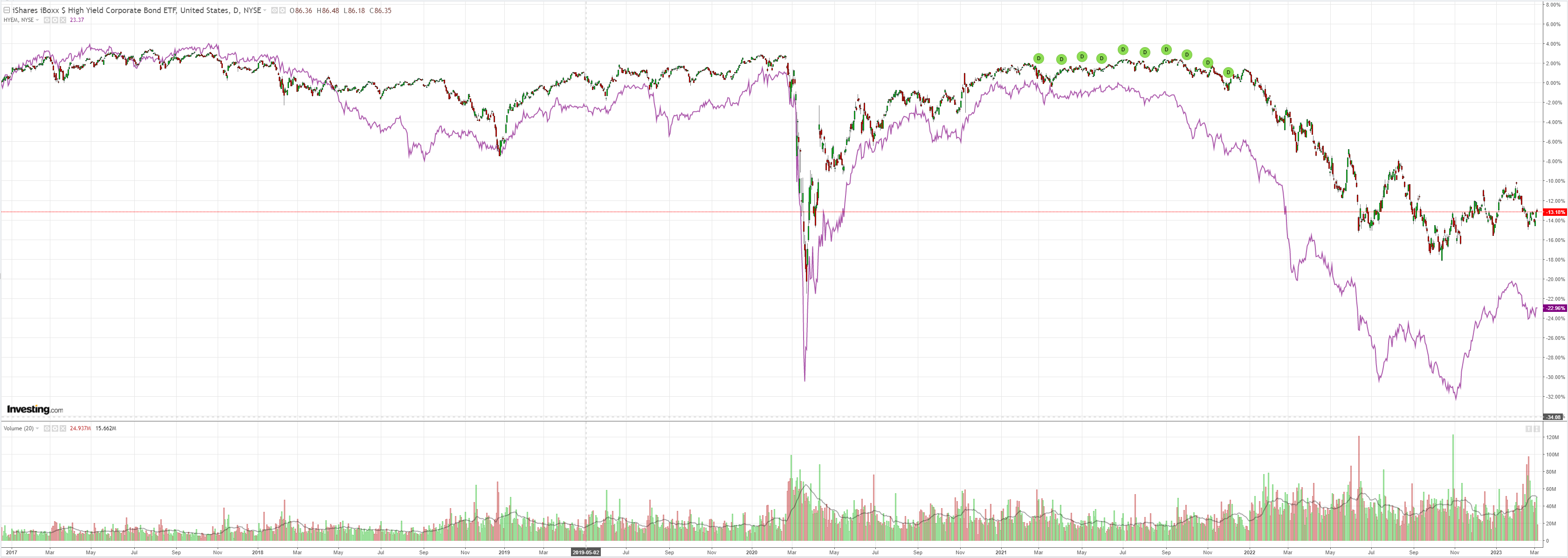

Junk (NYSE:HYG) too:

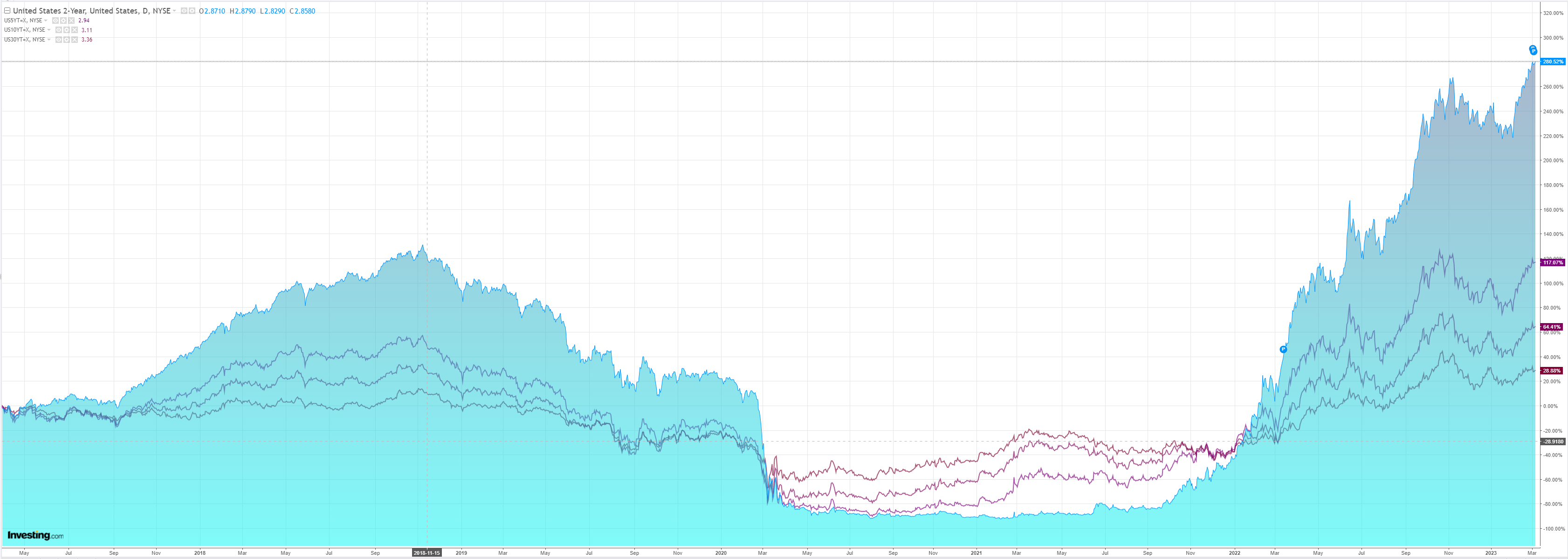

The US yield curve inverted further:

Stocks went nowhere:

The proximate cause for AUD weakness was the weakish Chinese growth target. But, that is only the latest blow to the currency.

What is really irking the battler is Australia’s incredibly interest-rate sensitive economy (think household debt) has not only caught down to other DMs but has overtaken them in the race to recession.

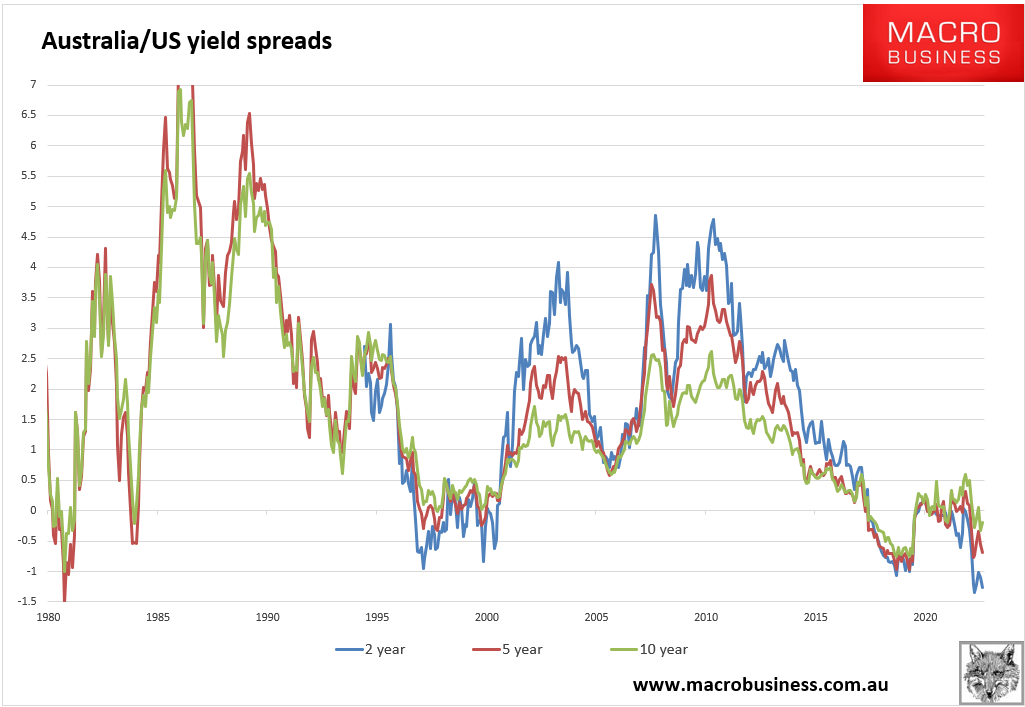

As a result, yield spreads to the US have cratered, kicking one leg from under the AUD, even if the terms of trade remain extreme:

And to think, the Aussie economy is actually materially less sensitive to higher interest rates this cycle, given the huge fiscal giveaways of COVID and the fixed-rate mortgage boom.

Not to mention that six months ago our business cycle was several quarters behind that of the US.

Yet here we are, just nine months from the first hike, amid a tightening cycle that commenced later than other DMs, poised at the fixed-rate mortgage cliff, and the economy has galloped downhill like the Man from Snowy River such that it will be the first to enter recession!

Congratulations must go Albo and the RBA for so swiftly ending the modern scourge of full unemployment.

Australians can now look forward to a return to the perma-recessionary conditions and lowflation to which they have become accustomed.

AUD is delivering its verdict.