DXY is a falling comet. EUR is a rising one. Thanks nice weather!

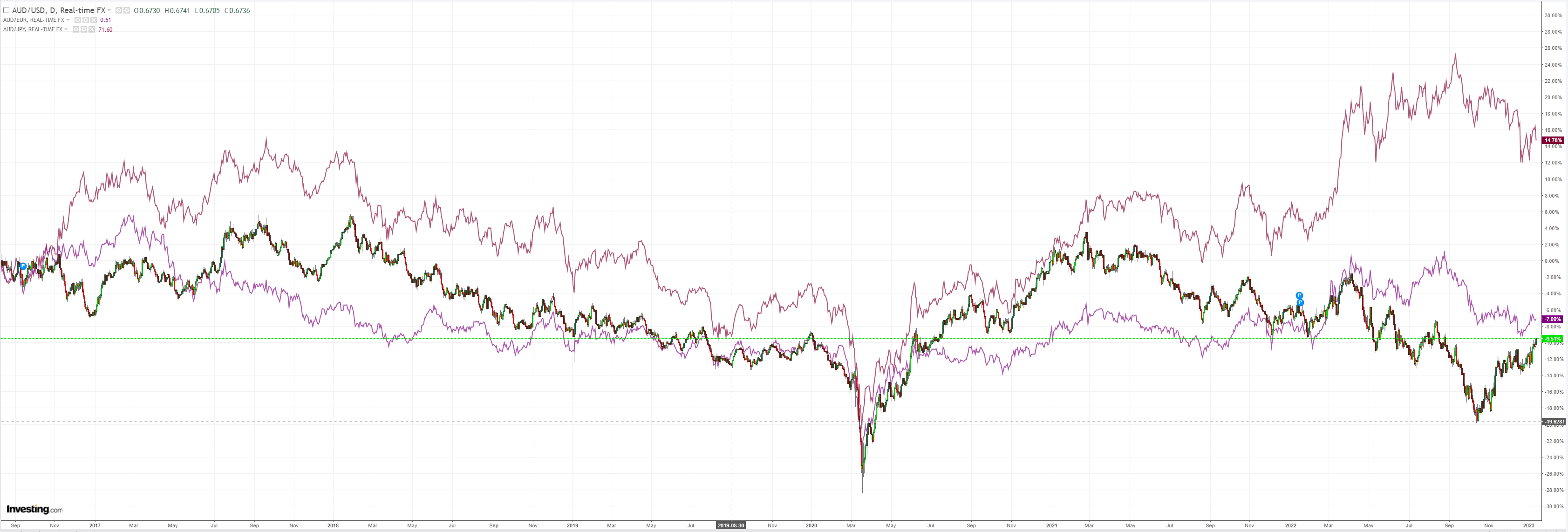

AUD is soaring versus DXY and grinding lower versus EUR and JPY:

Oil can’t break its downtrend. Gold has:

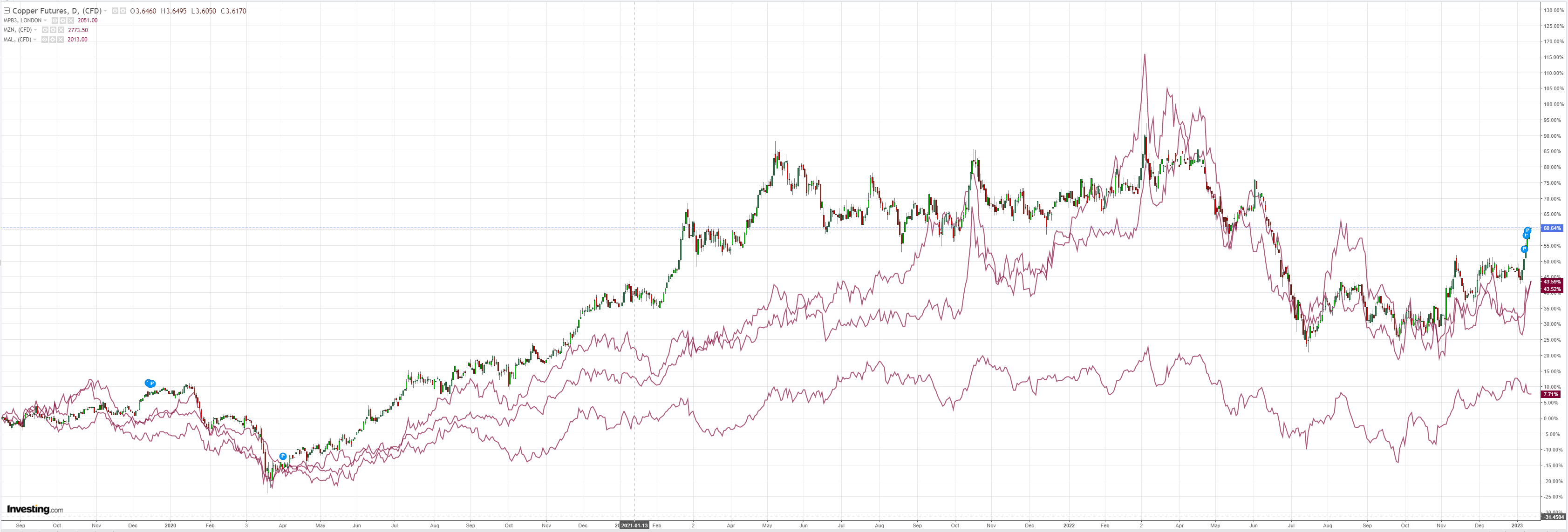

Base metals scream reflation:

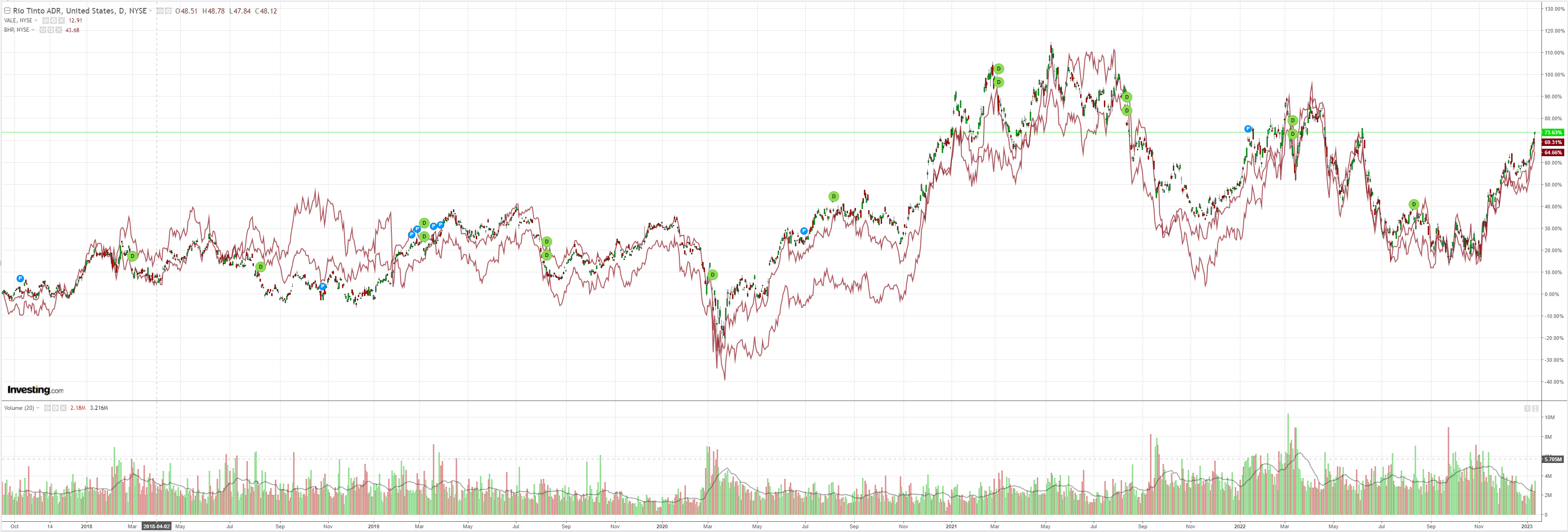

Big miners (NYSE:RIO) too though they have not broken downtrends either:

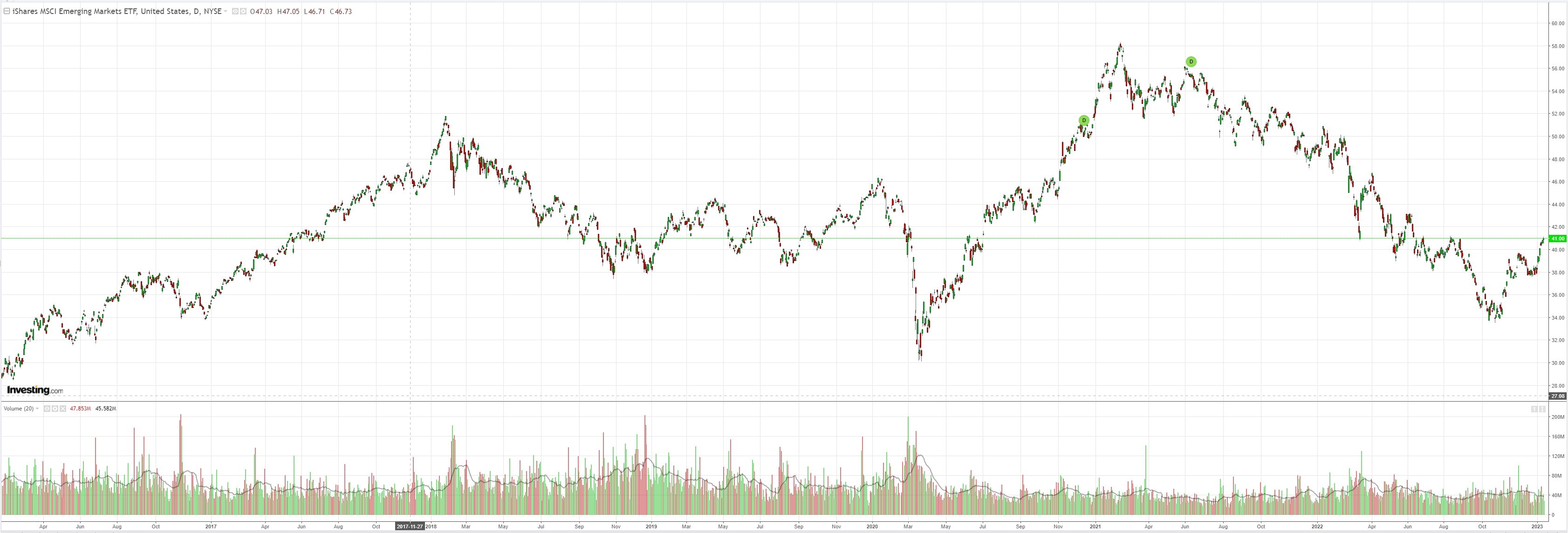

EM stocks (NYSE:EEM) are crashing up:

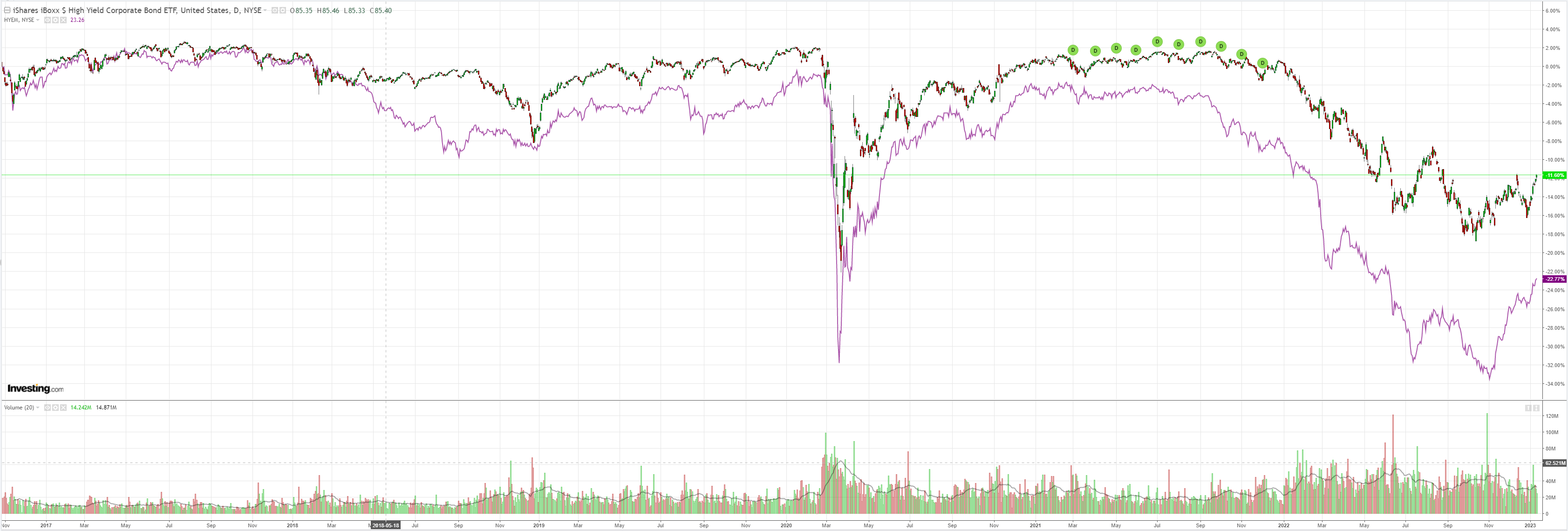

Chasing junk (NYSE:HYG):

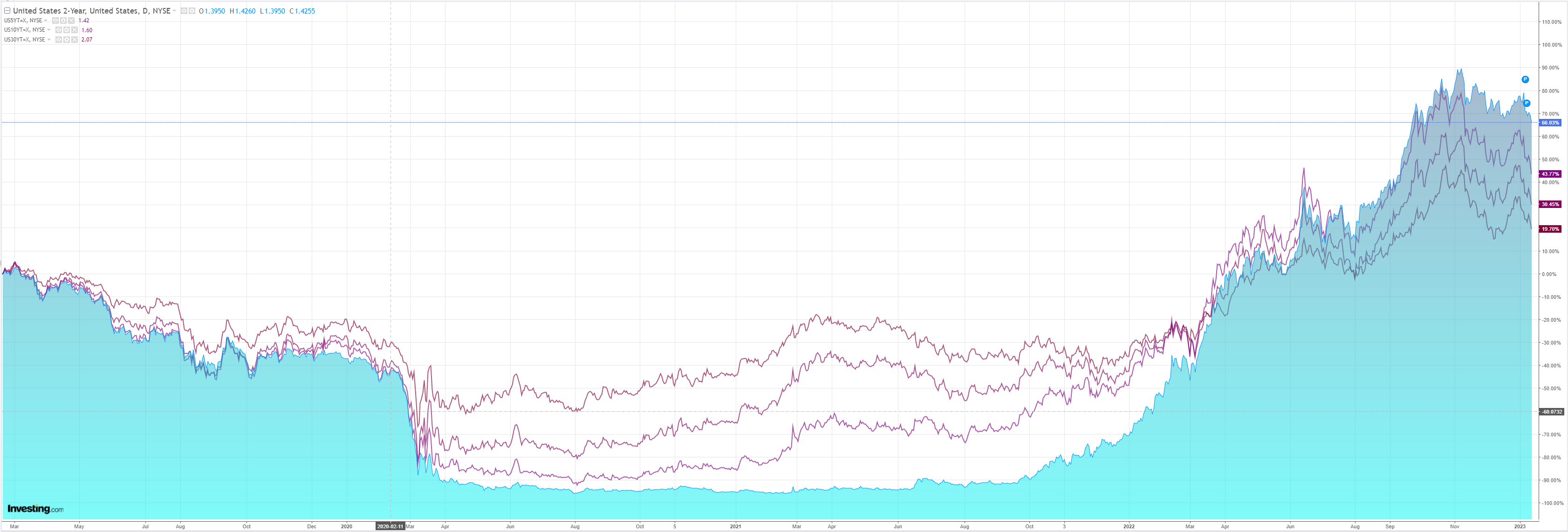

As US yields ease:

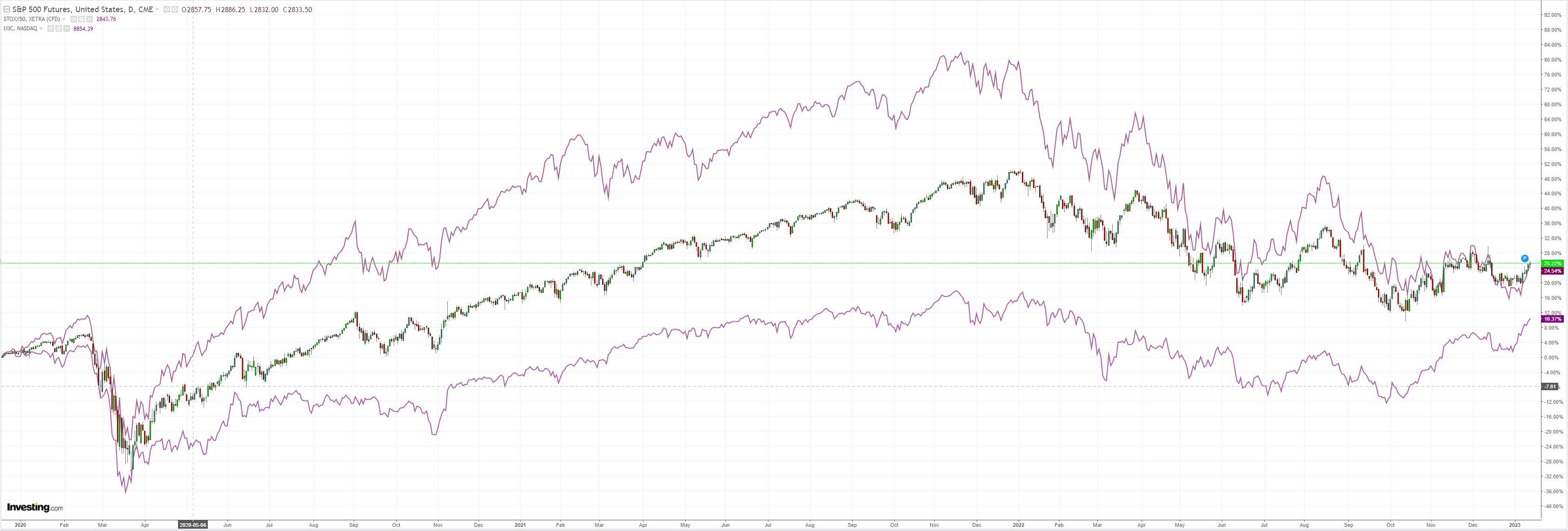

But stocks are still troubled, at least in the US:

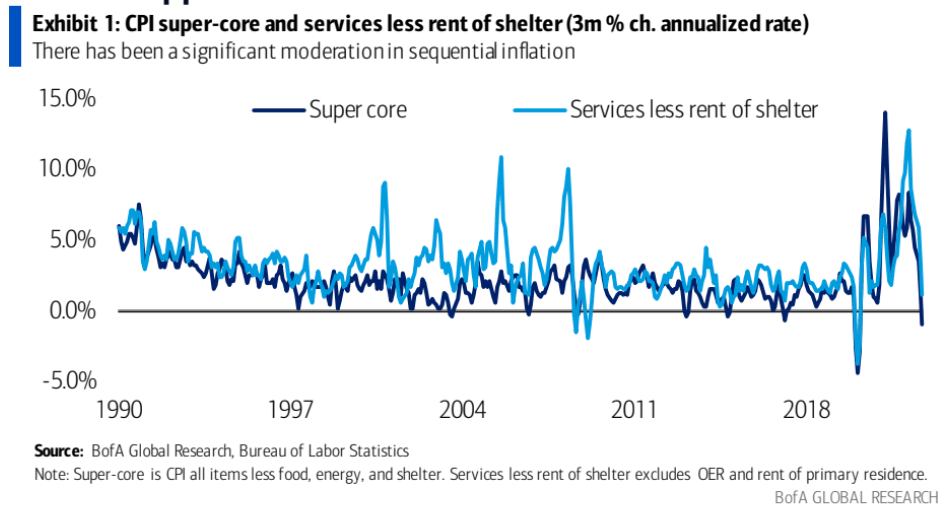

US CPI was the charm again. At some point, the market will look forward again but for now it is enjoying the bullish rear vision mirror. BofA has the detail.

- Headline and core CPI were in line with expectations in December. Headline fell by 0.1% m/m and core rose by 0.3% m/m.

- The details of the report were constructive, in our view. We see increased risks of a 25bp hike in Feb.

- The nominal curve bull steepened with break-evens higher.

Headline CPI inflation fell by 0.1% m/m or (-0.079% unrounded) in December following a 0.1% m/m increase in November. The decline was in line with consensus expectations and as a result the y/y rate fell from 7.1% to 6.5%, its lowest reading since October2021.Additionally, the NSA headline index fell to 296.797 from 297.7

The decrease in headline inflation was largely due to a sharp drop (-4.5% m/m) in energy prices owing to a 9.4% decline in energy goods. Energy services, meanwhile) rebounded with a 1.5% m/m increase. The fall in energy prices was roughly in line with our expectations. That said, food price inflation came in below our expectations at 0.3%m/m (exp: 0.5% m/m). The better-than-expected deceleration in food price inflation reflected food at home inflation moderating to 0.2% m/m from 0.5% m/m.

Core inflation was in line with expectations, increasing by 0.3% m/m (0.303% unrounded) following a 0.2% m/m increase in November. Over the last three months core CPI has grown at an annualized rate of 3.1% m/m a significant deceleration from earlier this year;super-core has declined by 1.0% (Exhibit 1).

The recent moderation in core CPI largely reflects deflation of core goods over the last three months. In December, core goods prices fell for a third consecutive month,declining by 0.3% m/m, resulting in the 3-month annualized % change declining from-3.5% to-4.8%(Exhibit 2). Once again, a sharp decrease (-2.6% m/m) in used car prices were the big driver of the fall in core goods. New car prices also fell for the first time since January 2021. That said, we had expected a more broad-based decline in goods because we thought that unseasonably high holiday discounts lead to declines in categories like apparel and household furnishings. While this did not materialize in December, we do expect the goods deflation to become more broad-based over time.

Meanwhile, core services inflation remained sticky, as core services rose by 0.5% m/m in December. This was a modest acceleration from the prior month and over the last three months, core services have grown at an annualized rate of 6.1%. The acceleration in core services largely reflected an uptick in shelter inflation (0.6% to 0.8%). That said, it is widely expected that shelter inflation will begin to moderate rather significantly in the second half of this year given the deceleration in asking rent growth.

Because of this, the focus within services is on the non-shelter components. While the BLS does not produce a CPI measure of core services ex shelter, it does publish a measure of services ex rent of shelter. This index recorded a 0.4% m/m increase in December after a flat reading in December. That largely reflects medical care services prices recording a 0.1% m/m increase after declines of 0.7% and 0.6% in November and October respectively. Other components of services recorded relatively moderate inflation in December. Indeed, transportation services, recreation services, education and communication services, and water & sewer & trash collection services all rose within arrange of 0.2%-0.3% m/m. Therefore, the data were relatively supportive of moderate services inflation.