DXY broke out last night as Russian missiles rain upon Ukraine. EUR is toast:

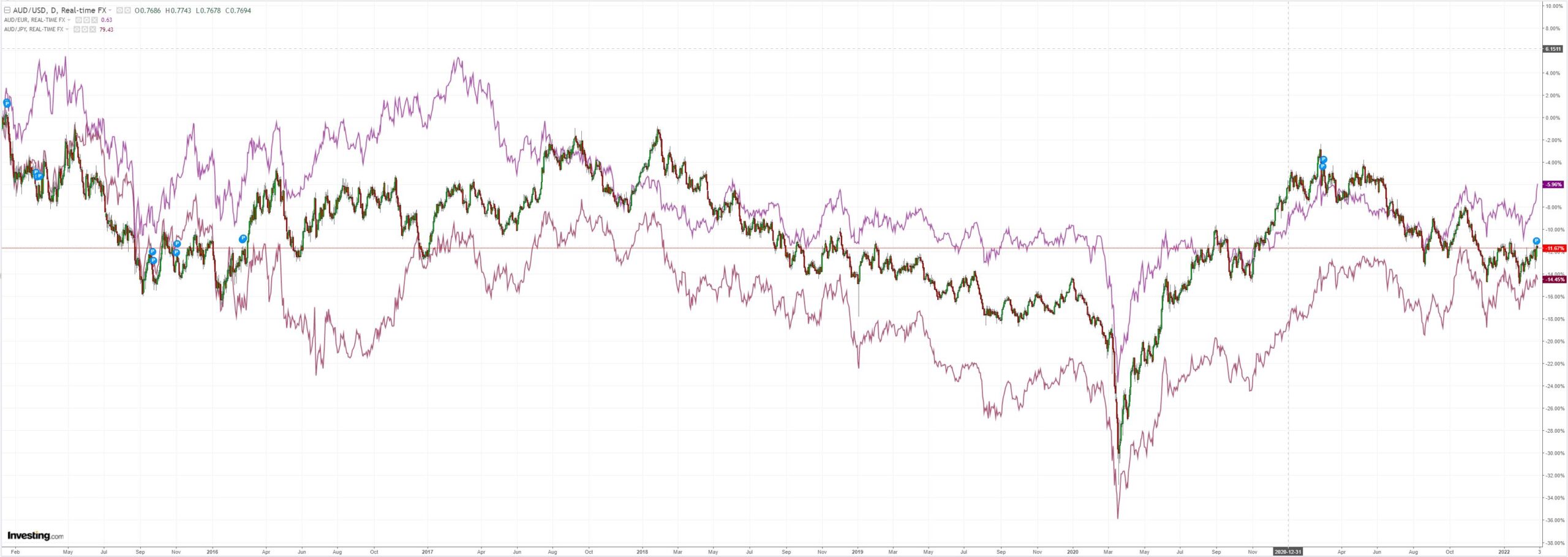

AUD boomed then busted with Russian bombs. The freefalling EUR cross is something else:

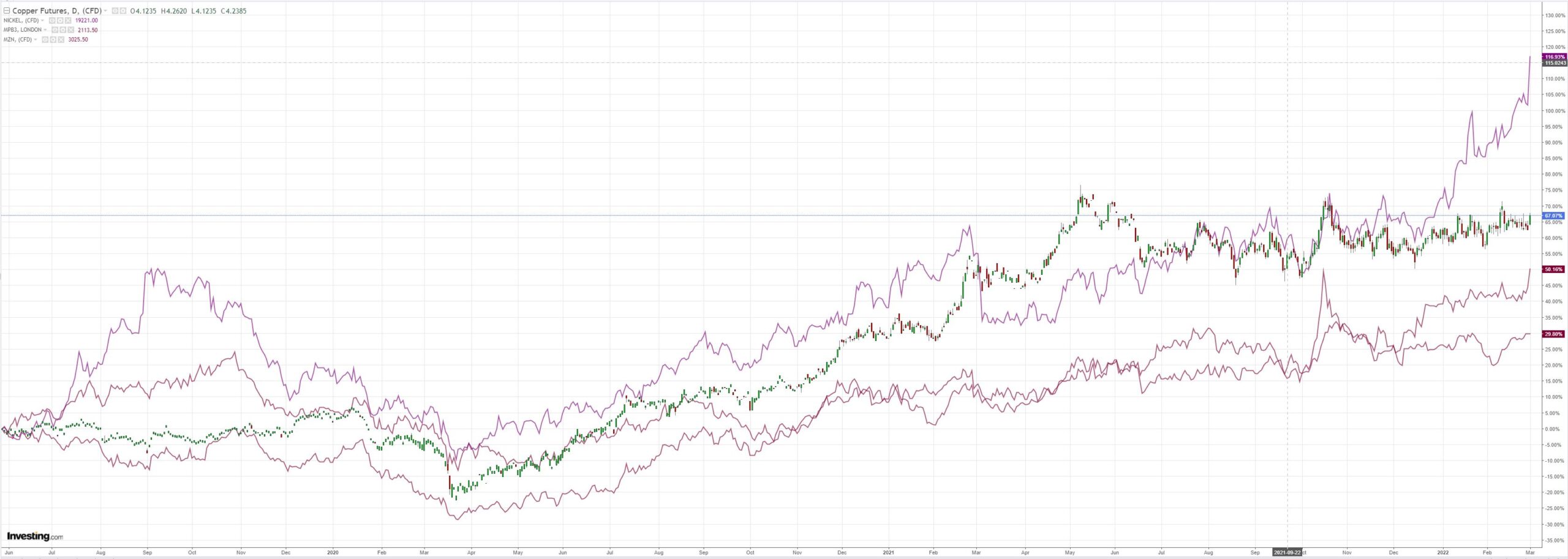

Markets have chosen death by commodities:

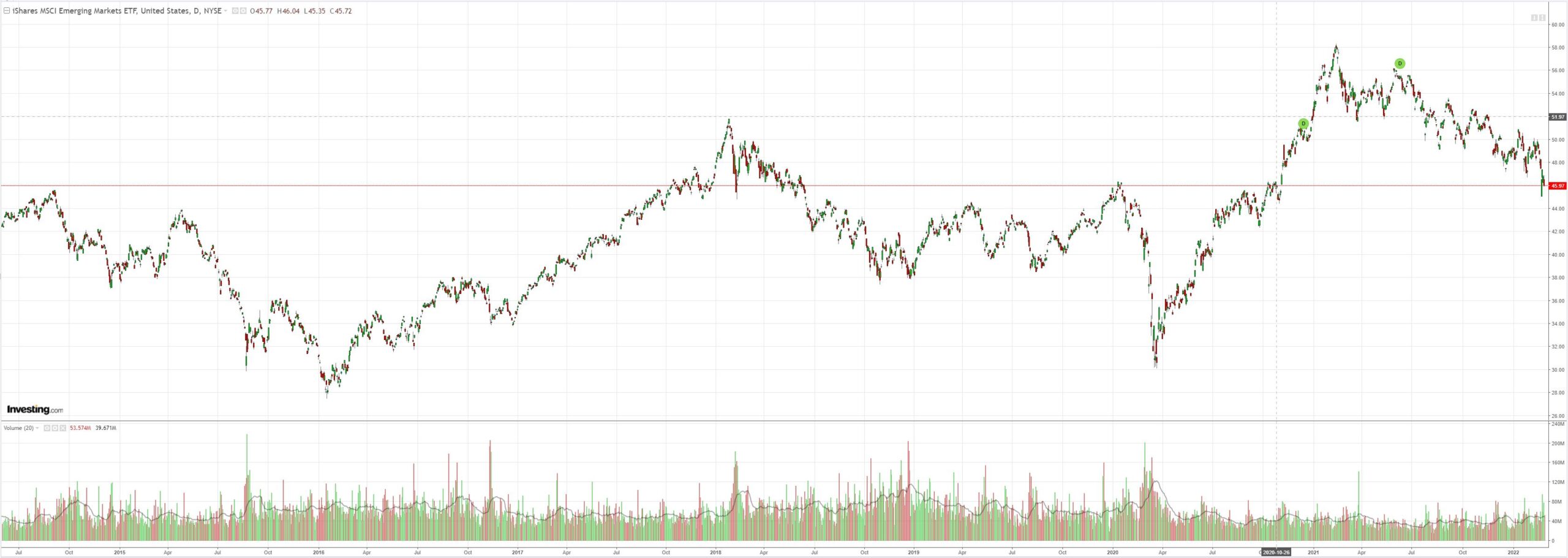

EM stocks (NYSE:EEM) were smashed:

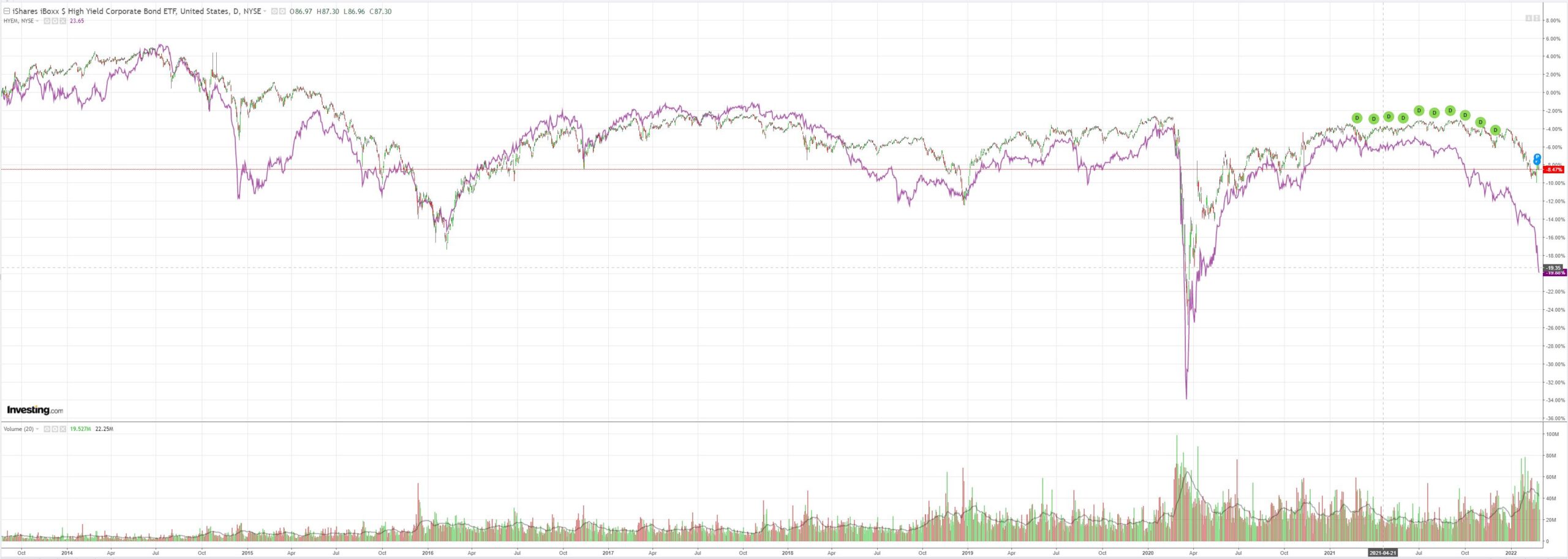

As EM junk (NYSE:HYG) hurtles into the abyss:

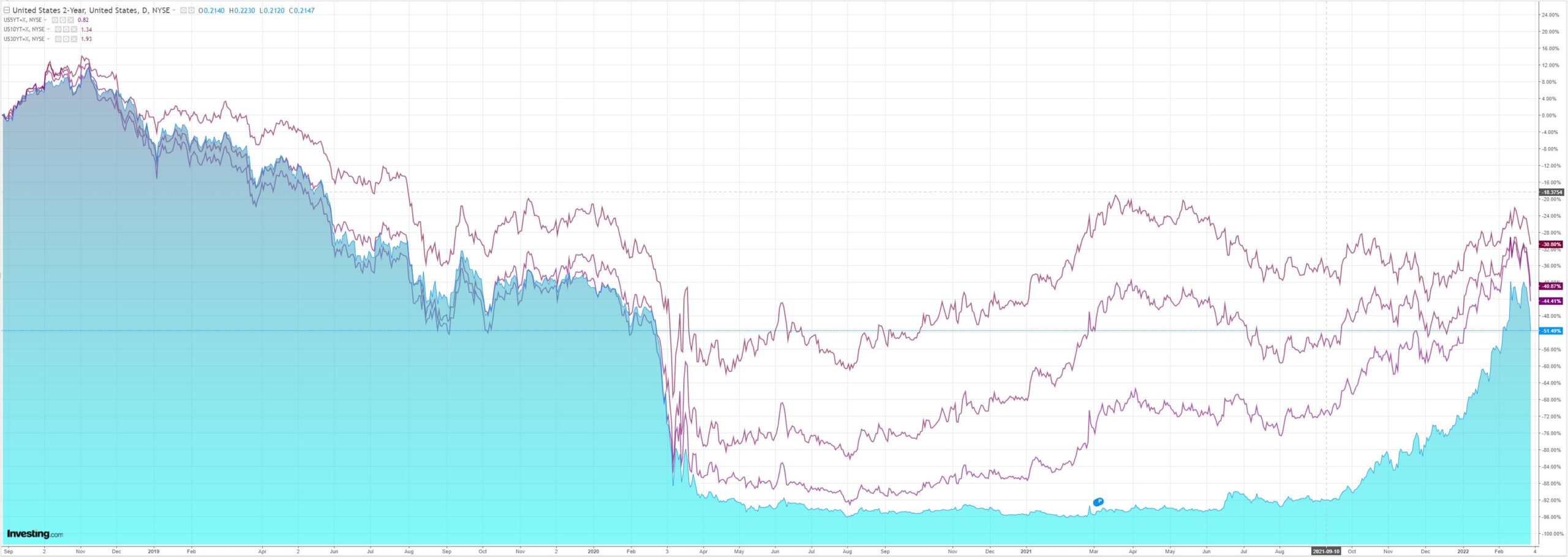

The bond bid roared:

Which limited falls for Growth but stocks are going lower:

Westpac has the wrap:

Event Wrap

German headline and harmonised January CPI pushed above estimates. Harmonised CPI rose to 5.5%y/y (prior 5.1%y/y, est. 5.4%y/y) with headline CPI at 5.1%y/y (prior 4.9%)

Italian headline Jan. CPI rose to 5.7%y/y (prior 4.8%y/y) and harmonised pushed to 6.2% (prior 5.1%y/y, est. 5.5%y/y).Eurozone final Feb. manufacturing PMI was shaved to 58.2 from Flash 58.4.

UK final Feb. manufacturing PMI rose to 58.0 from Flash 57.3.US Feb. manufacturing ISM was strong at 58.6 (est. 58.0, prior 57.6) with a lift in new orders. Employment pulled back slightly though remained positive whilst prices moderated, rather than the expected further lift, but remain at very high levels.

Event Outlook

Aust: Q4 GDP will be released. A rebound in activity is anticipated with the easing of restrictions seeing improvement in economic conditions. Support from consumer spending and public demand is expected to be offset slightly by weakness in home building; uncertainty around consumption in services is present. Westpac’s forecast of 3.3% is broadly in line with the market median.

NZ: Growth in building permits is expected to remain flat in January with monthly issuance holding at firm levels. The surge in import prices outpacing that of export prices should see the terms of trade fall in Q4 (Westpac f/c: -3.0%).

Eur/UK: Rising energy prices should remain a key driver of European consumer inflation in February (market f/c: 5.6%yr). The UK’s Nationwide house price growth should cool over the course of 2022 as rates continue to rise (February market f/c: 0.6%).

US: ADP employment change is set to rebound from the omicron decline in January (market f/c: 375k). The Federal Reserves’ Beige book will provide an update on current economic conditions across the Fed districts. FOMC Chair Powell will testify before the House Financial Services Committee. Evans and Bostic will discuss the economic and monetary policy outlook at separate events.

Credit Agricole (PA:CAGR) wraps it up:

AUD: RBA still the ball-and-chain

The RBA left its policy parameters unchanged as widely expected and remained dovish in its accompanying statement. While the RBA continues to acknowledge the economy is recovering strongly and inflation is picking up faster than it expected, the central bank continues to note it is too early to conclude that inflation is sustainably within its 2-3% target. The key uncertainties around the inflation outlook remain how quickly supply-chain issues are resolved as well as the acceleration in wages growth. On the latter, the RBA believes it will be “some time” before wages growth accelerates to a pace consistent with the inflation target. The RBA acknowledges the Ukraine crisis as another source of uncertainty on the inflation front, but refers to it as an external shock, which suggests the RBA will look through this impact unless it shows signs of being persistent. The RBA has said it will continue to watch inflation evolve, and so we continue to think the soonest time for a rate hike will be the central bank’s August meeting and after two upside surprises in inflation as well as further acceleration in wages growth. So, the RBA remains a ball-and-chain on the AUD for now. The currency, however, is being boosted by high commodity prices and its appeal as a hedge against commodity-based inflation.

USD: smiling, swift, scarce

The near-term USD outlook seems to follow closely the predictions of the socalled ‘USD smile’ analytical framework, according to which the currency will outperform during bouts of risk aversion and periods when the Fed is leading the global tightening cycle. Both USD-positives will be on display this week as investors continue to fret about the dual threat from the Ukraine crisis and the upcoming aggressive Fed tightening. On the day, the ongoing Ukraine crisis will attract attention as investors look for any indications that the end of the conflict is drawing near. In addition, focus will be on the ISM manufacturing for February as well as speeches from the Fed’s Rafael Bostic and Loretta Mester. Both the data and Fed speak could confirm that the recent escalation of geopolitical risks and the economic sanctions on Russia may have only limited impact on the US economy and thus the Fed outlook. In turn, this should boost the appeal of the high-yielding, safe-haven USD. Looking beyond the ‘USD smile’, we also note that the recent exclusion of some Russian banks from SWIFT has led to a renewed USD scarcity in the global money markets that has manifested itself in the sharp widening of cross-currency basis swap spreads. In particular, the measures have disrupted global payments in USD and forced global financial institutions to aggressively try to get hold of the currency. While the Fed and other central banks can address the USD scarcity, a concerted policy response may take time to be coordinated. In the meantime, the USD can continue to trade at a premium.

The ECB and RBA still have time on their side. But the Fed does not. It is going to have to have hike directly into the Russian storm.

With commodities now completely out of control, the AUD is fighting the DXY downdraft. But commodity hysteria, most notably energy, is now entering the domain of demand destruction even as the Fed will have to tighten.

These are late-cycle dynamics and global recession is moving swiftly towards the base case outcome. All we need now is a credit dislocation somewhere to finish the cycle off.

The AUD can hold while commodities blow off but if we head into the end-game for the cycle both it and commodities will crash in due course.