Street Calls of the Week

The assault upon the Australian dollar is coming from a tearaway DXY as EUR wilts:

The Australian dollar was universally weak. It’s chart is forming up a bearish descending triangle retest of the lows:

Energy is spiking again thanks to European gas and that is keeping metals afloat:

Big miners were largely flat:

EM stocks look ugly:

Junk too, with US now trailing EM down:

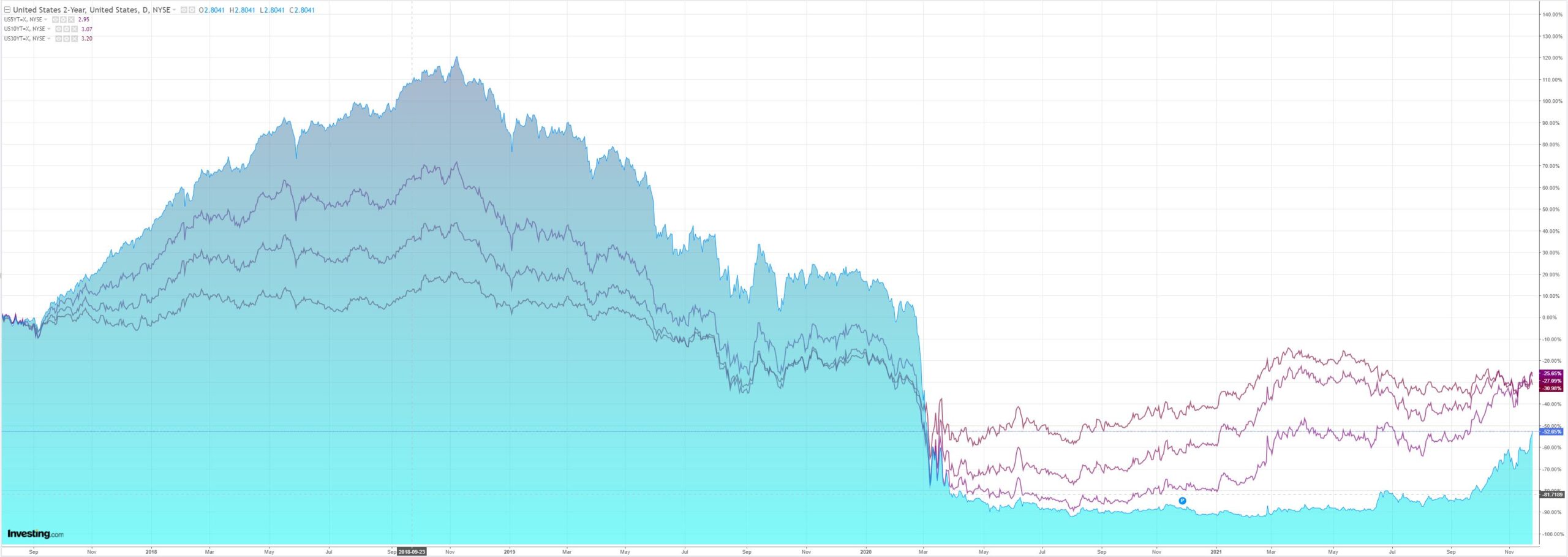

As short-end US yields crush the curve:

Which is keeping GAMMA alive:

Westpac has the wrap:

Event Wrap

The second estimate of US Q3 GDP was near expectations, up to 2.1%q/q annualised (from 2.0%, est. 2.2%). Personal consumption edged up to 1.7%q/q annualised from 1.6%.

Core PCE remained at 4.5% (while headline PCE ticked up to 5.9% from 5.7%). Durable goods orders fell 0.5%m/m (est. -0.2%m/m), but ex transport rose +0.5% as expected. Personal Income rose 0.5%m/m (est. +0.2%m/m), with spending up 1.3%m/m (est. +1.0%m/m). The core PCE deflator was in line with expectations at +4.1%y/y. University of Michigan consumer sentiment survey improved marginally from its surprisingly weak initial release, lifting to 67.5 from 66.8 (est. 67.0). Inflation expectations were unchanged from the initial release (4.9% 1yr, 3.0% 5yr). New home sales at 745k (est. 800k) were little changed from a downwardly revised 742k (prior 800k), but these remain at historically high levels. Initial jobless claims fell to a multi decade low (since 1969) of 199k (est. 260k), with continuous claims at 2.05m (est. 2.03m).German IFO business climate survey fell to 96.5 (est. 96.7, prior 97.7), with a larger fall in expectations to 94.2 (est. 94.6, prior 95.4),the current assessment in line at 99.0 (prior 100.2). French business confidence edged up to 114 from 112 (est. 112).

The UK CBI trends survey was stronger than expected. Headline orders rose to a record high of 26 (est. 8, prior 9), while selling prices rose to their highest since 1977 at 67 (est. 57, prior 59). Solid orders and optimism despite supply constraints and pricing pressures were noted.

Event Outlook

Aust: Investment disruptions caused by Australia’s extended delta lockdowns are expected to produce a sizeable dip in Q3 private new capital expenditure (Westpac f/c: -4.8%). 2020/21 capex plans should be positive, though Covid delays are likely to result in a sub-par upgrade estimate 3 to 4.Oct 30 weekly payrolls will give an indication of the employment boost from reopening.

NZ: A seasonal increase in agricultural exports is expected to lend some help in narrowing October’s trade deficit (Westpac f/c: -$1280m).

US: Observes Thanksgiving Day holiday.

Note that the last time DXY reset higher on interest rate expectations like this was in 2015 and 2018. Both culminated in EM and commodity crashes that ultimately fed back into DM stocks to stop the Fed hiking.

Both episodes also crashed the AUD.

I see no reason why we won’t repeat the pattern over 2022 with prejudice given a higher base for inflation, the US fiscal tailwind, China’s structural slowdown and Australia’s determination to jump back into the profits, wages and inflation black hole of the population ponzi.