DXY fell as war risks receded:

The AUD was roughly stable:

Oil puked:

Base metals fell:

Big miners (LON:GLEN) fell:

EM stocks (NYSE:EEM) popped:

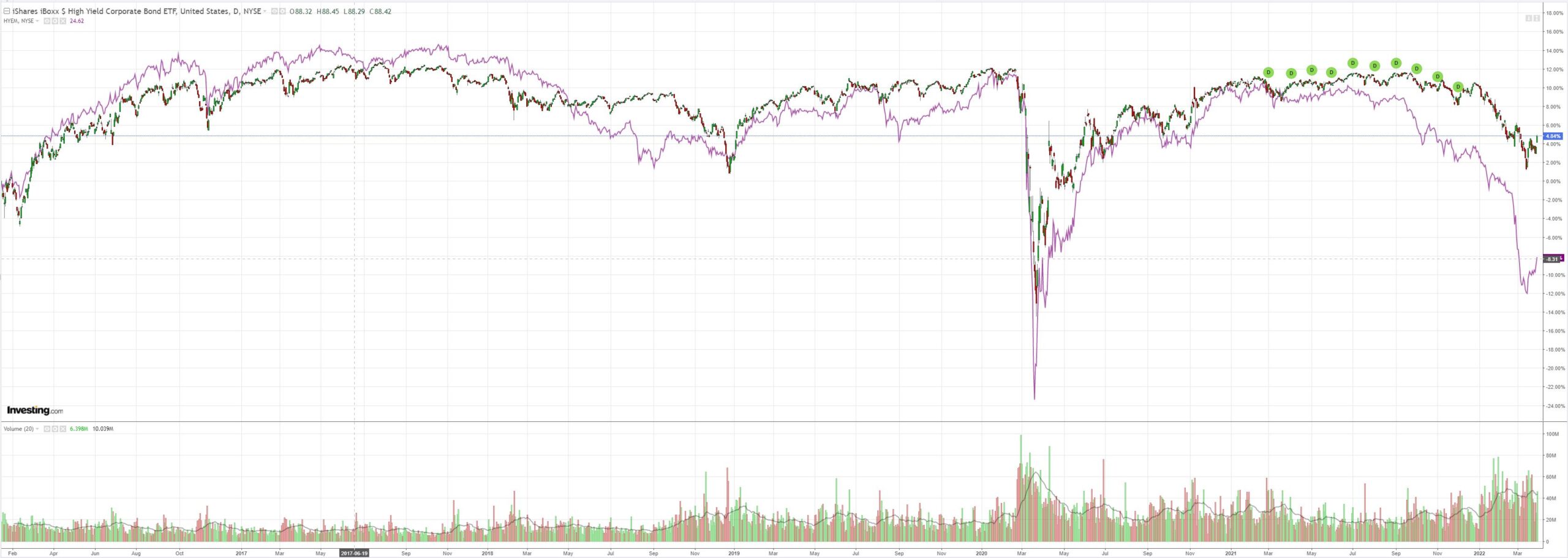

Junk (NYSE:HYG) too:

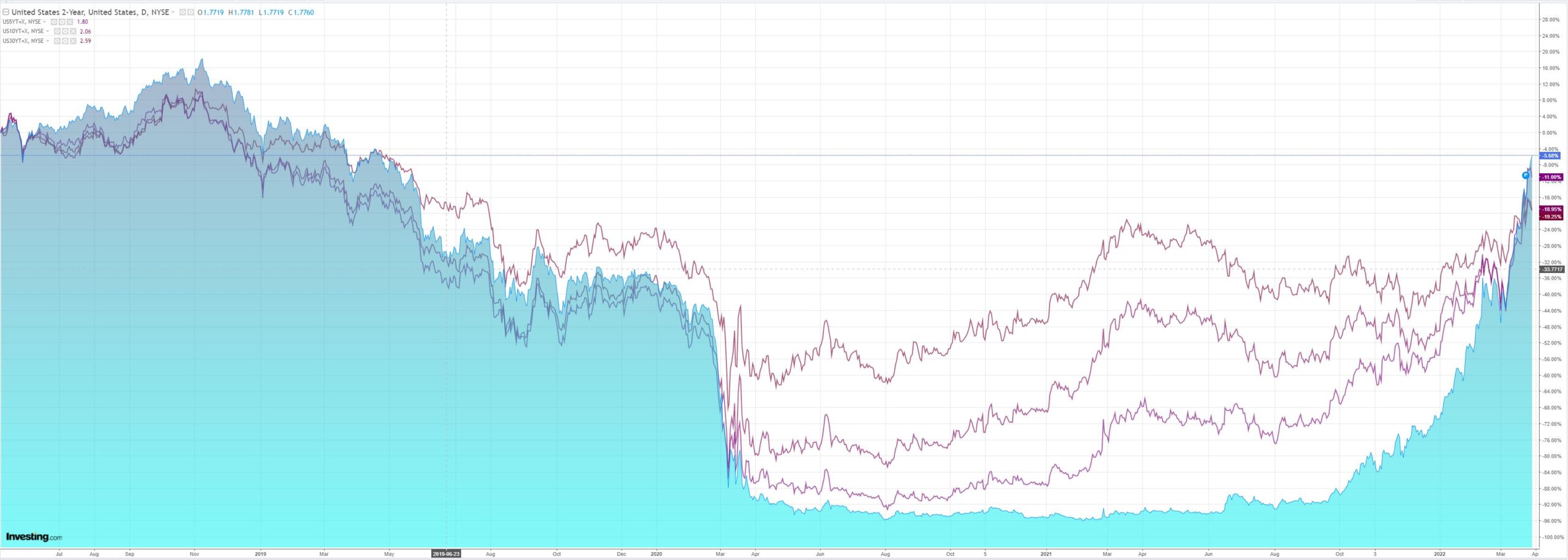

The 2-10 yield curve inverted, howling recession:

Which stocks just loved!

Westpac has the wrap:

Event Wrap

In Australia’s Federal Budget, the budget deficit profile was revised lower, reflecting the windfall from a stronger economy and after incorporating the cost of new spending initiatives. The cumulative deficit for the four years 2021/22 to 2024/25 was reduced to $261.4bn, down from $340bn in MYEFO – an improvement of $78.6bn. The 2024/25 forecast peak in net debt was cut to 33.1% of GDP, from 37.4%.

US JOLTS job openings in Feb. were 11.266m job openings (est. 11.0m) in another strong labour market update. The quit rate rose to 2.9% from 2.8%. Consumer confidence (Conference Board) at 107.2 was in line with expectations of 107.0, from a revised 105.7 (initially 110.5). Although the Present Situation was firm at 153.0 (prior 143.0), Expectations fell to 76.6 (prior revised to 80.0 from 87.5). CoreLogic house prices rose 1.79%m/m in Jan. (est.+1.50%, prior 1.43%), for an annual pace of 19.2% (18.9% prior).

FOMC member Harker adopted a more hawkish stance, saying that faster tightening is possible in order to reach a neutral Fed funds rate of 2.5%. He wouldn’t rule out a 50bp hike in May.

ECB hawk Holzmann (Austria) said that it needs to get rates to zero (via two hikes) before year end to provide more flexibility. Centrist members de Cos and Vasle also spoke of tightening potential.

Talks between Russia and Ukraine failed to reach agreement on a cease-fire, but offered a potential pathway to a meeting between Putin and Zelenskiy. Russia said it was cutting back military activity near the capital Kyiv and the city of Chernihiv, and its chief negotiator said Moscow would take steps to “de-escalate” the conflict.

Event Outlook

NZ: A strong rebound in building permits is anticipated for February after last month’s decline in multi-unit numbers (Westpac f/c: +10%). ANZ business confidence is set to remain weak in March given the surge in omicron cases and the invasion of Ukraine.

Eur: Concerns over robust inflation pressures and the Russia-Ukraine conflict should continue to weigh heavily on European economic confidence (market f/c: 109) and consumer confidence in March.

US: ADP employment change should continue to indicate a strong recovery in jobs growth after omicron-related disruptions earlier in the year (market f/c: 450k). The final estimate for Q4 GDP is expected to be in line with the prior estimate (market f/c: 7.0% annualised). The FOMC’s Bostic, Barkin and George are all due to speak at separate events.

Bloomie with the news:

Ukraine and Russia failed to clinch a cease-fire in talks that ended in Istanbul on Tuesday, with Moscow saying it will reduce military operations in areas where its forces are being pushed back and Kyiv calling for security guarantees from European Union and NATO members.

…A Ukrainian negotiator said his country is seeking guarantees for territory that doesn’t include Russian-controlled areas and that Kyiv is willing to discuss the status of occupied Crimea. Russia indicated a meeting was possible between President Vladimir Putin and his Ukrainian counterpart Volodymyr Zelenskiy.

What of the Donbas? Plenty of sticking points yet. Still, it seems that even Russian hardmen are woke enough to not annihilate deemed enemies these days.

As for markets, the relief rally in credit looks like it has room to run before the tightening Fed lands on it again, which offers more scope for DXY reversal and rising stocks in the short term.

For the AUD, these will probably cancel each other out as easing war risks offer respite while falling commodity prices create a headwind and a global recession builds in the background.

Crazy times!