Ever since COVID, markets have been unhinged and they have not disappointed again. Just as a modicum of sanity threatened, the madness returned in spades. DXY was firm and EUR weak:

Australian dollar roared anyway. We shall see now if former support turns resistance:

Oil crashed up:

Base metals meh:

Big miners to the moon!

EM stocks survived another brush with death:

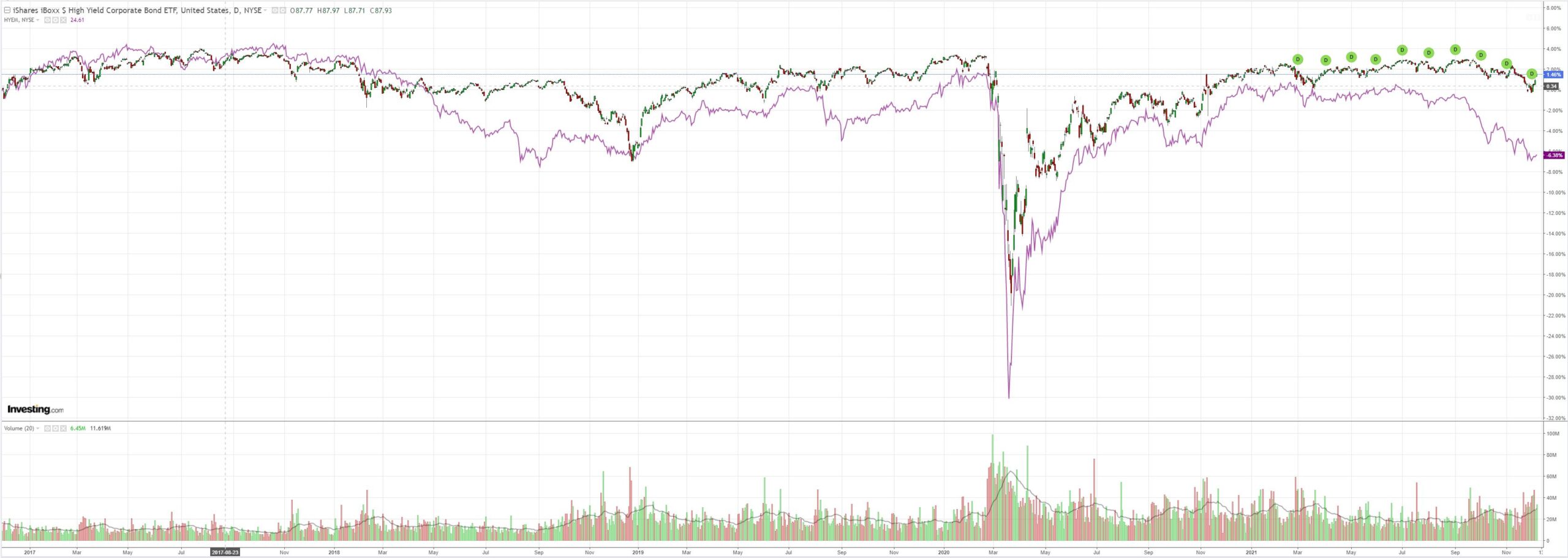

Junk too:

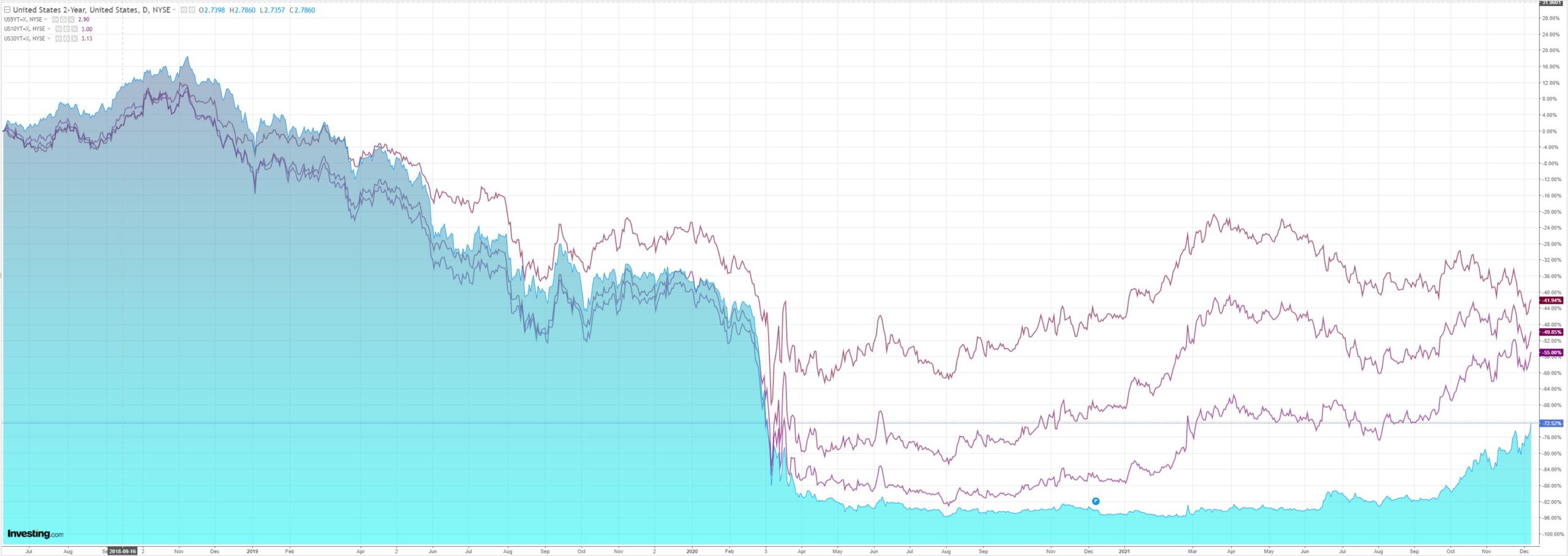

But the Treasury curve kept on flattening. A warning:

Buy all the things!

BofA sums it up:

- Last week, as the S&P 500 fell another 1.2%, clients were big buyers of the dip: inflows of $6.7B were the largest since2017 (and as a % of US mkt. cap, largest since last December).

- Clients bought both single stocks and ETFs, with the biggest single stock inflows in a year and biggest ETF inflows since mid-Sept.

- All three client groups (hedge funds, institutional clients, private clients) were net buyers, led by Institutional. Private clients’ inflows were the largest since Feb. Small, mid and large caps all saw inflows.

- Buybacks by corporate clients picked up to their highest weekly level since March. Previously we had not seen any evidence of corporates accelerating buybacks into year-end given tax reform risk (Nov. trends were in-line with typical seasonality). YTD, buybacks are tracking 7% below 2019 (pre-COVID) levels.

Buy all the things!

My takeout is that this market is still extreme in speed, positioning and valuation, as it has been since COVID began. The Fed is tightening and every uptick in the market will accelerate it to do more.

So, when the accident comes it will be equally precipitous.