Ah, markets! DXY sank as WWIII was averted for a day:

AUD pumped back into the 63s:

CNY is once again a pegged currency:

Oil and gold fell:

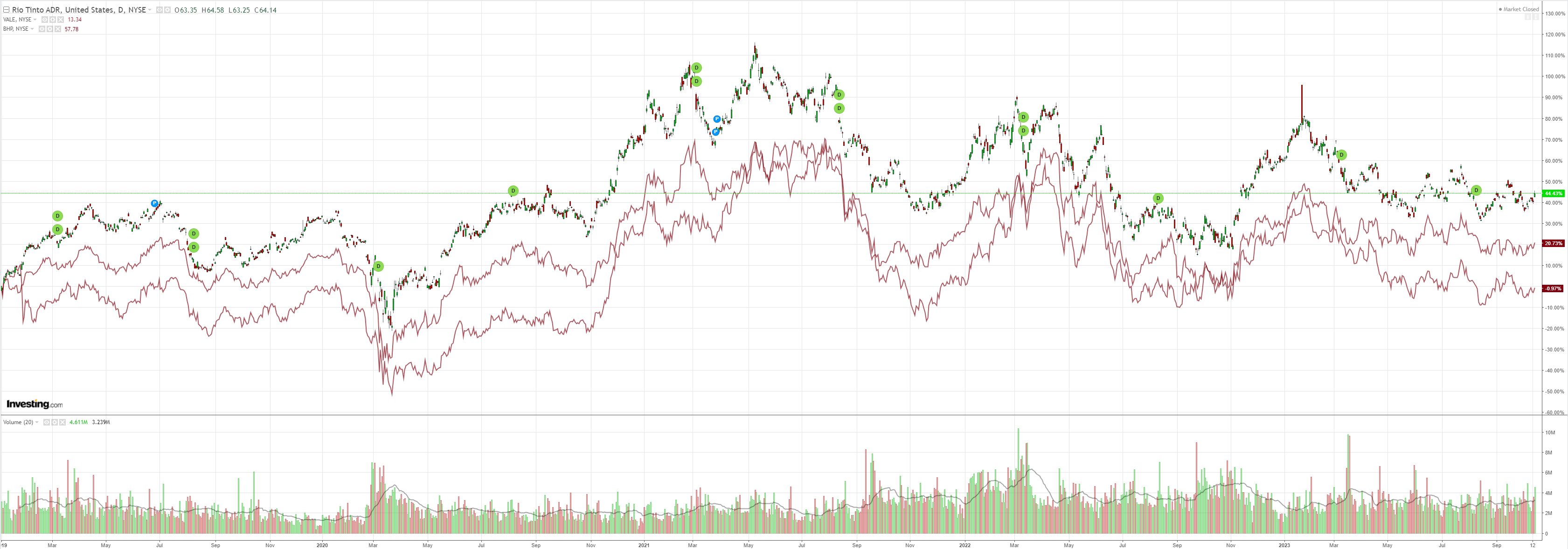

Base metals are not well:

Miners popped with iron ore:

EM lol:

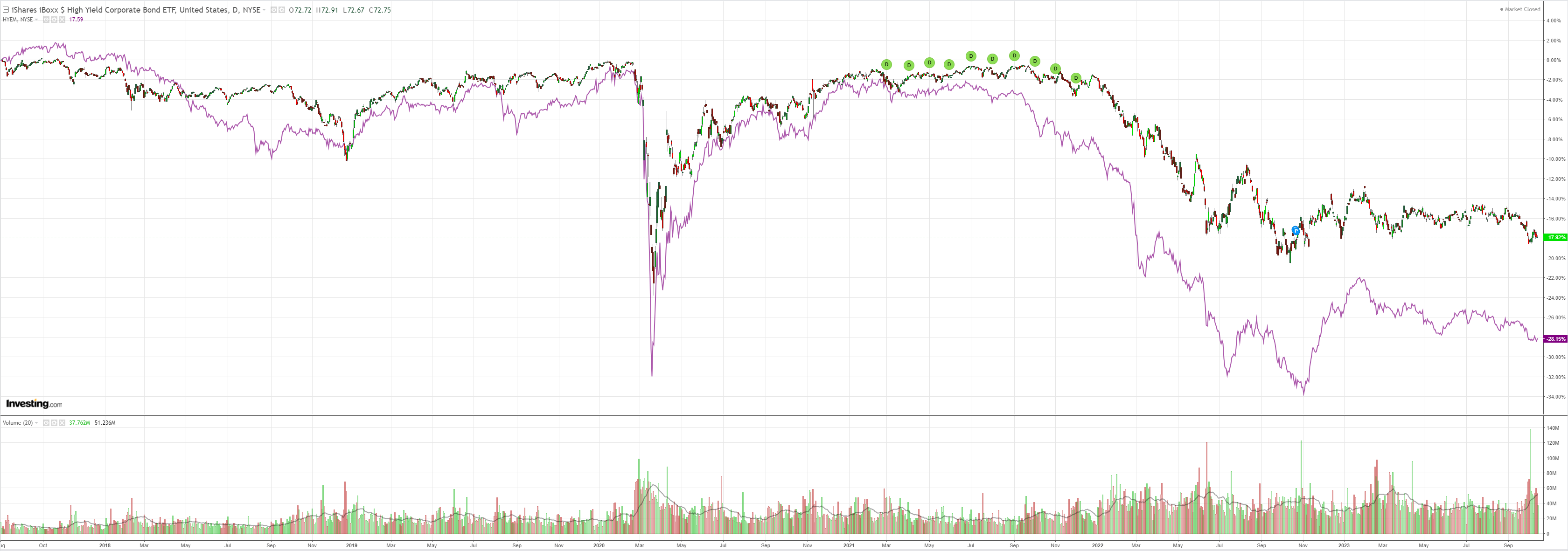

Junk held on:

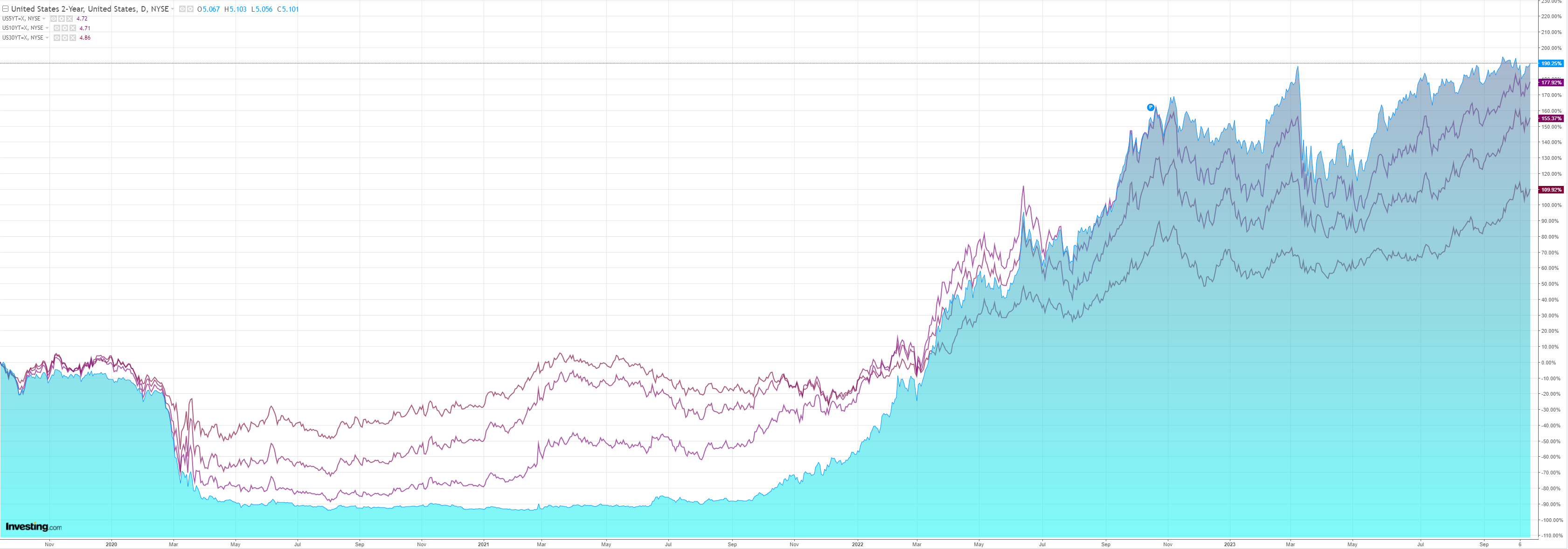

Yields poured it on:

Stocks won’t get far if that continues:

Not even the unedifying spectacle of Canberra scum entering the war talkin’ game could dissuade investors from buying the AUD. Doubtless, because FX markets understand the utter irrelevance of the Australian capital and all within it.

But I digress. Averting WWIII for a day was enough to put the bid back into the peso. This is probably right. I still can’t see in whose interests it is for the war to expand.

- Iran has already won by spiking Israel/Saudi detente. It gains nothing from being drawn into kinetic conflict now.

- Israel does not want to fight on multiple fronts.

- Hezbollah is firing minimal virtue-signalling rockets at Israel for good reason. The Lebanese economy is its real disaster.

- Other Arab autocracies have no interest in creating a humanitarian catastrophe and upsetting the man on the street.

Only the Hamas agenda will gain from a wider war, at the price of its destruction.

At this juncture, the significant risk for escalation is miscalculation, not strategic gain.

AUD will continue to be pushed around within its declining trend regardless.