DXY went bang!

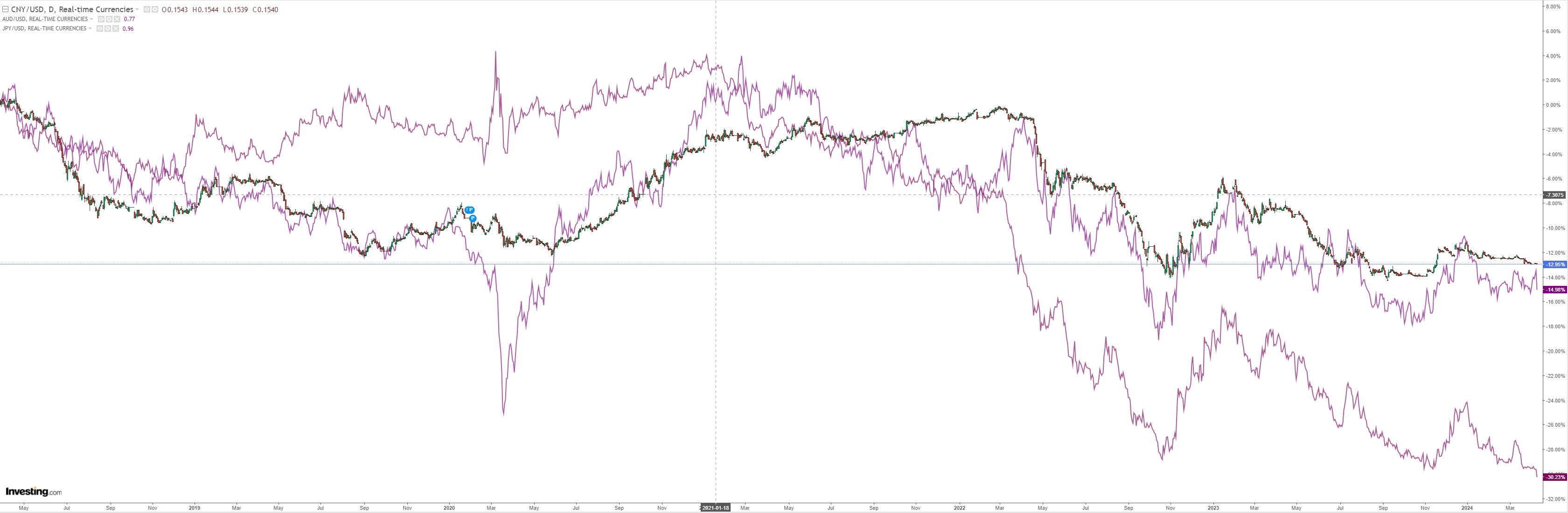

AUD was smashed:

Led by North Asia:

Oil held up. Old gold would normally crash right about now:

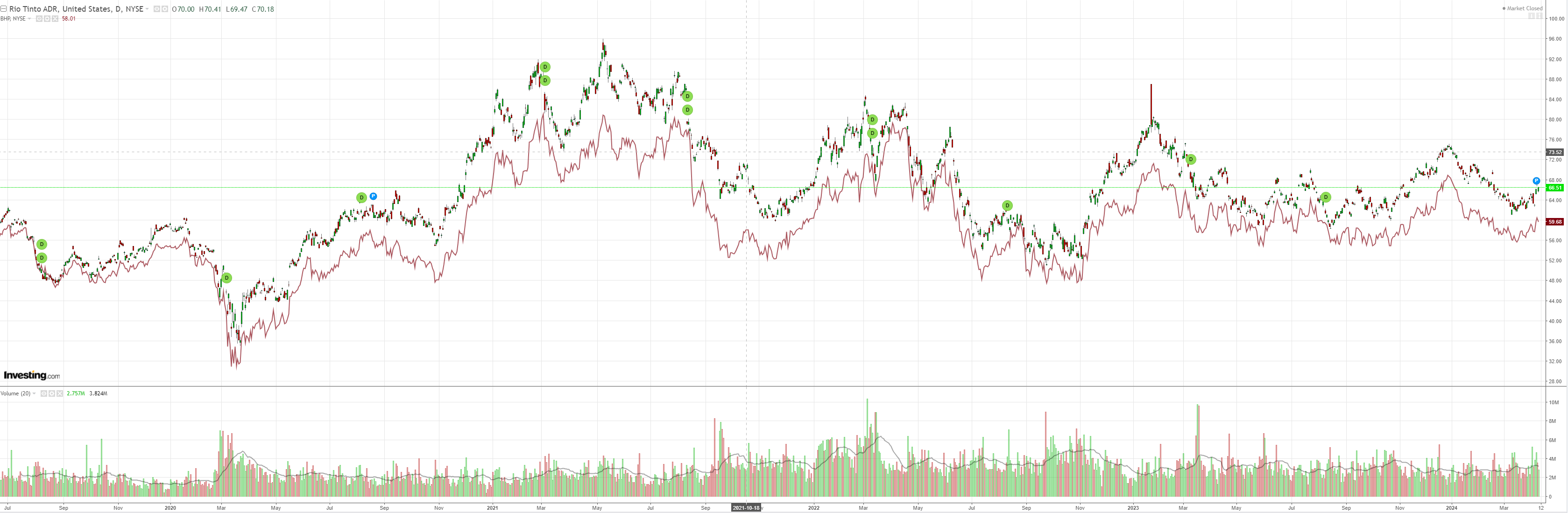

Commods hit turb:

Miners were hit:

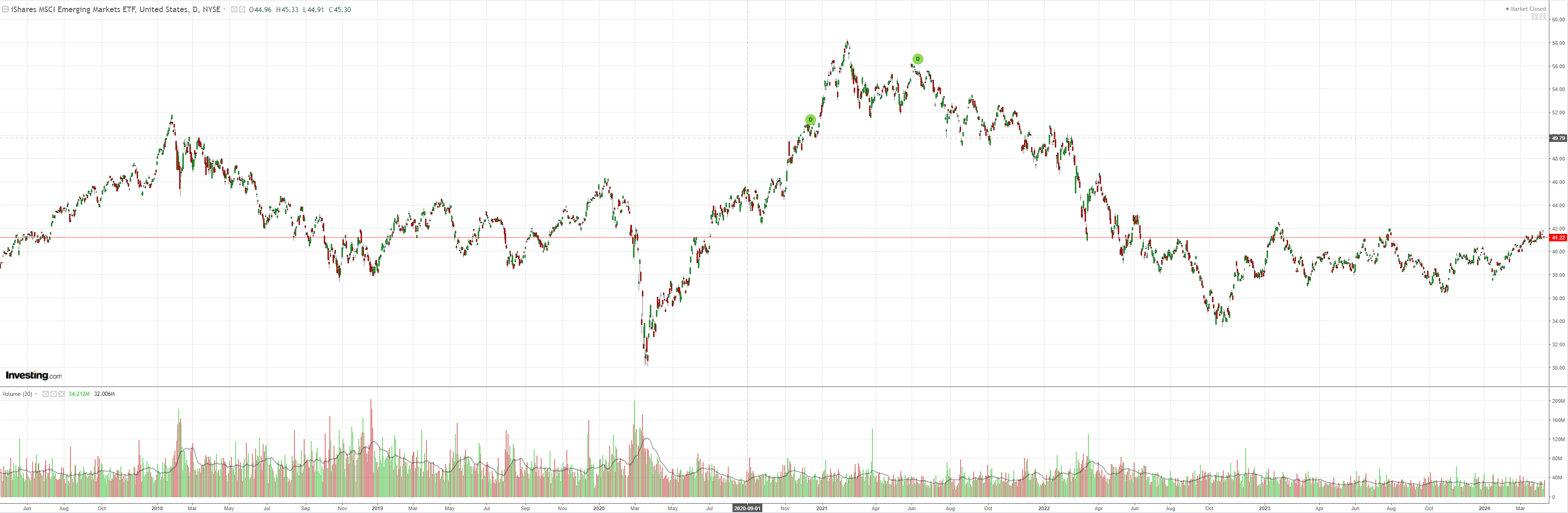

EM cowered:

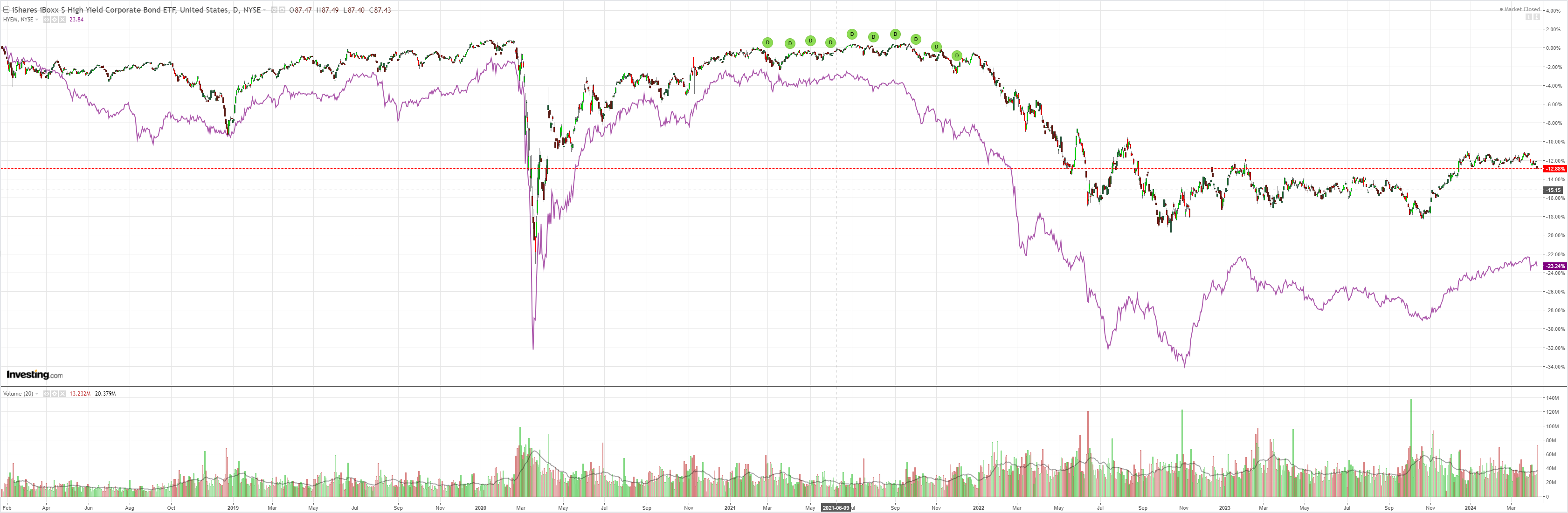

Junk signalled risk off:

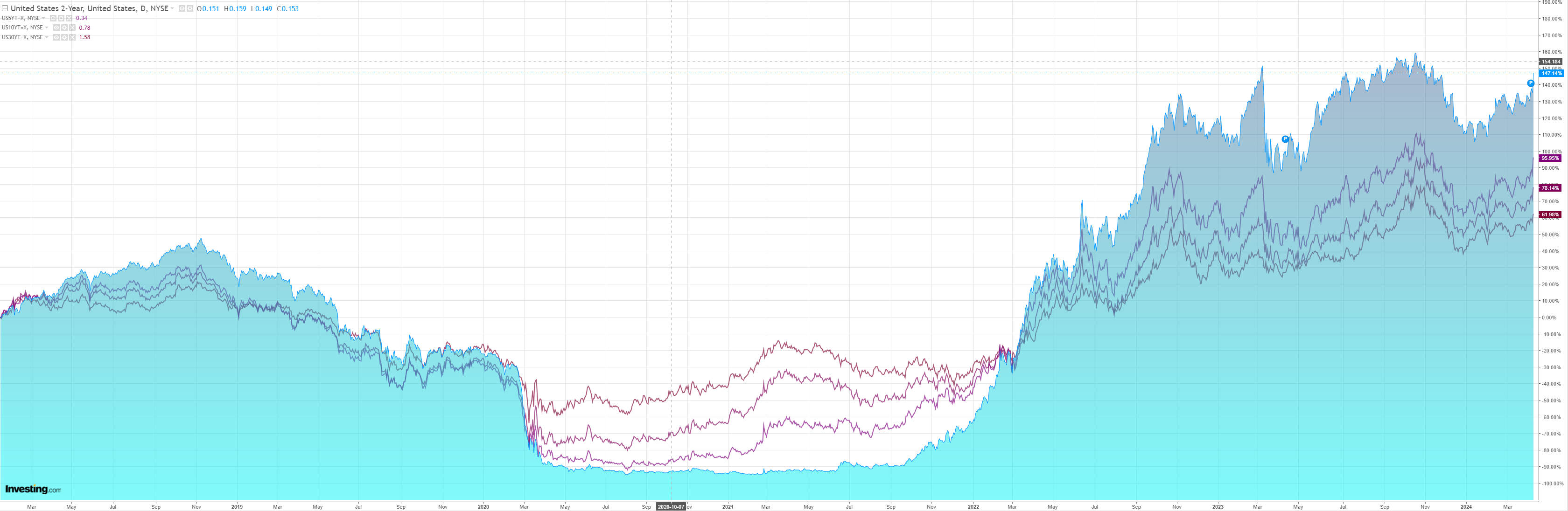

As yields jackknifed:

Stocks fell but look at risk of more:

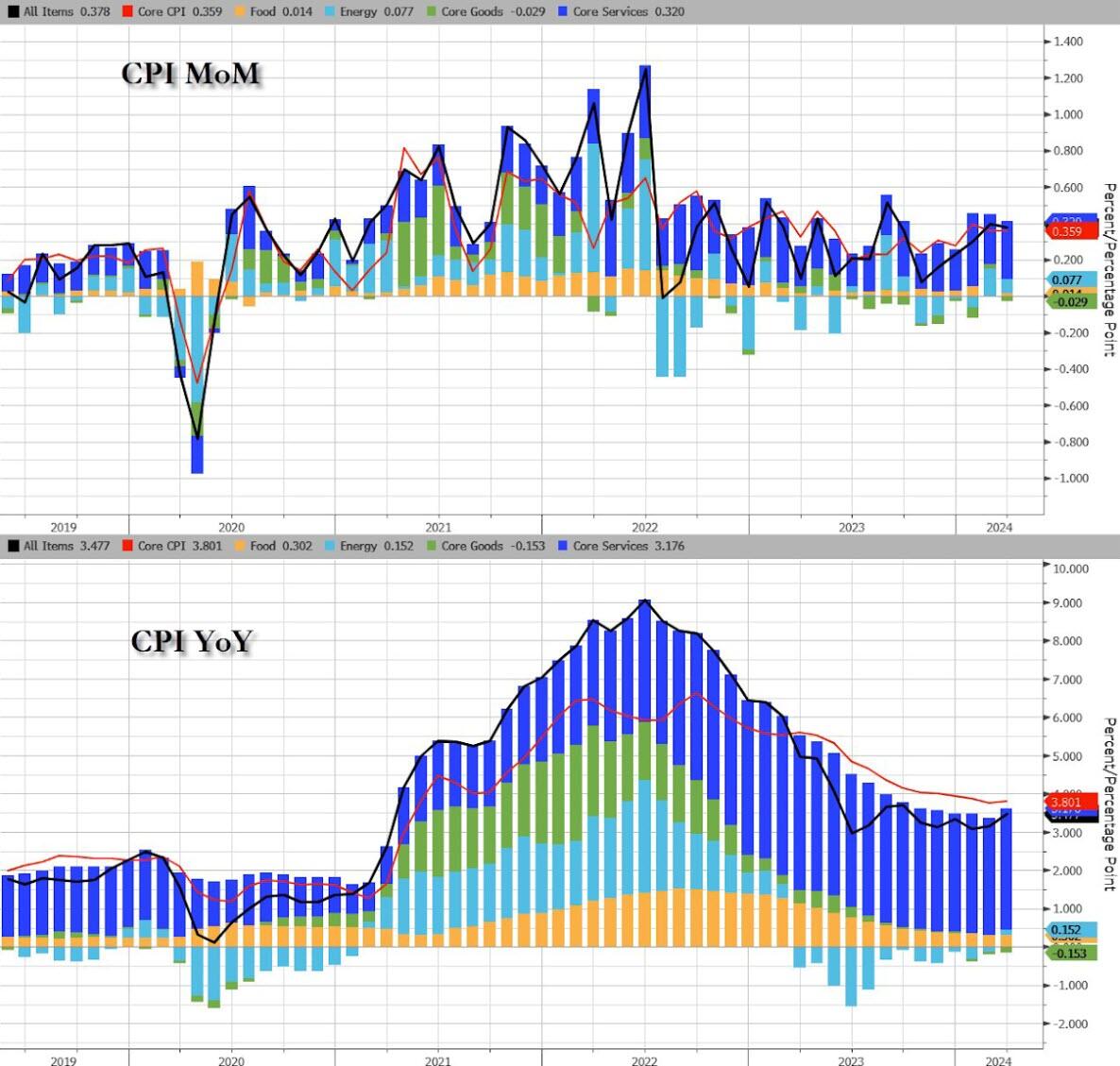

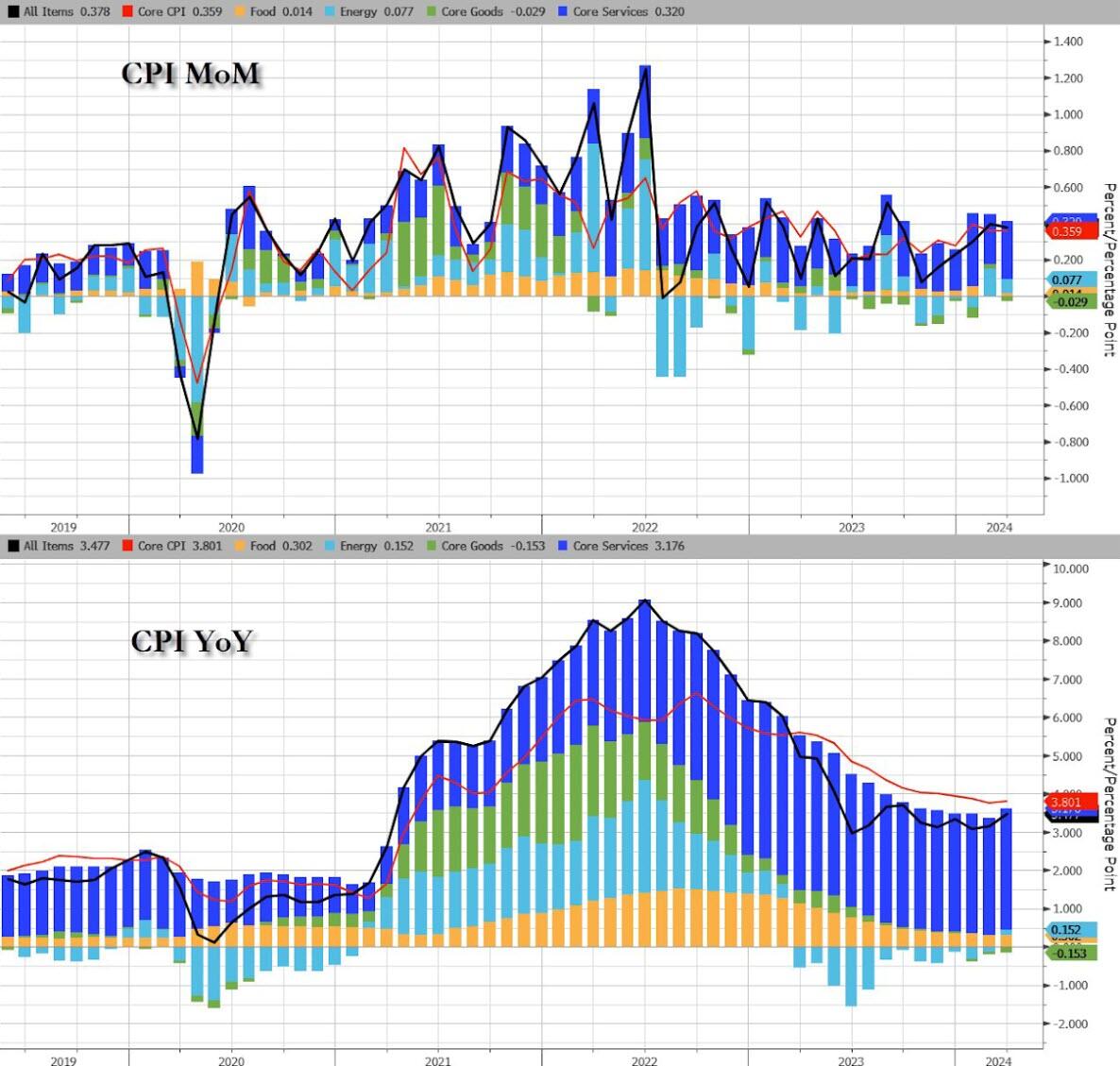

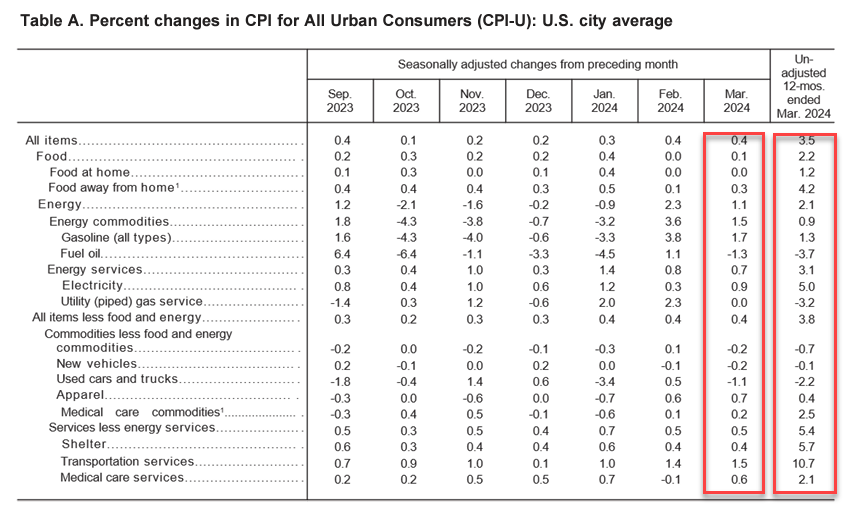

US inflation came in hot at 0.4% month on month and 3.5% year on year:

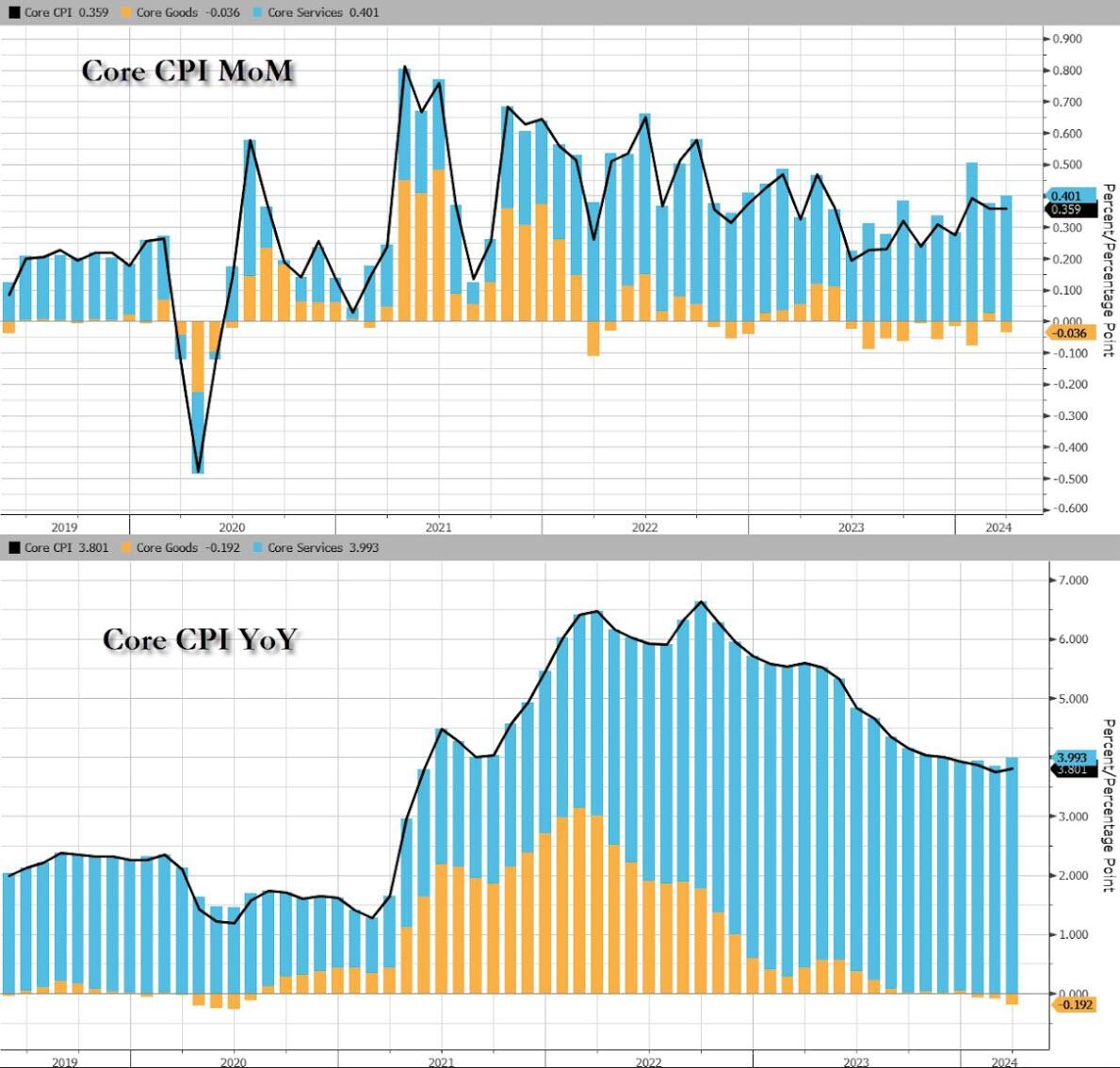

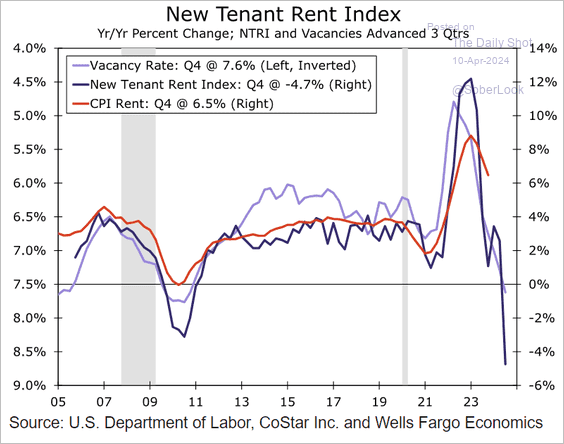

Core is ALL services, which is pretty odd given wage growth is still pulling back. It is still mostly housing-related, as OER refuses to match falling private rental indexes:

The second blow was energy:

The housing inflation pulse should still come off a lot more:

Energy is my concern, as oil pushes reflation through the system before it has reset.

The Fed is stuck for now and AUD has a heavy lid on it.