Street Calls of the Week

DXY is paused:

AUD too:

The peg too:

Oil faded:

And dirt:

Miners are still caught in a nasty descending triangle:

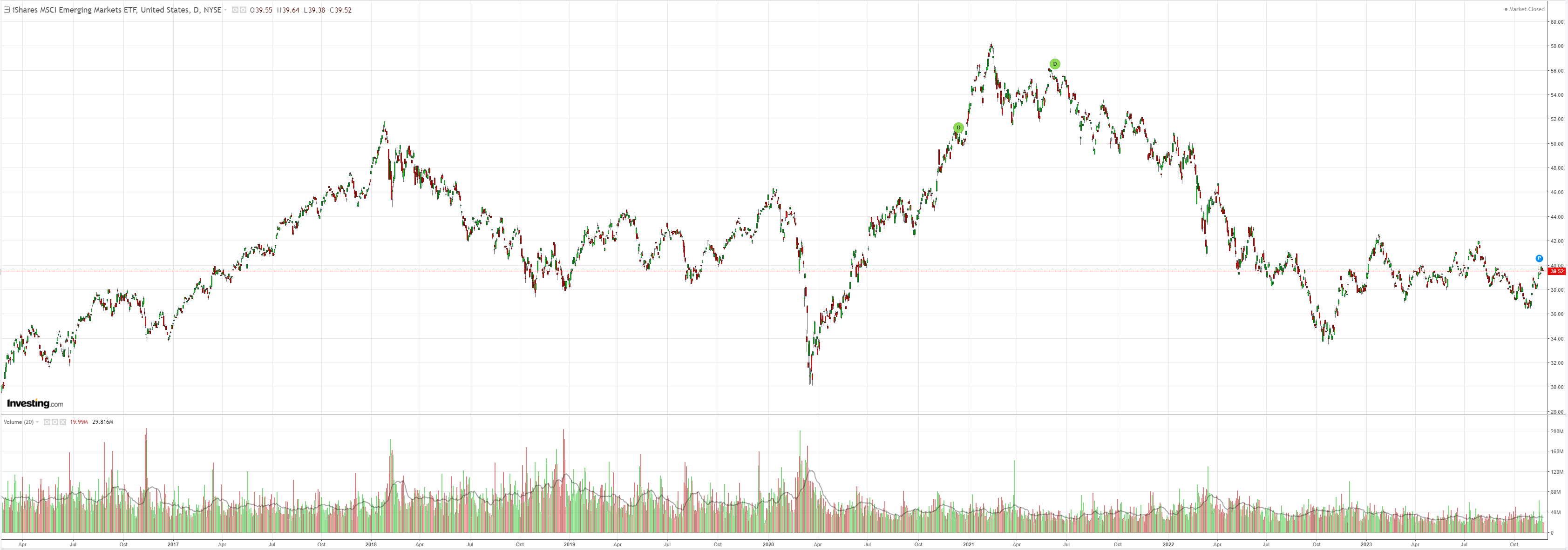

EM yawn:

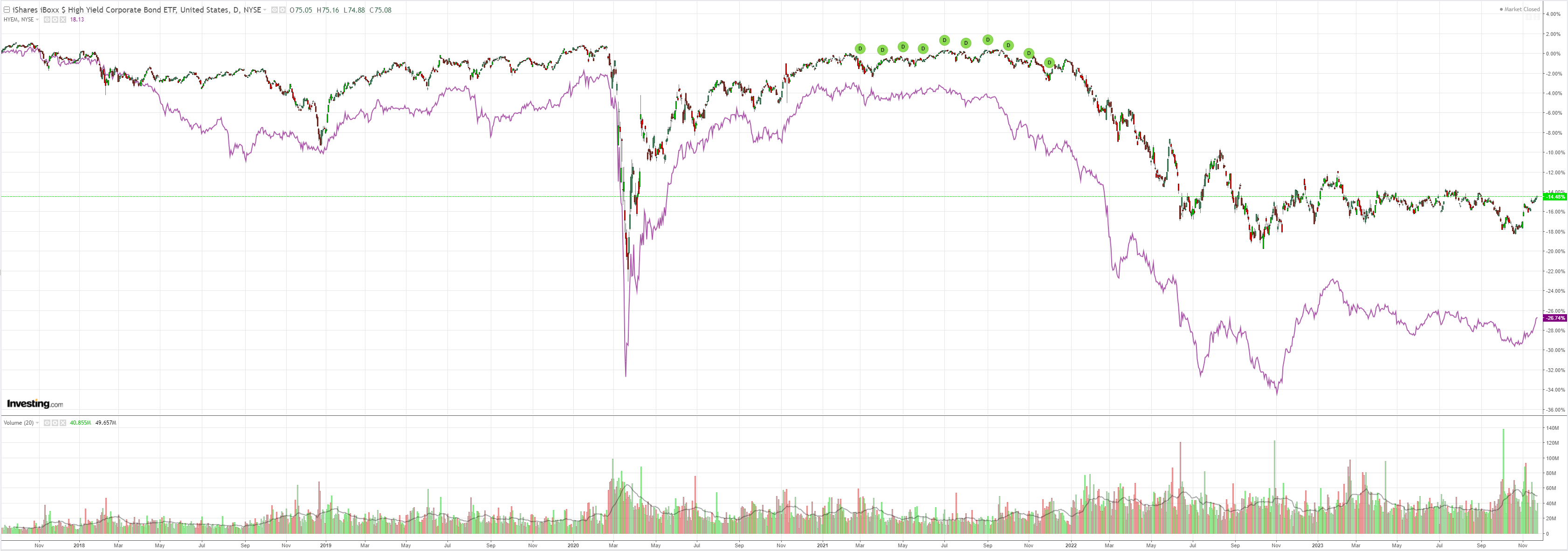

Junk hope!

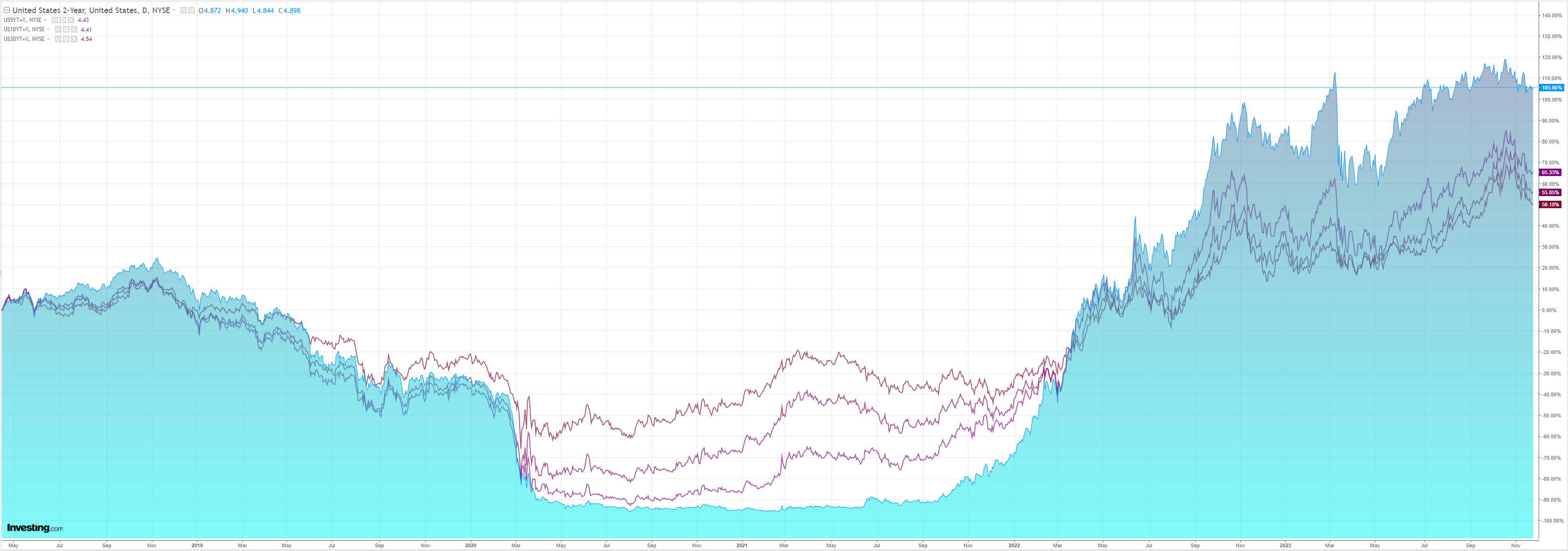

Yields fell:

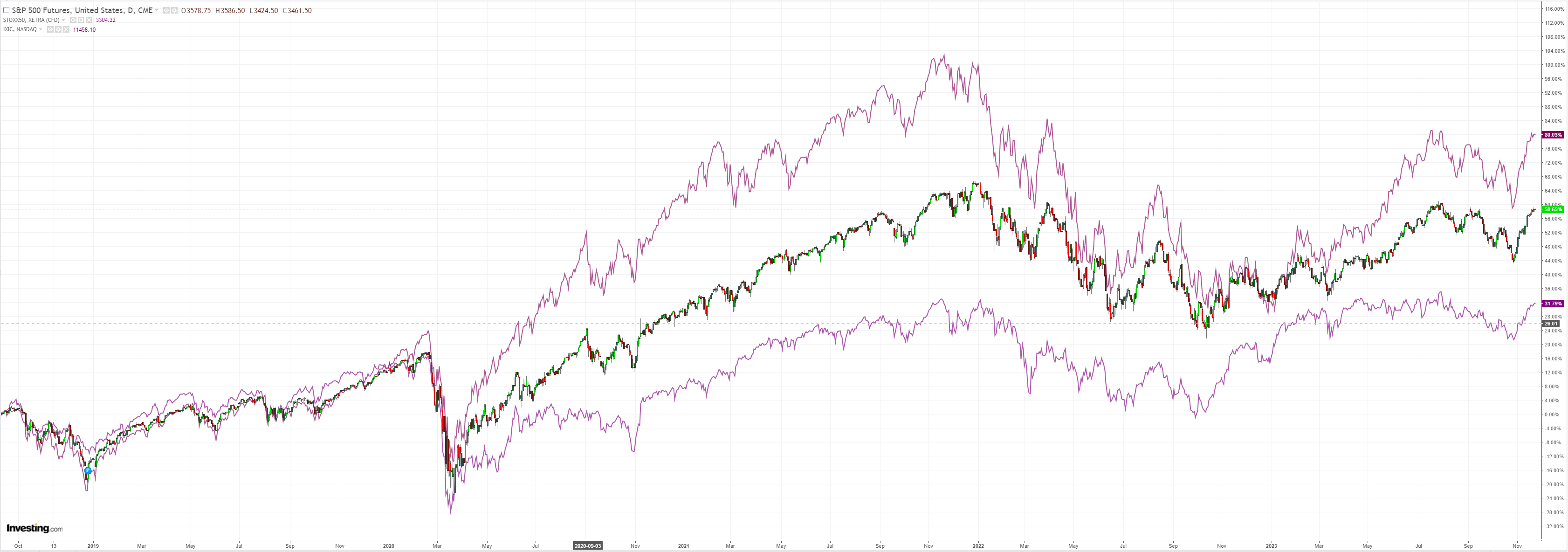

Stocks were shut for Thanksgiving:

OPEC is the key mover. MUFG:

Brent oil prices fell sharply by up to 4% at one point, as the OPEC+ meeting scheduled for this weekend has now been delayed to 30 November.

According to news reports, Saudi Arabia expressed dissatisfaction about other OPEC+ members’ oil production levels, effectively free-riding on the Saudi’s 1mn bbl/day production cuts even as US oil supply has been stronger than expected.

While Riyadh has been widely expected to extend its production cuts through 1Q next year, it may well reverse them if other OPEC members don’t pull their own weight.

Overall, the Dollar strengthened by 0.3%, on the back of lower initial jobless claims, coupled with a pickup in inflation expectations from the University of Michigan survey.

Meanwhile, China is looking to provide more financing support to the most distressed property developers, including private-owned enterprises.

Bloomberg News reported that Country Garden, Sino-Ocean Group and CIFI Holdings Group have been included on China’s draft list of 50 developers eligible for a wider range of financing support.

This also comes the back of reports that Chinese regulators are pushing for faster loan issuance to private developers, while also encouraging smaller banks to increase credit to property developers.

Marginally supportive of AUD but still no game changer there.

If OPEC doesn’t cut then DXY will resume its decline with yields. That will trigger another upleg for AUD.

IF it does cut then expect the reverse.