Street Calls of the Week

DXY is a rampaging bull:

AUD took out all support:

It is leaving CNY behind:

Oil bounced:

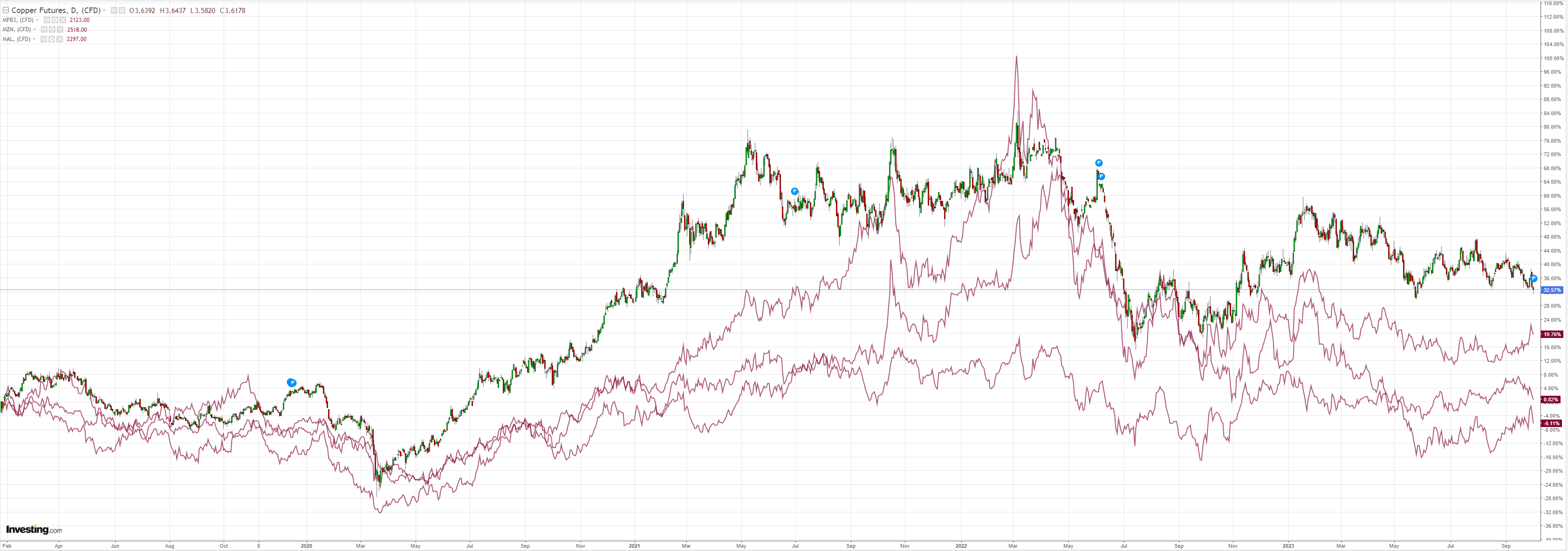

Copper’s chart of fugly:

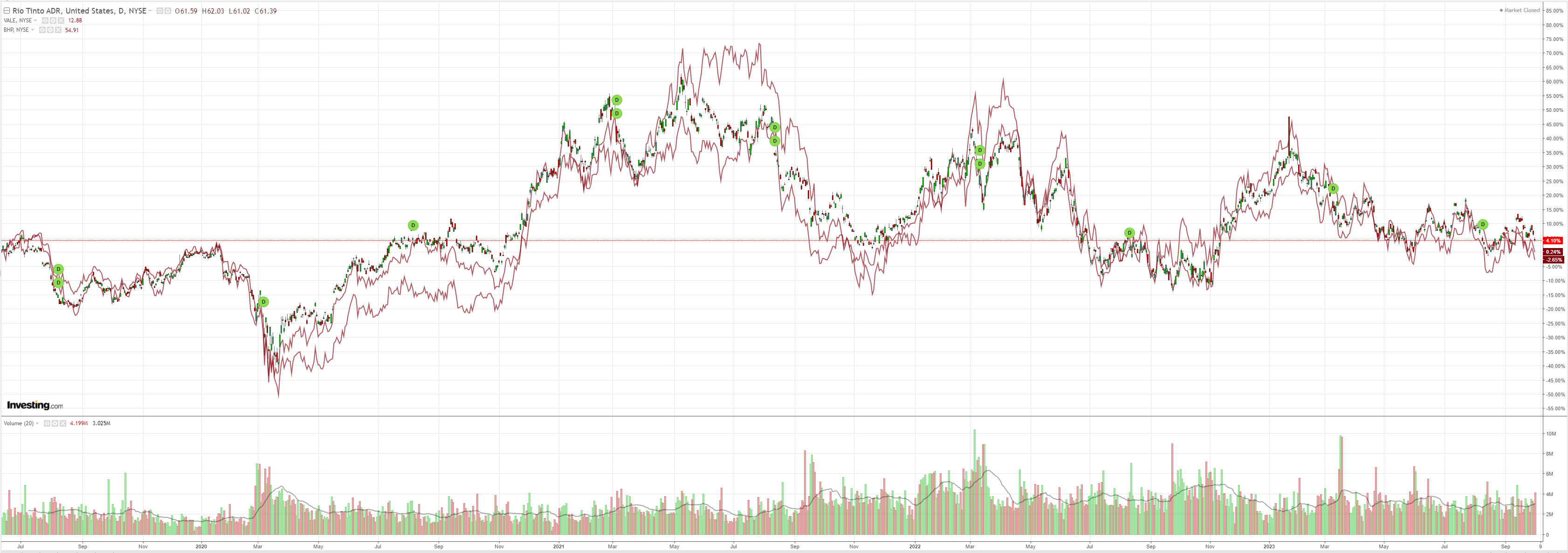

Big miners too:

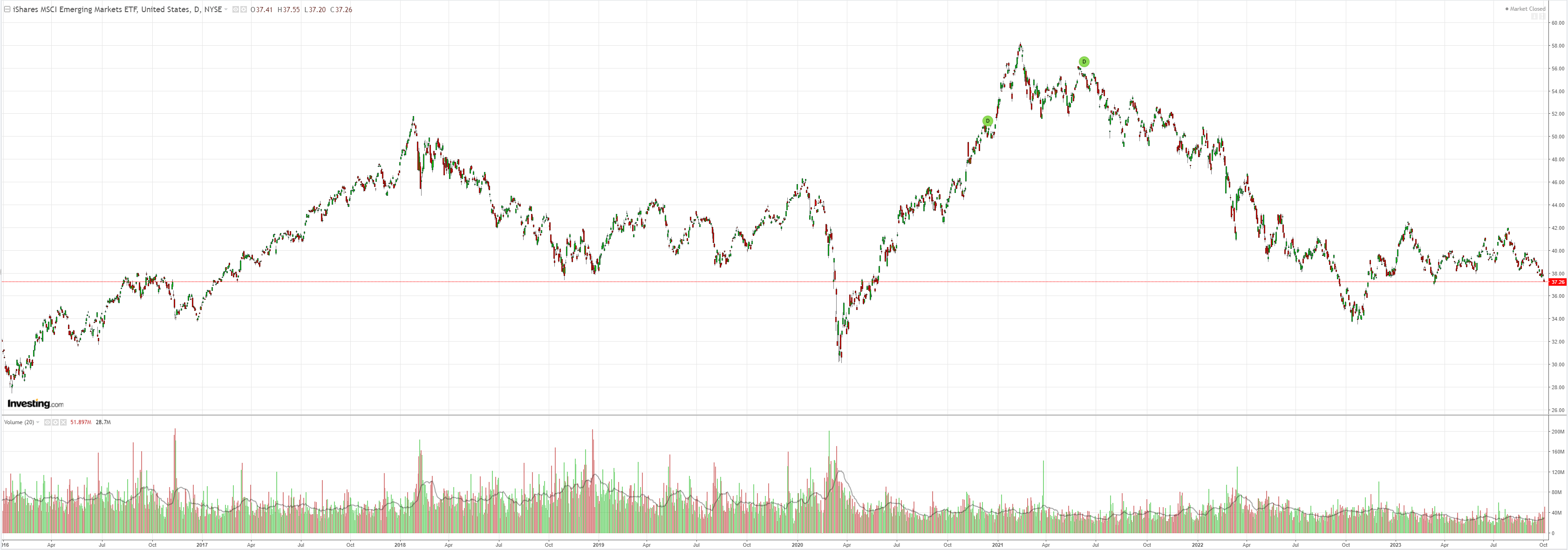

EMs stocks oh dear:

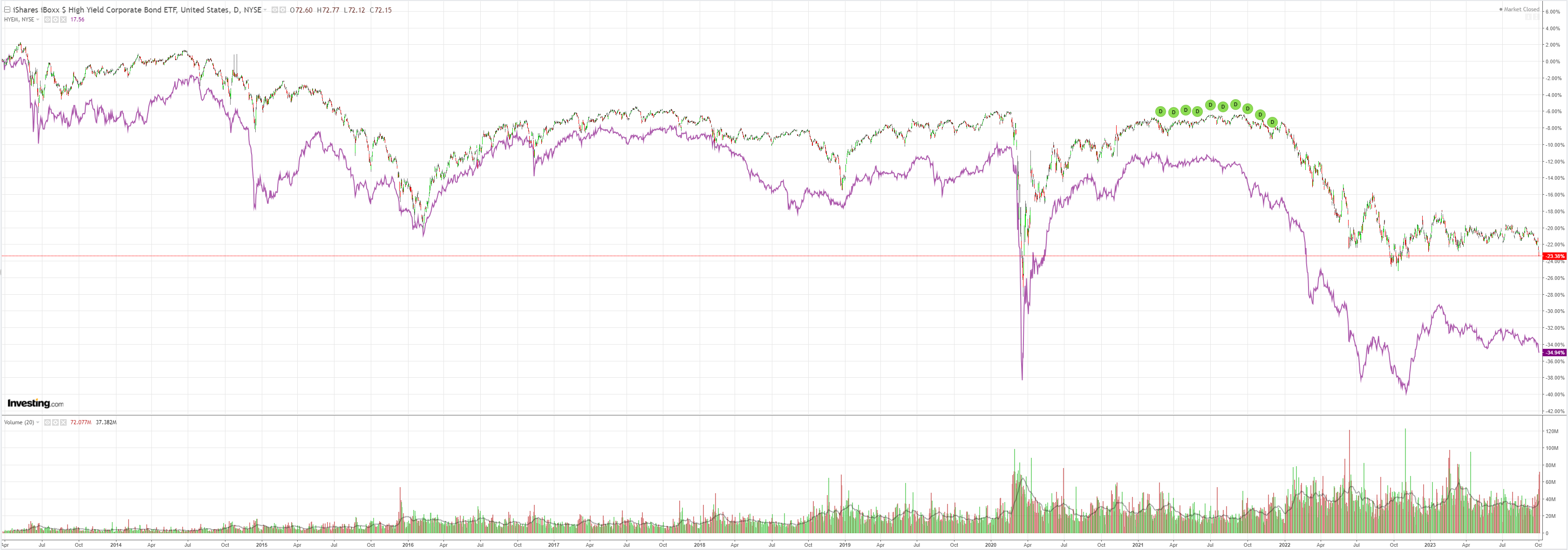

Junk is going down:

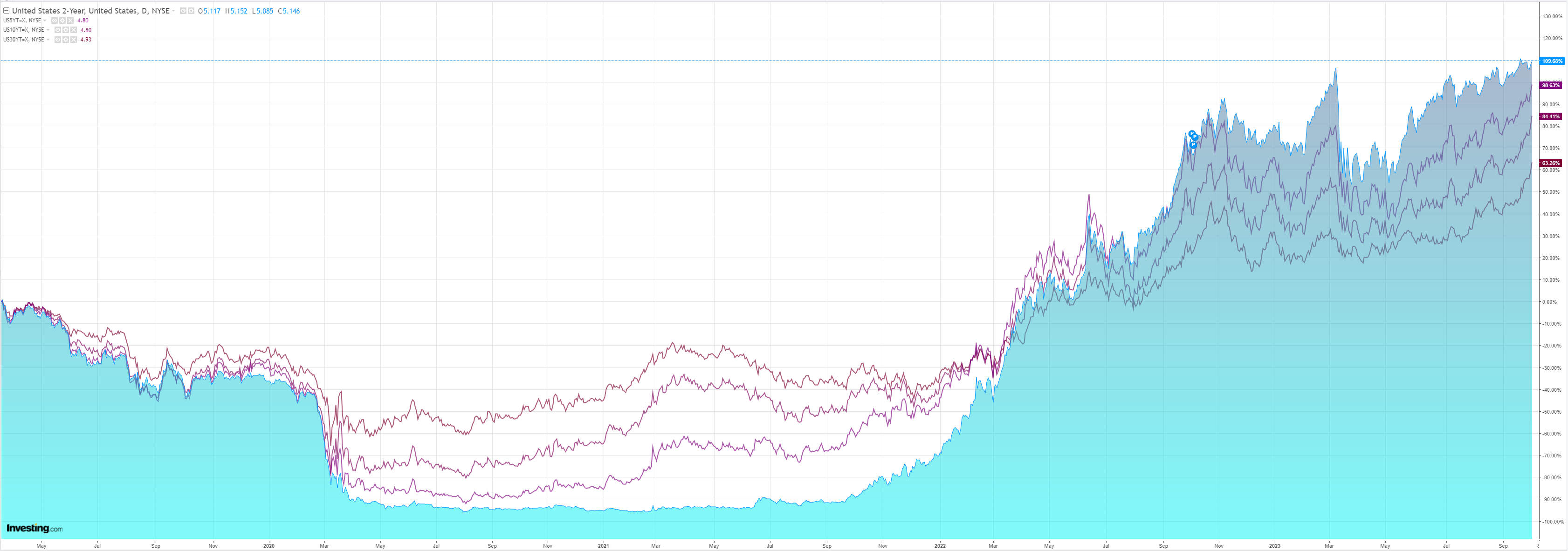

As yields are going up:

Stock were smacked:

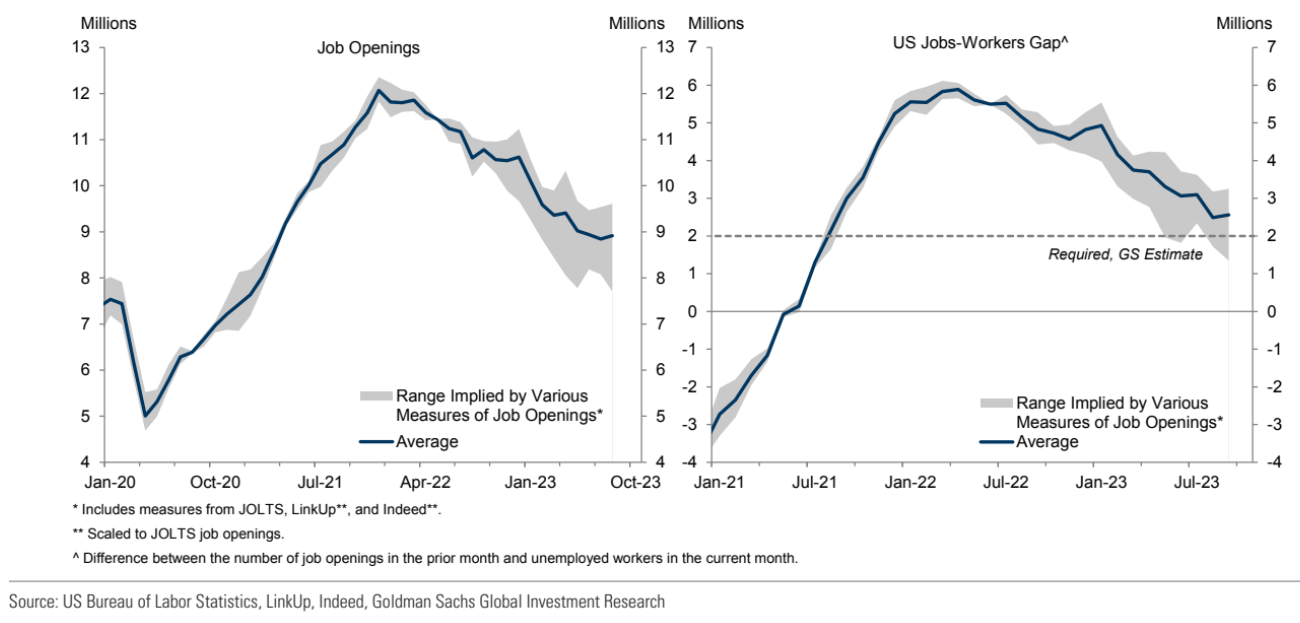

The culprit on the evening was US JOLTS which confirmed that good news is bad:

That was enough to jackknife Treasuries again, which took everything else down. NBS on Friday will be interesting. A good print and yields will explode. Conversely, very oversold markets will roar back on weak.

The FX implications were more muted than might have been were it not for this:

The yen surged from the weakest levels in a year versus the dollar amid speculation that Japanese officials were acting to slow the currency’s slide.

Japan’s currency reached 150.16 per dollar on Tuesday in New York trading, its cheapest since multidecade lows set in October 2022, as a report showing US labor demand remains resilient pushed Treasury yields higher.

The yen then soared nearly 2% in a matter of seconds to as strong as 147.43 per dollar. It last traded at around 149, with traders selling yen again as US yields rose to the highest level since 2007.

This is another factor that can slow the decline of the AUD though further falls are very likely ahead.

We are into another round of FCI tightening to kill off inflation and the AUD won’t stabilise before it does:

And the FCI won’t stabilise until something breaks.