Street Calls of the Week

The DXY rebound continues:

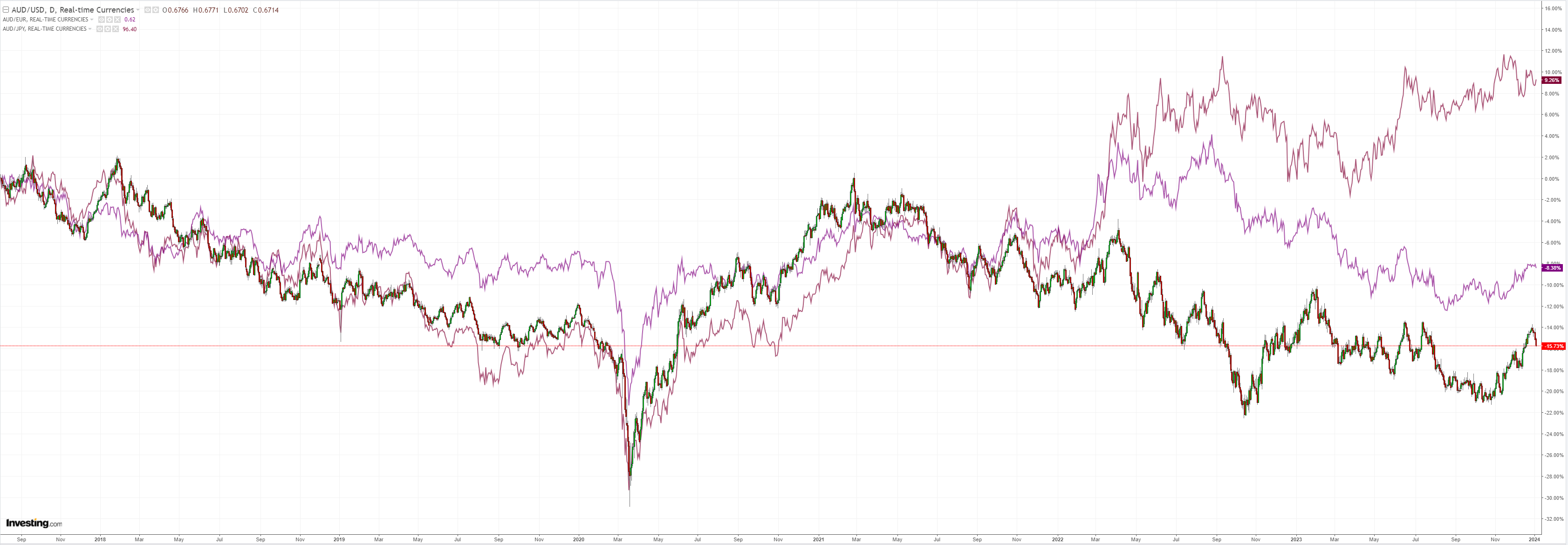

AUD shredded:

CNY concrete boots:

Oil popped on a Libyan hiccup:

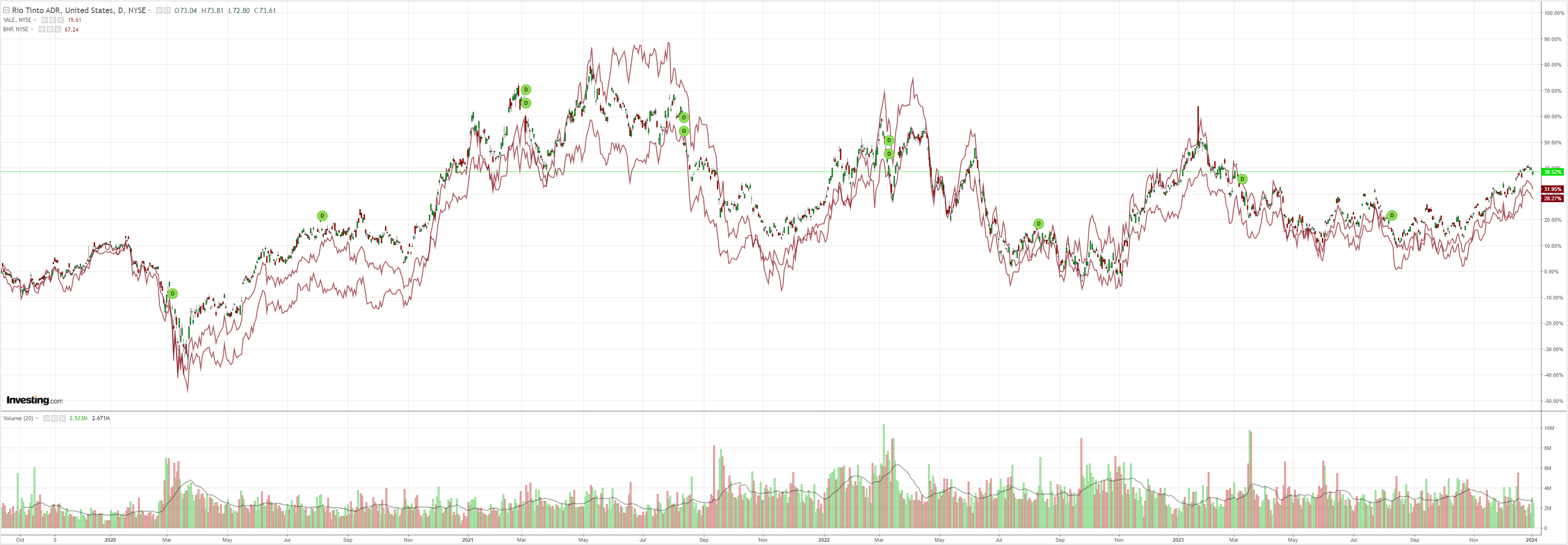

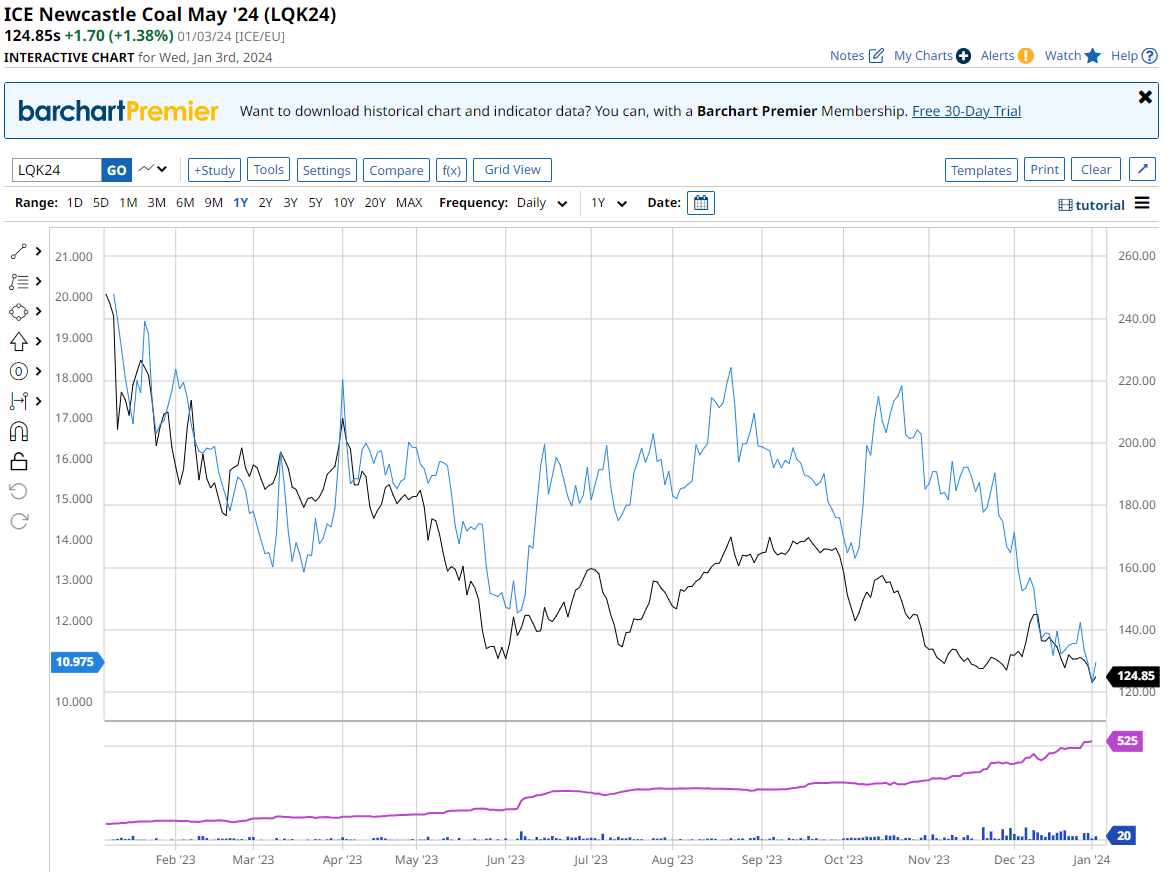

Dirt hosed:

Miners too:

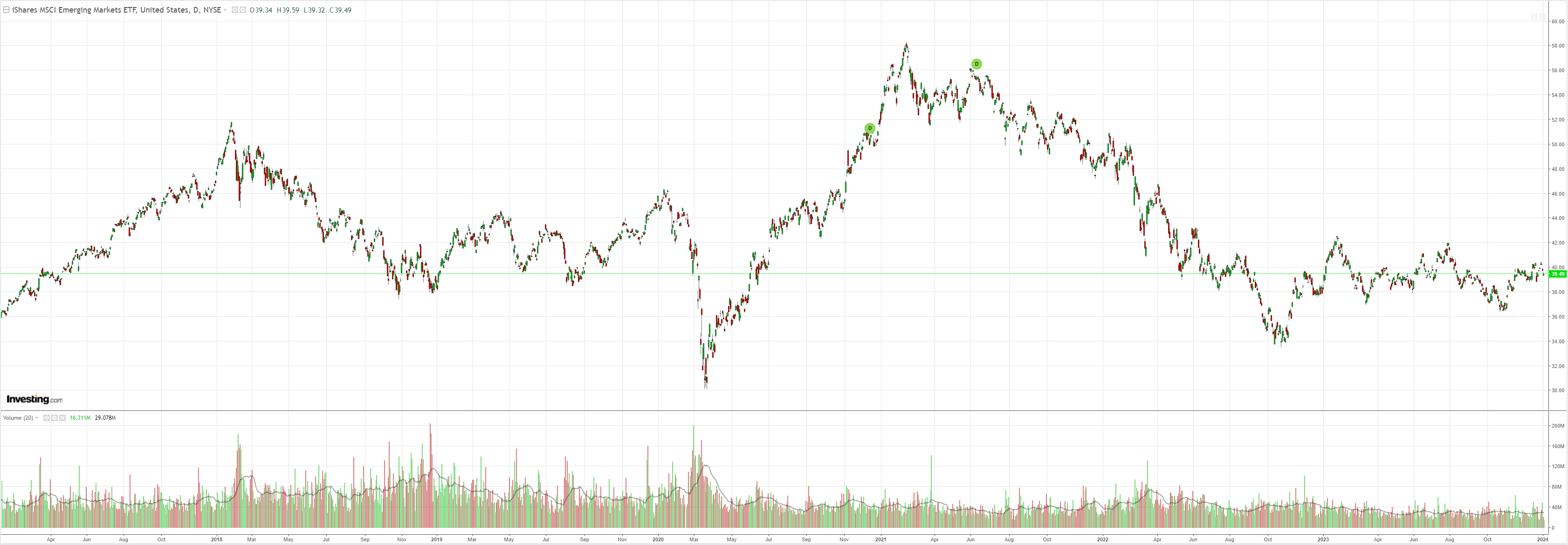

EM death:

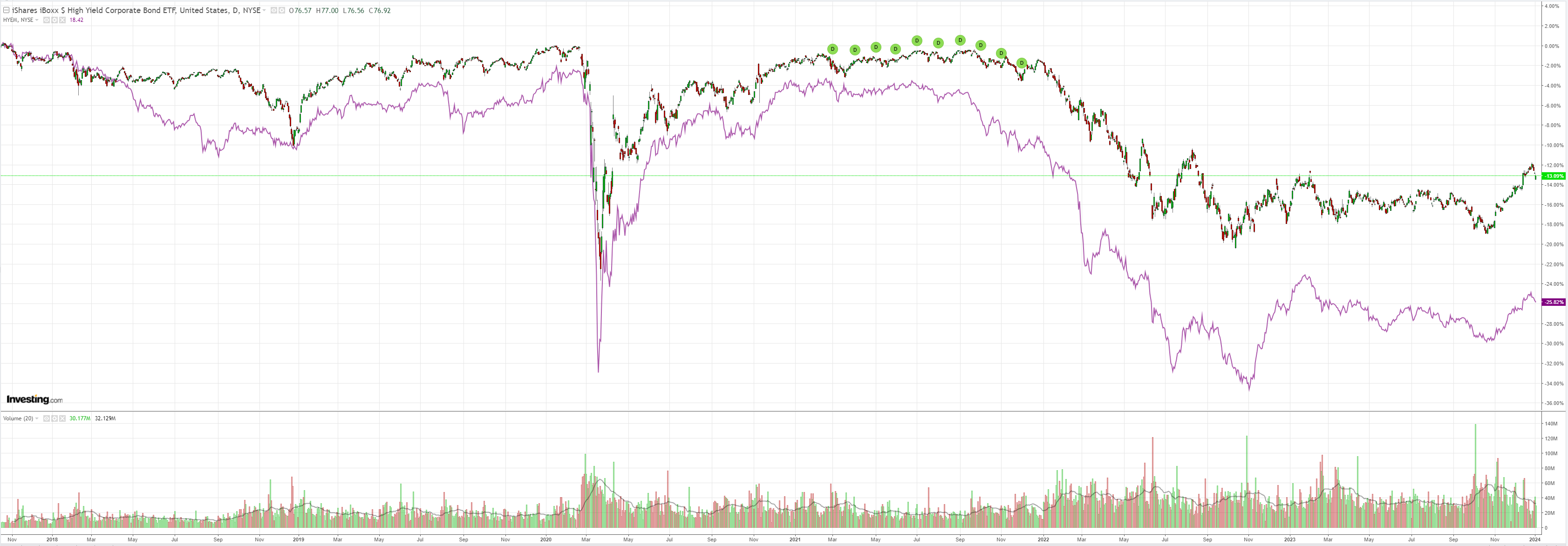

Junk fear:

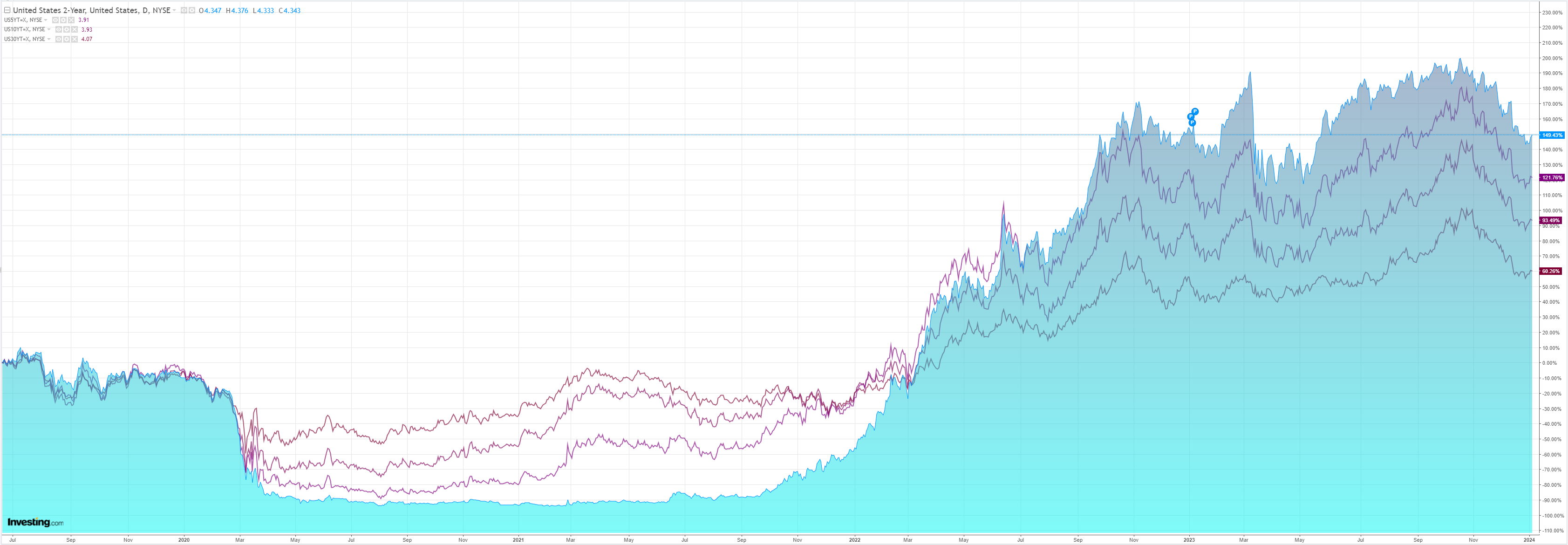

Yields were flat:

Stocks sank:

The Fed minutes pushed back on doves:

Participants generally perceived a high degree of uncertainty surrounding the economic outlook. As an upside risk to both inflation and economic activity, participants noted that the momentum of economic activity may be stronger than currently assessed, possibly on account of the continued balance sheet strength of many households. Furthermore, participants observed that, after a sharp tightening since the summer, financial conditions had eased over the intermeeting period. Many participants remarked that an easing in financial conditions beyond what is appropriate could make it more difficult for the Committee to reach its inflation goal. Participants also noted other sources of upside risks to inflation, including possible effects on global energy and food prices of geopolitical developments, a potential rebound in core goods prices following the period of supply chain improvements, or the effects of nearshoring and on-shoring activities on labor demand and inflation. Downside risks to economic activity noted by participants included the possibility that effects of past policy tightening may be larger than expected, the risk of a marked weakening of household balance sheets, possible negative spillovers from lower growth in some foreign economies, geopolitical risks, and lingering risks of further tightening in bank credit. Relatedly, several participants that the weakness in gross domestic income relative to GDP growth over the past few quarters may suggest that economic momentum during that period was not as strong as indicated by the GDP readings.

Fair enough. But it is still all about energy. So long as that deflation continues, then markets can rally into a softish landing and early rate cuts scenario.

Oil is flopping around, but nothing in the Red Sea makes me think we can’t go lower.

And China just dropped a tariff bomb on coal:

The tariffs were removed in May 2022 to guard against supply risks after Moscow’s invasion of Ukraine roiled global energy markets. That helped pave the way for record imports last year, which included an increased portion of Russian coal shunned by other buyers. Now, policy has shifted to protecting China’s mining companies from the consequences of a glut after domestic output also rose to an all-time high.

Coal and gas were smashed:

So long as energy falls, it is BFTD AUD!