DXY is up and away:

AUD has been shot to the cliff’s edge:

North Asia is a pair of lead boots:

Do we run our cars on gold or oil?

Goldman’s latest disgrace, squeezing copper and aluminium is sucking cash up the blood funnel:

The world’s second largest iron ore dog is now its hottest stock:

EM is cooked:

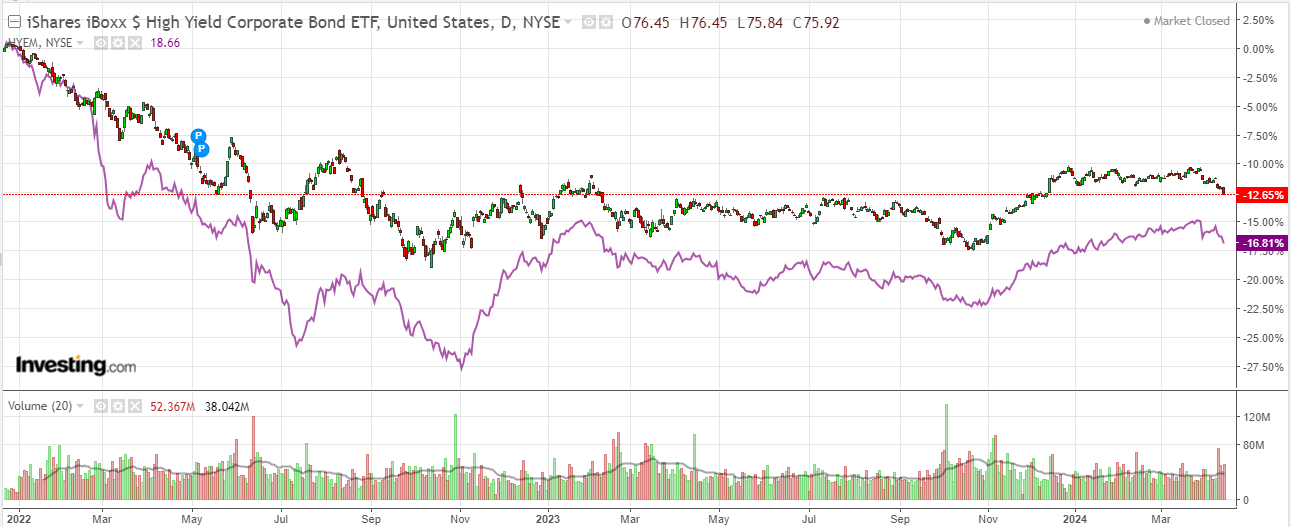

Junk is risk off:

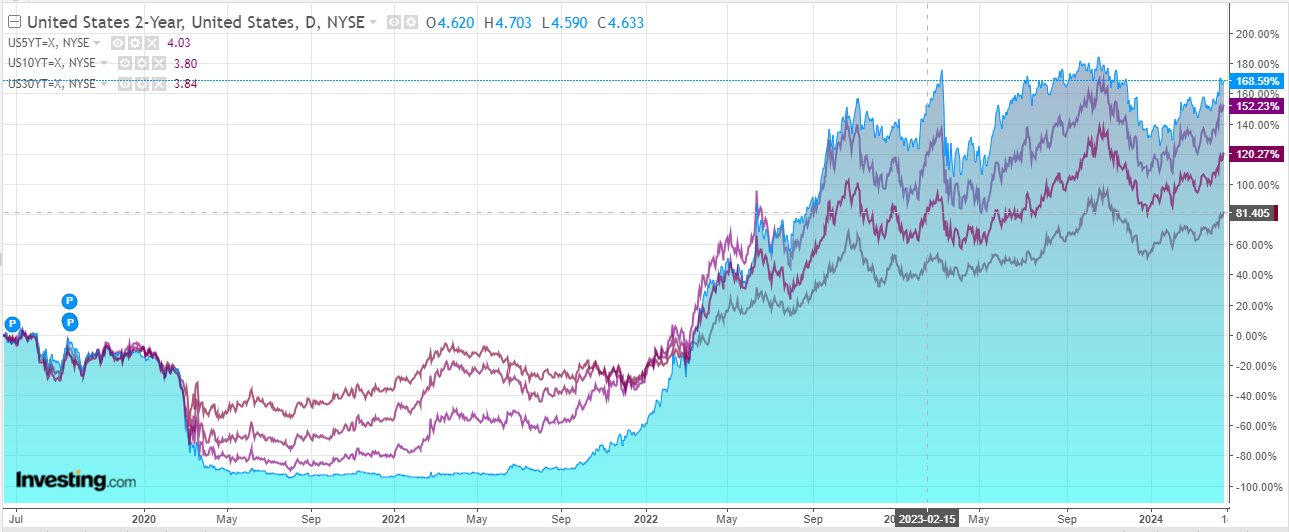

Yields are up and away:

Stocks are shot:

In a near perfect inflationary smash for all markets, US retail were red hot at 07.% in March with February revised up to 0.9%. US real income gains and doing the business.

Second, of course, is Iran and Israel at each other’s throats. Yet oil hardly moved, presumably on the basis that the options for both countries to inflict further harm are limited.

This is the rational take. However, there is not a lot rationality on the ground in Israel with a hated PM largely blamed for the Hamas attacks who can only hold power by rallying the troops. Israelis may not want to be bombed by Iran, but Benjamin Netanyahu does. So I wouldn’t discount some really stupid reprisal stuff getting worse before its gets better.

That leaves the Australian dollar dancing a jig naked in no man’s land.