DXY is now a streaking flare warning of imminent global shock and recession. I have held the Millennial high as my target for a year or more. Could we overshoot?

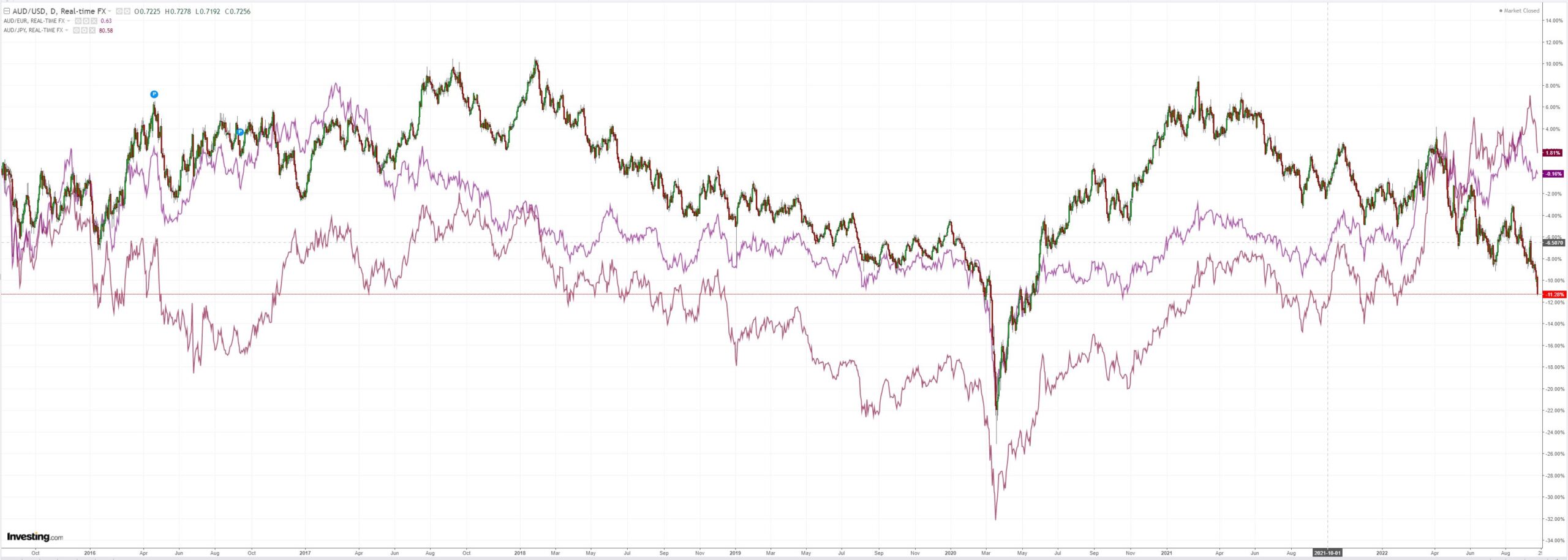

AUD is being flushed away:

Oil broke:

Aluminum broke. All base metals are next:

RIO (NYSE:RIO) broke support as well. BHP (NYSE:BHP) is next:

EM stocks (NYSE:EEM) are goners:

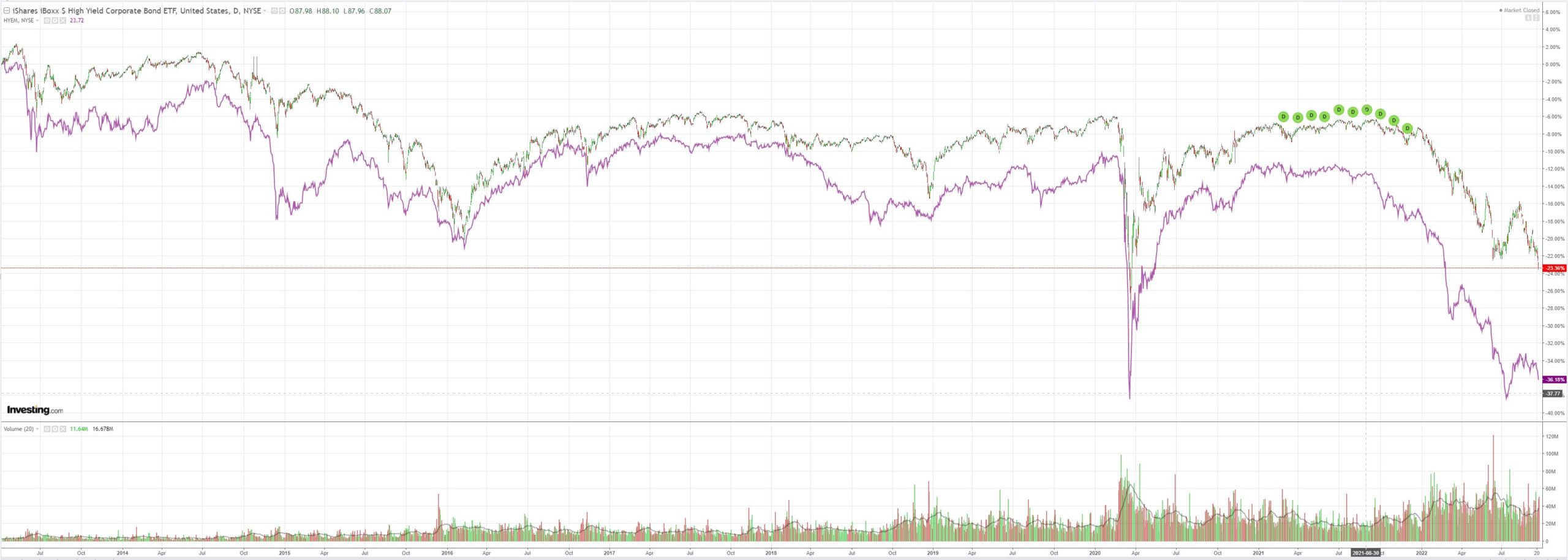

US junk (NYSE:HYG) is in free fall and junk firms will follow in due course. EM junk had rolled decisively next:

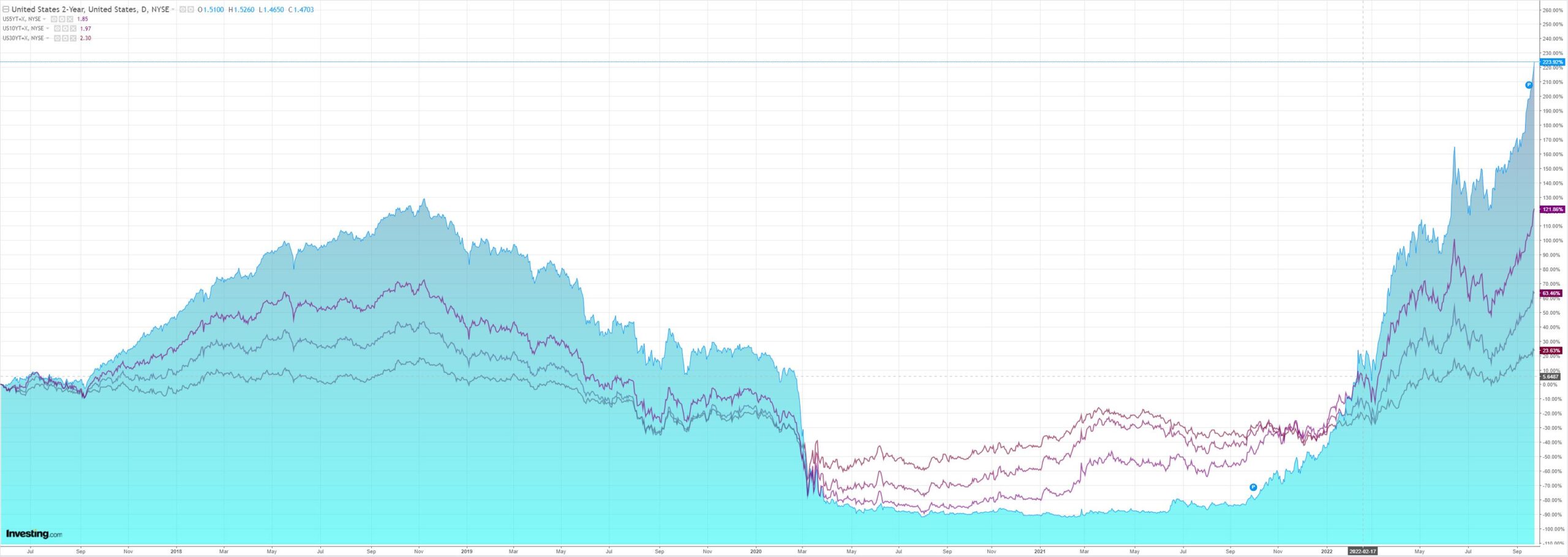

The Treasury curve was smashed again:

As stocks were routed to June lows. Good luck holding support:

Let me share an amusing anecdote from Michael Hartnett at BofA:

The investment mysteries in London: clients get the pandemic is over, there is a war, there is inflation, the central banks finally doing something about it, the dollar is overvalued, the old bull trends crepuscular; but there are mysteries …

• “where is credit event?”…”are we not missing the obvious systemic credit weakness…government balance sheets, especially when immediate outlook is Quantitative Tightening not yet QE4”?

• “when does US consumption contract?”…”if consumer so strong, why the stocks so weak? If so much excess savings, why so much credit card borrowing?”

• “what is going on in China?”…”why no bid whatsoever to Chinese risk when given China FX devaluation (quietly renminbi vs dollar almost weakest since 2007) & China monetary easing?”

Any money manager asking those three questions together needs to expand his canvas.

There is no systemic credit event coming in the US. It does not have any macro imbalance of substance to adjust. But that does not mean that there is no systemic adjustment underway.

The “credit event” that is transpiring is in China where the greatest property ponzi-scheme in history – by so far that second may as well not exist – is unwinding at astonishing speed. This dislocation has “Chinese characteristics” insofar as it is opaque.

But it is underway, getting worse, and is adding considerable downside risk to EM credit spreads, DM stock prices, and global growth.

Most obviously, it is already crashing CNY and, if the Fed does not relent in the few months, an overshoot to 8CNY/USD is in the offing. This would retrace most of the post-Millennial move to a higher CNY and signal a decisive end to Chinese catch-up growth:

As it falls, it will take with it the commodities complex as EM external accounts are sunk by capital outflow and rocketing Chinese competitiveness. Here’s CNY versus copper:

This tells us a number of things:

- China can no longer support its impossible trinity of capital flows, currency value, and interest rates.

- The PBoC is not trying very hard to stop it because it knows this.

- The long-mooted shift in Chinese growth from investment to consumption is a chimera. The CCP can’t tolerate the decentralisation that this implies. China is a mercantilist monster and will remain that way.

Whether the above will result in a typical external EM crisis for China, I cannot say. It remains a tail risk.

What we can say is that AUD is caught in the gravity well of the earth-bound CNY meteorite and both are going crash land: