DXY is up and away again:

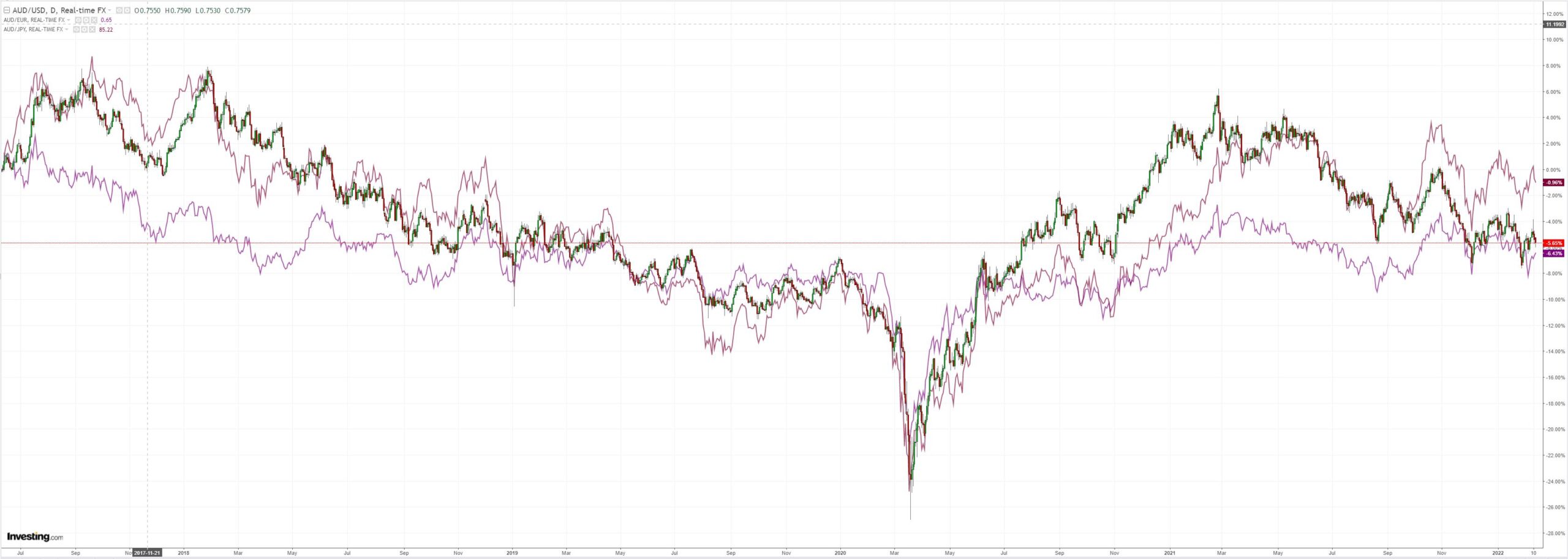

AUD sagged:

Base metals were mixed:

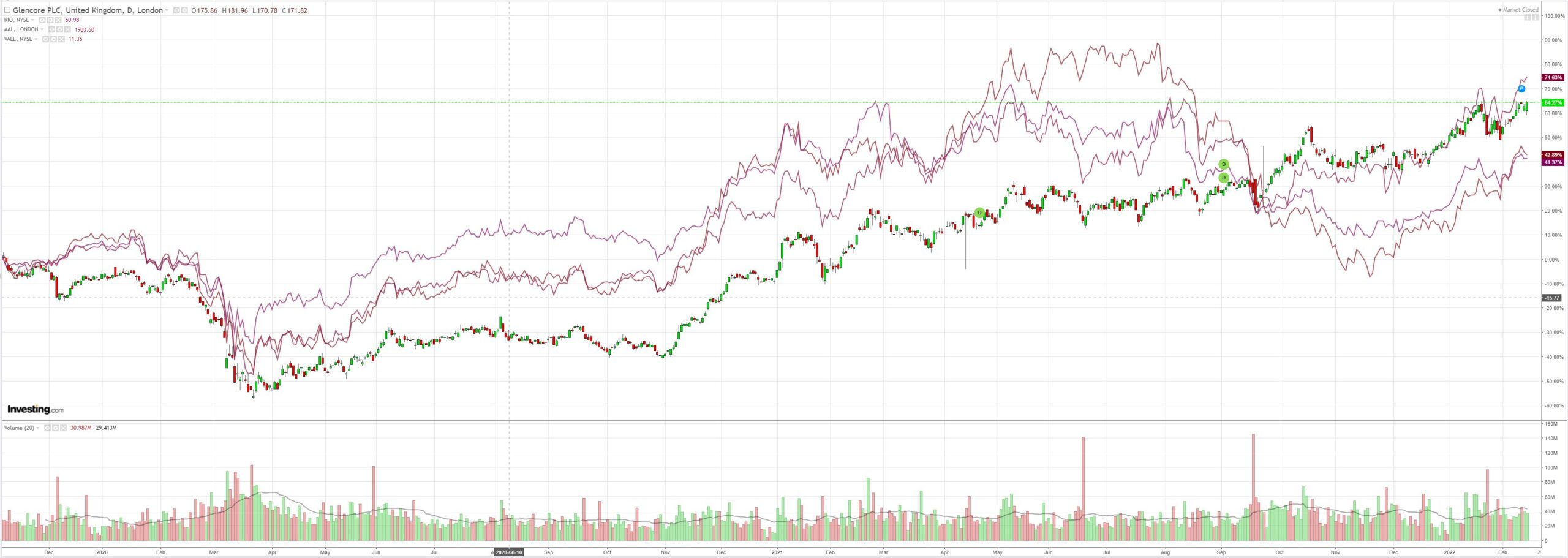

Big miners (LON:GLEN) too:

EM stocks (NYSE:EEM) are headed for a retest of the lows:

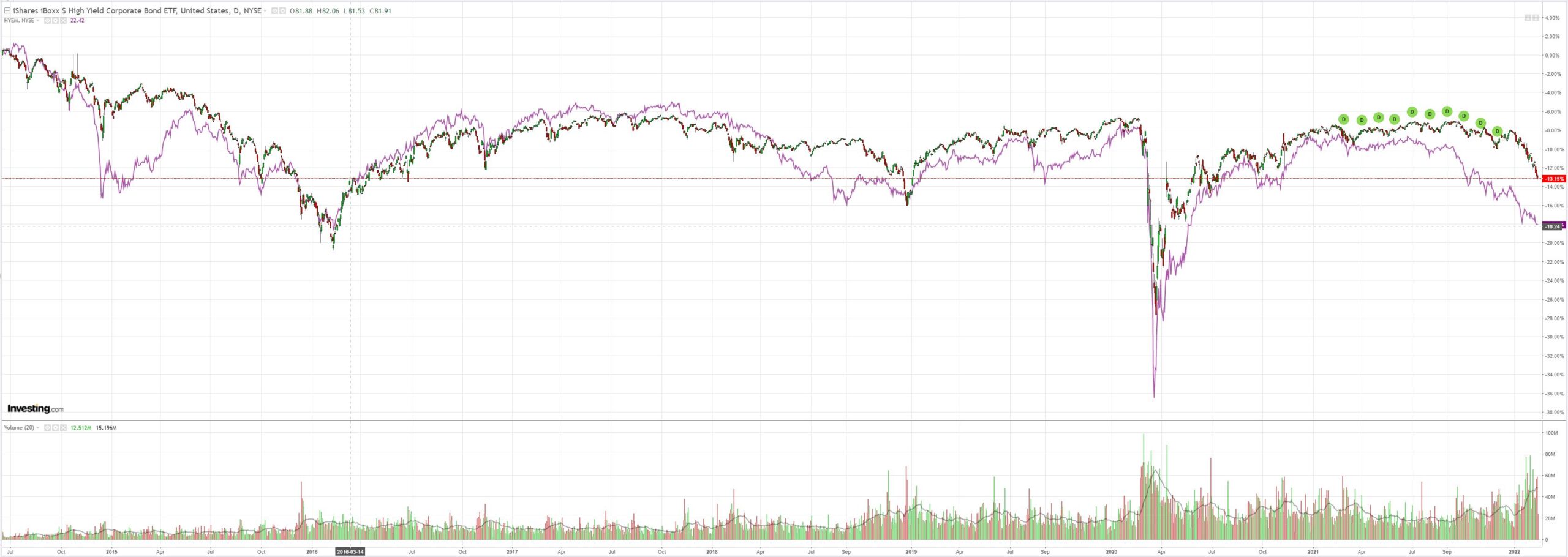

Junk (NYSE:HYG) is screaming meteor of doom:

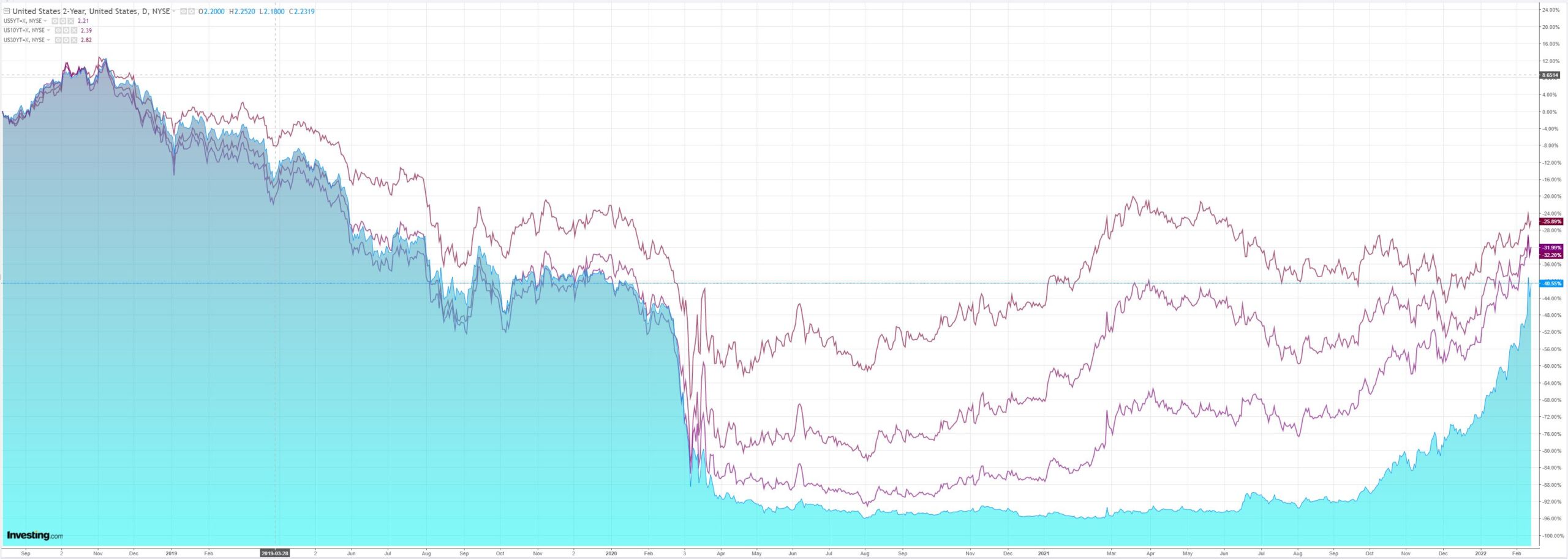

As yields rise plus the curve flattens:

DM stocks are headed for a retest as well:

Westpac wraps the data:

Event Wrap

FOMC member Bullard reiterated his preference for frontloading rate hikes and for rates to be at 1.0% by July. He said that the Fed had to react to the data and to follow through on market expectations regarding addressing inflation. George reiterated the need to get started on removing support. Although she pushed back on an inter-meeting hike, she did suggest that a 50bps move in March was up for discussion. Barkin spoke of the need for timely normalisation of policy but appeared less hawkish than some other committee members.

ECB President Lagarde reiterated that the ECB will act when appropriate but with due regard to the volatility in prices. She also stressed the ECB’s gradual approach.

Event Outlook

Australia: The RBA’s minutes for the February meeting will provide more colour around the Board’s central view and the risks.

NZ: REINZ housing data for January are published. Higher mortgage rates and tighter lending regulations have started to impact house sales and prices. December’s net migration is set to remain close to zero due to border restrictions.

Japan: The consumption rebound from delta is expected to drive GDP growth in Q4 (market f/c:1.5%qtr; 6.0%yr). Meanwhile, the final estimate of December’s industrial production will highlight the impact of broad-based supply issues.

Eur/UK: The ZEW survey of expectations has rebounded firmly above average, indicating that omicron disruptions are expected to only temporarily slow growth prospects. The surge in import prices is anticipated to widen the European trade deficit further in December (market f/c: -€4.7bn). The second estimate for Q4 GDP will confirm the slowing of year-end activity for the region (market f/c: 0.3%). Meanwhile, the UK’s recovery should continue to edge the ILO unemployment rate lower in December (market f/c: 4.1%).

US: The February Fed Empire survey will provide a timely update on the NY manufacturing sector (market f/c: 11.0). Producer prices should continue to be supported by supply issues in January (market f/c: 0.5%).

And HSBC has the analysis:

A decidedly unromantic tone in equity markets this morning leaves the dollar smile intact. Friday’s escalation of market concerns regarding Ukraine remains in evidence this morning, with bond markets enjoying a safe-haven bid and European equity markets down sharply. For now, RORO has reasserted its dominance over the FX market, with the JPY and CHF outperforming (followed by the USD), while the traditional “risk on” AUD, NZD, NOK and SEKareall languishing. Hawkish Fed news can help the dollar through both the rates and RORO channels, but geopolitical tensions show the dollar can still gain even if US yields are moving lower. Rate hike expectations for the Fed have been trimmed over the last two trading sessions, with the 1Y1M forward OIS 14bp lower, for example. The equivalent rates for the EURand GBP, by contrast, are higher but the safe haven allure of the USD is winning out.

The internal debate about the appropriate pace of Fed tightening remains evident in the weekend rhetoric. In comments to CBS yesterday, the Fed’s MaryDaly said she favours “moving in March and then watching, measuring and being very careful”, adding that “abrupt and aggressive action can actually have a destabilizing effect”. Her FOMC colleague, Esther George,sounded a little more open to activism, saying the market expectation of a possible 50bp rate hike in March “paves the groundwork” for Fed deliberations, but she said an inter-meeting move is unnecessary (WSJ). We will hear from James Bullard later this morning, who is likely to repeat his fondness for a 50bp hike. Wednesday’s release of FOMC minutes from the January meeting may provide a bit more insight on this debate and also the outlook for QT timing and potency. The market has 39bp of hikes priced in for March.

Weekend rhetoric from the ECB remained mostly dovish, pressuring a EURalready hit by heightened tensions regarding Ukraine. The ECB’s Ignazio Visconoted that inflation expectations remain firmly anchored and that he does not see wage-price pressures. His colleague Oli Rehn, while noting that rate hikes are coming nearer, says they are not around the corner and wage developments remain subdued. He warned that ““if we reacted strongly to inflation in the short term, we would probably cause economic growth to stop” (YLE TV1). Ireland’s central bank governor, Gabriel Makhlouf, told the FT that a June rate hike is unrealistic. The market is currently priced for 8bp of tightening by June which, if you believe normalisation will be delivered in 10bp steps, would suggest lift-off is close. A full25bp hike is priced in for the September ECB meeting. ECB president Christine Lagarde speaks later this morning (11:15 EST) and we think she is likely to repeat the patient narrative heard last week. The ECB may have wanted to massage market expectations towards a greater willingness to act, but recent rhetoric suggests the majority believes the market shift has overshot.

Lower AUD ahead.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI