DXY was flat Friday night:

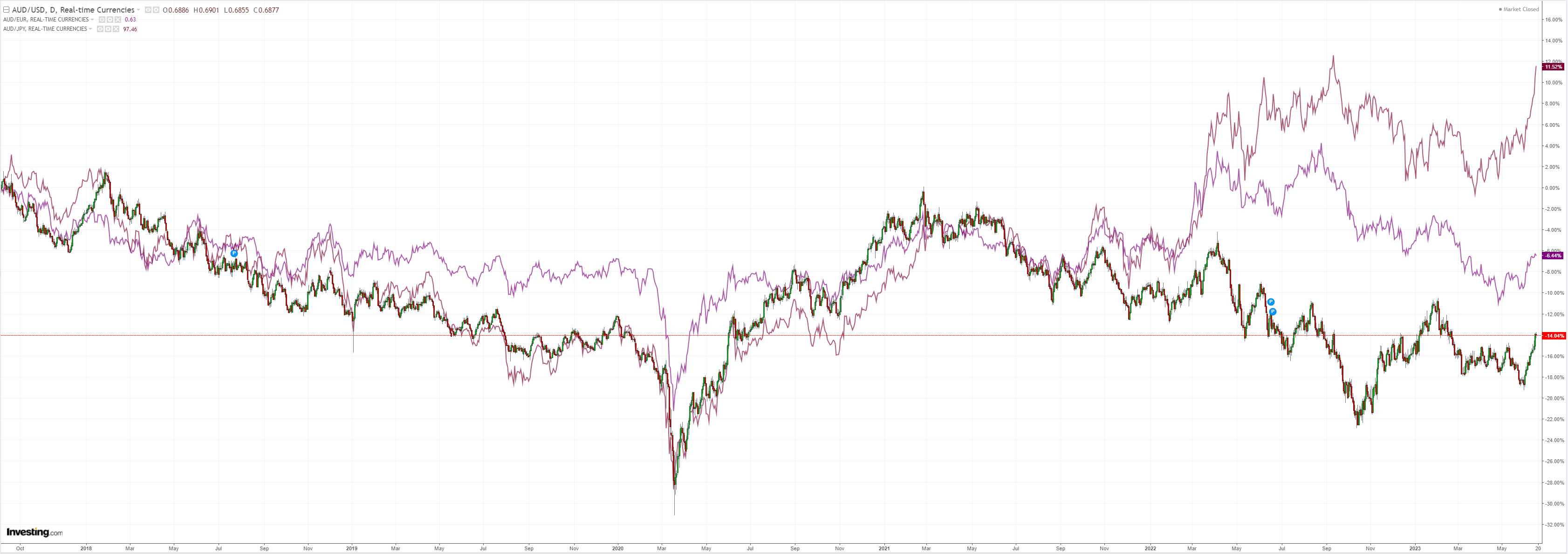

AUD flamed out. JPY is absolutely in the dog house:

To describe CNY as unconvincing is to give undue credit:

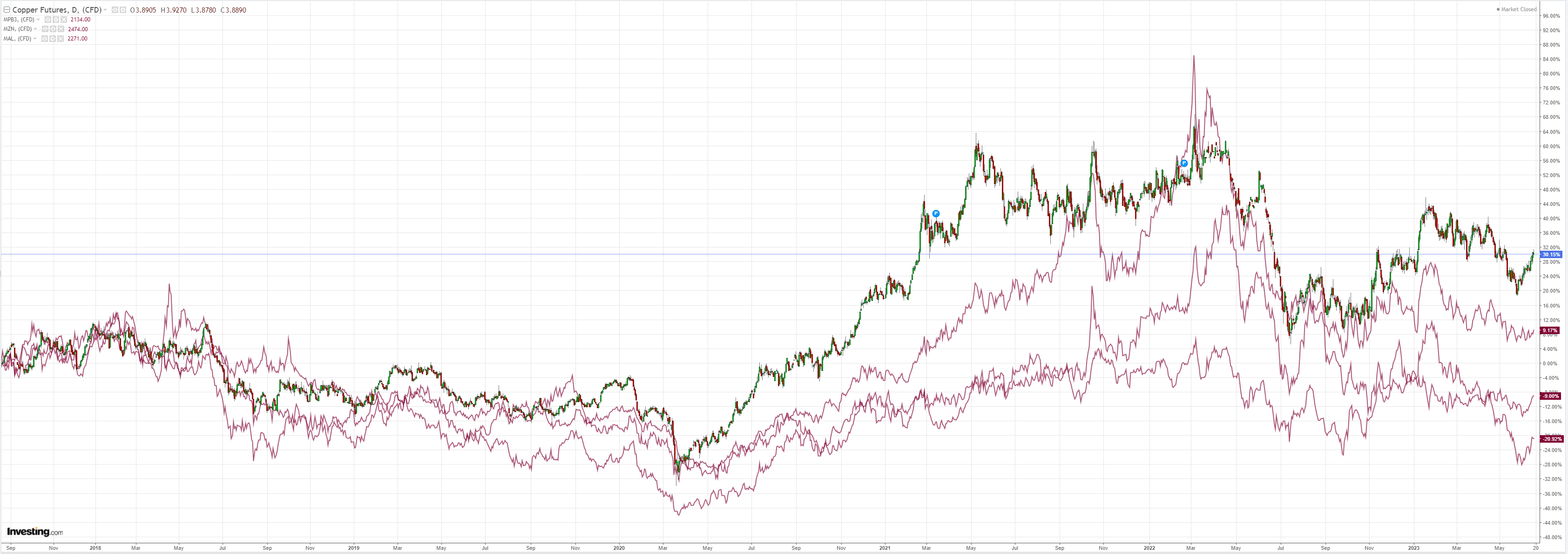

CommodIties flamed out:

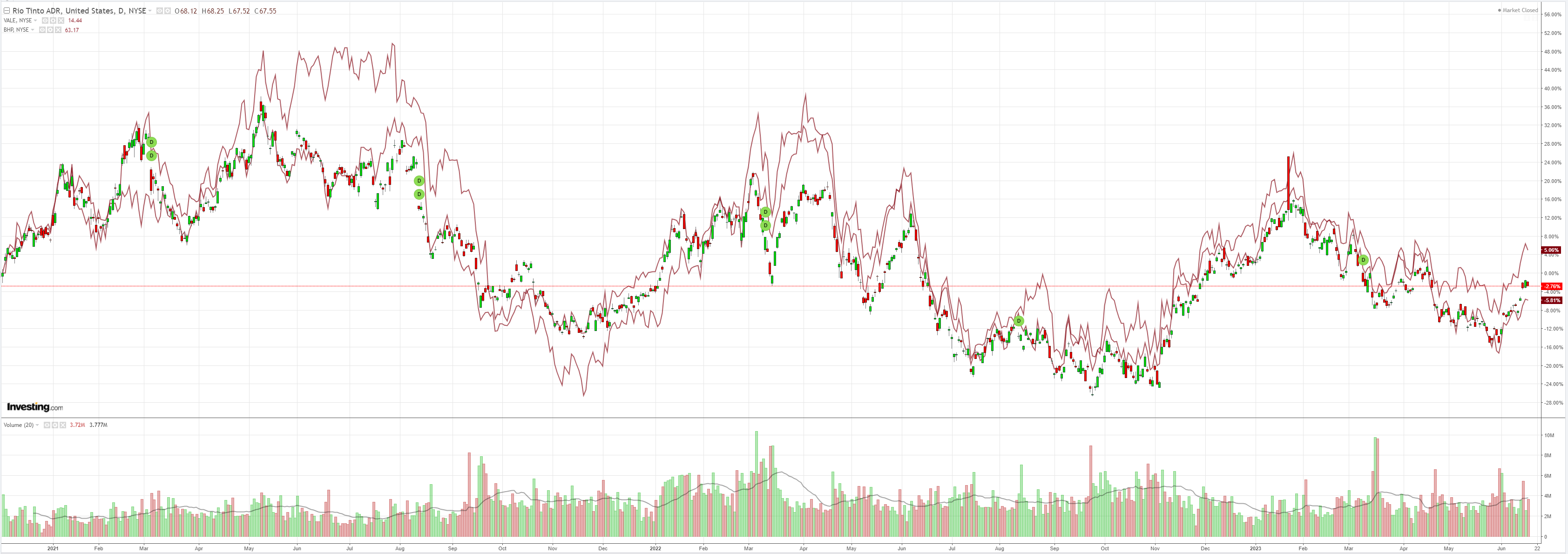

And big miners (NYSE:RIO):

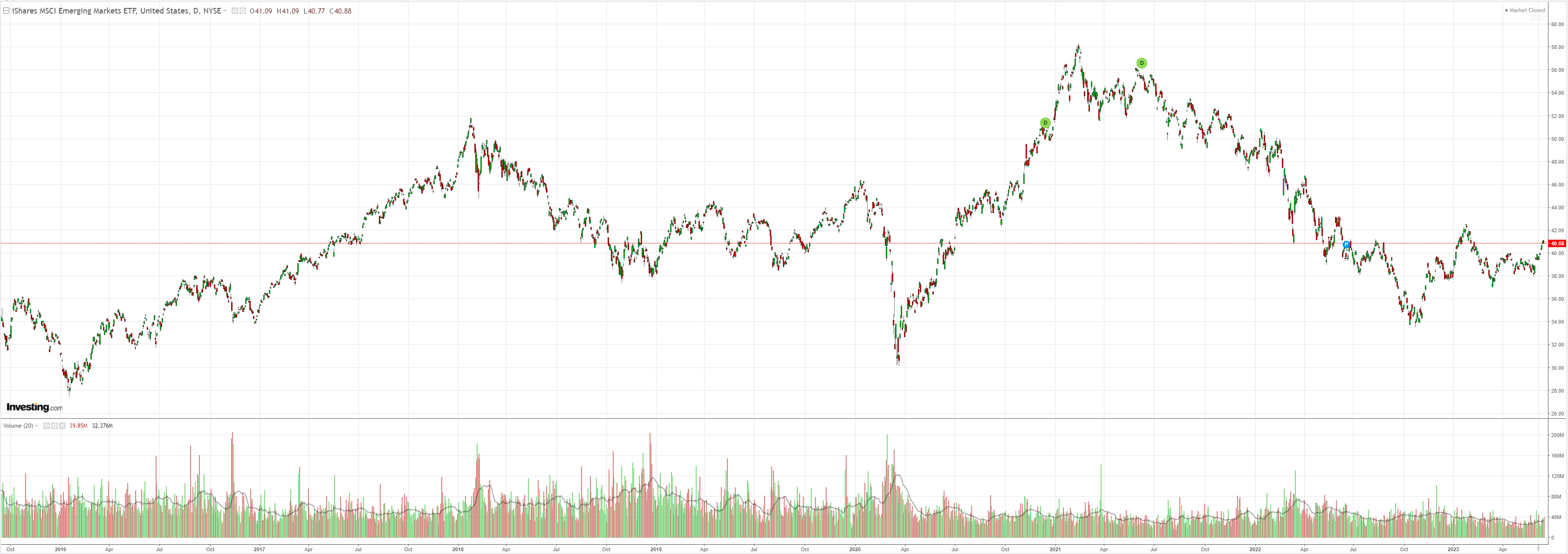

Plus EM (NYSE:EEM):

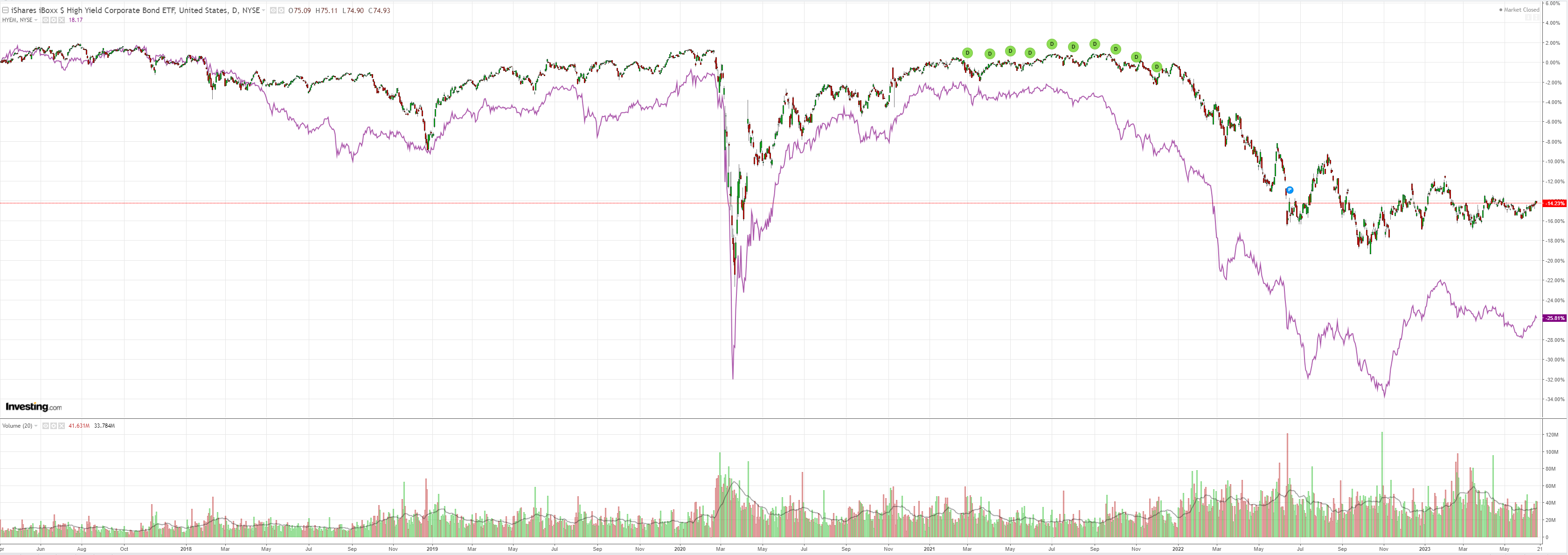

And junk (NYSE:HYG):

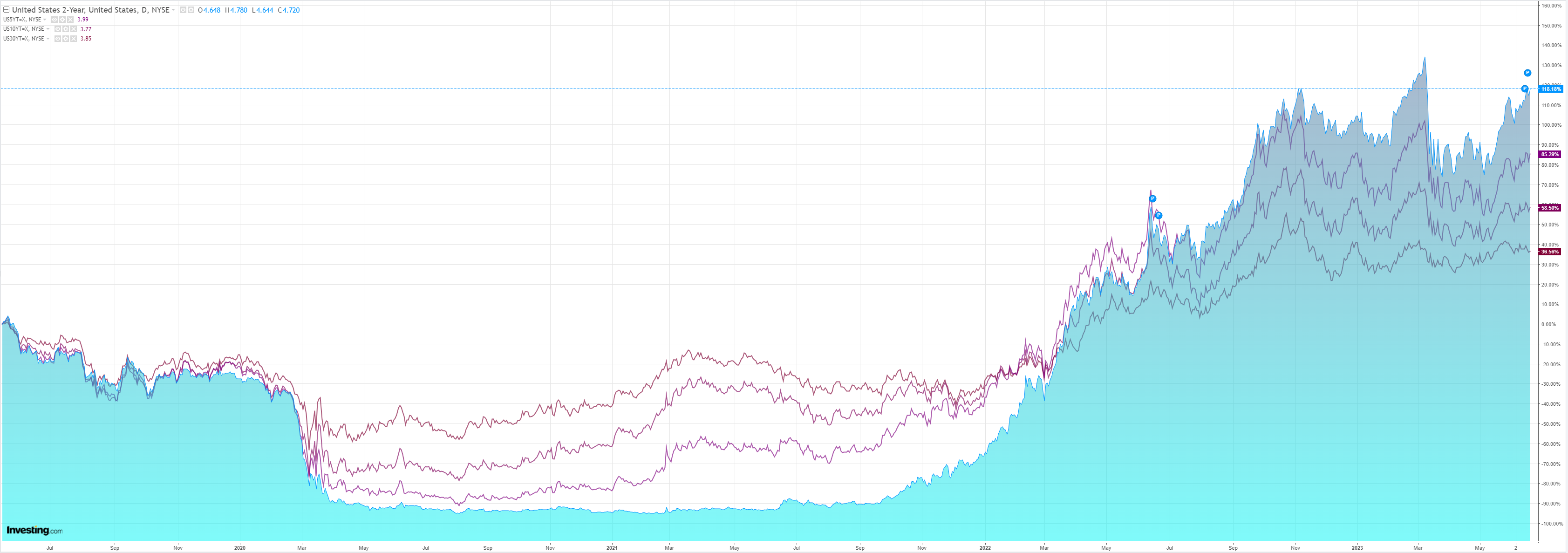

Yields rose:

Stocks fell:

Credit Agricole (EPA:CAGR) has the wrap:

USD: calling Powell’s hawkish bluff

US rates markets are still not convinced that the Fed can hike twice more this year as signalled by the updated June dot plot. Part of that stems from the fact that the FOMC remains very data dependent, focusing on both the incoming activity and inflation data. And, while the latest US retail sales surprised to the upside, jobless claims and PPI data disappointed. This left investors looking for evidence from the incoming releases that confirms the Fed’s outlook for a ‘soft landing’ before incorporating higher policy rates into their outlook. As a result, the hawkish Fed dot plot is yet to translate into a meaningful boost to the USD’s relative rate advantage. On the day, focus will be on the preliminary University of Michigan Consumer Confidence survey for June as well as speeches by the Fed’s James Bullard, Christopher Waller and Thomas Barkin. It would take evidence of further recovery of consumer confidence and stable inflation expectations as well as hawkish Fedspeak to encourage investors to reprice future Fed hikes. In the absence of that, the USD could continue to languish without the support of recovering rate appeal.

EUR: deliverance

At its June meeting, the ECB delivered a 25bp rate hike but revised its inflation outlook notably to the upside. During the press conference, President Christine Lagarde signalled that stickier Eurozone inflation ahead would warrant another rate hike in July but stopped well short of pre-announcing further tightening and thus a higher terminal rate than priced in by the markets at present. The EUR regained some ground in the wake of the ECB meeting, on the back offront-loading of rate hikes. That said, the moves of the market ECB rate hike expectations have been muted compared to the aggressive repricing we have seen in the case of BoE, BoC and RBA for example. As a result, the EUR continues to lag the GBP, CAD and AUD and was able to outperform mainly the low-yielding JPY.

Fed speakers were hawkish but data was dovish with jobless claims firm and inftation expectations falling.

The next key is the China stimulus which, at this stage, looks set to disappoint.

We probably have more upside yet in the short term AUD trade but China will have pull a rabbit out of the hat to give it real legs.