Street Calls of the Week

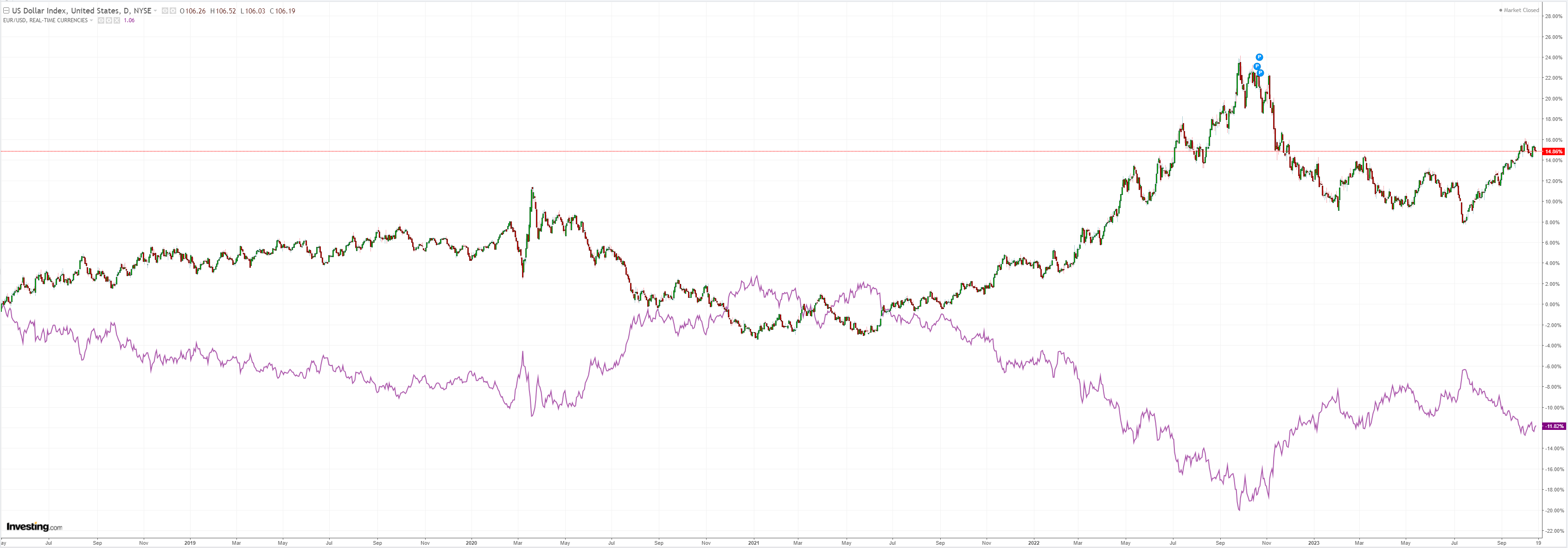

DXY continues to consolidate:

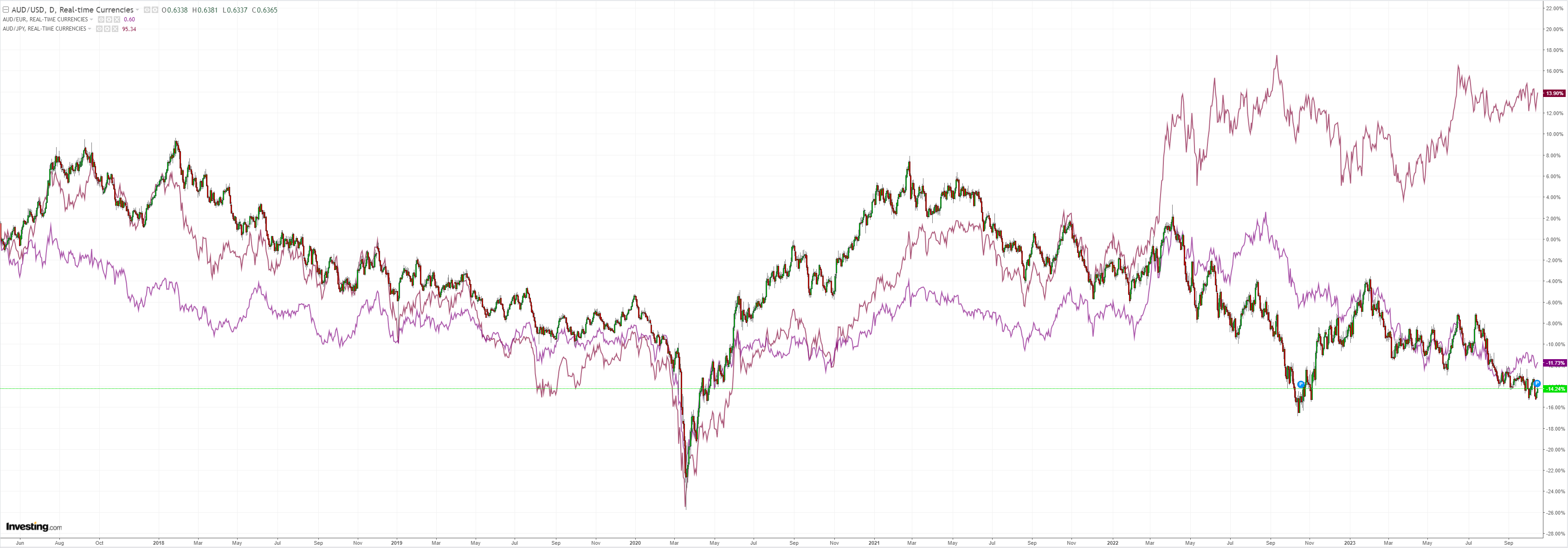

AUD roared into war, but the trend is still down:

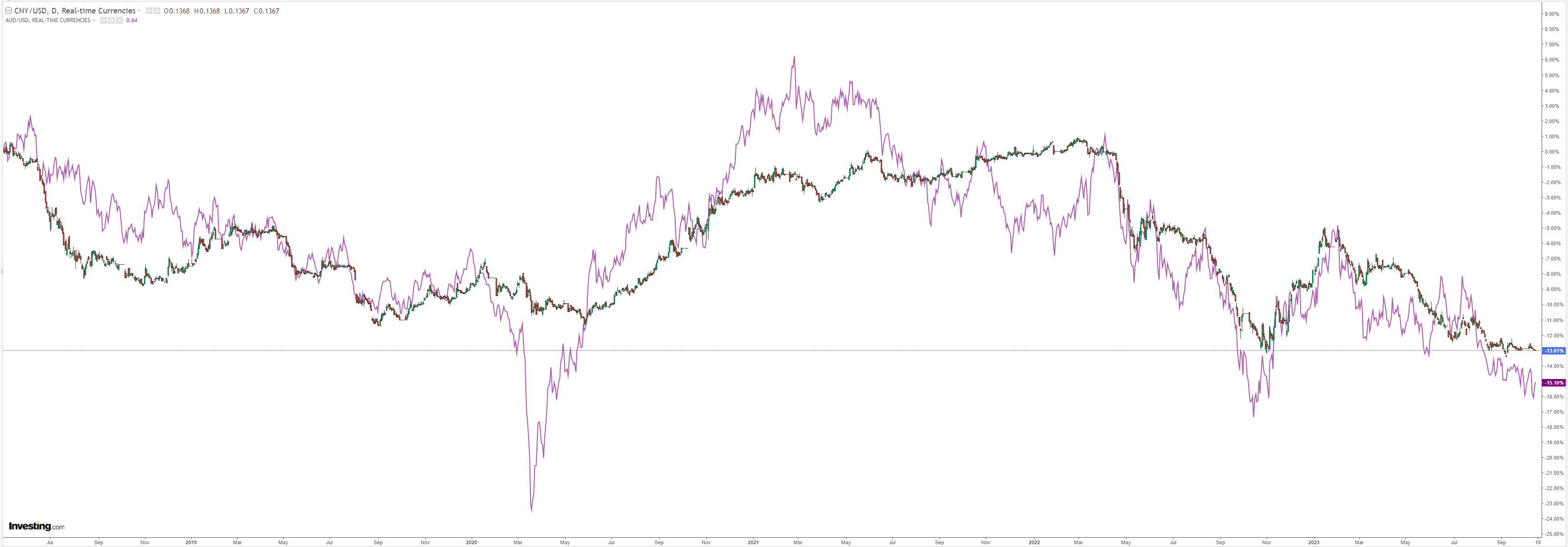

CNY is frozen:

Brent and oil firmed:

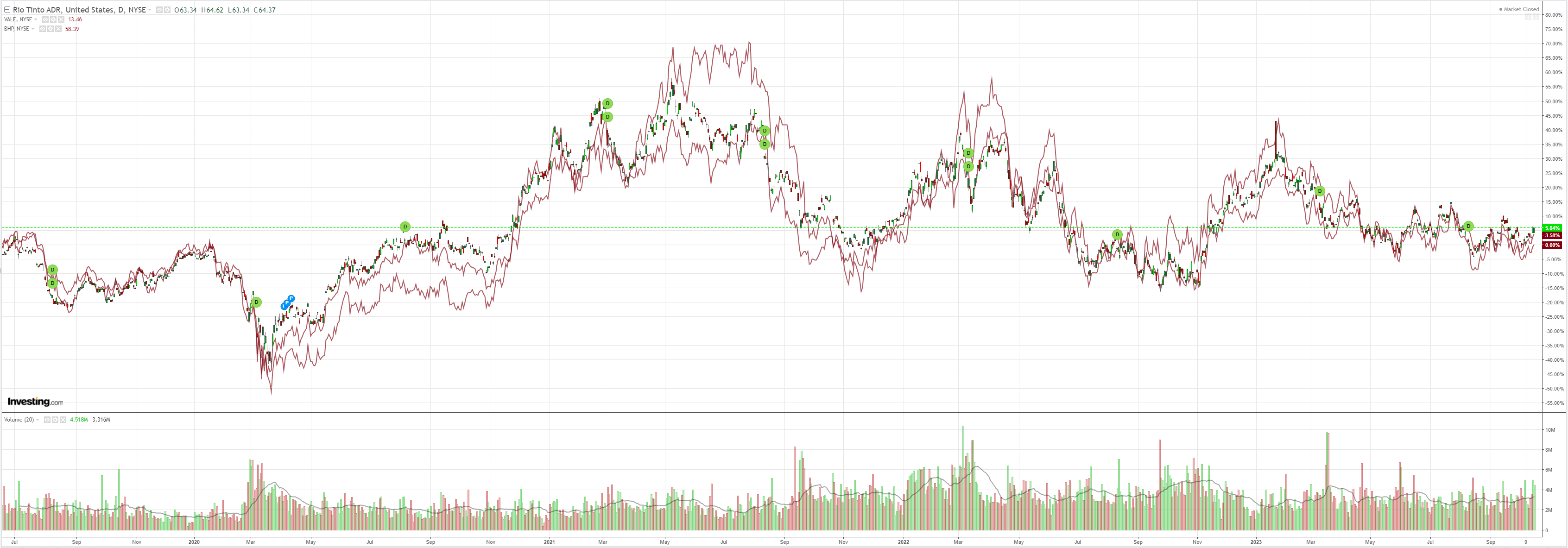

Dirt is in trouble:

Miners are supported by the iron ore miracle:

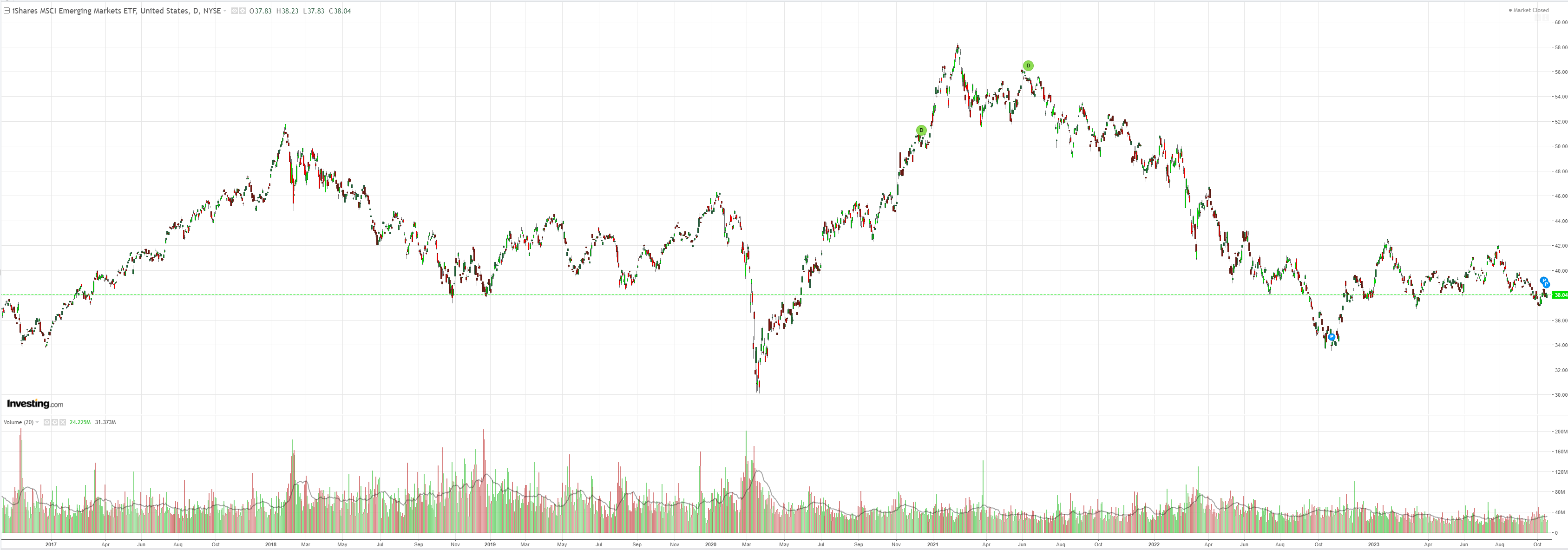

EM frozen:

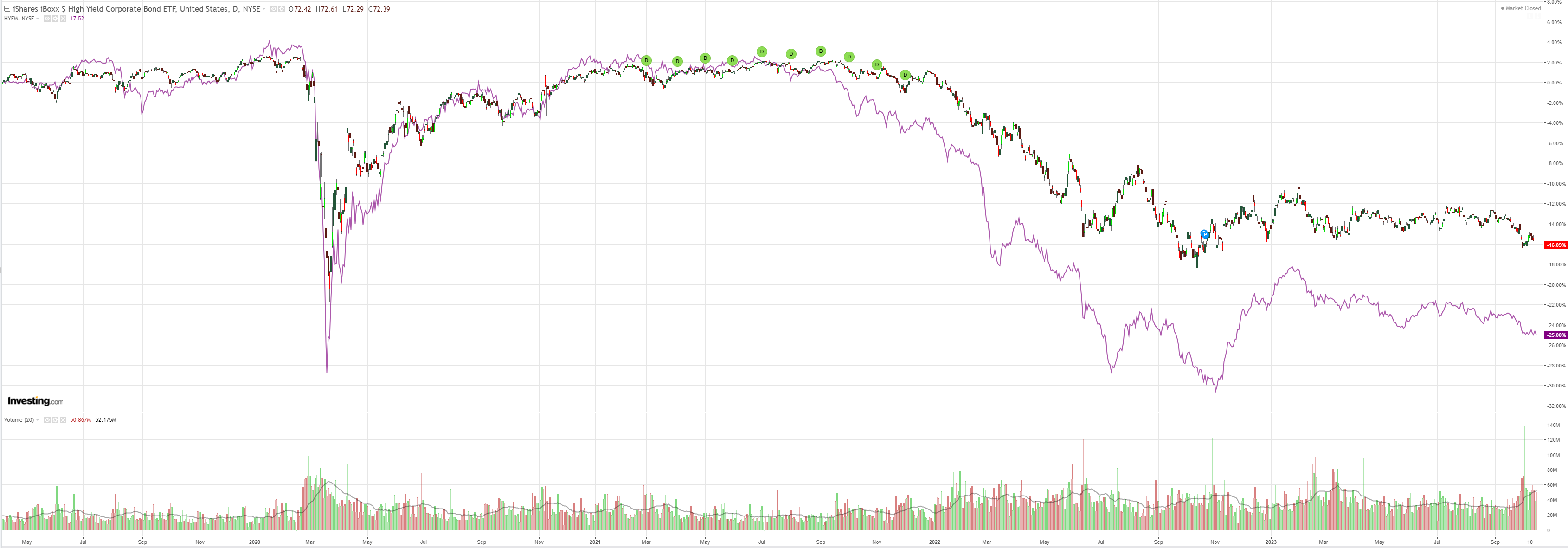

Junk is eroding:

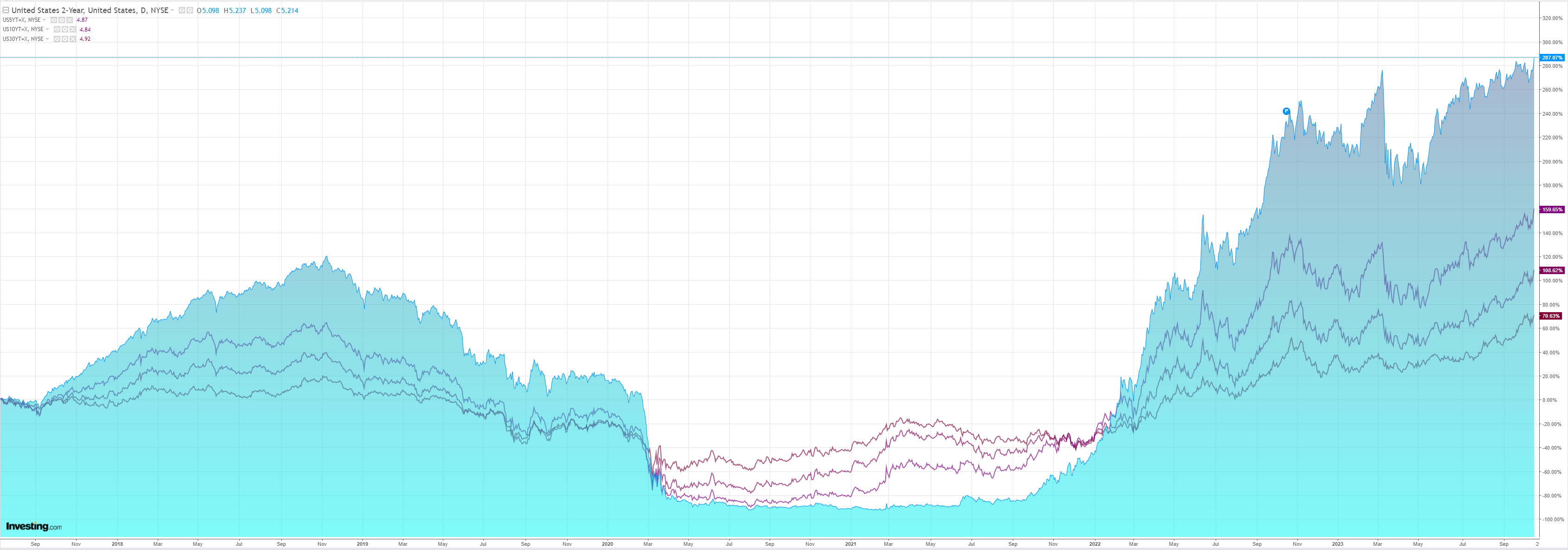

As yields break out:

Stocks eased:

Tearaway US retail sales were enough to lift yields, but DXY is too overbought to follow for now. Credit Agricole (EPA:CAGR):

One of the interesting FX market developments amidst the recent escalation of geopolitical risks in the Middle East has been the apparent inability of the USD to rally strongly in response to the returning market risk aversion. Indeed, it seems that both gold and the CHF were able to outperform the USD while the JPY was able to hold its ground against it in recent days. We believe that a key factor behind the USD’s relative underperformance vs other safe havens has been the dip of US real rates and yields. In turn, the development resulted from the surprisingly dovish Fed comments since the start of October which have highlighted that the recent tightening of US financial conditions could reduce the need for additional hikes. A dovish Fed stance could further prevail also as long as oil prices remain ‘well-behaved’ in the face of lingering tensions in the Middle East. To the extent that this keeps the US real yields subdued, the USD could struggle. We remain long XAU/USD because of that as well as because of the lingering political impasse in the US congress.

Long gold is fair enough here. But I still think the Fed (or yields) will have to chase oil and the US rebound higher yet. So use dollar averaging.

If so, AUD is closer to the bottom but with further to run lower.