Street Calls of the Week

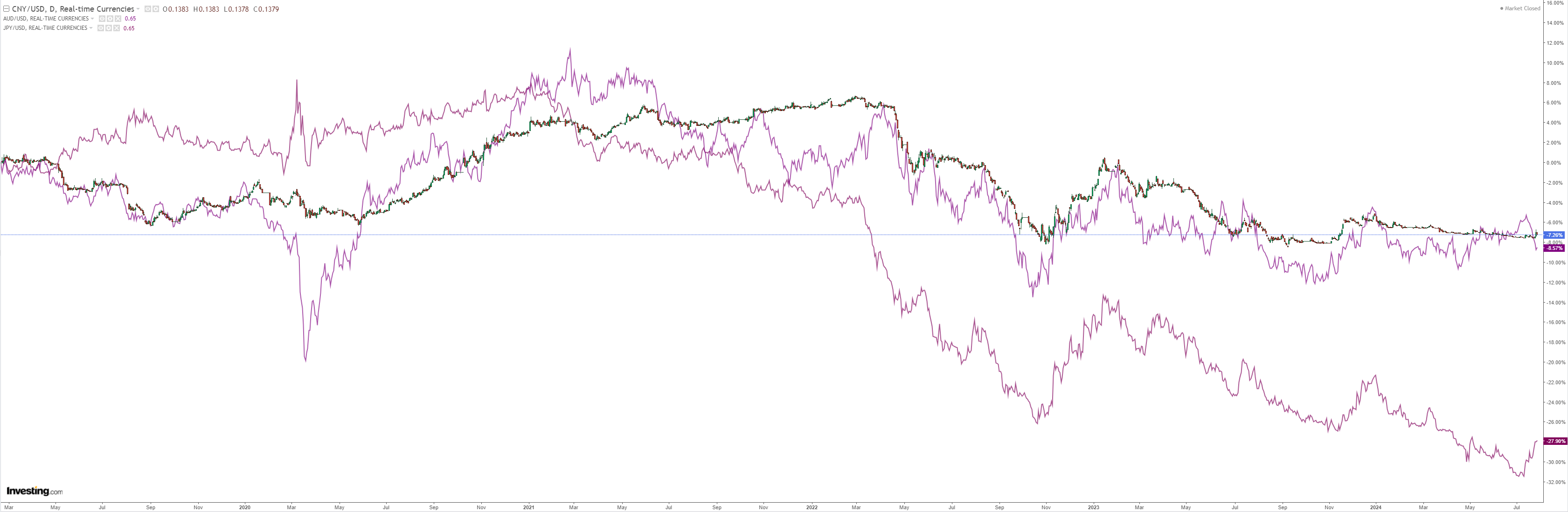

DXY was soft Friday night:

Which cut AUD some slack:

North Asia is mixed:

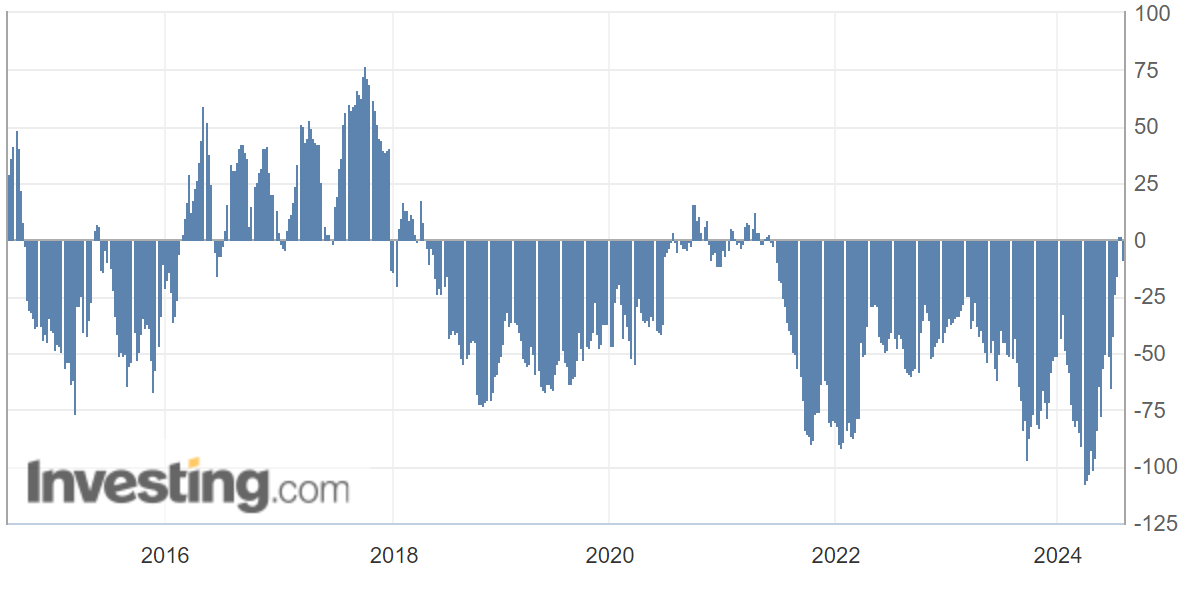

AUD bulls pulled back on CFTC:

Oil sagged:

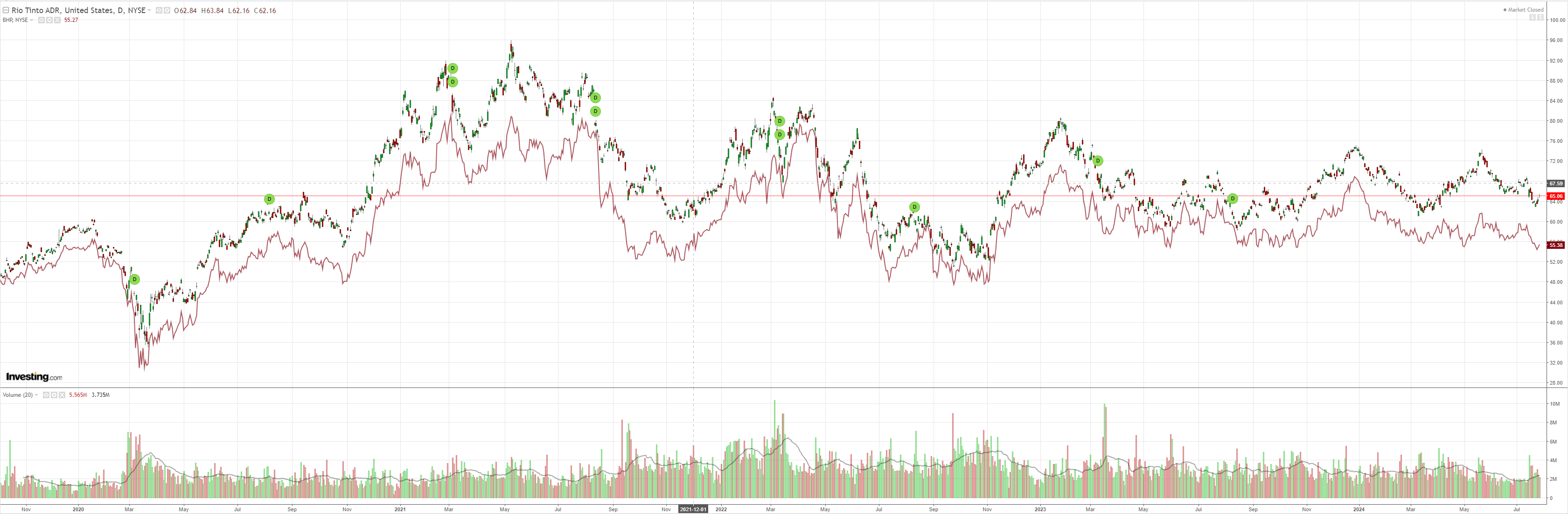

Commods caught a bid:

Miners too:

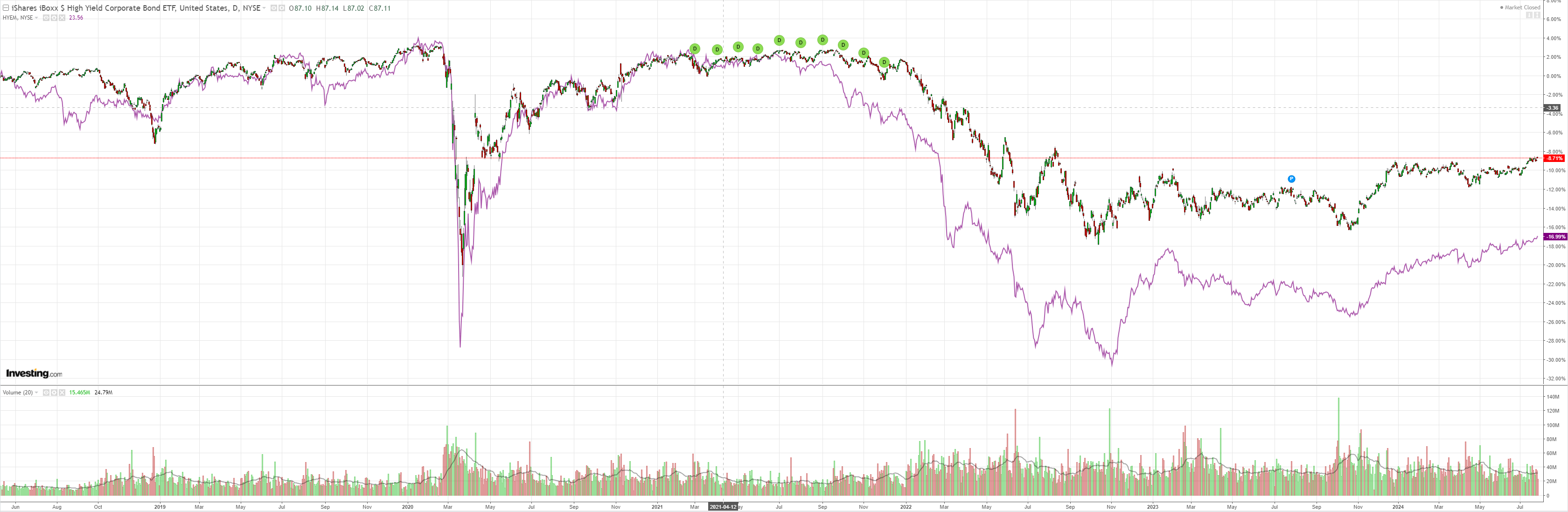

EM is holding support:

Junk spreads are telling you that everything is fundamentally OK:

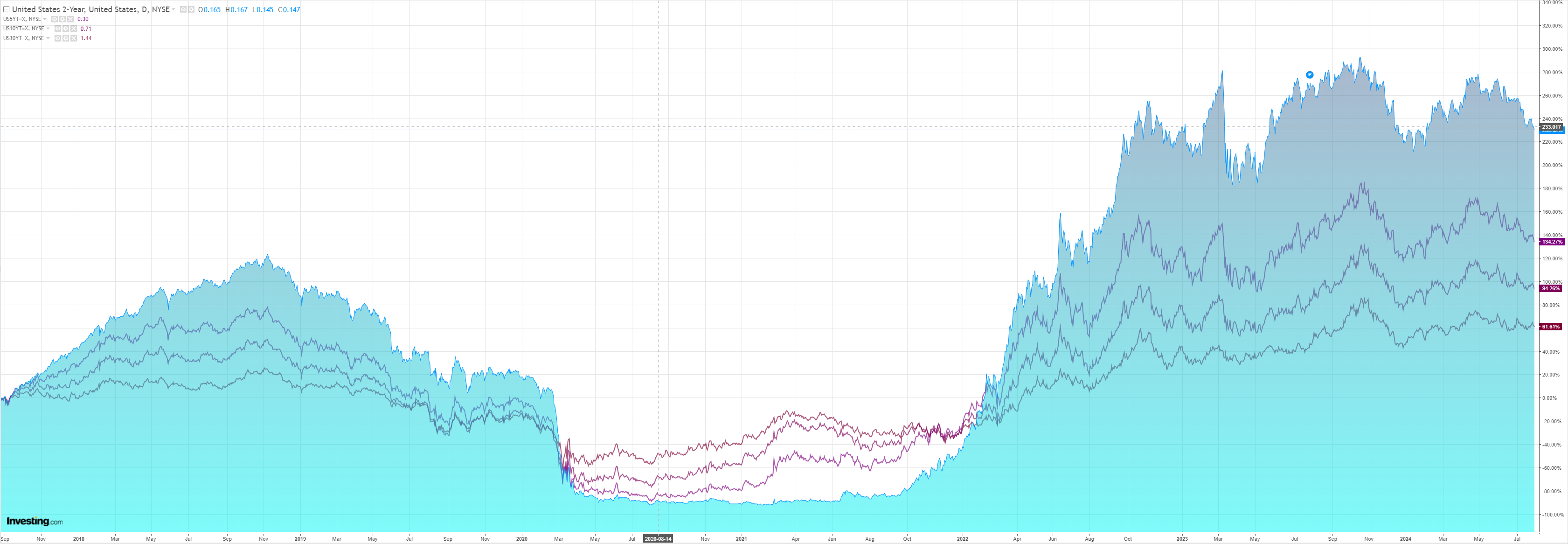

As yields fall:

And stocks tried to base:

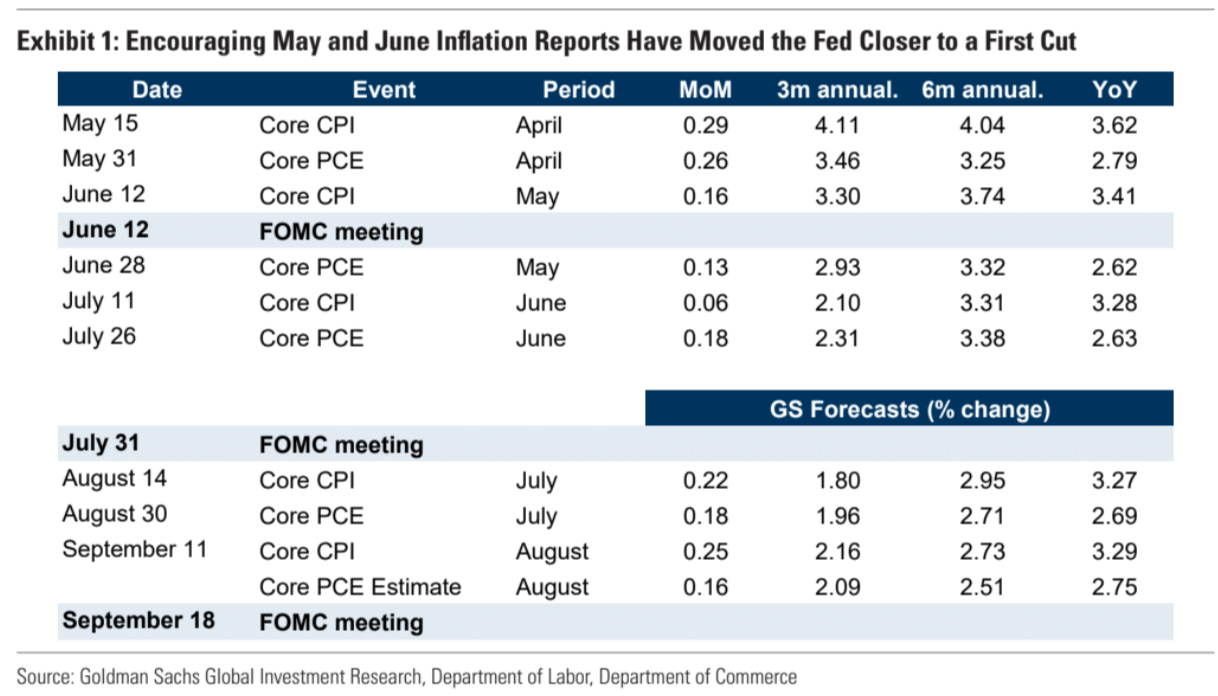

The tonic was a solid PCE report releasing the Fed doves. Goldman has more:

Encouraging inflation news and a further rise in the unemployment rate have pushed Fed officials closer to cutting.

The FOMC is set to hold steady next week but is likely to revise its statement to hint that a cut at the following meeting in September has become more likely.

Whether the FOMC deviates from the broader plan implied by the June dot plot to normalize the funds rate at a gradual pace of 25bp per quarter as inflation returns to target will likely depend mainly on the labor market, which has sent mixed signals lately, and on fiscal policy after the election.

We now see the risks to the Fed path as tilted slightly to the downside of our baseline of quarterly cuts, though not quite as much as market pricing implies.

More Fed cuts, faster is the outcome of a “red sweep”, notwithstanding a sudden one-off bump in inflation as tariffs kick in.

The issue is not US growth it is Chinese, which will be smashed by the tariffs.

Markets do not stand on ceremony with such things.

In short, both upside and downside pressures on the AUD are set to intensify in the coming months.

In the medium and long term, I expect the downside to win as key commodities grind out lows nobody today can imagine.