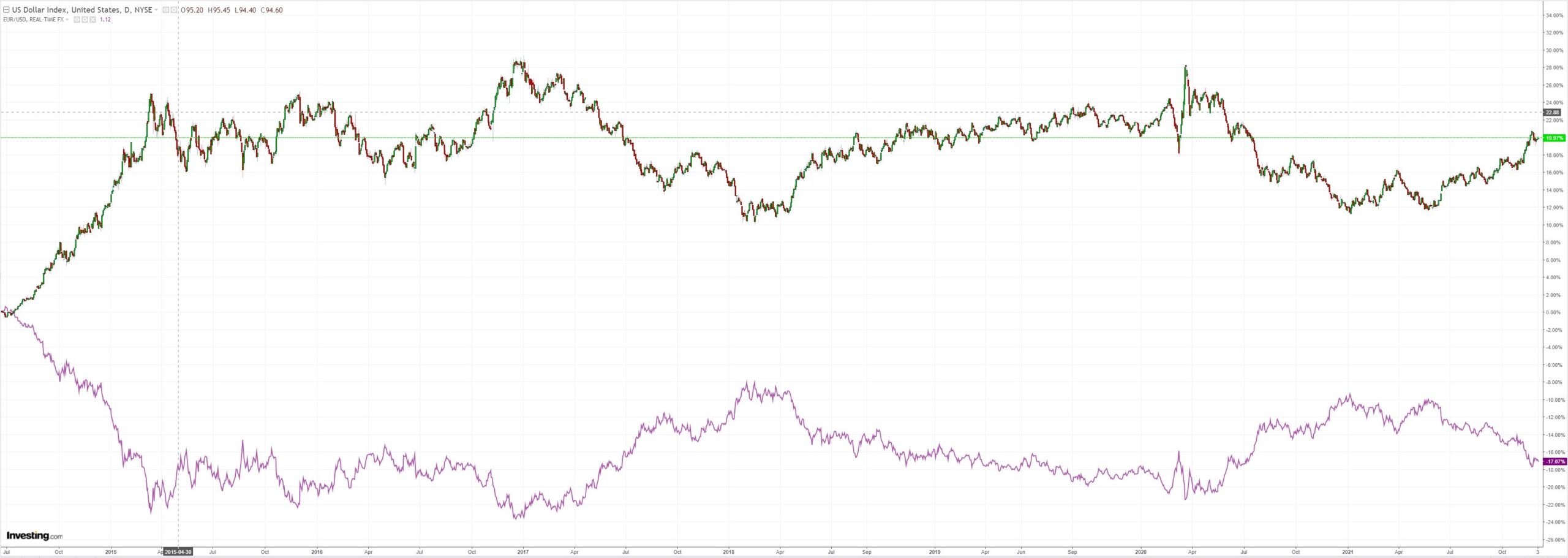

DXY firmed overnight as EUR fell:

The Australian dollar also rebounded:

With Oil:

Base metals were mixed:

Miners popped:

EM stocks still look nasty:

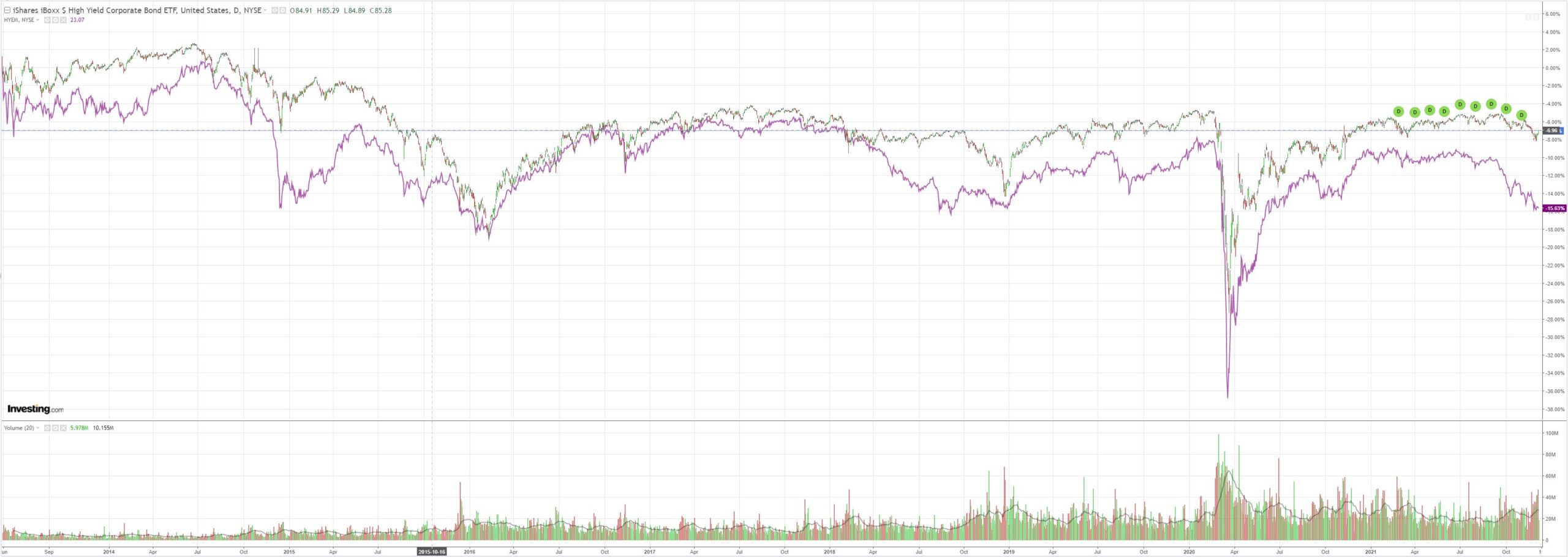

Junk is weak:

The Treasury curve steepened a litte:

Stocks lifted:

Westpac has the wrap:

Event Wrap

German factory orders in October disappointed with a fall of 6.9%m/m, to be down -1.0%y/y (est. -0.3%m/m and +5.5%y/y). Factory orders have been volatile recently, with the current slide led by a fall of almost 11% in non-EU orders.

BoE Dep. Gov. Broadbent said that there was a lot of uncertainty at present and Omicron added another surprise but that it was not deflationary. He would not be drawn on how he would vote next week, but spoke of the potential for tight labour markets to lead to wage inflation, and that labour conditions as furlough ends need to be assessed.

China’s central bank, PBoC, lowered the bank reserve requirement ratio by 0.5%, releasing USD188bn of liquidity for banks, effective from 15h December. Some of the funds are expected to be used to accommodate the large MLF maturity on 15 Dec, as well as to provide further support for SMEs.

Event Outlook

Aust: The RBA is expected to leave policy unchanged at their December meeting; the focus will instead be on any discussion of recent data and risks in the Governor’s decision statement.

NZ: RBNZ Assistant Governor Hawkesby will give a post Monetary Policy Statement address to the KangaNews NZ Debt Capital Markets Summit at 9am, and Deputy Governor Bascand will deliver a keynote speech titled ‘Reflections of a Central Banker’ at the Financial Services Council ReGenerations Conference at 9am. Westpac expects the bi-monthly GDT dairy auction tonight to result in a 2% rise in whole milk powder prices.

China: The trade surplus is anticipated to remain wide in November, supported by robust demand for Chinese exports as the global economy recovers and restocks (market f/c: US$83.60bn). Authorities meanwhile seem comfortable with the renminbi’s value, with foreign reserves little changed through 2021 (November market f/c: $3206.30bn)

Eur/Ger: The third estimate of Eurozone Q3 GDP will confirm the component detail outlined in November (market f/c: 2.2%). December’s ZEW survey of expectations should continue to reflect uncertainty over the outlook. Supply chain issues also likely hampered Germany’s industrial production in October (market f/c: 0.9%).

US: October’s trade deficit is anticipated to remain wide on the run to Christmas (market f/c: -$66.9bn).

Risk assets took thanks to waning fears for OMICRON and the Chinese move to cut reserve ratio requirements. That was enough to bounce the AUD and will probably give us a risk rally for a bit.

BMO offers analysis:

AUDUSD: The RBA will kick off a busy stretch for G20 central banks over the next two weeks. The RBA still has an ongoing QE program and has its base rate parked at 0.10% like the BoE, so its first tightening steps would be to further taper its pace of QE and to then implement a ‘micro’ hike to get its base rate up to 0.25%. The RBA announced its first taper step in July by cutting its pace of bond purchases from AUD5bn to 4bn per week, but with a forward-starting date in September. When September rolled around, that taper looked unwarranted, but the RBA chose to stick with its taper commitment but soften it by promising not to taper again until February 2022. At this meeting, the RBA could stick with the precedent it set in July by giving the market roughly 2 months of notice prior to its next taper increment. It could signal a taper to a bond purchase pace of AUD3bn from February onward. The drawback with that approach is that the past two times the RBA has committed itself that far into the future, the pandemic has made rapid U-turns and the RBA has been left with pre-commitments that seemed outdated. With that in mind, we tend to think the RBA is unlikely to commit to a particular taper increment at tomorrow’s meeting. But we do think that Governor Lowe’s Statement will try to carve flexibility for itself for its meeting on February 1, 2022. With where things stand today, the RBA may want to forego any additional taper steps and simply end its QE program at that point. However, if the Omicron Variant causes another wave of the pandemic, the RBA may want to keep its QE program alive and only taper by a 1bn/month increment. Where neither inflation nor politics are anywhere close to getting out of hand, we don’t see much value that the RBA can derive by pre-committing itself. Assuming Lowe’s Statement is as noncommittal as we expect, the voices clamoring about RBA rate hikes in 2022 will likely continue. But so will those that argue the curve has dramatically overpriced hikes (with the micro hike fully price in for August and roughly 61bps of additional hikes priced by the end of 2022). The AUD directionality on this is hard to read, but do think it should open the currency up to greater volatility. We think the broader set of AUD fundamentals (trade surplus, commodity prices, fiscal balance, etc) are positive enough that AUDUSD belongs north of 0.80 rather than south of 0.70, so we think AUD is a bargain at the present moment. But the problem with entering a position today is that the RBA could potentially blow it out of the water with a dovish approach tomorrow.

I am not expecting any surprises from the RBA doves. The pandemic is an issue largely owing to border closures and delays to the plan to reboot the flow of cheap foreign labour that will stop inflation in its tracks. So, if OMICRON does resolve it will be very bearish for Australian yields and the AUD.

Conversely, if OMICRON triggers lockdowns and a growth shock then the AUD will fall anyway.