US Dollar Index was back last night as EUR fell:

AUD was weak:

Oil faded. Gold is not signalling any turn in DXY, though perhaps bitcoin is:

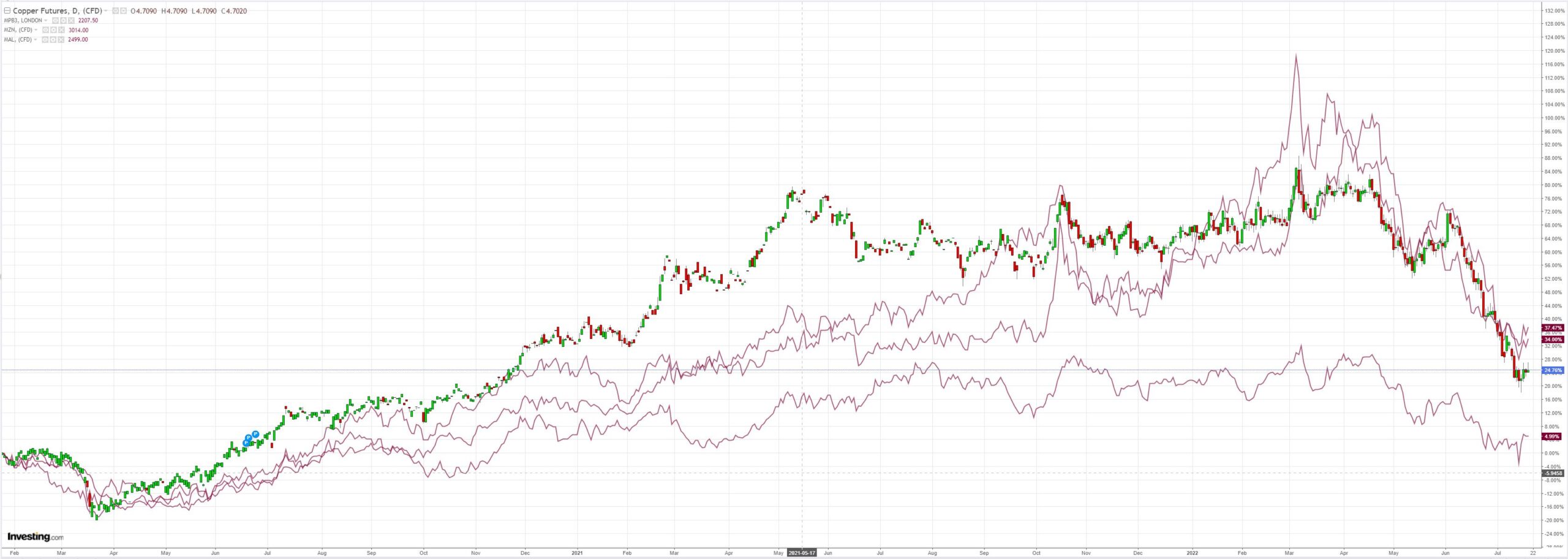

Metals are trying:

But not miners (LON:GLEN):

EM stocks (NYSE:EEM) lifted:

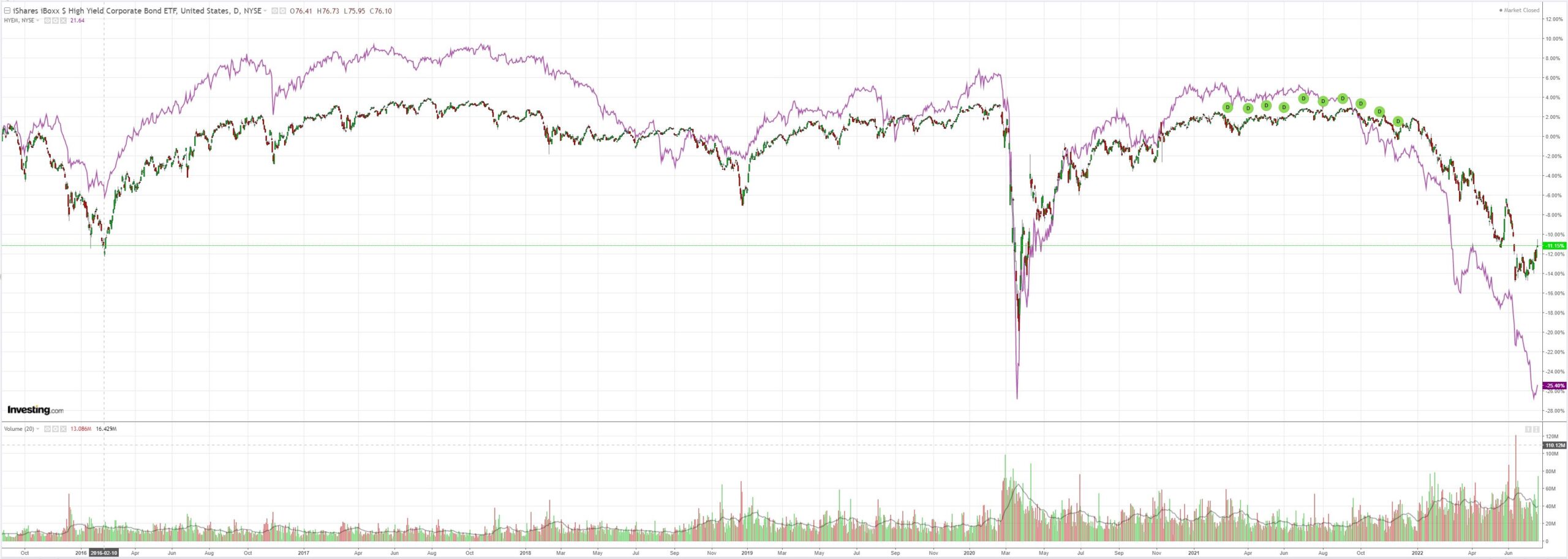

Even EM junk (NYSE:HYG) caught a break:

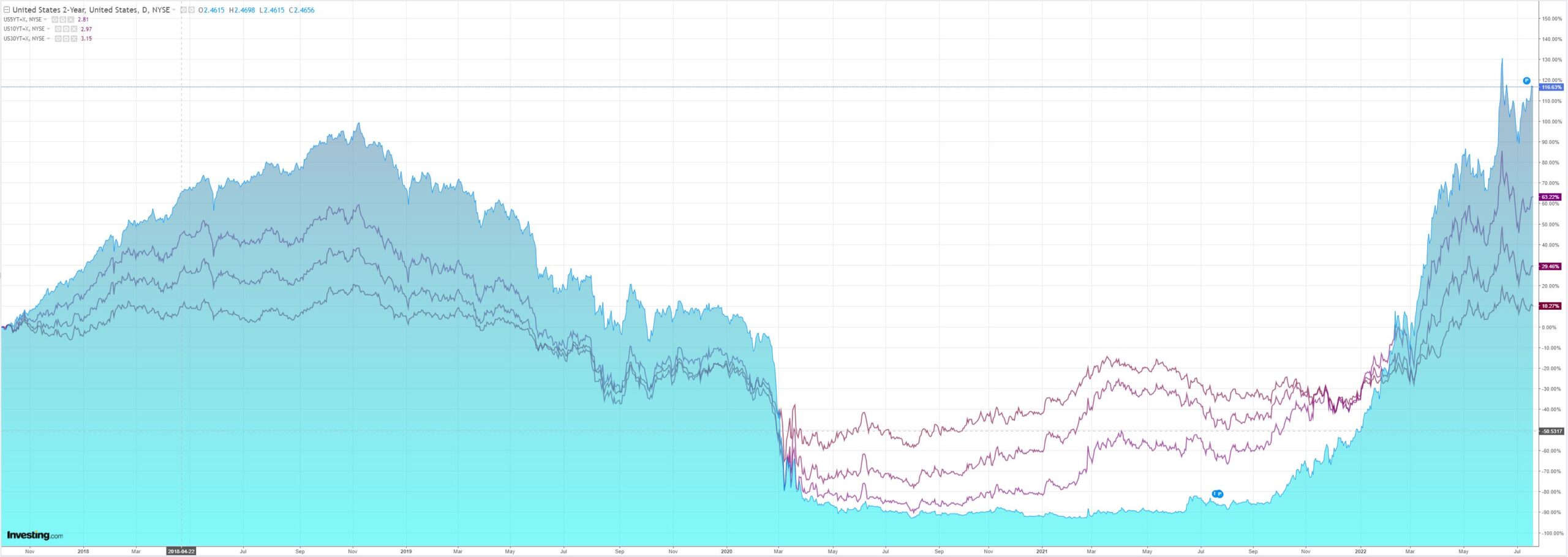

The US curve was demolished. This is not consistent with any rally:

But the bear squeeze rolls on:

Westpac has the wrap:

Event Wrap

US existing home sales in June fell 5.4% (est. -1.1%, prior -3.4%). The housing sector in 2022 has been affected by soaring mortgage rates and heightened uncertainty.

German PPI inflation in June rose 0.6%m/m and 32.7%y/y (est. +1.5% and 33.7%, prior 1.6% and 33.6%). While price increases for basic and energy goods moderated somewhat, capital goods as well as durable goods inflation accelerated.

Eurozone consumer confidence fell to -27.0 (est. -24.9, prior -23.8).

UK CPI inflation in June rose 0.8%m/m and 9.4%y/y (est. +0.7% and 9.3%, prior 0.7% and 9.1%).This is a fresh 40 year high for the annual pace. RPI also rose, to 11.8% y/y – a reading which will be the focus of unions in wage negotiations.

Italian Prime Minister Draghi appeared set to lose power after three key parties failed to support him in a confidence vote. Draghi’s resignation would plunge the country into months of political turmoil just as economic warning signs start to flash.

Russian President Putin signalled that Europe will start getting gas again through a key pipeline, but warned that unless a spat over sanctioned parts is resolved, flows will be tightly curbed.

Event Outlook

NZ: A trade deficit is expected to print in June given the seasonal slowing in agricultural exports and elevated oil prices (Westpac f/c: -$100mn).

Japan: The Bank of Japan decision will likely retain a policy rate of -0.10% and a 10yr yield target of 0.00%.

Eur: At the July policy meeting, the ECB is expected to begin their rate tightening cycle with a 25bp hike across all key policy rates, with the main refinancing rate rising from 0.00% to 0.25%.

US: The July Phily Fed index should continue to signal weak business conditions in the region (market f/c: 1.5). Meanwhile, initial jobless claims are set to remain near historic lows (market f/c: 240k) and the June leading index should indicate a deteriorating growth outlook (market f/c: -0.6%).

It’s all about Europe for now. Perversely, markets are excited by the prospect of accelerated ECB tightening given that will help take pressure off DXY.

But what about growth? The European economy is on the verge of a war recession just as the ECB kicks off a tightening cycle. Is that really EUR positive?!

Moreover, Italy is falling apart again:

Italy’s prime minister, Mario Draghi, has said his government’s survival hinges on “rebuilding the pact of trust” as he weighed a groundswell of support for him to remain in the post before a vote of confidence scheduled for Wednesday evening.

And NordStream1 gas flows are still in doubt:

I can’t see why anybody would want to own EUR right now, nor therefore, AUD.

But this is what markets do. As sentiment is stretched they bid on the hope that the worst is over. Eventually, one of these gambles will be correct.

Just not yet!