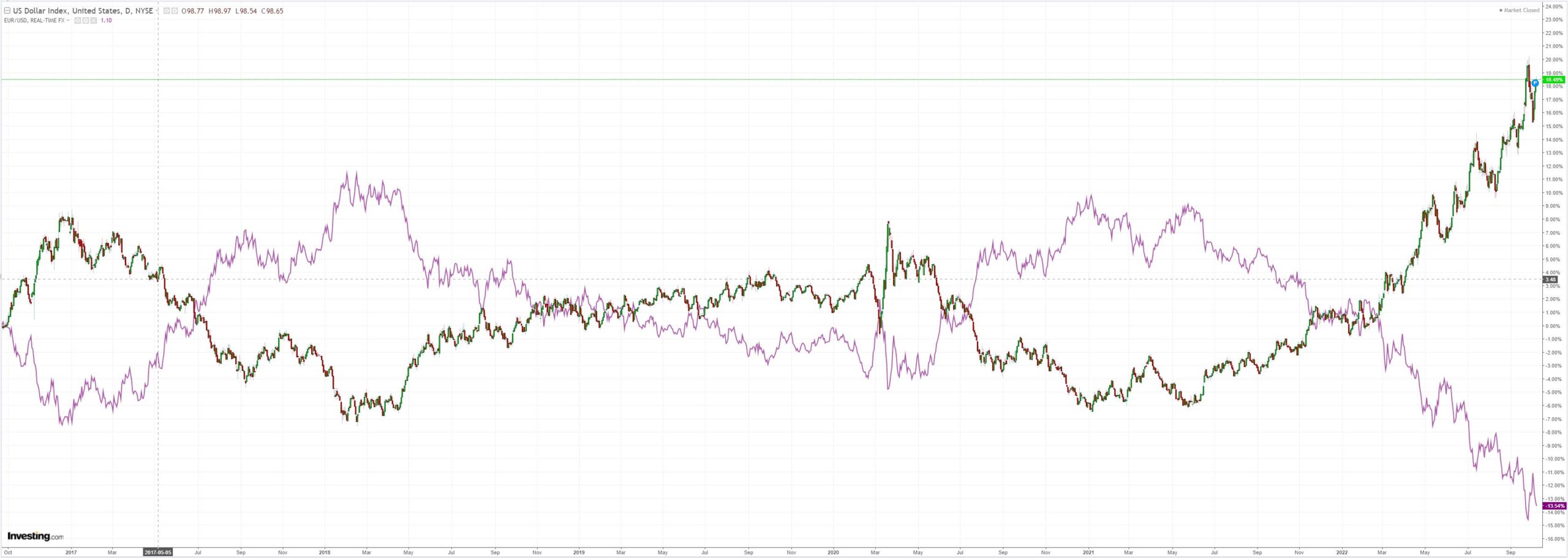

DXY has resumed its run and is howling imminent crisis:

CNY returned from holiday to a nice clubbing:

AUD is now a falling meteor against everything DM, including the beleagured GBP:

Oil reversed. All things considered, gold is holding up pretty well!

Dirt was OK:

Miners (NYSE:RIO) too:

EM stocks (NYSE:EEM) are at the cliff:

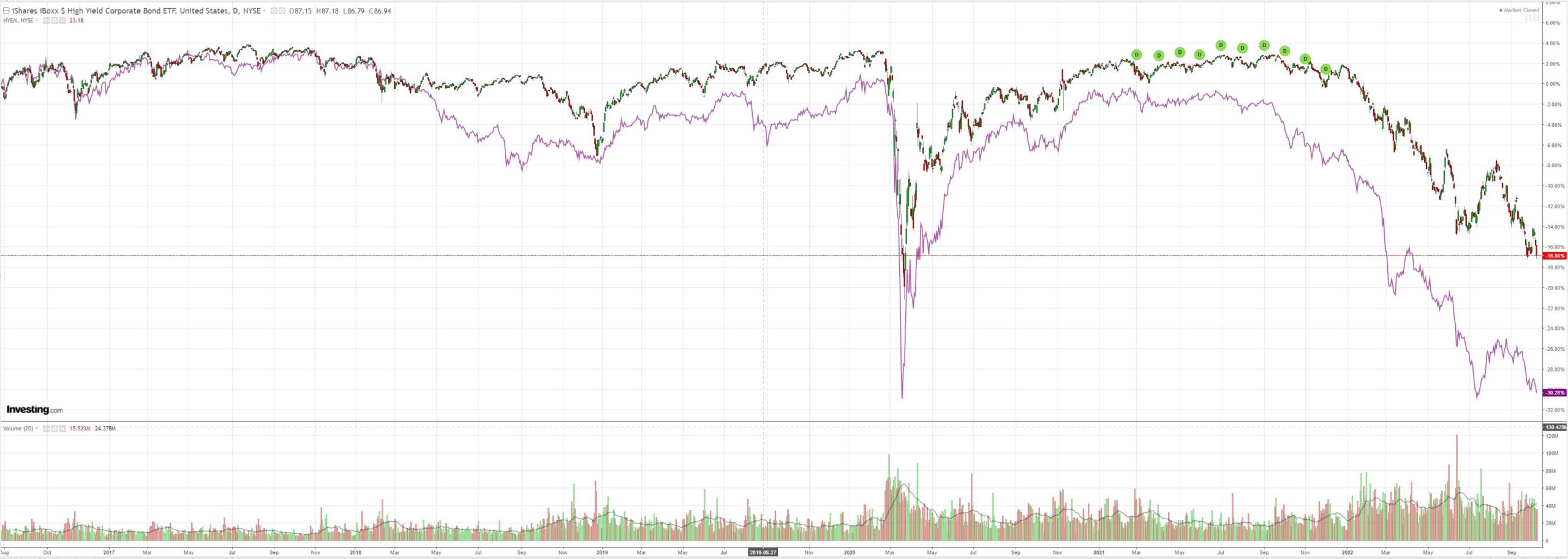

Junk (NYSE:HYG) is over it:

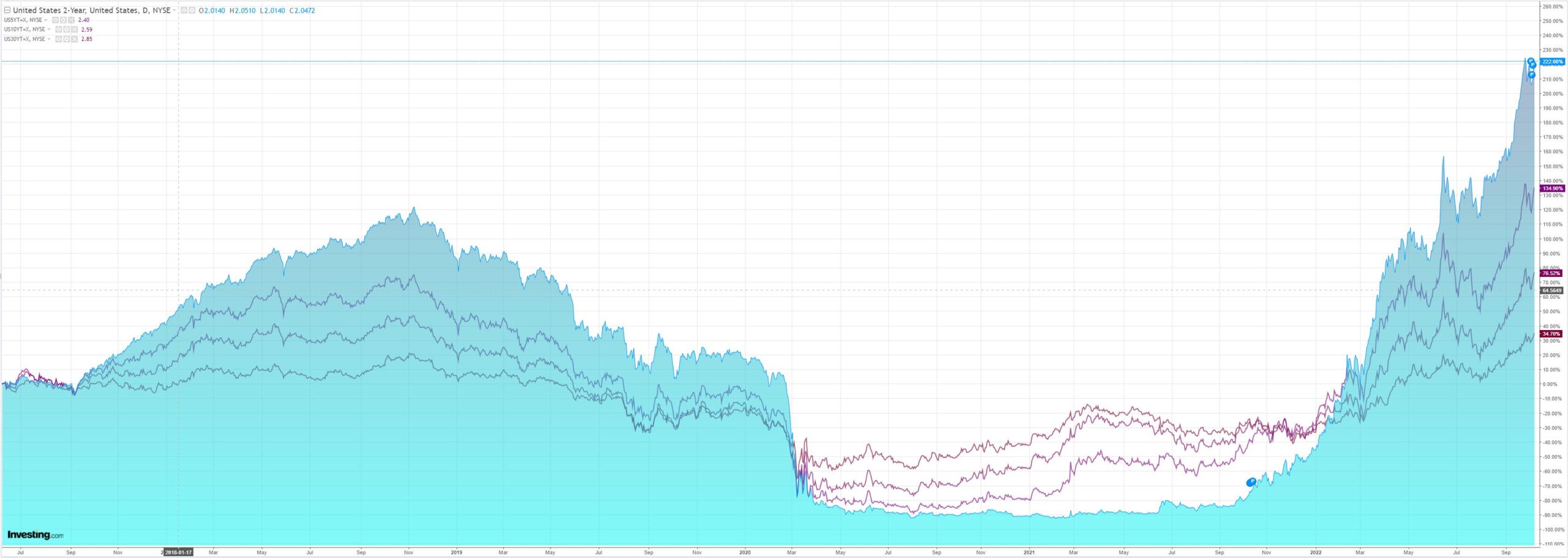

Treasuries were sold:

As were stocks. A breakdown of support is inevitable:

The macro is not complicated. Credit Agricole (EPA:CAGR):

- A solid September employment report keeps pressure on the Fed to continue with another 75bp hike in November.

- In our view, the hurdle to downshift from 75bp to 50bp is high at this point, barring a substantial downside surprise in September CPI.

- We maintain our bearish view on front-end Treasuries, given a healthy jobs market and the likelihood of sticky inflation.

Solid job gains in September and a dip in the unemployment rate to 3.5% keep pressure on the Fed to continue with another jumbo rate hike at the 2 November FOMC meeting.

In our view, the hurdle for the Fed to downshift the pace of rate hikes from 75bp to 50bp is high at this point, barring a weaker-than-expected September CPI report that will be released on Thursday 13 October.

The market has priced in a policy rate increase of 74bp at the November meeting, and a total of 127bp for the next two meetings. The pricing of the terminal policy rate now sits at 4.65% in March 2023.

It was premature to expect a dovish pivot from the Fed after the RBA hiked 25bp instead of 50bp on 4 October. The Fed still believes its fight against inflation is far from over, and has yet to see convincing evidence that inflation has peaked and is headed back down. A strong labour market supports such a hawkish stance, in our view.

Treasuries have retraced much of the rally that took the 10Y yield down to 3.56%on 4 October. Both real yields and breakevens have bounced, with the 10Y real yield back to the high of 1.66%.

We switched to being short front-end Treasuries early this week, as the 2Y rate at4.10% looked too low, given the likelihood of sticky inflation and a healthy jobs market.

Liquidity in Treasuries has deteriorated amid recent market volatility to levels not seen since Covid, and it could stay there or get worse now that the Fed’s QT has reached it stop speed of USD95bn per month. Regulatory relief remains elusive.

Fed Governor Michelle Bowman favoured “an opportunity to consider adjustments to the components of the capital requirements for the largest institutions, including the supplementary leverage ratio”, a comment that encouraged market participants on 4 October. Market friendly adjustments to the SLR could support swap spreads. That said, the timing of such adjustments remains unclear.

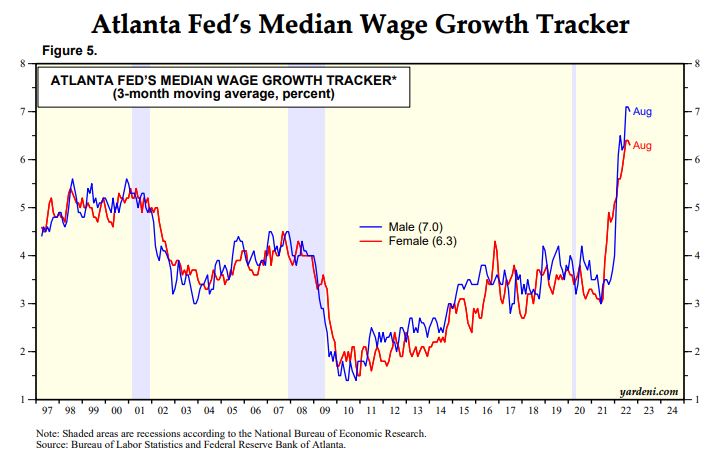

The BLS did suggest that wages may be topping but the evidence is clearly too weak:

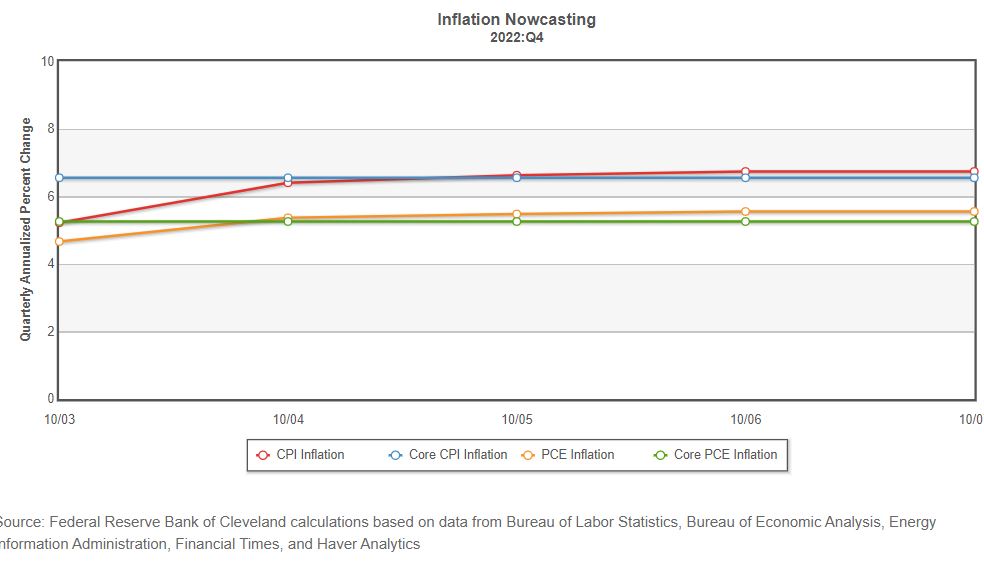

The Fed’s inflation nowcast is still too strong:

The only question at this point is whether inflation will come down sufficiently for a Fed pivot before or after a major market dislocation. As volatility spreads, the latter has to be the strong favourite.

Meaning AUD ain’t done selling.