DXY firmed a little last night:

AUD managed to bounce of false China hope too:

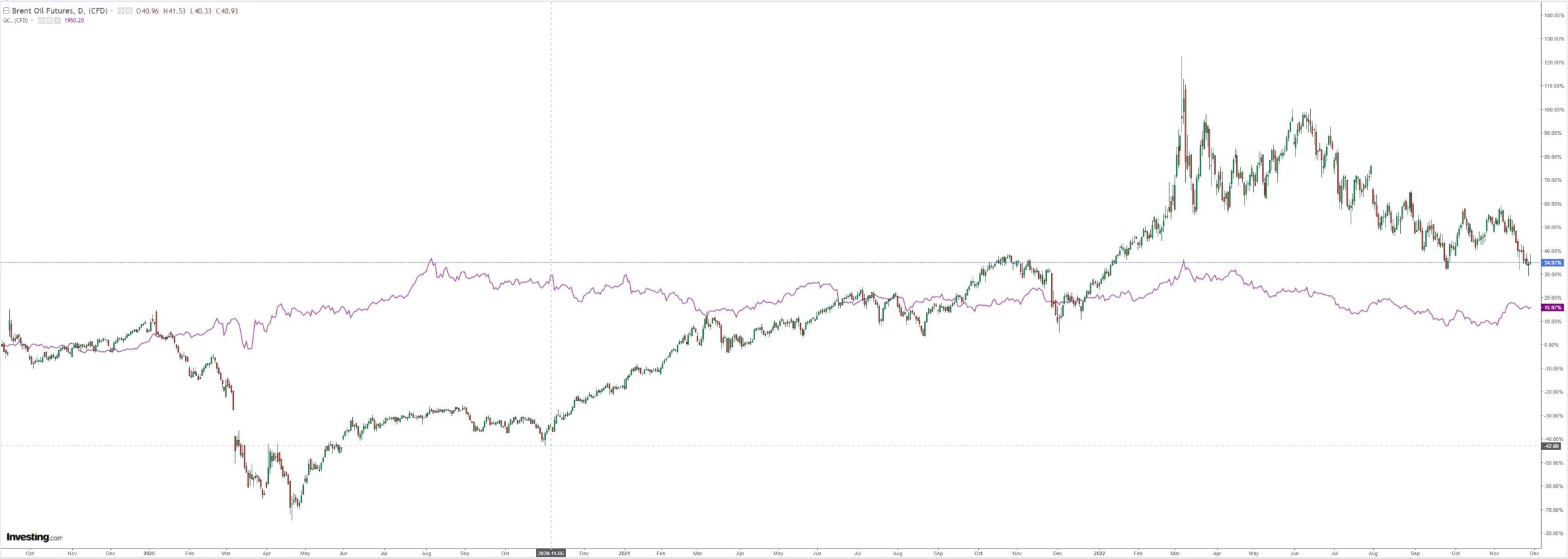

Oil is hanging on to support for dear life:

Base metals are stuck:

Big miners (ASX:RIO) are flying with iron ore:

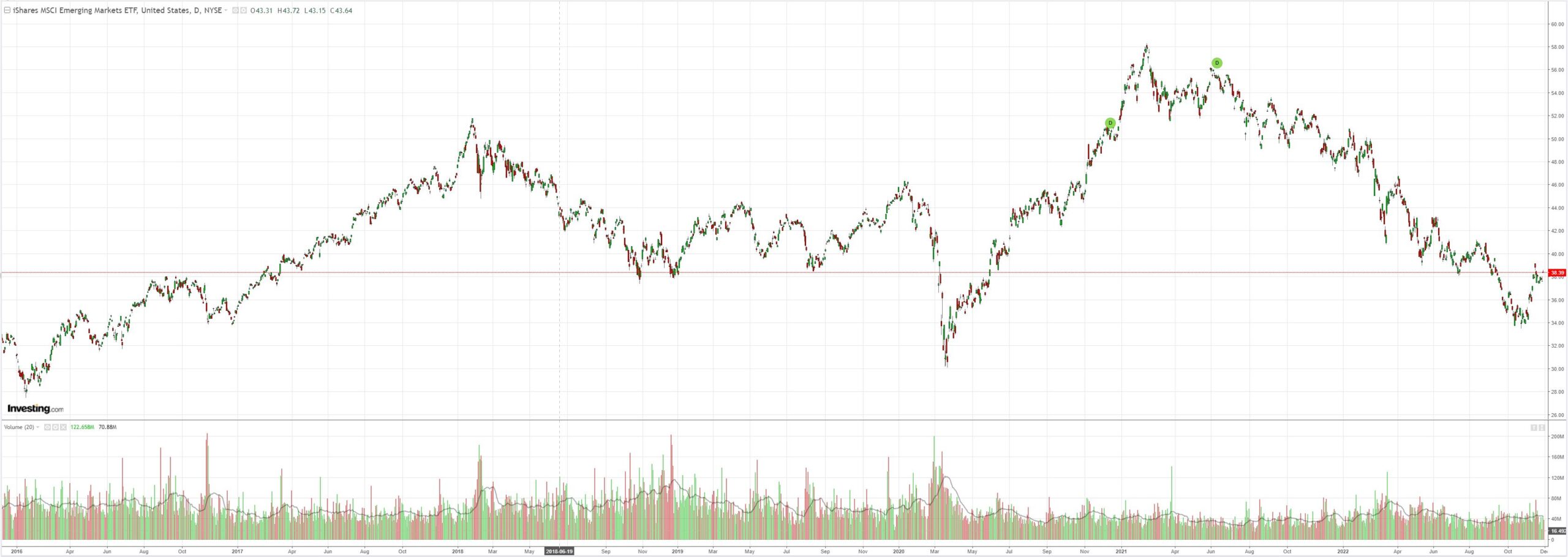

EM stocks (NYSE:EEM) did better:

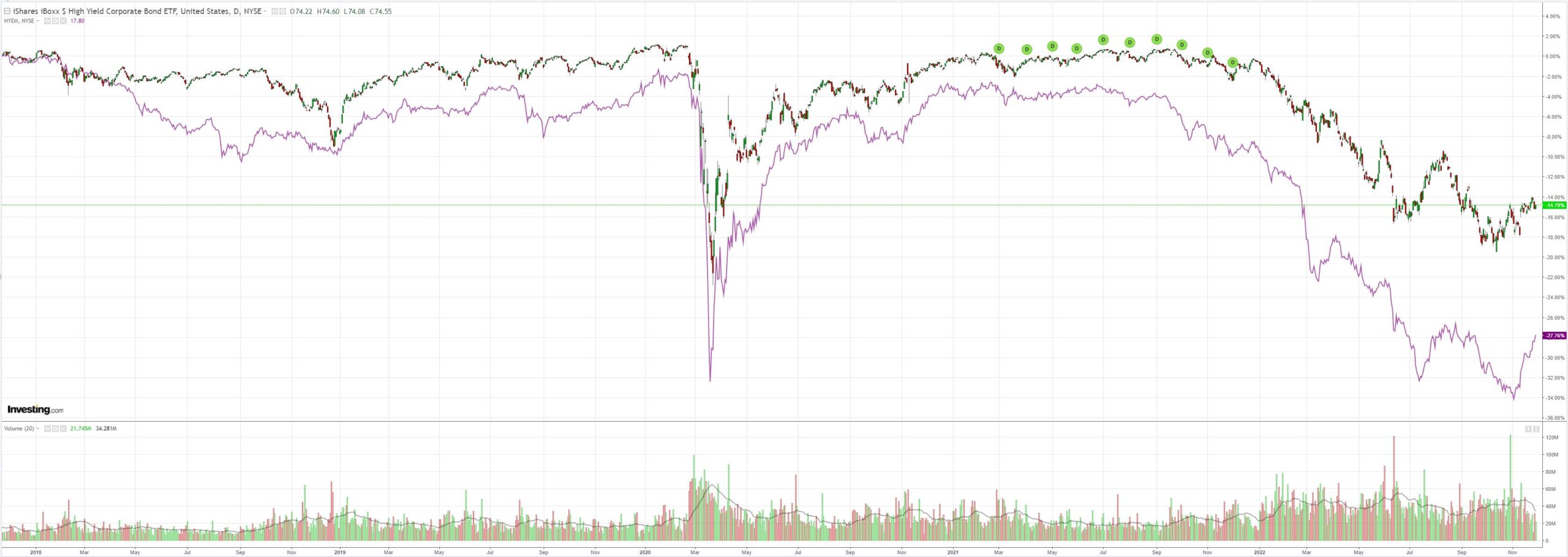

As junk (NYSE:HYG) surges on relentless China property announcements:

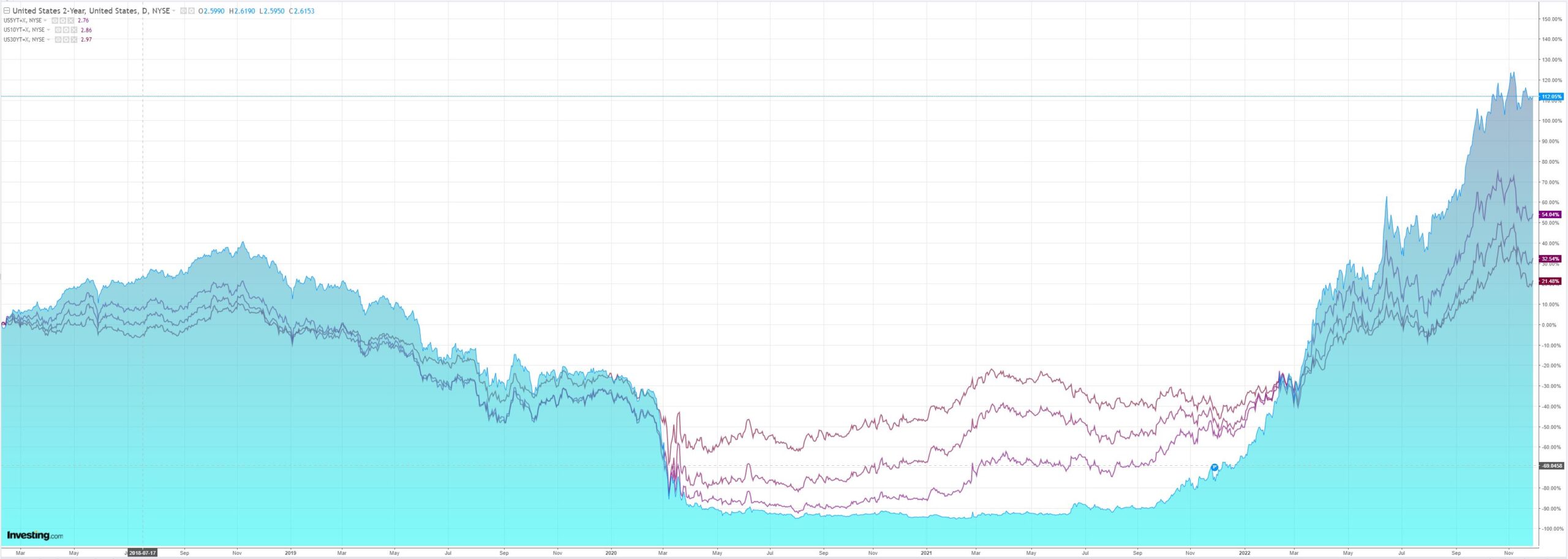

But US yields are firming again:

Which is squashing the bear market rally:

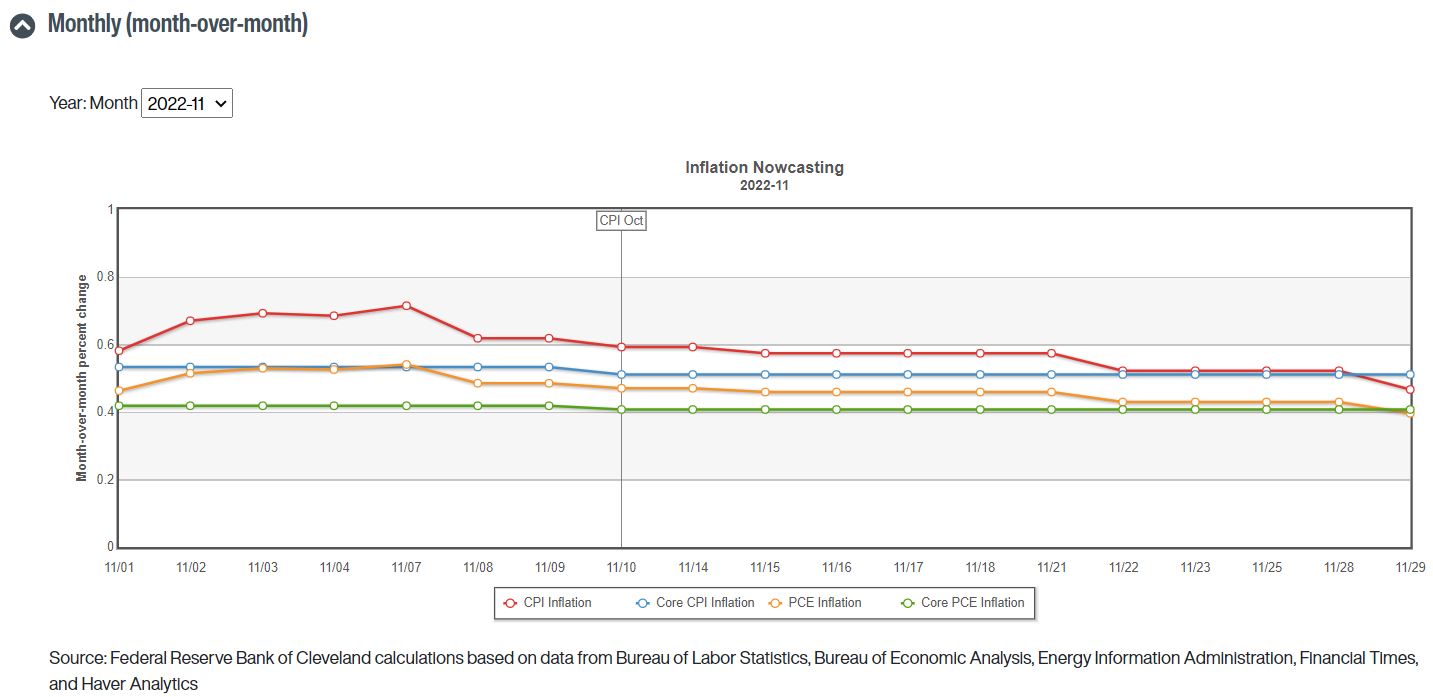

The Fed’s inflation nowcast model of CorePCE is unmoved as other measures float down to its level:

The Fed still has more work to do to unglue CorePCE.

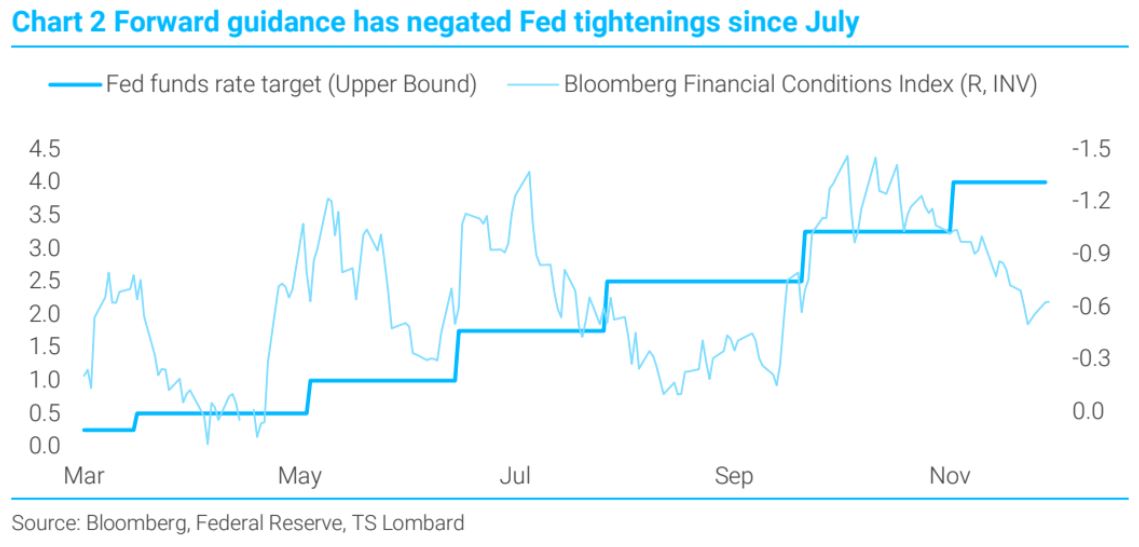

Meanwhile, markets have been so busy with their reflexive reflation that they have set the Fed back by 225bps!

Nobody should ever accuse markets of being efficient. They are far from it. What they are is ruthless and will punish mistakes brutally. Even their own in due course.

I still see AUD lower as the recent reflation needs to reverse, and FCI hit new highs, to dislodge sticky CorePCE.

Jay Powell speaks tomorrow.