The DXY rocket eased up overnight and a seared EUR stabilised:

That couldn’t save the Australian dollar which was pounded across the board:

The strong DXY is wreaking havoc with commodities already. Oil was down though Gold up:

Base metals puked:

Bid Iron is onwards and downwards:

EM stocks have rolled again:

Though junk held up:

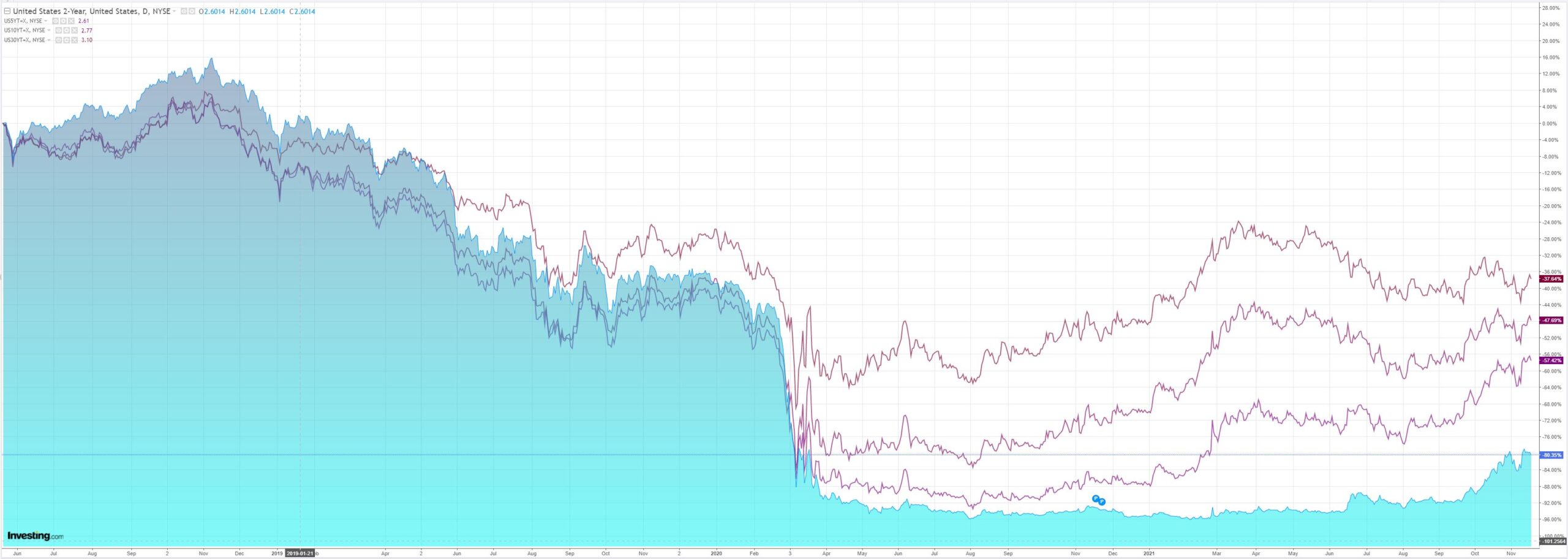

As Treasury yields eased:

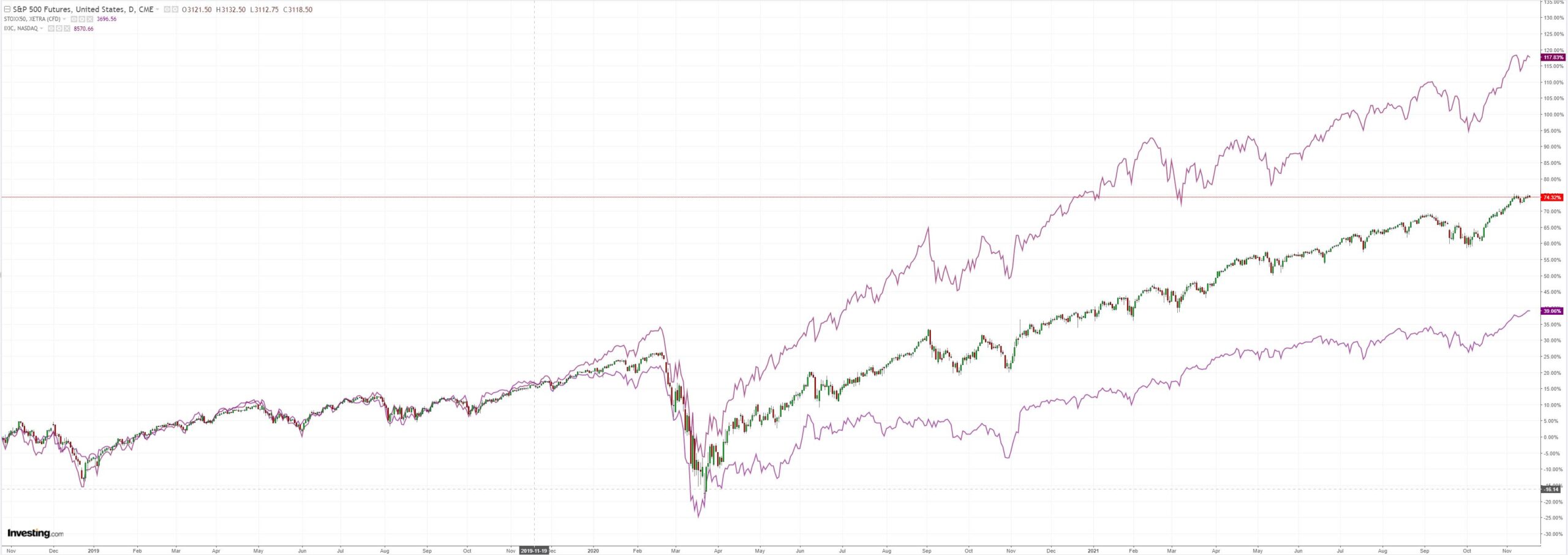

Which boosted GAMMA and nothing else:

Westpac has the wrap:

Event Wrap

US housing starts in October were lower than expected, at 1.52m (est. 1.58m, prior 1.53m) but permits rose to 1.65m (est. 1.63m, prior 1.59m). The slippage in starts was concentrated in the single home (most value-add) sector, with supply difficulties delaying starts. Overall, industry optimism remains strong (as noted in the NAHB survey on Tuesday).

Canadian CPI for Oct was as expected at 0.7%m/m and 4.7%y/y, but the core measures were around 0.1% below expectations.

UK inflation in October was stronger than expected. Headline CPI rose 1.1%m/m and 4.2%y/y (est. 0.8%m/m and 3.9%y/y), with core rising to 3.4%y/y (est. 3.1%y/y). RPI was similarly 0.3% above consensus (6.0%y/y).

Event Outlook

Aust: RBA Assistant Governor (Economic) Ellis will speak at an online CEDA event, 3pm.

NZ: The RBNZ’s Q4 inflation expectations for two-years ahead are expected to push higher, driven by robust domestic activity and ongoing cost pressures.

US: The gradual downtrend in initial jobless claims should remain in place (market f/c: 260k). The November Philly Fed index and Kansas City Fed index will offer a gauge of business conditions in the two regions. Strength in key indicators throughout October should meanwhile lift the leading index from September’s soft result (market f/c: 0.8%). The FOMC’s Bostic, Williams, Evans and Daly are all due to speak at different events.

And Credit Agricole (PA:CAGR) the advice:

AUD: RBA correct on wages growth for now Australian Wage Price Index (WPI) data came out in line with the consensus estimate showing a rise in wages growth from 1.7% YoY to 2.2% YoY. The RBA looks for wages growth to average 2.25% YoY in H221, so today’s outcome is also in line with the central bank’s expectation. The RBA forecasts it will take another two years for wages growth to reach the 3% level it believes is needed for inflation to be “sustainably” within its 2-3% inflation targeting band. Wages growth normally accelerates in Q3 as the annual living wage decision is implemented then and many enterprise bargaining agreements also see wage and salary rises in Q3. Indeed, the ABS notes that over the past ten years, 35-40% of jobs record wage rises in the September quarter. But this year the ABS notes that pay freezes and postponed negotiations due to Covid lockdowns led to this number dropping to just 20%. So, there could be further pent up wage rises in the coming quarters. For now, the RBA is being proven correct on its wage growth forecasts and the next reading for the WPI is a long way off on 23 February 2022. So, the debate between the Australian rates market and the RBA will rage on. The rates market is currently pricing in a cash rate of just below 1% by end 2022 and well above the current rate of 0.10%. The RBA is sticking to its call for no rate hikes until 2024, with some potential for rate hikes in 2023.

Any rate hikes at all are a tail risk in Australia as returning immigration, crashing commodity prices and mortgage resets squash prices for several years at least. The base case is no hikes. The larger risk case is more printing. More from CA:

The AUD saw fresh buying interest last week, predominantly driven by IMM flows. That said, our FX flow data points at hedge fund outflows. The latest squeeze of AUD-shorts has been too aggressive according to our analysis, and the currency is looking overbought relative to its long-term positioning trend.

Subsequently, we have entered a short position in AUD/USD with a target of (+3%) and a stop-loss of (-1.5%). The model remains up 8.89% with a hit ratio of 59% over the past twelve months.

I see nothing but downside for AUD in 2022.