It’s blow-off time. DXY to the moon:

AUD not so such much!

CNY is still stuck:

Oil to the moon:

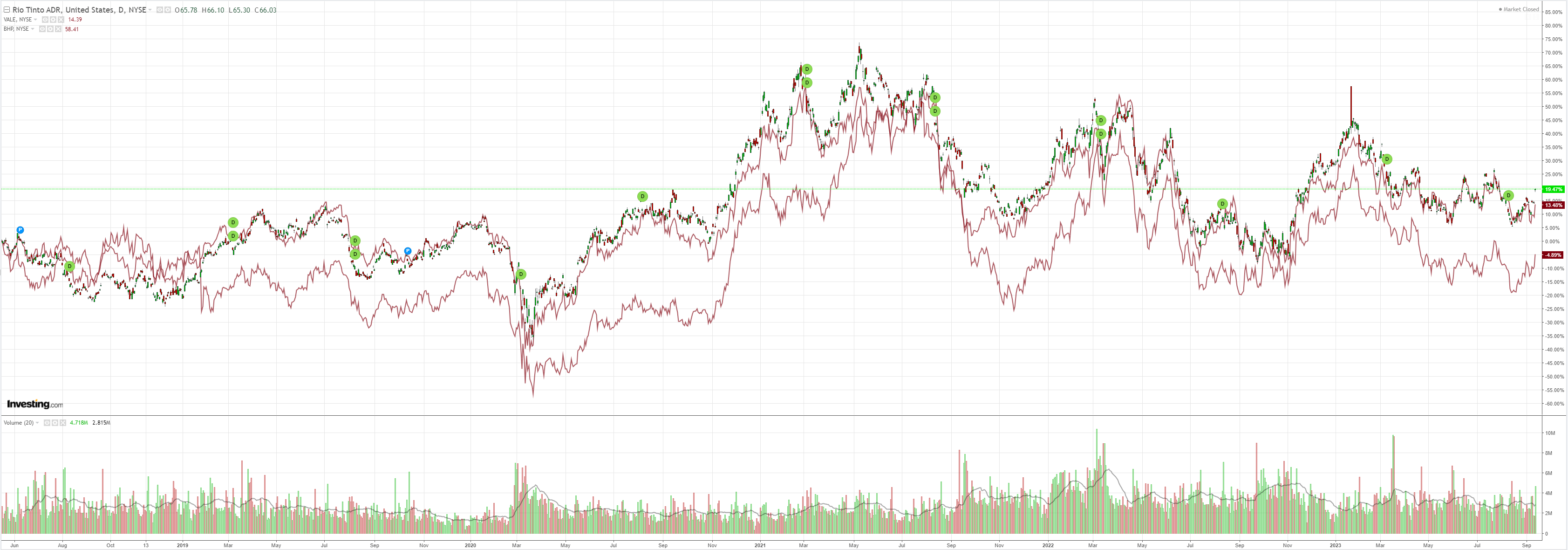

Dirt less happy:

Miners took off:

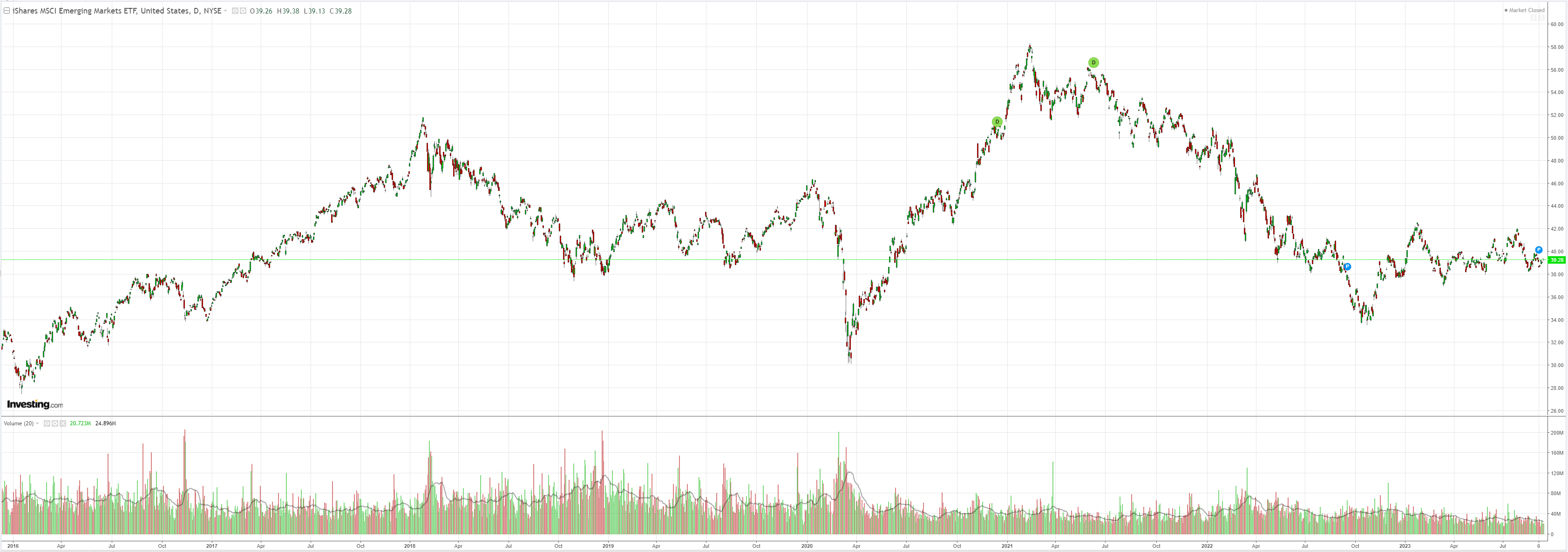

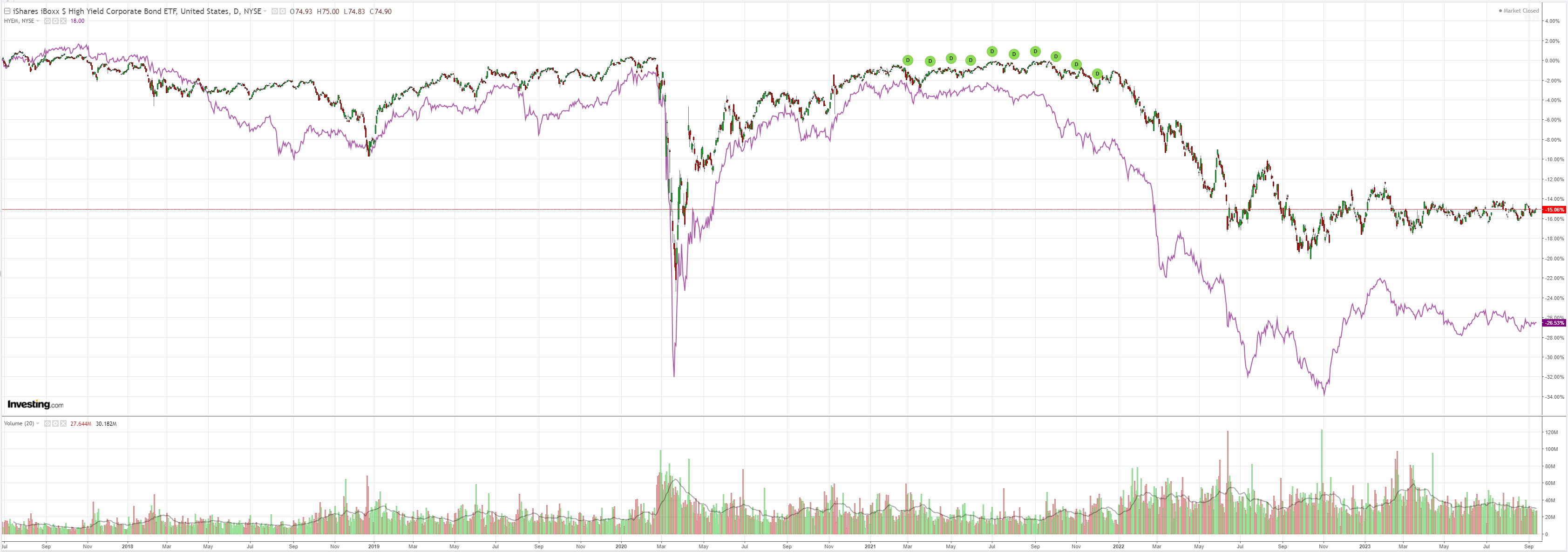

EM and junk comatose:

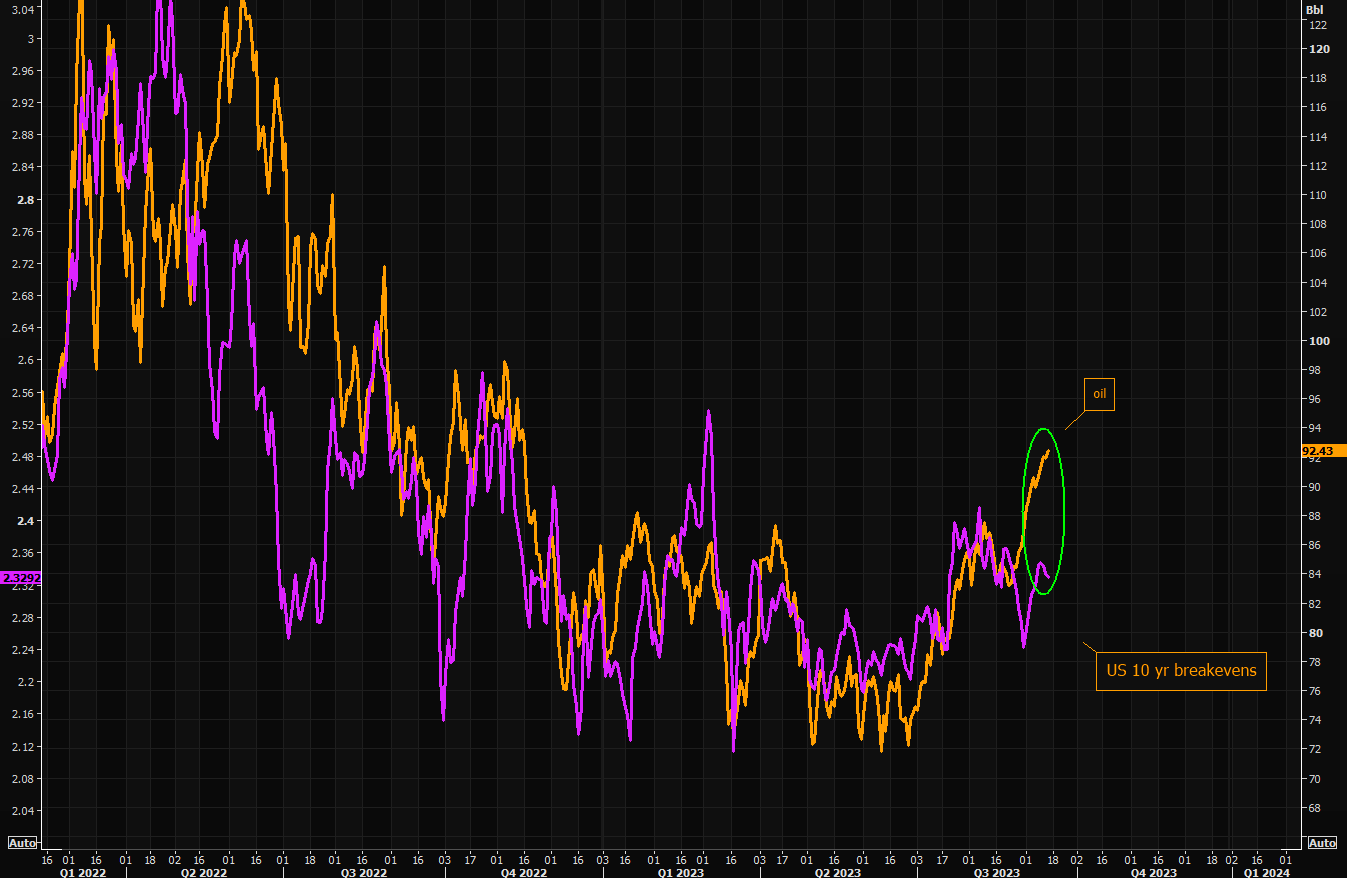

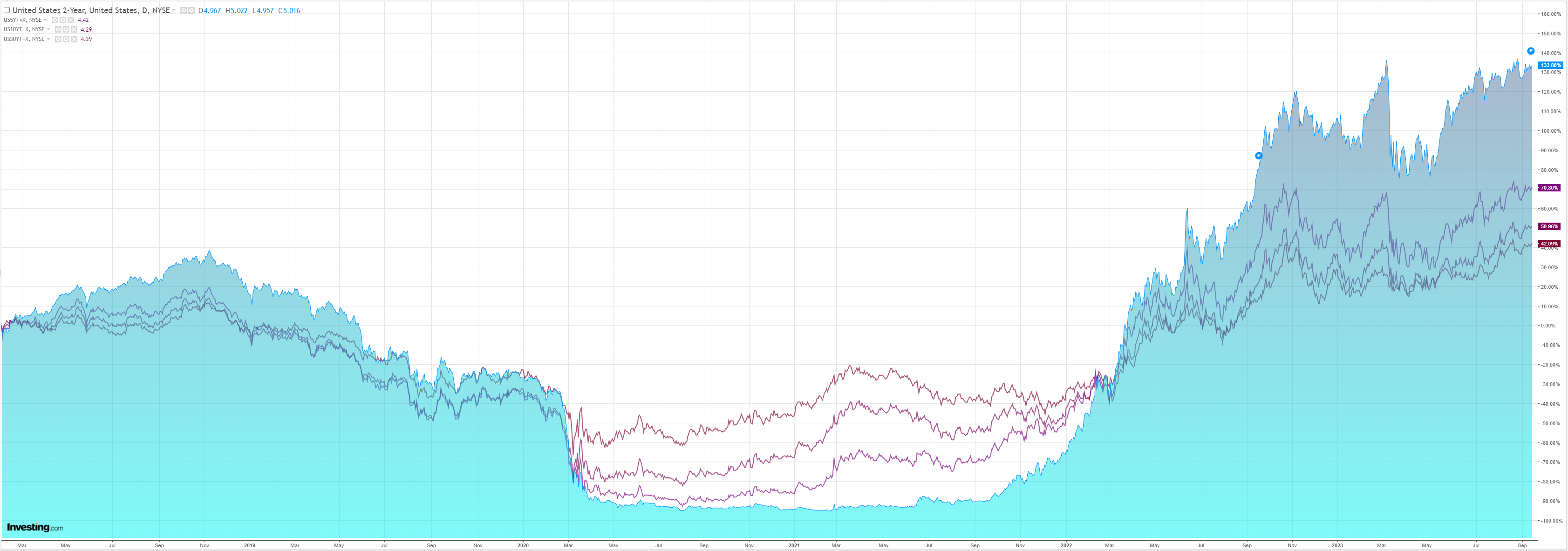

Yields ignored oil:

Allowing stocks to party:

Why oil is suddenly disinflationary is a question you can ask the market. I don’t have an answer:

Oil is overbought and may correct before long. But, so long as soft landing happiness prevails, it looks more than likely that it will have to reach levels that deliver demand destruction, given the global shortfall in Q4. That’s well above $100.

That is undoubtedly inflationary, as well as DXY bullish. The ECB also looks done, so we are back to the Fed leading hikes. The market is not long the greenback, and it is approaching a golden cross to die for.

2023 has so far been a kind of microcosm recovery cycle. We crashed into late 2022, toyed with a recession, had a credit event and Fed bailout, which juiced stocks fed by AI, triggering a wealth-driven consumption recovery. Now we’re late cycle again as oil blows off.

Sooner rather than later, the market must price the implications of $100+ oil and 110+ DXY.

Neither is good for stocks, most notably tech.

Nor AUD.