Street Calls of the Week

DXY eased off:

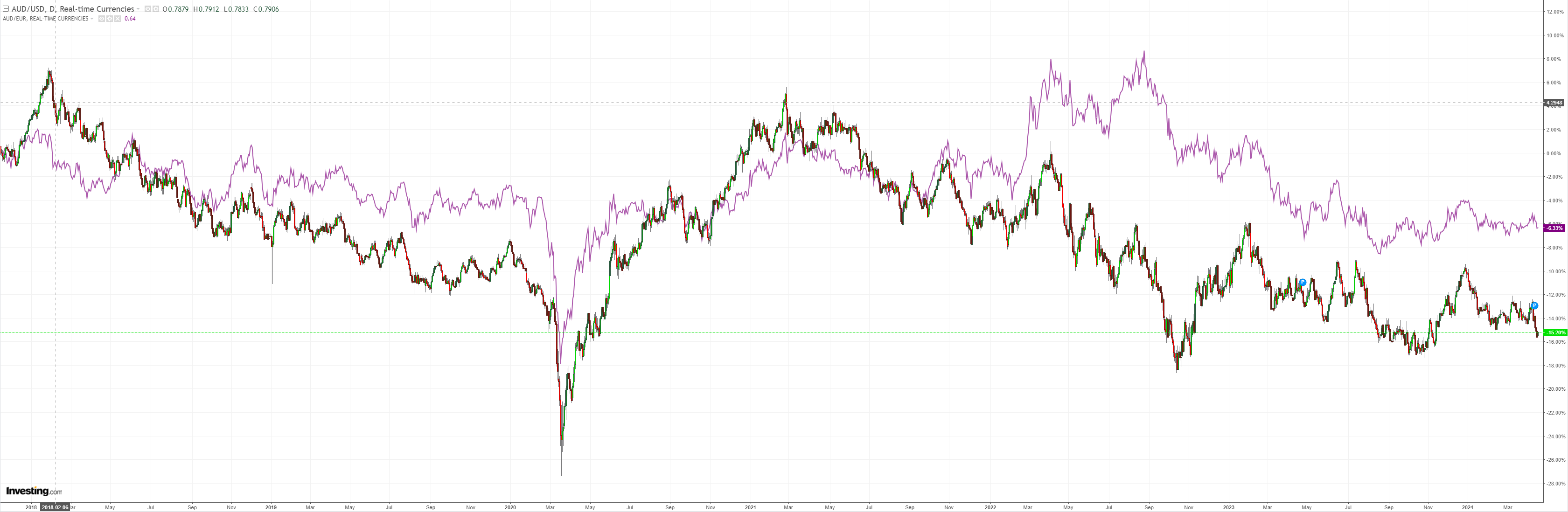

AUD backed away from the cliff:

North Asia helped:

Oil tanked:

Metals are still warm:

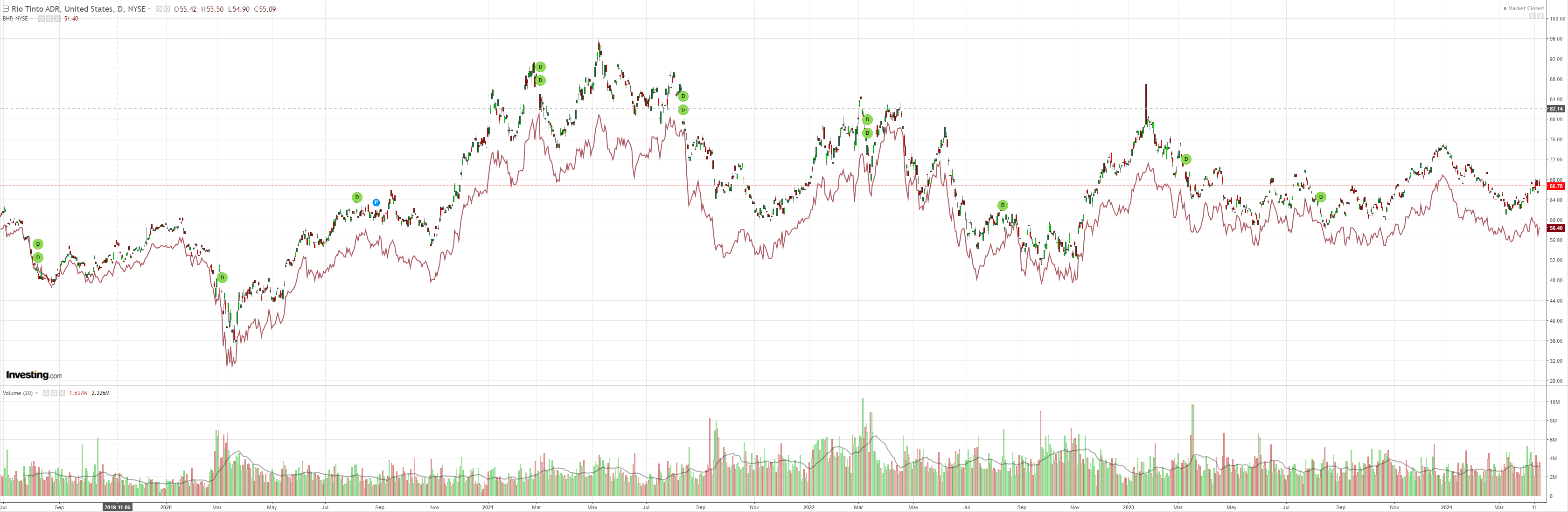

Miners popped with the iron ore loon:

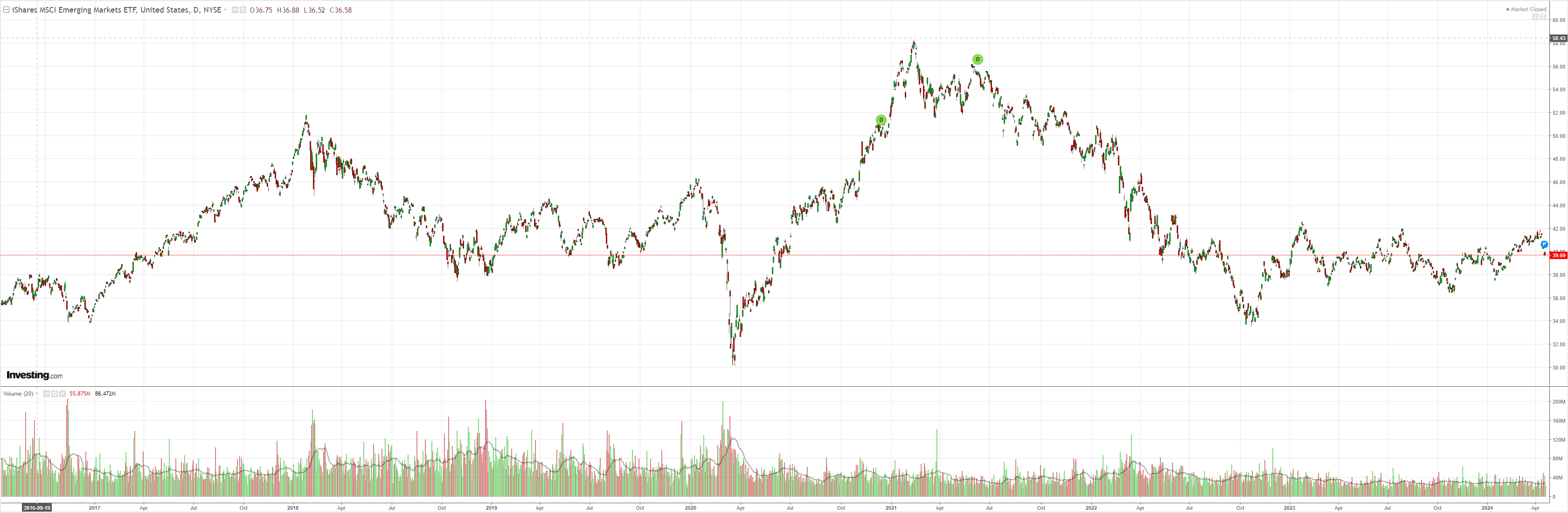

EM is stuck again:

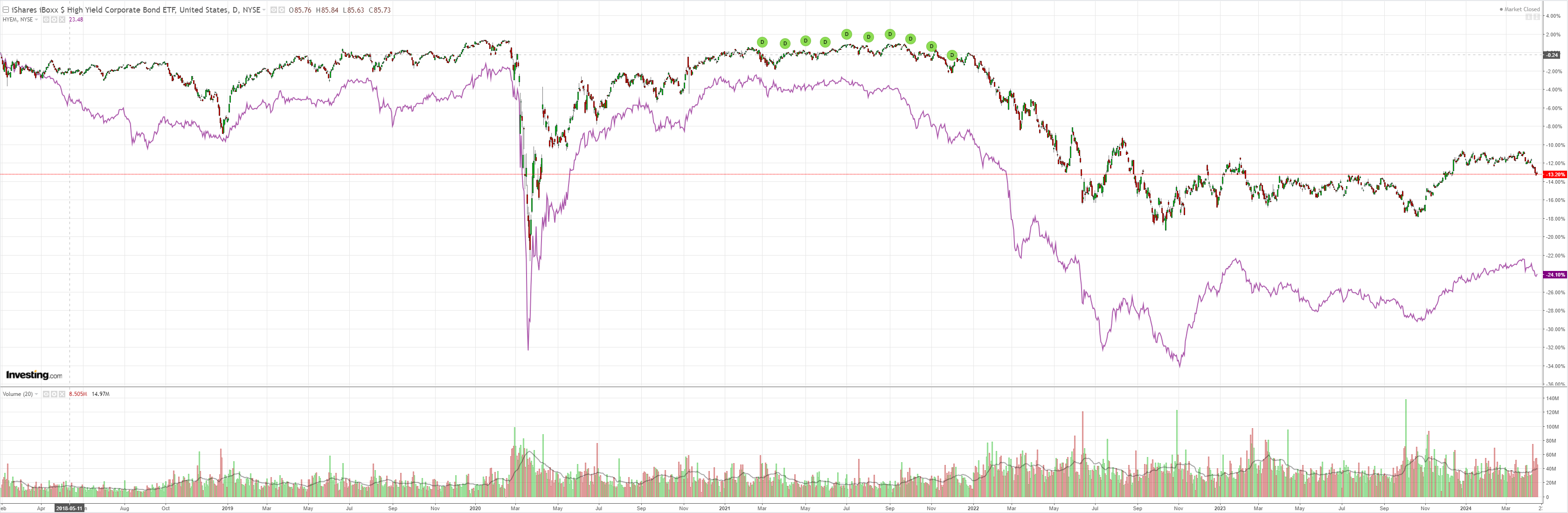

Junk pulled out of the dive:

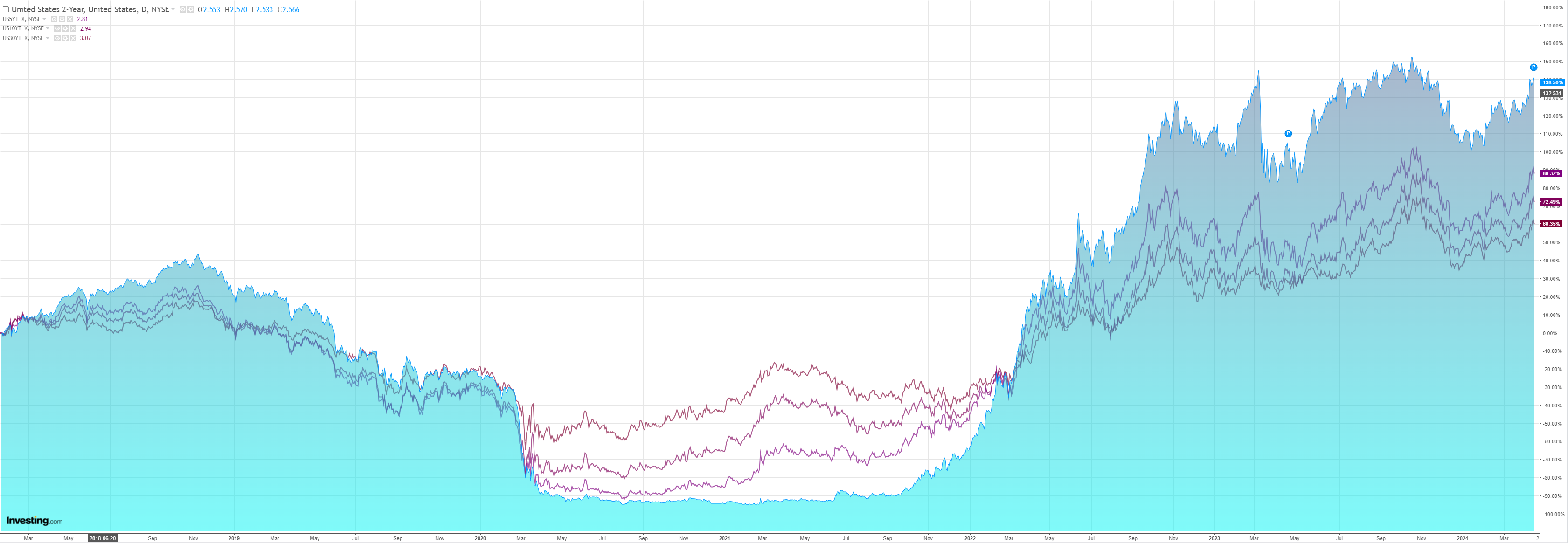

As yields fell:

But stocks corrected anyway:

Bloomie wraps it up:

Treasuries rebounded a day after Jerome Powell threw cold water on expectations for rate cuts, with Citi saying Wall Street is incorrect to slash bets. The Fed chief’s pivot and rising housing costs are partly to blame for what went wrong on the last mile to 2% inflation. Traders are nonetheless piling into a contrarian bet that pays off if the Fed eases aggressively this year. Asian equity futures are down after US stocks fell.

We are chopping through the wood of US inflation worries and overheated stocks. Oil down is helping create a bottom.

However, Israel still appears poised to invade Rafah, and revenge against Iran is an open wound.

I still think we need some more downside in risk and therefore AUD.